Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- Why bears can’t keep the stock market down despite bad news (marketwatch)

- Fed’s Williams says inflation is slowing and labor market is cooling (marketwatch)

- Alibaba’s (BABA) grocery stores operator Freshippo pursuing Hong Kong IPO, could be valued upward of $10B (streetinsider)

- Regional Banks Post Hits and Misses but Prove Strength After Turmoil (barrons)

- Contagion in banking sector isn’t likely, but credit probably tightens: Howard Marks (marketwatch)

- Tesla Earnings Dented by Price Cuts (wsj)

- Lending Slowed, Economy Cooled After Bank Failures, Fed Report Shows (wsj)

- The Era of Easy Deposits Is Over for Main Street Banks (wsj)

- Builders Are Winning as Search-Weary US Buyers Rush to New Homes (bloomberg)

- AMEX spending volume climbed 14% to $398.9 billion in first quarter (bloomberg)

- The Number Of Americans Claiming Jobless Benefits Hits 17-Month High (zerohedge)

- Las Vegas Sands (LVS) blows past Q1 estimates; Analysts raise numbers (streetinsider)

- Can Intel become the chip champion the US needs? (ft)

- Jeff Bezos’s First Job Was At McDonalds, Here’s What The Billionaire Learned During His Time Flipping Burgers (benzinga)

- STAR Market Shines, Yellen To Visit China (chinalastnight)

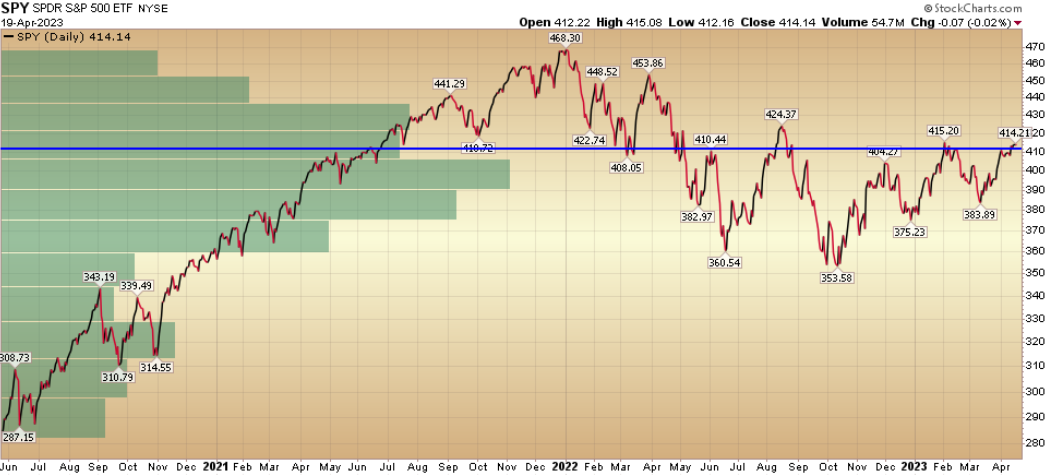

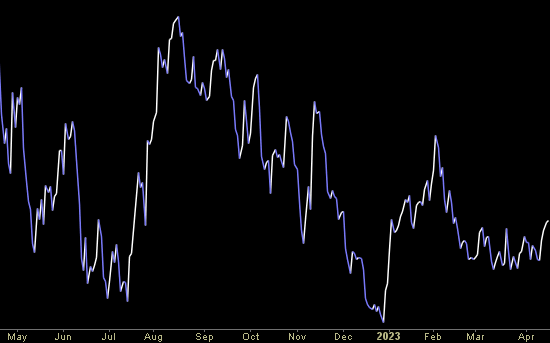

“Knockin’ On Heaven’s Door” Stock Market (and Sentiment Results)…

“‘Knockin’ on Heaven’s Door’ is a song by American singer-songwriter Bob Dylan, written for the soundtrack of the 1973 film Pat Garrett and Billy the Kid. Released as a single two months after the film’s premiere, it became a worldwide hit, reaching the Top 10 in several countries. The song became one of Dylan’s most popular and most covered post-1960s compositions, spawning covers from Eric Clapton, Guns N’ Roses, Randy Crawford and more.” Wikipedia

Continue reading ““Knockin’ On Heaven’s Door” Stock Market (and Sentiment Results)…”

Tom Hayes – Yahoo! Finance Appearance – 4/19/2023

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – April 19, 2023

Watch in HD directly on Yahoo! Finance

Where is money flowing today?

Be in the know. 16 key reads for Wednesday…

- Alibaba’s Grocery Arm Gears Up for Hong Kong IPO (bloomberg)

- Wall Street turns even more bullish on China’s economy as the end of zero COVID boosts growth (businnessinsider)

- Goldman Sachs Says Mega-Cap Tech Leaders Offer the Best Way to Play the AI Boom (24/7 Wall Street)

- Why the ‘pain trade’ explains the stock market’s continued rise despite bad news (marketwatch)

- Andy Beal, America’s richest banker, makes a massive bond bet on inflation (marketwatch)

- Netflix Lays Bare Tech’s Big Conundrum: How to Cut Costs While Boosting Growth (barrons)

- Why the Stock Market Is Going Up When Worries Abound (barrons)

- Redfin sees U.S. home prices in March fall the most in 11 years (marketwatch)

- Western Alliance Stock Surges as Bank Deposits Stop Falling. It Buoys Other Regionals (barrons)

- China’s Consumers Give Economy a Post-Covid Boost (wsj)

- China’s Economic Renaissance Poses a Fresh Dilemma (bloomberg)

- Bank of America customers are spending more and that’s supporting U.S. employment, CEO says (cnbc)

- The Fed must end rate hikes quickly to avoid a recession as inflation is cooling and the banking system remains fragile, Moody’s Analytics chief economist says (businessinsider)

- Investors who ‘sell in May and go away’ this year could miss a big summer rally in the stock market, Bank of America says (businessinsider)

- A Signal Flashes That Was Bullish Last Nine Times (zerohedge)

- Intuitive Surgical (ISRG) delivers best procedure growth in a decade; shares gain (streetinsider)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

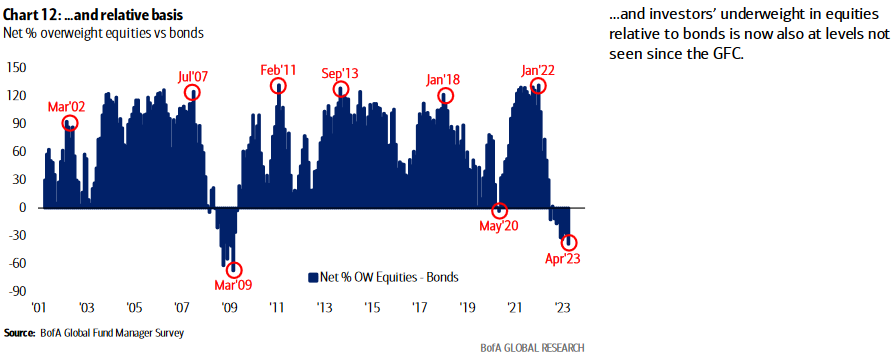

April 2023 Bank of America Global Fund Manager Survey Results (Summary)

The April survey covered 286 fund managers with $728 billion under management. Continue reading “April 2023 Bank of America Global Fund Manager Survey Results (Summary)”