Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – April 19, 2023

Where is money flowing today?

Be in the know. 16 key reads for Wednesday…

- Alibaba’s Grocery Arm Gears Up for Hong Kong IPO (bloomberg)

- Wall Street turns even more bullish on China’s economy as the end of zero COVID boosts growth (businnessinsider)

- Goldman Sachs Says Mega-Cap Tech Leaders Offer the Best Way to Play the AI Boom (24/7 Wall Street)

- Why the ‘pain trade’ explains the stock market’s continued rise despite bad news (marketwatch)

- Andy Beal, America’s richest banker, makes a massive bond bet on inflation (marketwatch)

- Netflix Lays Bare Tech’s Big Conundrum: How to Cut Costs While Boosting Growth (barrons)

- Why the Stock Market Is Going Up When Worries Abound (barrons)

- Redfin sees U.S. home prices in March fall the most in 11 years (marketwatch)

- Western Alliance Stock Surges as Bank Deposits Stop Falling. It Buoys Other Regionals (barrons)

- China’s Consumers Give Economy a Post-Covid Boost (wsj)

- China’s Economic Renaissance Poses a Fresh Dilemma (bloomberg)

- Bank of America customers are spending more and that’s supporting U.S. employment, CEO says (cnbc)

- The Fed must end rate hikes quickly to avoid a recession as inflation is cooling and the banking system remains fragile, Moody’s Analytics chief economist says (businessinsider)

- Investors who ‘sell in May and go away’ this year could miss a big summer rally in the stock market, Bank of America says (businessinsider)

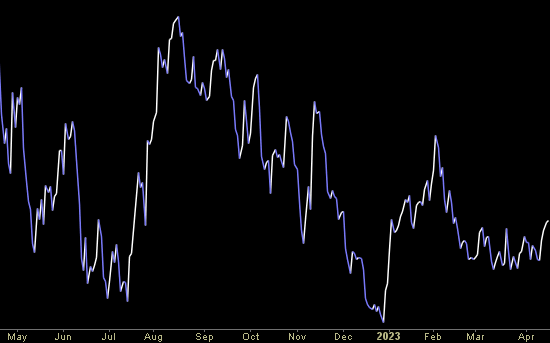

- A Signal Flashes That Was Bullish Last Nine Times (zerohedge)

- Intuitive Surgical (ISRG) delivers best procedure growth in a decade; shares gain (streetinsider)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

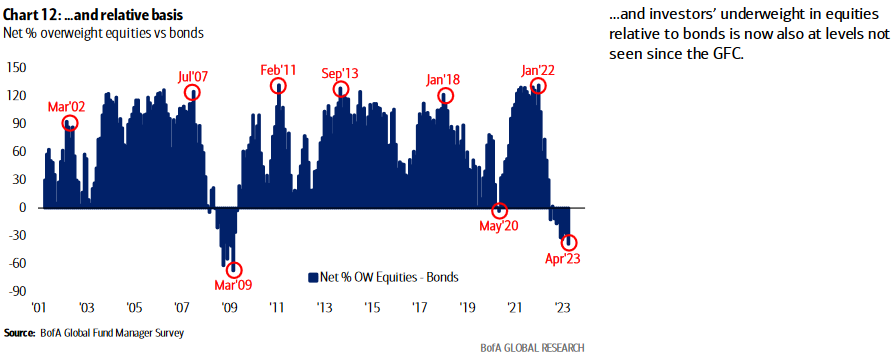

April 2023 Bank of America Global Fund Manager Survey Results (Summary)

The April survey covered 286 fund managers with $728 billion under management. Continue reading “April 2023 Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 40 key reads for Tuesday…

- Alibaba (BABA) gains as China eases pressure on Ant Group (streetinsider)

- Ant IPO Might Actually See Light: China Proposes Lower Penalty For Jack Ma’s Fintech Affiliate (benzinga)

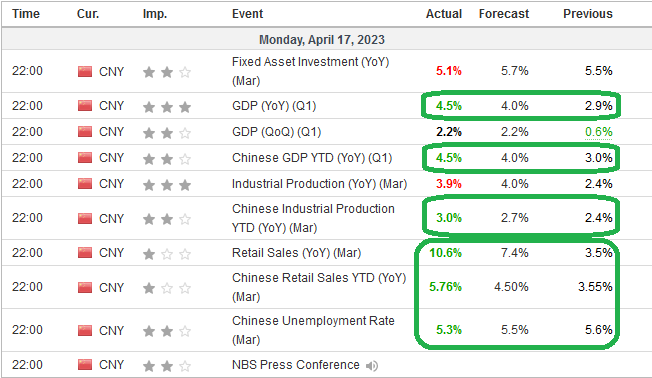

- China’s GDP Beat Expectations. Alibaba, Baidu and JD.com Are Rising. (barrons)

