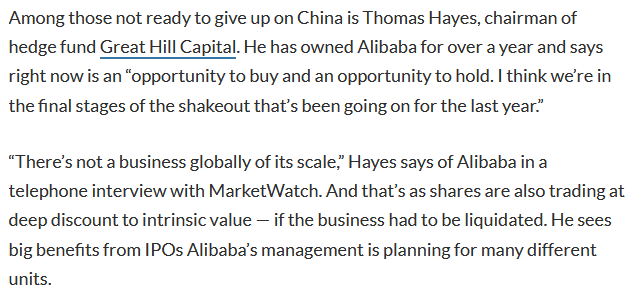

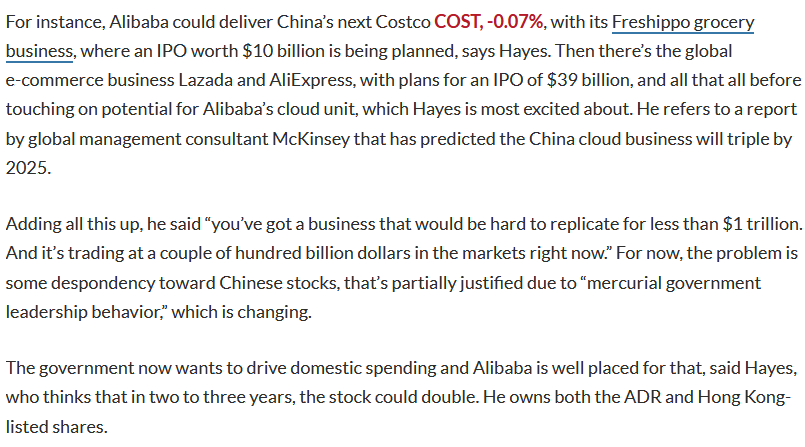

Tom Hayes – Quoted in MarketWatch article – 5/17/2023

Thanks to Barbara Kollmeyer for including me in her article on MarketWatch today. You can find it here:

Click Here to View The Full MarketWatch Article

Be in the know. 25 key reads for Wednesday…

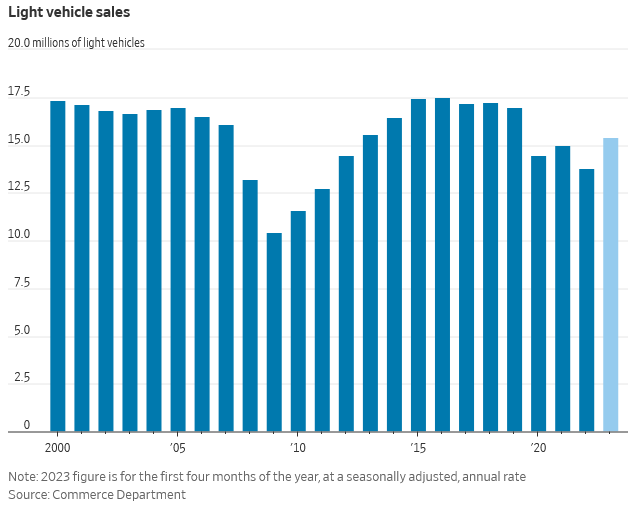

- How Car Sales Could Keep the Economy Humming. Retail spending is still growing and could soon get a boost for car sales (wsj)

- Thinking of Buying Vornado Realty?; Here Are The Properties And Tenants You’d Be Adding To Your Portfolio (businessinsider)

- Tencent posts 11 per cent rise in first-quarter revenue (scmp)

- Tencent’s Sales Grow Most in Over a Year After China Reopens (bloomberg)

- Tencent’s revenues accelerate as China emerges from Covid lockdowns (ft)

- Tencent Is Worth More Than a Utility, Fidelity Fund Manager Says (yahoo)

- JD Stock Earnings: JD.com Beats EPS, Revenue Estimates (yahoo)

- China’s Baidu beats earnings estimates as chatbot awaits government approval (cnbc)

- Baidu Beats, Retail Sales Up +18% Year-over-Year (chinalastnight)

- Tencent Music Profits Leap as Streaming Subscriptions Climb (variety)

- Why Two Activist Hedge Funds Took a Stake in Google-Parent Alphabet (barrons)

- Baidu’s new AI-powered smartphone helps kids study with interactive ‘tutor’ (scmp)

- “It could happen when economic data improves or for whatever reason the market breaks the upside of the range and triggers the fear-of-missing-out buying alongside another round of bullish chorus,” he said. “Many investors are sitting on the sideline and positions are light overall in Chinese stocks now.” (scmp)

- People are paying less than suggested price for new cars (foxbusiness)

- Biden to cut short overseas trip as US debt ceiling talks inch forward (ft)

- This Is What Hedge Funds Bought And Sold In Q1: 13F Summary (zerohedge)

- JPMorgan Asset Says Markets Are Right to Bet on US Rate Cuts (bloomberg)

- Western Alliance Deposit Growth Powers Regional Bank Rally (bloomberg)

- Here’s How Much Wealth You Need to Join the Richest 1% Globally (bloomberg)

- Elon Musk talks Tesla, Twitter, and why he tweets freely — even if it costs him money (cnbc)

- Kraft Heinz unveils customizable sauce dispenser with more than 200 condiment combos for restaurants (cnbc)

- ‘Too much latency’: Elon Musk slams the Fed for reacting too slowly to economic challenges (businessinsider)

- Shoppers Boosted Retail Sales in April, Reversing Two Months of Declines (wsj)

- Venture-Fund Returns Show Worst Slump in More Than a Decade (wsj)

- What Everyone—Except the U.S.—Has Learned About Immigration (wsj)

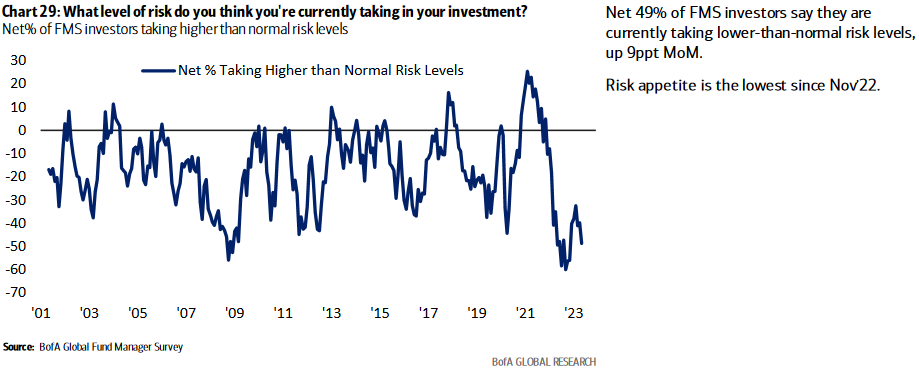

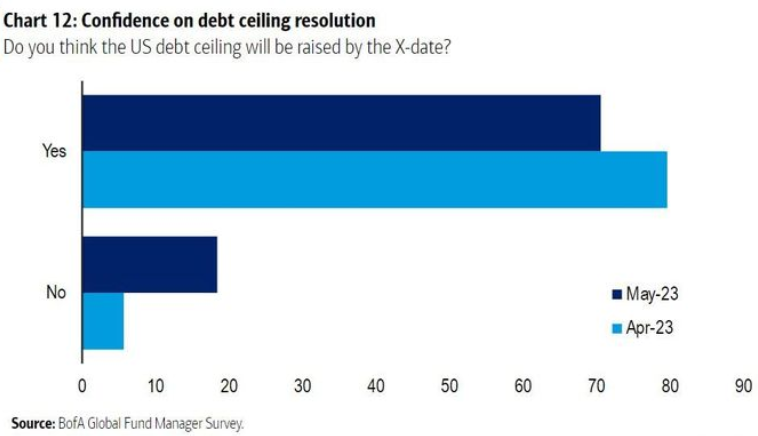

May 2023 Bank of America Global Fund Manager Survey Results (Summary)

The May survey covered 251 fund managers with $666 billion under management.

Continue reading “May 2023 Bank of America Global Fund Manager Survey Results (Summary)”

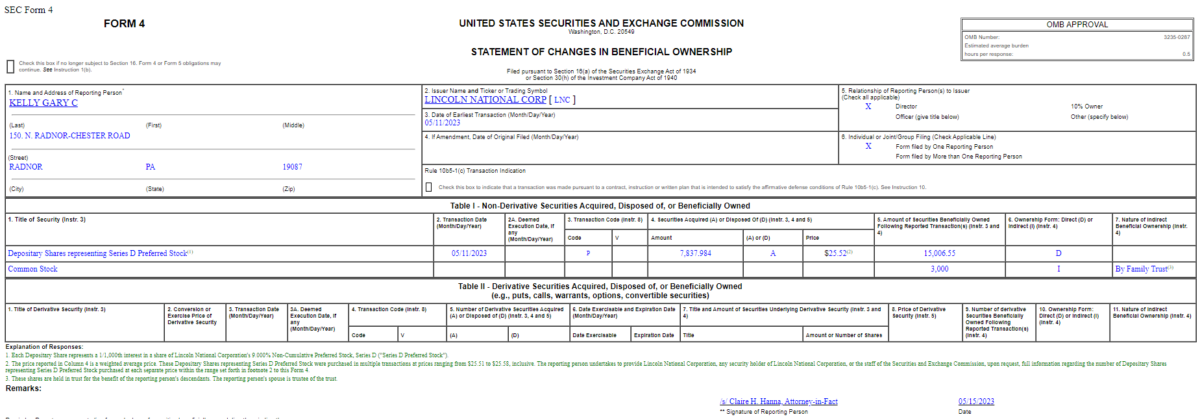

Insider Buying in Lincoln National Corporation (LNC)

