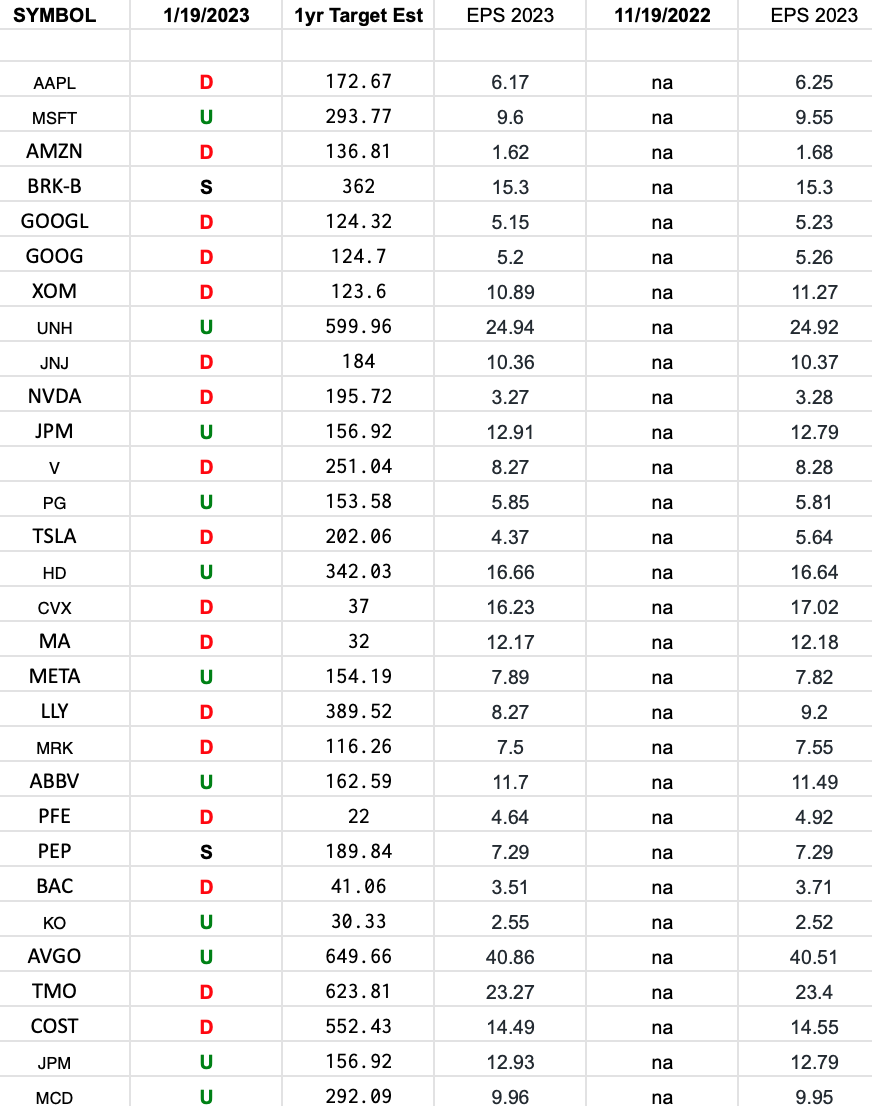

S&P 500 Earnings Estimates

In the spreadsheet above I have tracked the top 30 weights for the S&P 500 ETF (SPY).

DOW 30 Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Dow Jones Industrial Average 30 stocks. Continue reading “DOW 30 Earnings Estimates/Revisions”

Be in the know. 25 key reads for Thursday…

- Getting Fired Was The Best Thing To Happen To This Billionaire (ibd)

- Investors are holding near-record levels of cash and may be poised to snap up stocks (cnbc)

- The odds of a more than 20% gain for the stock market are on the rise as the Fed turns dovish amid transitory inflation, Fundstrat says (businessinsider)

- Nuclear Power Is Making a Comeback in the Stock Market and Hollywood (barrons)

- The 1980s was the blueprint for the upcoming disinflation cycle and these are the stocks for it, strategists say (marketwatch)

- More than 25,000 global tech workers laid off in the first weeks of 2023, says layoff tracking site (marketwatch)

- Chinese cities relax homebuying restrictions, offer subsidies to attract talent (scmp)

- The Importance of Vice Premier Liu He’s Davos Speech (chinalastnight)

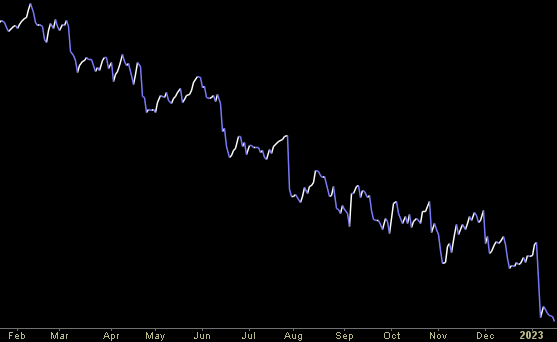

- Dollar touches 7-month low as Fed rate rise expectations slide (ft)

- This Changes Everything for Hedge Fund Managers (institutionalinvestor)

- Are semiconductor chips the new oil? (foxbusiness)

- Hedge funds that punted early on China recovery reaped the rewards (reuters)

- Ukraine Is Getting More Money From the U.S. Defense Stocks Are Edging Up. (barrons)

- The Obscure Law Biden Should Invoke to Get Around the Debt Limit (barrons)

- S. Retail Sales Fell 1.1% in December (wsj)

- Treasury to Begin Special Measures as Debt Limit Nears (wsj)

- Amazon Kicks Off Round of Job Cuts Affecting 18,000 People (bloomberg)

