Data Source: Finviz

Be in the know. 10 key reads for Tuesday…

- China’s Politburo meeting to offer traders policy clues as they eye new bets (scmp)

- GM raises 2023 guidance as first-quarter earnings beat expectations (cnbc)

- Remote Work Is “Bulls**t”, Says CRE Billionaire Sam Zell (zerohedge)

- China’s Politburo Likely to Shift Focus From Stimulus to Reforms (bloomberg)

- China to Scrap PCR Test For Inbound Travelers in Latest Easing (bloomberg)

- 3M Co. (MMM) Q1: strong quarter, in-line guidance, 6,000 new job cuts (streetinsider)

- GE Stock Needed a Good Quarter. Its Earnings Delivered. (barrons)

- Raytheon Technologies Beats on Earnings, Raises Dividend (barrons)

- Corporate Insiders Step Up Stock Buying After Banking Turmoil (wsj)

- “While Alibaba stock may remain volatile, downside may be limited as valuations approach single digits again.” (bloomberg)

Tom Hayes – Public.com Appearance – 4/24/2023

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 4/24/2023

Thanks to Deborah Mary Sophia and Bansari Mayur Kamdar for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the now. 17 key reads for Monday…

- Alibaba’s cloud services unit expands business with China’s data exchanges under major new deal in southern tech hub Shenzhen: “In 2022, Alibaba Cloud remained the top cloud infrastructure services provider in mainland China, with a 36 per cent share of the market’s US$30.3 billion overall revenue that year, according to research firm Canalys. It ranked Alibaba Cloud ahead of the rival cloud services units of Huawei Technologies Co, Tencent Holdings and Baidu in the same period.” (scmp)

- Corporate Insiders Increase Stock Buying After Banking Turmoil (wsj)

- Larry Summers Rejects De-Dollarization Hype (bloomberg)

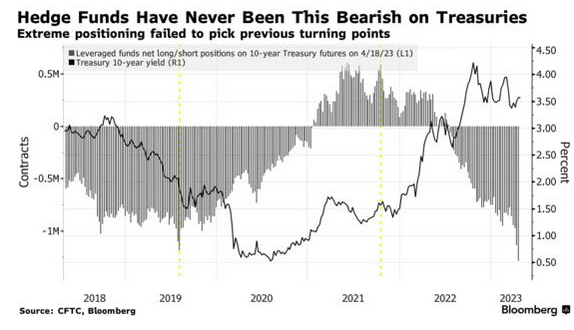

- Hedge Funds Place Biggest Ever Short on Benchmark Treasuries (bloomberg)

- Stock-market investors get a new ‘fear gauge’ Monday. What you need to know (marketwatch)

- Big Tech Is Carrying Stocks on Its Shoulders. Why AI Will Be Critical. (barrons)

- How Hyundai Motor Rose to Number 3 In the U.S. Vehicle Market (barrons)

- Drew Maggi, 33, gets second chance at MLB debut with Pirates: ‘Let’s f–king go!’ (nypost)

- As Big Tech determines the course of Wall Street, here is why Amazon will hold the most sway (marketwatch)

- Vehicle inventory is nearly back at pre-pandemic levels; these are the brands with the most and least supply (marketwatch)

- Big Tech Earnings Are Coming. What to Know About Amazon, Microsoft, Alphabet, and Meta. (barrons)

- Carbon Capture Is Set to Take Off. These Companies Are Ahead of the Game. (barrons)

- J&J Consumer-Health IPO Process to Kick Off Key Test for Moribund New-Issue Market (wsj)

- Why the Banking Mess Isn’t Over (wsj)

- Four Reasons Why Investors Expect US Dollar to Keep Sliding (bloomberg)

- ExxonMobil unleashing affordable energy with refinery expansion (foxbusiness)

- Tech investors focus on profits after layoffs; companies to highlight AI (reuters)

Be in the know. 30 key reads for Sunday…

- SL GREEN: “.. recent evidence of higher office utilization within our portfolio as physical occupancy regularly exceeds 60% on many workdays .. an increasing drumbeat of optimism about return to work .. companies .. mandating people come back..” (commercialobserver)

- Yellen offers an olive branch to China (ft)

- Devils stun Rangers in OT in Game 3 to get back into series (nypost)

- The Winner’s Edge (fs)

- Tech Billionaires Bet on Fusion as Holy Grail for Business (wsj)