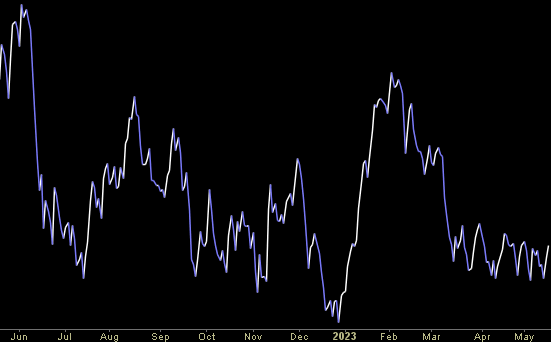

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 37 key reads for Tuesday…

- ‘Big Short’ Michael Burry is long on China’s Alibaba and JD.com — these stocks are now a fifth of his portfolio (businessinsider)

- Community Banks Are the Backbone of the Economy. The Little Guys Are Under Pressure. (barrons)

- Baidu Stock Rises After Solid Earnings. It Wasn’t AI That Drove the Beat. (barrons)

- North American Freight Markets Show Signs of Picking Up in Second Half (bloomberg)

- Shoppers Boosted Retail Sales in April (wsj)

- McCarthy Says Debt Ceiling Talks ‘Not In A Good Place’ As Yellen Warns ‘Time Is Running Out’ (zerohedge)

- PBOC Extends Cash Support in May After Credit Growth Slumped (bloomberg)

- Taobao Tmall Commerce Set to Invest In Winning Users (alizila)

- Debt-Ceiling Talks Set to Resume Tuesday. (barrons)

- China’s Demand for Oil Hits Record (wsj)

- Berkshire Hathaway Sold U.S. Bancorp, Bank of New York Stock. Here’s What It Bought. (barrons)

- Home Depot’s Earnings Beat Estimates. Why the Stock Is Falling and Hitting the Dow. (barrons)

- Opinion: Retail sector insiders are betting on no recession: 4 undervalued stocks they like now (marketwatch)

- Futures Drop After China Dismal Data Dump, Debt Ceiling Debate Enter Crunchtime (zerohedge)

- Rolls-Royce CEO Embarks on ‘Last Chance’ Overhaul at Jet-Engine Maker (wsj)

- Fed Officials See Rates Remaining High This Year (barrons)

- Here’s the big thing holding up the stock market, says Bank of America (marketwatch)

- Expedia Has ‘Overlooked Tailwinds’ for Growth. The Stock Gets an Upgrade. (barrons)

- Memorial Day Air Travel Expected to Be Busiest Since 2005 (barrons)

- Teaching Kids About Money: An Age-Based Guide for Advisors (barrons)

- The Disappearing White-Collar Job (wsj)

- AI Spending Will Cloud Chip Slowdown (wsj)

- Golf Drives Scotland’s Most International Housing Market: St. Andrews (mansionglobal)

- Rise in Distressed Sales Signals New Chapter for Beleaguered Office Market (wsj)

- The Data That Explains LIV Golf vs. the PGA Tour (wsj)

- Gene-Therapy Investors Have a Powerful Ally: Patients (wsj)

- Rusty Old Oil Tankers Fetch Big Bucks (wsj)

- Indian Tech’s Promise of Rivaling China Is Falling Apart (wsj)

- Yellen Warns ‘Time Is Running Out’ Ahead of Biden-McCarthy Meet (bloomberg)

- Investors Most Pessimistic So Far This Year, BofA Survey Shows (bloomberg)

- Baidu’s Revenue Beats After China Recovery Fuels Advertising (bloomberg)

- The Key Points That Could Complicate a Debt-Limit Deal (bloomberg)

- David Einhorn’s Greenlight Capital snapped up 2 regional banking stocks during last quarter’s turmoil (businessinsider)

- China’s Tencent Music revenue beats estimates on jump in paying users (reuters)

- Capital One shares up after billionaire investor Buffett’s near $1 bln bet on bank (reuters)

- ‘Big Short’ investor Michael Burry is betting big on China tech as other hedge funds have cooled on Beijing (fortune)

- Baidu, Alibaba, & Tencent Earnings This Week, SOE ETFs Prepare To Launch In China (chinalastnight)

Tom Hayes – Bloomberg HT (Turkey) TV Appearance – 5/12/2023

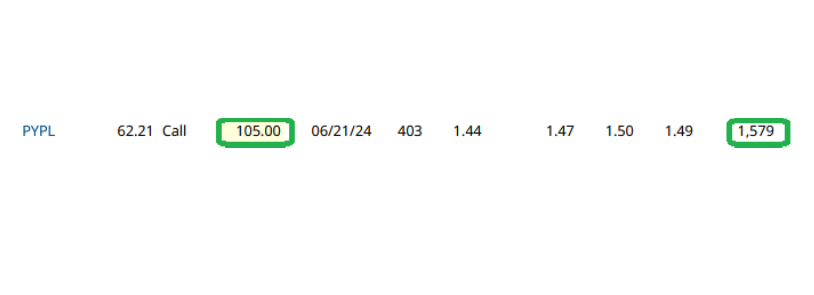

Unusual Options Activity – PayPal Holdings, Inc. (PYPL)

Data Source: Barchart

On Monday some institution/fund purchased 1,579 contracts of Jun. 2024 $105.00 strike calls (or the right to buy 157,900 shares of PayPal Holdings, Inc. (PYPL) at $105.00).

Continue reading “Unusual Options Activity – PayPal Holdings, Inc. (PYPL)”