- China Plans Property Rescue as Xi Surprises With Policy Shifts (bloomberg)

- China’s 16-Point Plan to Rescue Its Ailing Property Sector (bloomberg)

- Biden Set to Meet Xi in Bid to Avert a Full Rupture in US-China Ties (bloomberg)

- Big Investors Are Giving Up on Crypto Markets Going Mainstream (bloomberg)

- Key Takeaways From Asean Meeting Before Xi-Biden Summit at G-20 (bloomberg)

- Eight Things to Watch for as Global Leaders Meet in Bali (bloomberg)

- Student Debt Relief Applications Halted After Court Ruling (bloomberg)

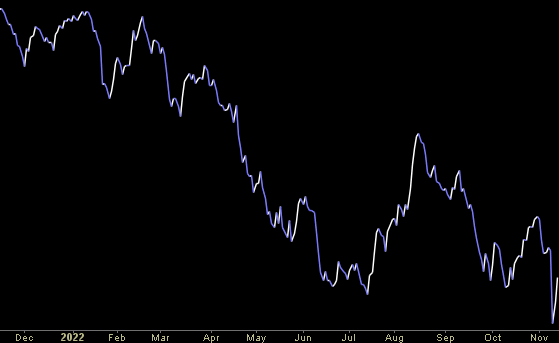

- A year-end melt up is the real pain trade (zerohedge)

- Goldman Desk: Year-End Rally Driven By $5BN In CTA Buying And $10BN In Buybacks Every Day (zerohedge)

- Beyond the Midterm Elections…Less Uncertainty and Historically Solid S&P 500 Performance (almanactrader)

- China regulators urge more financing support for property firms (reuters)

- What It’s Like To Top 200 MPH In A McLaren 720S Spider (maxim)

- Alibaba brings AR, VR, and virtual influencers to online shopping (technode)

- META Lesson 2: Accounting Inconsistencies and Consequences (aswathdamodaran)

- You Can Forget About Crypto Now (theatlantic)

Be in the know. 17 key reads for Saturday…

- The Dollar Is Tanking. That’s Good News for the Stock Market. (barrons)

- China Eases Zero-Covid Rules as Economic Toll and Frustrations Mount (wsj)

- Chinese Stocks Surge as Beijing Eases Some Covid Restrictions (wsj)

- An Inflation Reading Sends Stocks Soaring as if It Were 2020 (barrons)

- Alibaba said Singles Day sales were in line with last year (reuters)

- On Alibaba’s Singles Day, Chinese Brands Fill Shopping Baskets (nytimes)

- Intel CEO Pat Gelsinger Buys Up Intel, Mobileye Stock (barrons)

- Walgreens Stock Gets a New Bull With ‘Increased Faith’ (barrons)

- Disney Details Plans for Cost Cuts, Layoffs and Hiring Freeze in Memo (wsj)

- Krugman Says the Fed Should Pause Rate Hikes, Has Done Enough (bloomberg)

- China’s Li Says Nation to Boost Trade Cooperation With Asean (bloomberg)

- US Stock Rebound Has Room to Run, Morgan Stanley Says (bloomberg)

- Americans Have $5 Trillion in Cash, Thanks to Federal Stimulus (bloomberg)

- Jeremy Siegel says the crypto meltdown sparked by FTX’s implosion is not a Lehman Brothers moment and won’t spread contagion to stocks (businessinsider)

- Chinese are criticizing zero-Covid — in language censors don’t seem to understand (cnn)

- Tech-heavy Nasdaq Composite on track to score its biggest weekly gain since March (marketwatch)

- Graham & Dodd Annual Breakfast 2022 (substack)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is the money flowing today?

Be in the know. 25 key reads for Friday…

- Asia Stocks Jump Most Since 2020 as China Covid Zero Pivot Seen (bloomberg)

- Biden Set to Meet With China’s Xi on Monday (barrons)

- Powell’s Favored Curve Calls Time on the Fed’s Tightening Cycle (bloomberg)

- Some US Officials See Winter As Opportunity For Diplomacy In Ukraine (zerohedge)

- Plane Ticket Bookings Double in Hour as China Eases Covid Rules (bloomberg)

- Chinese Stocks in US Jump on Watershed Moment for Covid Policy (bloomberg)

- China Eases Quarantine, Ends Flight Bans in Covid Zero Shift (bloomberg)

- These Are China’s 20 New Guidelines for Easing Covid Zero (bloomberg)

- Here’s What Changed in Top China Leadership’s Covid Language (bloomberg)

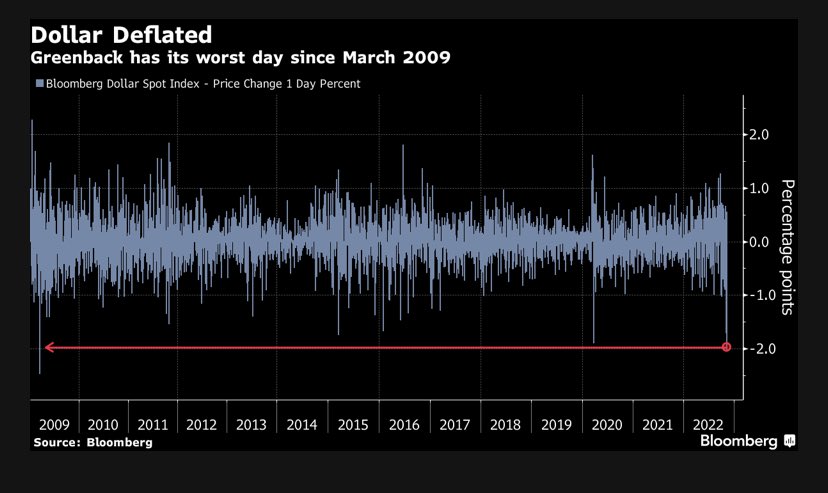

- Dollar flags after biggest daily fall since 2015 (reuters)

- Boeing Sees Bright Future in India as Clouds Persist Over China (bloomberg)

- What China’s Covid Pivot Means for Its Beaten-Down Markets (bloomberg)

- China May Inject Cash Soon as $139-Billion Maturity Wall Looms (bloomberg)

- Chinese travel, consumption stocks rally as Beijing eases COVID rules (marketwatch)

- Big Pharma Stocks Are Breaking Out. Here Are Some Winners. (barrons)

- China’s Biggest Shopping Event Is Friday. Why the Stakes Are High. (barrons)

- 2- and 10-year Treasury yields post biggest daily drops in over a decade after October inflation data (marketwatch)

- Federal Judge in Texas Strikes Down Biden Student-Loan Forgiveness Program (wsj)

- The Dollar Is on Track for Its Worst Day in 13 Years. That’s Good News for the Stock Market. (barrons)

- Market Explosion Sends CTAs Into Short Covering Frenzy: $79BN To Buy (zerohedge)

- The stock market is poised for a significant year-end rally because ‘inflation is basically over’, Wharton professor Jeremy Siegel says (businessinsider)

- Nobel economist Paul Krugman says the drop in inflation means a soft landing of the economy is ‘increasingly plausible’ (businessinsider)

- Citi says investors have up to six weeks to keep squeezing the bears after the inflation surprise (marketwatch)

- Bridgewater’s China bets suffer again after stock sell-off but founder Dalio sees bright long-term outlook (scmp)

- Money leaves US equity funds for first time in four weeks (reuters)

Tom Hayes – CNBC Indonesia Appearance – 11/11/2022

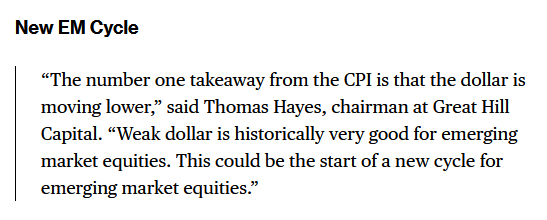

Tom Hayes – Quoted in Bloomberg article – 11/10/2022

Thanks to Abhishek Vishnoi, Richard Henderson, Georgina McKay, Matthew Burgess and Tassia Sipahutar for including me in their article on Bloomberg today. You can find it here:

Click Here to View The Full Article on Bloomberg

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 160

Hedge Fund Tips with Tom Hayes – Podcast – Episode 150

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”