- China’s Consumer-Driven Growth Gives Boost to Global Economy (bloomberg)

- Investors Most Underweight Stocks Versus Bonds Since 2009, BofA Says (bloomberg)

- Why NDR Is Still Bullish on Stocks — For Now (institutionalinvestor)

- China’s Economy Rebounds After Three Years of Zero-Covid Isolation (wsj)

- Chinese Millennials Look Beyond Property Investments to Build Wealth (bloomberg)

- China’s GDP growth rises to 4.5%, as economic recovery appears back on track (marketwatch)

- Case for Stocks Is Seen in Model Showing Economic Bottom Is Past (bloomberg)

- Consumer spending could become the backbone of a new growth model but that would require Beijing to relinquish some political control (ft)

- China’s Commodities Output Roars Ahead as Economy Reopens (bloomberg)

- The Dollar Is Not Losing Its Status Any Time Soon (bloomberg)

- De-dollarisation is just a pipe-dream (thehindubusinessline)

- Warren Buffett and Japan’s Trading Titans Would Be Formidable Allies (wsj)

- Top 5 China Stocks: Li Auto, NetEase Flash Buy Signals (investors)

- Alibaba integrates own ChatGPT-style service to collaboration app DingTalk (scmp)

- Bank of America’s Earnings Top Expectations. Profit Climbs 15%. (barrons)

- J&J’s Stock Is Rising. It Beat on Earnings, Raised Guidance. (barrons)

- Kevin McCarthy Says House GOP Plans to Vote on Debt Limit, Spending Cuts (wsj)

- China’s Xi Jinping Seeks to Shake Trans-Atlantic Solidarity With Flurry of Diplomacy (wsj)

- Rockefeller Center Strikes Deal for Luxury Hotel by Aspen Hospitality (wsj)

- Few Banks Are Hedging Interest-Rate Risk (wsj)

- Connecticut Horse Farm Sells After Nearly a Decade On and Off the Market (wsj)

- China’s Economy Defies Naysayers (wsj)

- S. Car Brands Will Benefit Most From Electric Car Tax Breaks (nytimes)

- Eight Months In, What Is Happening With Biden’s CHIPS Act? (bloomberg)

- China’s Diplomatic Dance Isn’t What It Seems (bloomberg)

- For the first time since 1945, RBC sees signs market may ignore recession (cnbc)

- The stock market is poised to rally thanks to strong earnings and a weakening dollar, Deutsche Bank’s chief US equity strategist says (businessinsider)

- Nobel economist Paul Krugman says there’s no real risk to the dollar – unless the US defaults on its debt (businessinsider)

- How to Tell Biotech’s Likely Winners From Losers (wsj)

- European shares hold near 14-month top, sterling strengthens (streetinsider)

- Taiwan Semi (TSM) upgraded at Susquehanna as ‘worst case dialed in’ (streetinsider)

- FT Alphaville. Rumours of China’s economic demise may be greatly exaggerated (ft)

- China’s economy: five takeaways from first-quarter GDP data (ft)

- China’s economy rebounds more than expected after Covid reopening (ft)

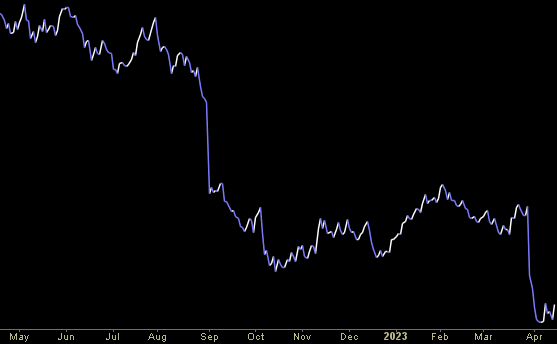

- Investors bet US dollar has further to fall (ft)

- Amazon: Breaking Down CEO Andy Jassy’s Shareholder Letter for 2022 (gurufocus)

- Hong Kong Rises On Signs of Consumer Comeback (chinalastnight)