- Two Fed Officials Back Quarter-Point Rate Rise Next Month (wsj)

- Fed’s Beige Book Says Businesses Expect Weak Growth in Months Ahead (wsj)

- Fake Meat Was Supposed to Save the World. It Became Just Another Fad (bloomberg)

- The 2023 Aston Martin DBX 707 Is a Game-Changing SUV (bloomberg)

- Jim Cramer says market is in a period of consolidation, getting rid of ‘weak-handed investors’ (cnbc)

- China tightens media control with tiny stakes in two Alibaba units (cnbc)

- Goldman Sachs: These 40 stocks have at least 34% upside right now while the rest of the market struggles for gains in 2023 (businessinsider)

- LIV Golf Reaches Deal to Broadcast Events on CW Network (wsj)

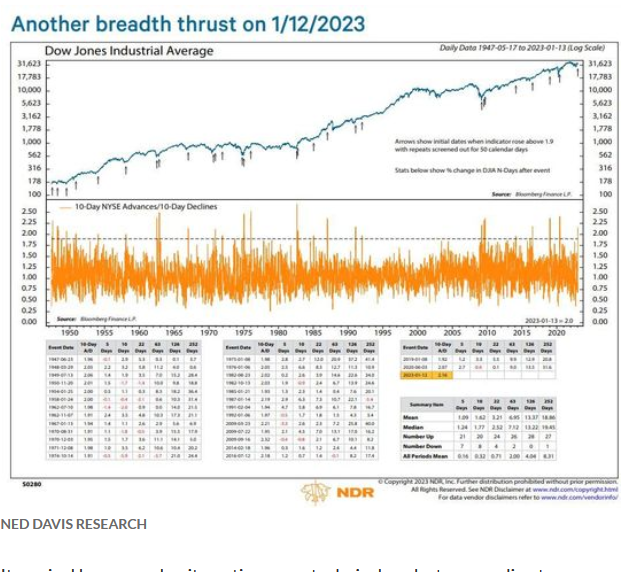

Stock Market Breather (and Sentiment Results)…

After a 14%+ move off of the October lows, the market has been consolidating sideways for the past 6 weeks or so. This is a normal consolidation and will resolve it self (higher in our view) as we work through earnings and the Fed meeting in coming weeks. For the next few days, who knows…

Continue reading “Stock Market Breather (and Sentiment Results)…”

Tom Hayes – Benzinga Appearance – 1/18/2023

Benzinga – Thomas Hayes – Chairman of Great Hill Capital – January 18, 2023

Watch Directly On Benzinga HERE

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 22 key reads for Wednesday…

- China’s Revenge Spenders Are Just Warming Up (bloomberg)

- United Stock Rises After Beating Estimates (barrons)

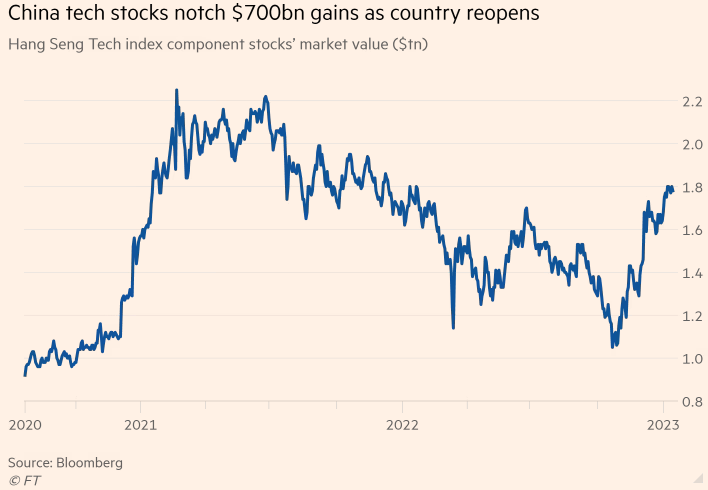

- China’s Reopening Is a Win for Stocks in Other Markets (barrons)

- Retail Sales Fell 1.1% in December (wsj)

- Moderna Sees Success in RSV Vaccine Trial (barrons)

- China Is Open Again. 13 Ways to Tap Into Its Recovery Right Now. (barrons)

- Should Disney Spin Off ESPN and ABC? It’s Harder Than It Looks. (barrons)

- China Says Economy to Return to Faster Growth as Covid Isolation Ends (wsj)

- K. Inflation Falls for Second Month, Following Global Move (wsj)

- China Returns to Davos With Clear Message: We’re Open for Business (nytimes)

- Microsoft to Lay Off 10,000 Employees (wsj)

- US Producer Prices Plunge Most Since COVID Lockdowns (zerohedge)

- S. Treasury Secretary Yellen and China Vice Premier Liu aim to ease tensions in first face-to-face meeting (marketwatch)

- Summers Is More Upbeat on US Outlook Than He Was a Few Months Ago (bloomberg)

- Amazon Kicks Off Round of Job Cuts Affecting 18,000 People (bloomberg)

- China’s economy will be ‘on fire’ in the second half of 2023, StanChart chairman says (cnbc)

- China’s likely to rebound in 2023, but much depends on the consumer: KraneShares (cnbc)

- China offers olive branch to the West, but some are still skeptical (foxbusiness)

- IMF signals upgrade to forecasts as optimism spreads at Davos (ft)

- China tech stocks stage $700bn recovery rally (ft)

- China’s tutoring giant triples sales by selling eggs after crackdown (scmp)

- China set for ‘steady, continuous’ foreign capital inflows as investors return (scmp)

Tom Hayes – Quoted in Reuters article – 1/18/2023

Thanks to Shreyashi Sanyal and Amruta Khandekar for including me in their article on Reuters today. You can find it here: