Data Source: Finviz

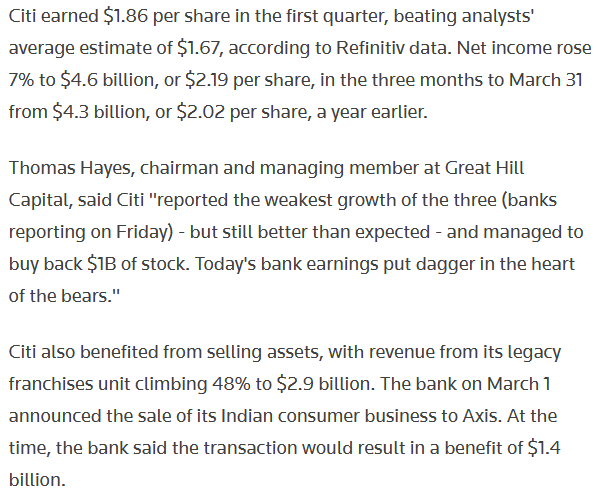

Tom Hayes – Quoted in Reuters article – 4/14/2023

Thanks to Bansari Kamdar, Tatiana Bautzer and Mehnaz Yasmin for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 20 key reads for Friday…

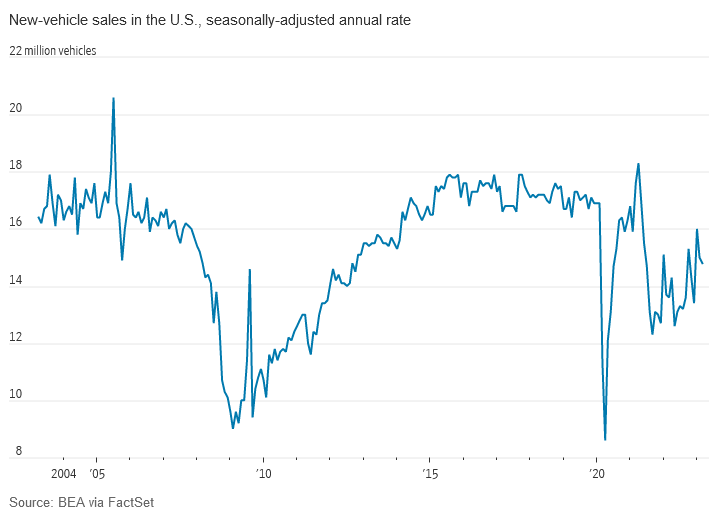

- As Dealerships Get More Stock, Auto Makers’ Sales Rebound. GM, Hyundai and others report a robust start to the year, due in large part to rising inventory levels and easing supply-chain troubles (wsj)

- JPMorgan Chase stock shifts into rally mode after it blasts past earnings and revenue estimates (marketwatch)

- Banking crisis forces ECB policymakers to rethink rate hikes, but focus still firmly on inflation (cnbc)

- Wells Fargo shares rise after bank’s first quarter profit and revenue top the Street (cnbc)

- Can Intel become the chip champion the US needs? (ft)

- Birkin bag maker Hermes sees no U.S. slowdown as sales jump 23% (cnbc)

- For Regional Banks, Surviving Won’t Be the Same as Thriving (wsj)

- JPMorgan Chase posts record revenue that tops expectations on higher interest rates (cnbc)

- Wall Street is wrong: Former Pimco chief economist Paul McCulley predicts rate hikes will end next month (cnbc)

- New-vehicle inventories, discounts rise as the New York Auto Show heralds spring selling season (wsj)

- Hedge Fund 101: You Always Buy Liquidation Events (chinalastnight)

- Big banks kick off earnings season with a bang (yahoo)

- BofA Strategists Prefer Global Stocks to Tech-Heavy US Market (bloomberg)

- PBOC Pledges Stronger Support to Economy (bloomberg)

- Buffett Focus on ‘Quality’ Helps Narrow Hunt for Value in Japan (bloomberg)

- Citigroup profit rises and beats analyst forecasts, shares rise (marketwatch)

- Retail Sales Fell More Than Expected in March (barrons)

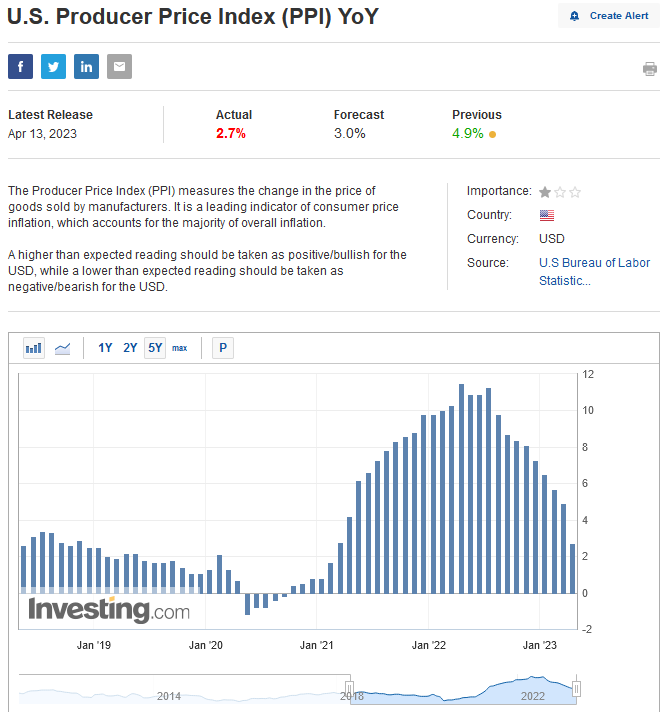

- Supplier Prices Fell in March, Adding to Signs of Moderating Inflation (wsj)

- Amazon CEO Andy Jassy Commits to Cost-Cutting, Innovation in Shareholder Letter (wsj)

- The Fed could turn a mild downturn into an ugly recession if it doesn’t stop raising rates soon, market veteran Ed Yardeni says (businessinsider)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 182

Hedge Fund Tips with Tom Hayes – Podcast – Episode 172

Where is money flowing today?

DOW 30 Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Dow Jones Industrial Average 30 stocks. Continue reading “DOW 30 Earnings Estimates/Revisions”

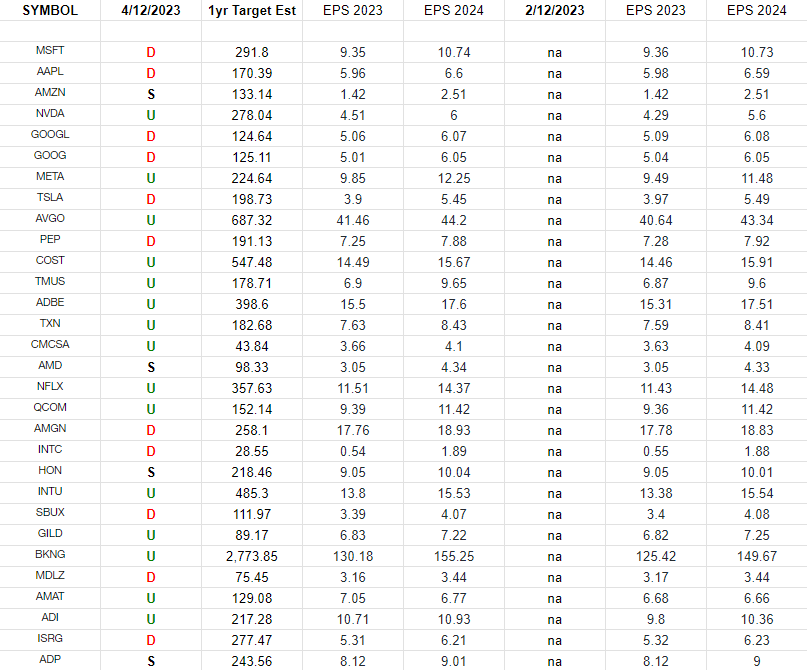

Nasdaq (top 30 weights) Earning Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2023 estimates were on 2/12/2023 and today.

