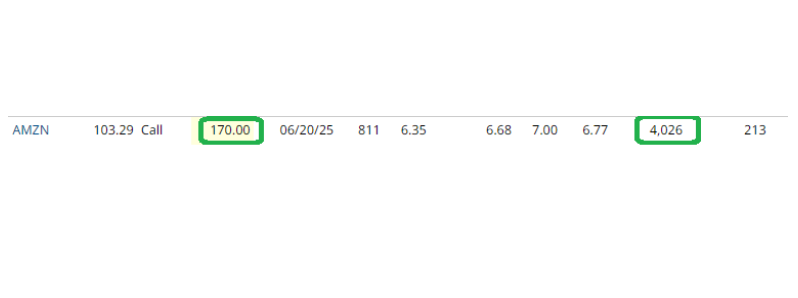

Data Source: Barchart

On Friday some institution/fund purchased 4,026 contracts of Jun. 2025 $170.00 strike calls (or the right to buy 402,600 shares of Amazon.com, Inc. (AMZN) at $170.00). The open interest was just 213 prior to this purchase.

Continue reading “Unusual Option Activity – Amazon.com, Inc. (AMZN)”