- China Is Opening Fast. Don’t Miss the Rebound for Stocks. (barrons)

- The Rest of the World Is Running With the Bulls (bloomberg)

- Shanghai eyes 5.5 per cent consumption-led economic growth for 2023 (scmp)

- Used car prices post biggest drop ever as new luxury car sales boom (yahoo)

- Jamie Dimon Is Changing His Tune About an Economic Hurricane. He’s Not Alone. (barrons)

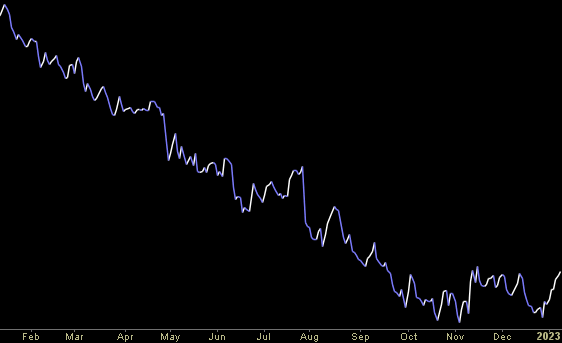

- Trust the bond market, not the Fed, on interest rates, Gundlach says (marketwatch)

- 18 stock picks in a ‘Goldilocks’ scenario for U.S. consumers (marketwatch)

- Rents Take a Breather. Why Housing Stocks Are for Serious Buyers. (barrons)

- European Stocks Are Outshining U.S. Peers (wsj)

- Disney Adds Lower Priced Theme Park Access and Perks (wsj)

- China Jet Fuel Demand Set To Soar Ahead Of Lunar New Year (zerohedge)

- Hedge Fund Shorting Of Tech Stocks Hits Record High, Goldman Prime Finds (zerohedge)

- JPM Trading Desk Sees 85% Odds CPI Print Will Push S&P At Least 1.5% Higher (zerohedge)

- Where The World’s Ultra-Wealthy Live (zerohedge)

- Analysts praise Boeing (BA) after ‘strong’ December orders/deliveries (streetinsider)

- Activist investor Bluebell Capital builds stake in Bayer AG, pushes for breakup reports Bloomberg (streetinsider)

- As Infrastructure Money Lands, the Job Dividends Begin (nytimes)

- Fed’s No-Rate-Cut Mantra Rejected by Markets Seeing Recession (bloomberg)

- China Shows Why Emerging-Markets Investing Is So Much Fun (bloomberg)

- Mortgage refinance demand surges, as homeowners take advantage of lower interest rates (cnbc)

- Iconic West Coast burger chain heads east in big expansion (foxbusiness)

- What Terry Smith gets wrong (and right) this time on Unilever (ft)

Tom Hayes – Quoted in TheStreet article – 1/10/2023

Thanks to Ellen Chang for including me in her article on TheStreet.com. You can find it here:

Click Here to View The Full Article on TheStreet.com

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

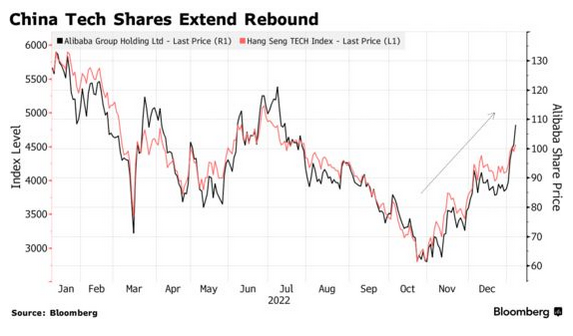

- Alibaba (BABA) stock is a new Top Pick at Goldman Sachs and Morgan Stanley (streetinsider)

- Xi Jinping’s plan to reset China’s economy and win back friends (ft)

- The Fed will start cutting rates this summer as core PCE inflation will drop to 2.1%, says UBS’ global chief economist (businessinsider)

- Chinese stocks have been on a tear. Morgan Stanley says it’s turning even more bullish on China. (marketwatch)

- Ant Group Won’t Be Squashed After All (wsj)

- US Online Prices Drop a Fourth Month on Steep Holiday Discounts (bloomberg)

- The Chatbots Are Coming for Google (bloomberg)

- ChatGPT Is No Magic Bullet for Microsoft’s Bing (bloomberg)

- 5 Beaten-Down Stocks That Can Outperform This Year (barrons)

- Meta, Alphabet, and Uber Are Top Tech Stock Picks for 2023, Says Analyst (barrons)

- Beijing Signals Two-Year Internet Crackdown May Be Coming to an End (wsj)

- Pfizer gears up to make Covid drug Paxlovid in China (ft)

- Emerging market stocks jump 20% from October low (ft)

- Experts Spent Years ‘Angst-ing’ Over Value. In the End, the Answer Was in the Textbook. (institutionalinvestor)

- Jamie Dimon sounds alarm on rising US debt having ‘potentially disastrous outcomes’ (foxbusiness)

- Mary Daly Says Slower Rate Raises Could Help Fed Account for Monetary Policy Lags (wsj)

- Meta Named Favorite Internet Stock for 2023 in JPMorgan Survey (bloomberg)

- Amazon expands its service that adds Prime badge to other sites (cnbc)

- A new rally in US housing could drive a 20% surge in Zillow stock, Bank of America says (businessinsider)

- ‘Stocks look downright cheap’: These are the top 33 bargain stocks to buy heading into 2023, according to Morningstar (businessinsider)

Tom Hayes – Cheddar News TV Appearance – 1/10/2023

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 26 key reads for Monday…

- Eurozone inflation returns to single figures in sharper than expected fall (ft)

- Goldman to Cut About 3,200 Jobs This Week After Cost Review (bloomberg)

- Alibaba Leads China Tech Gains as Regulatory Woes Ease Further (bloomberg)

- Asia Stocks On Track to Enter Bull Market as China Rally Extends (bloomberg)

- Beijing Signals Two-Year Internet Crackdown May Be Coming to an End (wsj)

- Looking to Play American Airlines, JetBlue? Consider Their Convertible Bonds. (barrons)

- Goldman Sees China Stock, Yuan Gains Extending on Policy Shifts (bloomberg)

- Hedge Funds Boost Dollar Shorts on Bets for Slower Fed Hikes (bloomberg)

- Jack Ma Is Giving Up Control of Ant. What Does That Mean for Ant’s IPO Reboot? (bloomberg)

- Over 800,000 UK Households to See Mortgage Rates Double in 2023 (bloomberg)

- Country Garden Stocks Triple on Funding, China Property Support (bloomberg)

- Tech Companies Keep Slashing Jobs (bloomberg)

- These Are the Wall Street Firms Making Job Cuts (bloomberg)

- FDA Approves Eisai and Biogen’s New Alzheimer’s Therapy (barrons)

- Used-Car Dealers’ Stocks Attract Buying From Insiders (barrons)

- The Dow takes ‘important first step’ toward a new bull market (marketwatch)

- Globalization is not dead, but it is facing a big tail-risk, expert says (marketwatch)

- Opinion: Republicans and Democrats actually agree that America must be a tech leader. Here’s what this means for the U.S. economy and jobs. (marketwatch)

- Tech’s Bill Is Coming Due. Investors Aren’t the Only Ones Who Will Pay. (barrons)

- Wall Street Sets Low Bar for Corporate Earnings Season (wsj)

- As White-Collar Layoffs Rise, Blue-Collar Resilience Faces Test in 2023 (wsj)

- China Reopens to the World as International Travel Restrictions End (wsj)

- Goldman Sachs: These 40 stocks have at least 34% upside right now while the rest of the market struggles for gains in 2023 (businessinsider)

- Chinese rush to renew passports as COVID border curbs lifted (reuters)

- Alibaba founder Jack Ma in Thailand to continue study of farming technology (scmp)

- Jeff Ubben takes $500mn stake in Bayer (ft)