Datasource: Finviz

Be in the know. 25 key reads for Monday…

- Hedge funds caught in bigger squeeze than 2021 meme stock frenzy – Goldman Sachs note (reuters)

- What China Savings Mean For World Consumer Firms (zerohedge)

- China’s Local Entities Splurge on Land Shunned by Developers (bloomberg)

- China urges calm after U.S. shoots down suspected spy balloon (cnbc)

- China’s Mega Railway Project Hits Roadblock in Pakistan (bloomberg)

- China willing to restart trade dialogue with Australia after talks (reuters)

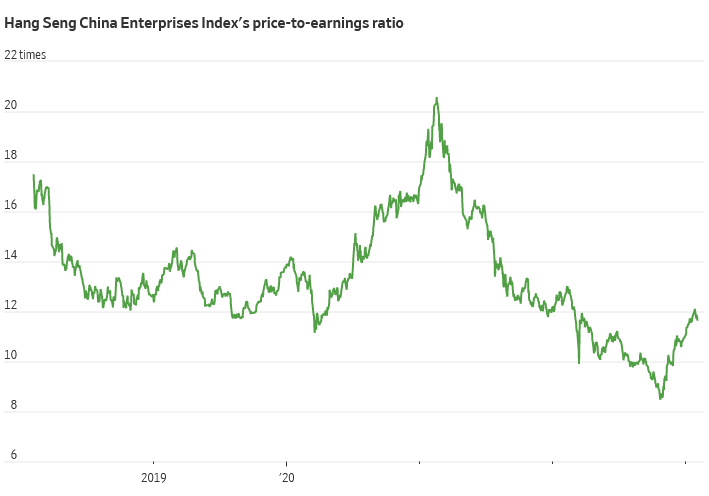

- Now That Zero-Covid Is Over, China Needs to Show Investors the Money (wsj)

- Key Events This Week: UMich, Inflation Expectations And All Ears On Powell Tomorrow (zerohedge)

- Adani Flagship’s Share Price Has 40% More Downside, NYU Professor Says (bloomberg)

- From Nike to Nutella: Company names you have probably been mispronouncing your whole life (cnbc)

- Toyota and 25 Other Stock Picks for This Year, According to Our Roundtable Pros (barrons)

- Prior Chinese Balloon Incursions Over U.S. Went Undetected, Officials Say (wsj)

- For Pete’s Sake. The Energy Report 02/06/2023 (Phil Flynn)

- States Are Flush With Cash, Which Could Soften a Possible Recession (wsj)

- January’s Hiring Boom Caught Economists by Surprise. Why Forecasts Often Miss the Mark. (wsj)

- When Does Elon Musk Sleep? Billionaire Speaks of Limits to Fixing Twitter and His Back Pain (wsj)

- Tesla Has Raised New Car Prices as Used Values Sink. Carvana Is Trying To Keep Up. (barrons)

- Onsemi reports Record fourth quarter automotive revenue of $989 million grew 54% year-over-year (onsemi)

- Lawrence Summers and IMF director both say odds of soft landing for U.S. are improving (marketwatch)

- Upbeat Economic Data Keep Investors on Edge About Fed (wsj)

- Wharton professor Jeremy Siegel warns the blowout US jobs report may be bad news for stocks – and could lead to a recession this year (businessinsider)

- Steve Eisman of ‘Big Short’ Fame Sees a New Paradigm Unfolding in Markets (yahoo)

- Investors snap up Wanda bonds in bet on China property revival (ft)

- Big Tech companies use cloud computing arms to pursue alliances with AI groups (ft)

- Apple’s Next Move: An iPhone That’s More High-End Than Pro Max? (benzinga)

Be in the know. 15 key reads for Sunday…

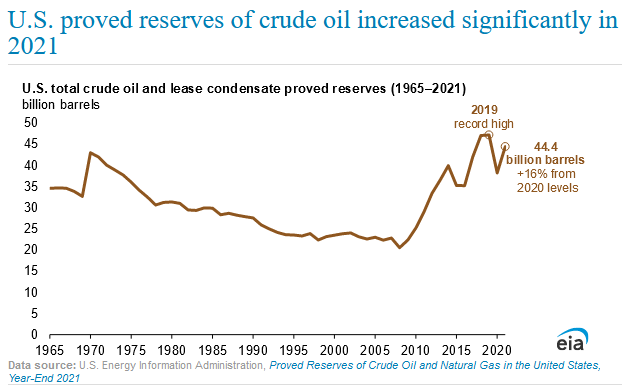

- U.S. proved reserves of crude oil increased significantly in 2021 (eia)