Continue reading “Nasdaq (top 30 weights) Earning Estimates/Revisions”

Be in the know. 35 key reads for Thursday…

- PPI data show wholesale inflation registering sharpest monthly decline in three years (marketwatch)

- Fed Stresses Vigilance on Credit as Rate Views Scaled Back (bloomberg)

- Alibaba Stock Rises as SoftBank Eyes the Exit. (barrons)

- China Exports Unexpectedly Jump in March. (barrons)

- Goldman Sachs drops its call for a Fed interest-rate hike in June (businessinsider)

- IMF warns hard landing ‘within the realm of possibilities’ for U.S. economy (cnbc)

- Fed Keeps May Interest-Rate Increase on Table (wsj)

- FOMC minutes (federalreserve)

- Warren Buffett’s Japan Bet Is Paying Off Big (wsj)

- Alibaba Stock Rebounds After Bearish Softbank News, But Is BABA Stock A Buy Now? (investors)

- Bank Earnings Are a Test. An ‘F’ Would Upset Wall Street. (barrons)

- Earnings Season Could Offer Upbeat Surprises (barrons)

- The ‘Godfather of AI’ Says Doomsayers Are Wrong and ChatGPT Isn’t Remarkable (barrons)

- Warren Buffett is willing to bet $1 million that depositors won’t lose money (marketwatch)

- New-Car Prices Are Falling. It’s Time to Start Haggling. (barrons)

- Amazon Web Services Faces Headwinds, Warns CEO, but AI Set to Be ‘Transformative’ (barrons)

- Fed expects banking crisis to cause a recession this year, minutes show (cnbc)

- Fed Officials Weighed Pause in Rate Hikes as Banking Turmoil Hit (barrons)

- Goldman Sachs says it expects to see further deposit losses at banks (marketwatch)

- S. Inflation Eased to 5% in March (wsj)

- Here’s why Warren Buffet isn’t panicking about banking industry (nypost)

- White House Rejects Fed Staff Outlook, Says No Sign of Recession (bloomberg)

- Fed Leans Toward Another Hike, Defying Staff’s Recession Outlook (bloomberg)

- Manhattan Rents Reach Record High With Busy Season Yet to Come (bloomberg)

- There’s No Such Thing as Low Season in the Caribbean Anymore (bloomberg)

- Amazon Joins Generative AI Race, Targets Tech at Cloud Customers (bloomberg)

- Credit Investors See Defaults Rising, 84% Chance of US Recession (bloomberg)

- Amazon jumps into the generative A.I. race with new cloud service and its own large language models (cnbc)

- Amazon CEO says in annual letter he’s confident he can get costs under control (cnbc)

- Young people in Greater China are blowing their paychecks every month (cnbc)

- Amazon CEO Andy Jassy is betting big on AI – and touts the technology as a ‘big deal’ for shareholders (businessinsider)

- Warren Buffett predicts more bank failures, dismisses bitcoin buyers as gamblers, and warns inflation and recession are serious threats in a new interview. Here are the 14 best quotes. (businessinsider)

- Jeremy Siegel says he’s ‘shocked’ at what the Fed’s overlooked and sees stocks struggling over the next 6 months (businessinsider)

- Bullishness Remains Missing, Which Is A Good Thing (zerohedge)

- Fed, We Have A Problem: Wage Growth Is Actually Crashing (zerohedge)

“Snatching Defeat” Stock Market (and Sentiment Results)…

Snatching Defeat From The Jaws of Victory

On Wednesday, the market started up nicely on the back of the better than expected CPI prints:

Continue reading ““Snatching Defeat” Stock Market (and Sentiment Results)…”