- US-China Relations Set to Improve ‘Very Shortly,’ Biden Says (bloomberg)

- (Here come the dealer incentives!) Auto Dealers Finally Have Cars to Sell Again (wsj)

- Investment Advice From The Vietnam Veteran Who Turned A 2-Bedroom House Into A $4.7 Billion Fortune (forbes)

- Brooks Koepka Surges to the Lead at P.G.A. Championship (nytimes)

- This 5-Star Coastal Resort Outside Los Angeles is a Golfer’s Paradise (maxim)

- Lamborghini Unveils Most Elite Urus SUV Yet (maxim)

- Aston Martin’s DBX 707 AMR23 Edition Is A Luxury SUV For F1 Superfans (maxim)

- Tom Cruise Rides Off A Cliff In New Trailer For ‘Mission: Impossible – Dead Reckoning Part One’ (maxim)

- How Wall Street Legend James Simons Built His $28 Billion Fortune (maxim)

- Check Into This Historic Luxury Hotel From ‘Midnight in Paris’ (maxim)

- Atlanta GDP Now (atlanta fed)

- How Much Aid Has the U.S. Sent Ukraine? Here Are Six Charts. (cfr)

- Can YOU solve the debt crisis? (npr)

- How AI could help rebuild the middle class (npr)

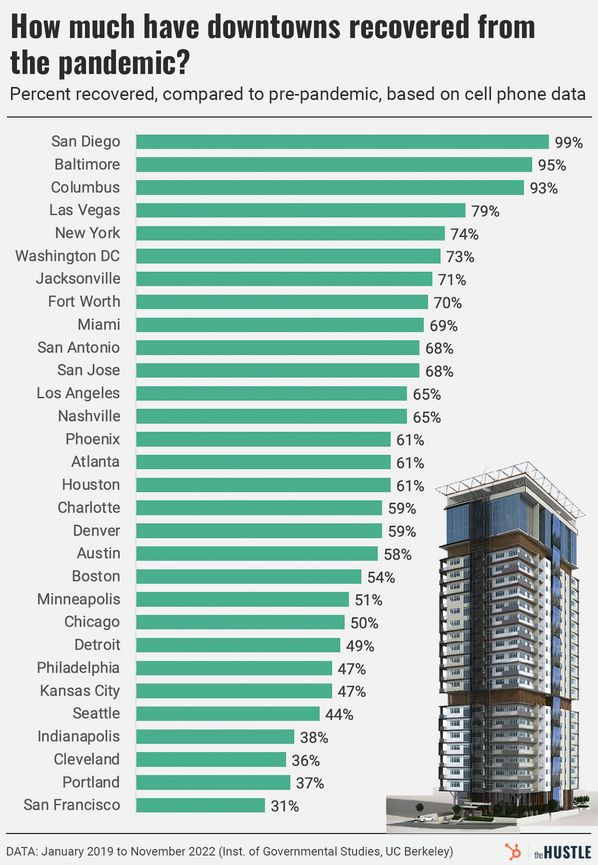

- The developers who see dollar signs in abandoned downtowns (thehustle)

- Leonardo DiCaprio, Martin Scorsese’s ‘Killers of the Flower Moon’ Gets 9-Minute Standing Ovation at Cannes (people)

- President to Speak With McCarthy on Stalled Debt-Limit Talks (bloomberg)

Be in the know. 12 key reads for Saturday…

- China’s Tech Giants Signal the First Steps in a Bumpy Recovery (nytimes)

- Powell Comments Lower Expectations of Rate Hike (barrons)

- Western Alliance Stock Is Positioned to Outperform Peers (barrons)

- Stock Market Shrugs Off Doomsday Scenarios. It Might Be Right. (barrons)

- Fed’s Powell warns of slow slog to bring inflation down to 2% (marketwatch)

- What is the G-7? Which countries are in it? Here’s what you should know about this year’s summit. (marketwatch)

- Brazil’s Market Likes Its New President. 6 Stocks to Play. (barrons)

- Powell Says Bank Stress Could Influence Rate Path (wsj)

- Debt-Limit Talks Resume After Optimism Curbed by GOP Walk-Out (bloomberg)

- Nobel economist Paul Krugman says he’s worried the Fed’s war on inflation may trigger future shocks, including more banking chaos (businessinsider)

- Alibaba Options Traders Bet On Stock Surging This Much By September Expiration (benzinga)

- Mario Gabelli and John Rogers talk Value Investing (Gabelli)

Where is money flowing today?