- The 10 Best Companies to Invest in Now (morningstar)

- Jeremy Siegel: We will have a ‘large decrease in rates’ in the second half of the year (cnbc)

- U.S. Shoots Down Suspected Chinese Spy Balloon (wsj)

- Price Cuts Working: Tesla Shipped 66,051 Vehicles In China In January, Up 18% From December (zerohedge)

- These Were The Best And Worst Performing Assets To Start The Year (zerohedge)

- William D. Cohan on the Rise and Fall of GE (bloomberg)

- is the cybertruck closer than ever? tesla’s long-awaited car spotted with new design (designboom)

- HIGH BEAN Inside Mr Bean actor Rowan Atkinson’s jaw-dropping car collection including £9.9m McLaren F1 and £400k Rolls Royce (the-sun)

- McLaren’s New 740 HP Supercar May Replace the 720S as the Marque’s Flagship (robbreport)

- ‘Bond King’ Gundlach predicts stocks have further room to rally as Fed ends tightening cycle (fortune)

- Cancer vaccines are already a reality—but your doctor might not tell you about them unless you ask (fortune)

- China’s XPeng G9 Could Be the Best Electric SUV Around (wired)

- Subway CEO predicts 2023 will provide pricing pressure ‘relief’ for consumers: We’re through the ‘worst part’ (foxbusiness)

- Central Bankers Curb Their Enthusiasm for Rate Hikes: Eco Week (bloomberg)

Be in the know. 20 key reads for Saturday…

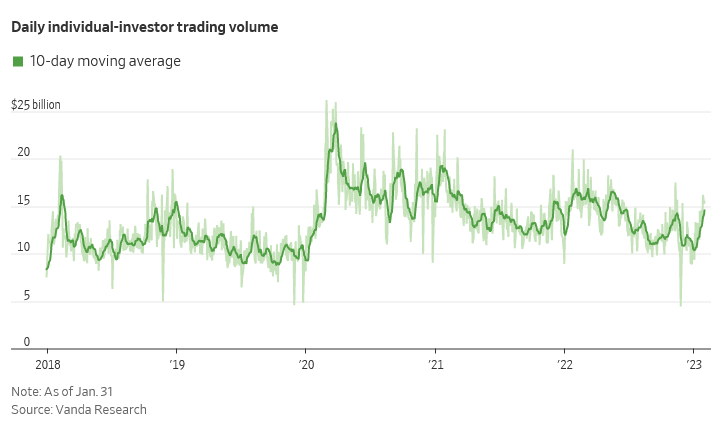

- The Retreat of the Amateur Investors (wsj)

- Pfizer Is Moving Beyond Covid. Why Its Stock Is a Buy. (barrons)

- The Stock Market Stopped Worrying About the Jobs Report. Here’s Why. (barrons)

- U.S.-China Tension Grows as Suspected Spy Balloon Leads to Postponed Visit (barrons)

- Tech Stocks Are Soaring Despite Weak Earnings. Here’s What It Means. (barrons)

- Sherwin-Williams CEO John Morikis Bought Up Shares (barrons)

- Exclusive Italian Automaker Pagani Shows off Its $7.4 Million Huayra Codalunga (barrons)

- Opinion: Zuckerberg and Intel are shipping the proceeds from their layoffs straight to Wall Street (marketwatch)

- Alphabet and Other Stocks That Are Solid Bets in a Wild Market (barrons)

- SEC Considers Easing Climate-Disclosure Rules After Investor Pushback (wsj)

- Load Management? What’s That? No Days Off for Hockey’s Winningest Team (wsj)

- Ford Sees US Car Prices Falling 5% This Year as Rebates Rise (bloomberg)

- What CEOs Are Saying: 2023 ‘Is the Year of Efficiency’ (wsj)

- FTC Prepares Possible Antitrust Suit Against Amazon (wsj)

- No signs of US slowdown in surprisingly robust jobs market (ft)

- Stock barometer is stacked with companies that dodged last year’s global sell-off (ft)

- China Weekly Covid Deaths Halve as Country Returns From Holiday (bloomberg)

- How Zelle is different from Venmo, PayPal and CashApp (cnbc)

- How ChatGPT Kicked Off an A.I. Arms Race (nytimes)

- Offices are more than 50% filled for the first time since the pandemic started (cnn)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 2/3/2023

Thanks to Lucia Mutikani for including me in the article on Reuters today:

Click Here to View The Full Reuters Article

Be in the know. 25 key reads for Friday…

- Nordstrom Stock Surges 30% on Report Activist Investor Has a Stake (barrons)

- Jobs Growth Was Double the Forecast. It’s a Challenge for the Fed. (barrons)

- ‘It Is an Employer’s Market’: Tech Layoffs May Have Turned the Great Resignation Into the Great Recommitment (barrons)

- S. unemployment rate falls to 3.4% — lowest level since 1969 — as economy creates 517,000 jobs in January (marketwatch)

- Alphabet to Launch a ChatGPT Rival. Microsoft is Forcing Google to Take a Risk. (barrons)

- The Hottest Sectors of the Reopening Are Now Driving a Wage Slowdown (bloomberg)

- Baidu Plans a ChatGPT Rival. The Chinese Internet Giant’s Stock Could Reap the Returns. (barrons)

- A new bull market is underway amid Powell’s acknowledgement of falling inflation, Fundstrat says (businessinsider)

- Apple Sales Shrink as Pandemic Rally Ends for iPhone Maker, Other Tech Giants (wsj)

- The Bosses Are Back in Charge (wsj)

- Amazon Warns of Period of Slower Growth (wsj)

- Drug Prices Increase 5.6% as Government Ramps Up Pressure to Lower Costs (wsj)

- George Costanza’s Guide to Better Living (wsj)

- Ford Posts $1.3 Billion Fourth-Quarter Profit, Misses Full-Year Profit Guidance (wsj)

- Oil Hokey Pokey. The Energy Report 02/03/2023 (Phil Flynn)

- 3M Investor Raises Concerns About Company Leadership (wsj)

- Netflix to feature electric cars from GM and others in shows, films (nypost)

- European Central Bank Raises Rates Again but Markets See an End to Escalation (nytimes)

- Why Chinese Companies Are Investing Billions in Mexico (nytimes)

- European Stocks Set for Bull Market on Rates, Growth Optimism (bloomberg)

- Ford Returns to F1 as Racing Series Sees Surge in Popularity (bloomberg)

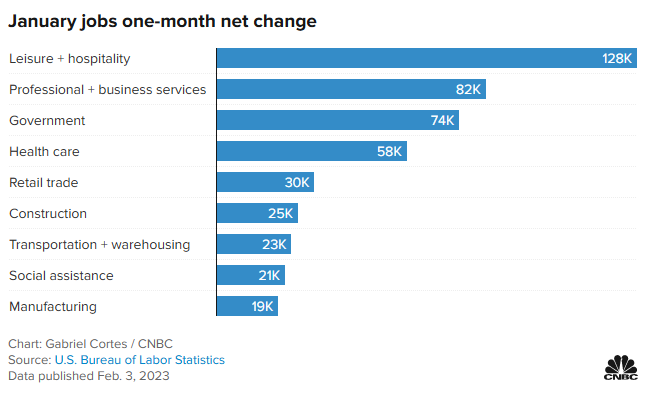

- Here’s where the jobs are for January 2023 — in one chart (cnbc)

- YouTube Shorts surpassed 50 billion daily views, a bright spot for Alphabet as it faces fierce competition from TikTok and declining ad revenue (businessinsider)

- ‘Big Short’ investor Michael Burry deletes his Twitter profile after ominous ‘sell’ warning (businessinsider)

- Mark Cuban and Amazon Are Shaking Up Generic Drugs (wsj)