Datasource: Finviz

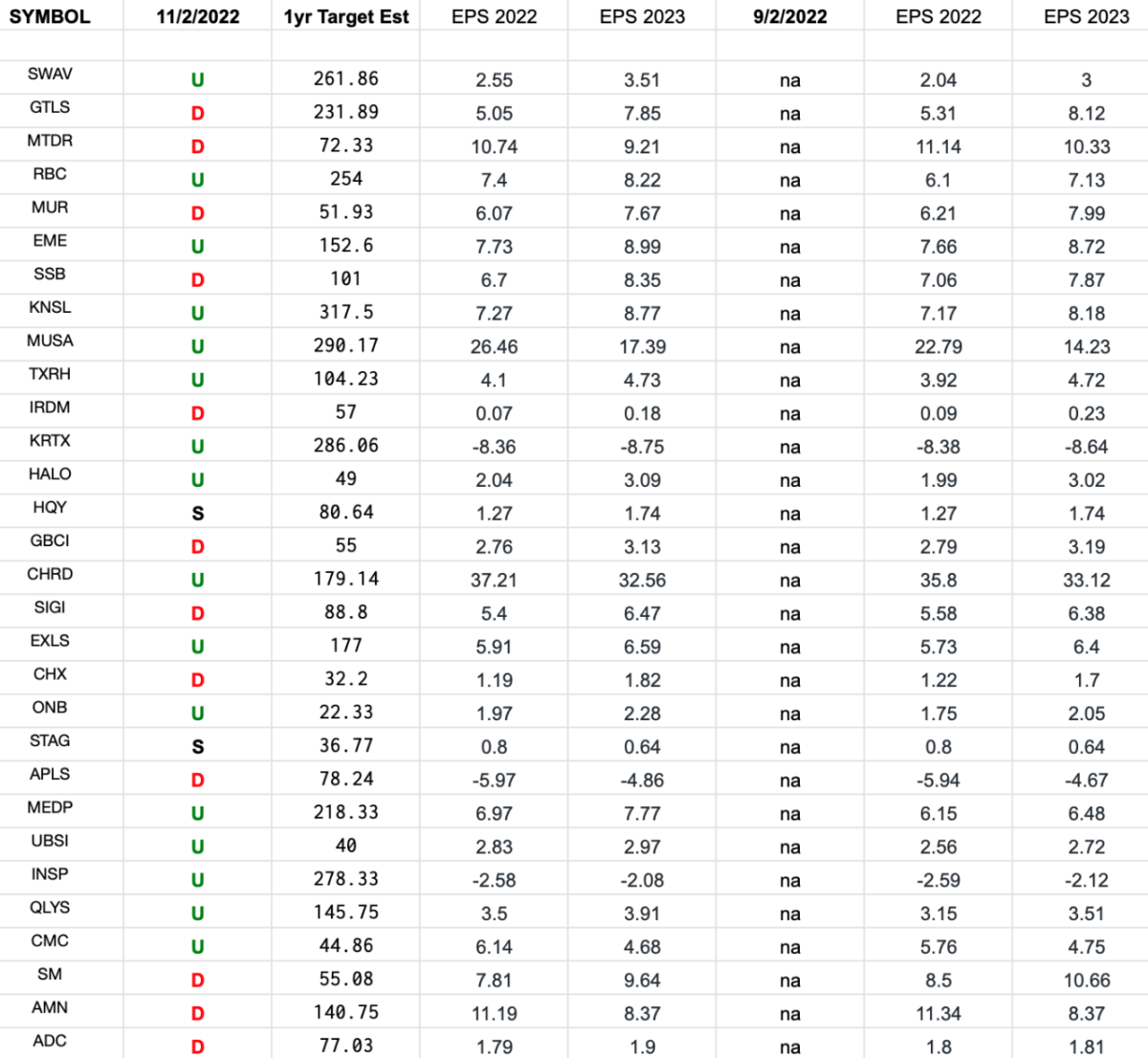

Russel 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2022 estimates were on 9/2/2022 and today.