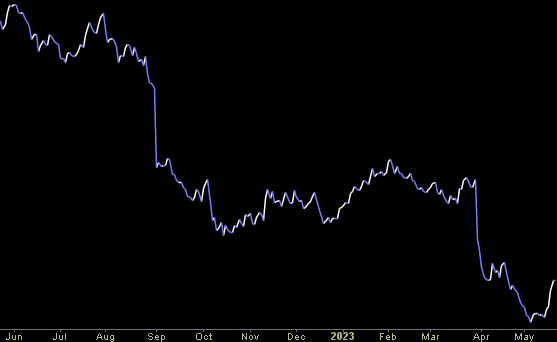

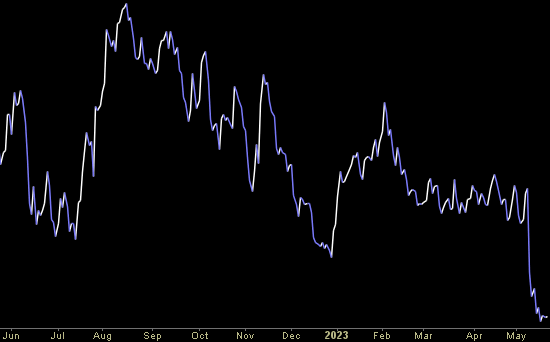

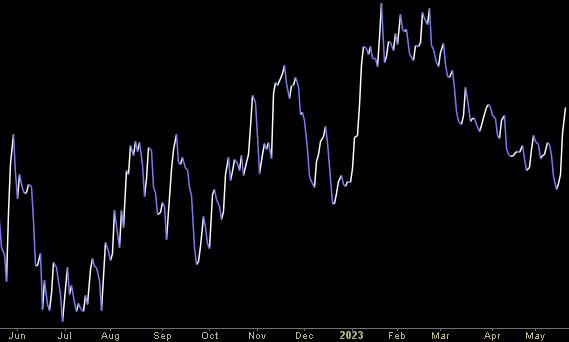

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 18 key reads for Friday…

- The stock market has flipped from ‘sell the rip’ to ‘buy the dip,’ and that should help push the S&P 500 above a key resistance level (businessinsider)

- Markets Aren’t Buying What the Fed Is Selling. There’s a Good Reason Why. (barrons)

- Stocks are rallying, but investors say they’re miserable. That’s a good thing. (marketwatch)

- Disney Scraps Plan for $900 Million Florida Campus, Closes ‘Star Wars’ Adventure Hotel (wsj)

- Home Prices Posted Largest Annual Drop in More Than 11 Years in April (wsj)

- Chinese Dissidents’ New Weapon Against Beijing: Sell-Out New York Comedy Shows (wsj)

- S., Taiwan Reach Trade Deal as Tensions With China Simmer (wsj)

- Bargain Hunters Turn to Walmart, Boosting Sales (wsj)

- The NHL’s Palm Tree Playoffs (wsj)

- In Battle Over A.I., Meta Decides to Give Away Its Crown Jewels (nytimes)

- China Tech Megacaps in a Funk Despite Upbeat Sales: Tech Watch (bloomberg)

- This Week in China: Nothing Is Good Enough for Impatient Market (bloomberg)

- Carl Icahn lost $9 billion on an ill-timed short trade. Here’s what he says are 3 big lessons from the soured bet. (businessinsider)

- Fed’s Williams says there is no evidence the era of very low ‘natural’ rates of interest has ended (marketwatch)

- Small-caps are on track for yet another dismal year, but there are some solid reasons why they might be a good investment—especially now (marketwatch)

- Las Vegas Sands & Wynn Resorts price target raised at UBS on Macau recovery (streetinsider)

- Ron DeSantis Slammed By Miami Mayor for ‘Personal Vendetta’ On Disney: 2,000 Jobs Gone, $1B Fallout (benzinga)

- China’s Big Tech bosses take different business approaches towards generative AI like ChatGPT (scmp)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 187

Article referenced in VideoCast above:

The Dierks Bentley “Feels Like Gold” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 177

Article referenced in Podcast above:

The Dierks Bentley “Feels Like Gold” Stock Market (and Sentiment Results)…