- April 2nd Half Strength After Tax Deadline (almanac trader)

- Inflation is yesterday’s news (cbp)

- Inflation is basically down to the Fed’s target of 2%: Wharton’s Jeremy Siegel (cnbc)

- IPO Market Shows Signs of Life Even as Recession Fears Persist (bloomberg)

- Fed weighs impact of banking turmoil on next interest rate moves (ft)

- Shifting production from China is impossible, says shipping boss (ft)

- China urges jobless graduates to ‘roll up their sleeves’ and try manual work (ft)

- ‘The flattening’: tech sector calls time on middle managers (ft)

- Now is the time to buy bank shares (ft)

- What’s Happening in EM: The Sovereign Bond Laggards (Podcast) (bloomberg)

- Bond Traders Wait for Calm to Shatter With Fed ‘Breaking Stuff’(bloomberg)

- Is Alphabet’s Stock a Buy Before Earnings? (morningstar)

- Undervalued Communication Services Stocks (morningstar)

- 10 Of The Best Stock Market Investing Books For Beginners (2023) (acquirersmultiple)

- Lessons from Silicon Valley Bank (Howard Marks)

- AI Can Write a Song, but It Can’t Beat the Market (wsj)

- Warren Buffett on ChatGPT and AI: This is extraordinary but not sure if it’s beneficial yet (cnbc)

- Small Caps Trading at Extreme Discounts versus Large Caps (0.7x) only seen once before during Tech Bubble (Bill Miller)

- Better than feared first quarter earnings results will power the stock market to new highs, Fundstrat says (businessinsider)

- Japan Has Millions of Empty Houses. Want to Buy One for $25,000? (nytimes)

- Hartnett: Central Banks Are Giving Up On Rate Hikes, “Locking In” Structurally Higher Inflation (zerohedge)

- Nasdaq Composite Holds Critical Support, So Far So Good For Bulls! (kimblechartingsolutions)

- Amazon, Facebook, Google Headline Busy Earnings Week for Tech (wsj)

- Mercedes-Benz Just Unveiled a One-of-a-Kind Retro G-Wagen Inspired by the Boxy Original (robbreport)

- TikTok’s CEO on its future — and what makes its algorithm different (ted)

Be in the know. 15 key reads for Saturday…

- The Stock Market Barely Budged, but Don’t Let It Fool You—Earnings Season Is Going Swimmingly. “About 76% of companies in the MSCI USA Index have seen upwardly revised earnings estimates for the next year, according to Ned Davis Research. That’s the highest level in 10 months and up from a recent low of just under 60%, and it could be a sign that estimates have bottomed and are ready to rebound.” (barrons)

- Buy Expedia Stock. Get a Mini Airbnb for Free. (barrons)

- Bill Gross Scoops up Regional Bank Stocks (bloomberg)

- Deals Are Delayed, Not Dead, Bankers Hope (barrons)

- Fewer Money Managers Are Bullish on the Stock Market Now: Barron’s Poll (barrons)

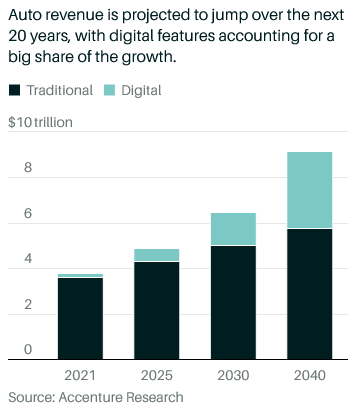

- The Battle for the Future of the Car Is Under Way. Investors Won’t Have to Pick a Side. (barrons)

- Detroit Is Staging a Surprising Comeback. Tech Could Fuel the Next Stage. (barrons)

- Why Taiwan Semi Should Still Be a Core Holding for Tech Investors (barrons)

- Bank of America CEO Brian Moynihan says bank earnings this week proved the system worked (marketwatch)

- Delta Air Director David Taylor Buys Up Stock (barrons)

- Inside Barry Diller’s Plan to Stop ChatGPT From Destroying the News Business (barrons)

- This Couple Built an Obscure Corner of Sports Betting Into a Billion-Dollar Business (wsj)

- The Secret History of AI, and a Hint at What’s Next (wsj)

- They’re the Happiest People in America. We Called Them to Ask Why. (wsj)

- Pepsi’s New Diet: More Chips and Soda (wsj)