Continue reading “Russel 2000 (top weights) Earnings Estimates”

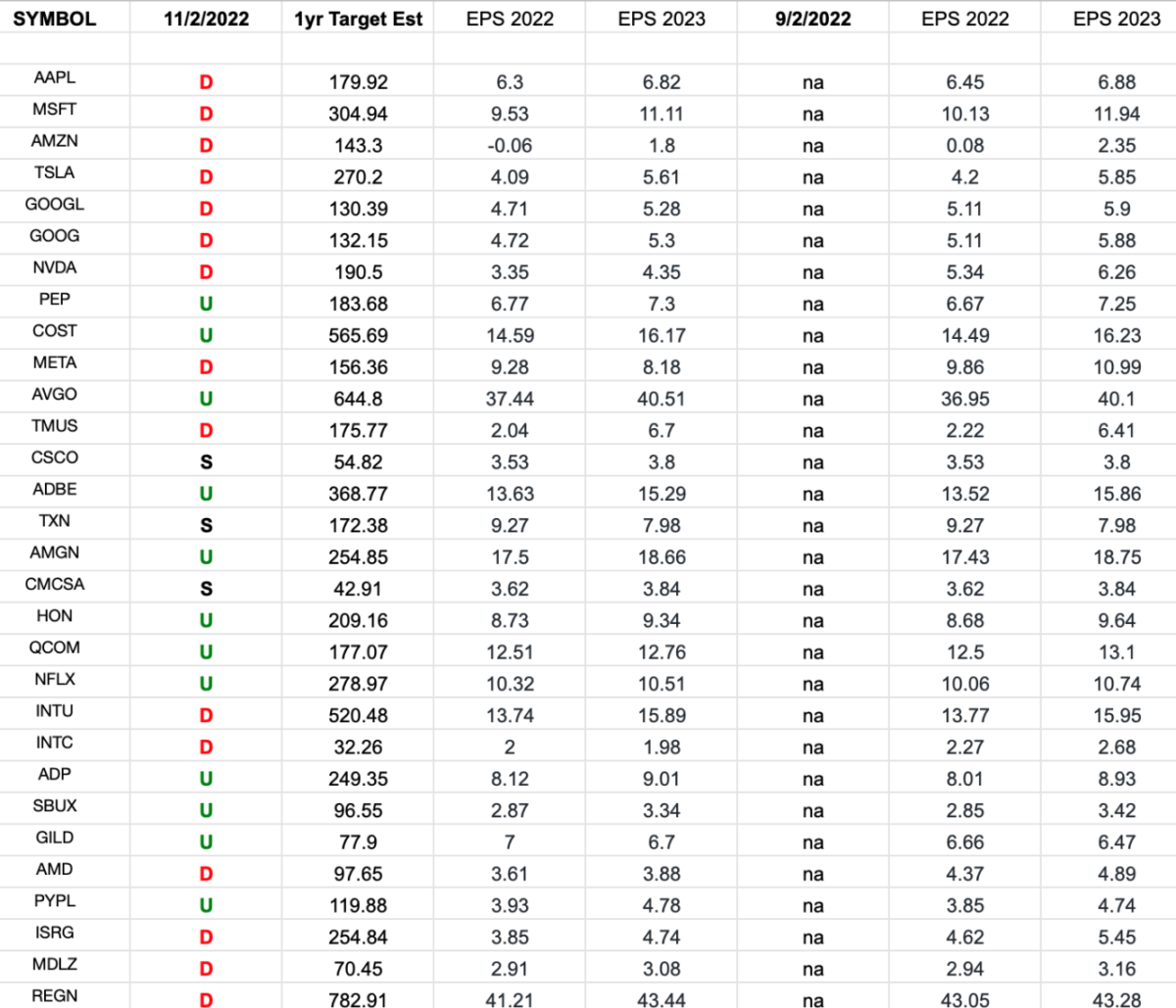

Nasdaq (top 30 weights) Earning Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2022 estimates were on 11/2/2022 and today.

Continue reading “Nasdaq (top 30 weights) Earning Estimates/Revisions”

Be in the know. 14 key reads for Wednesday…

- The Fed’s Next Big Rate Hike Is Coming. Don’t Expect Powell to Tip His Hand. (barrons)

- Meta, Amazon, and Other Stocks Most Vulnerable to Tax-Loss Harvesting (barrons)

- Recession Is the Dark Cloud Hanging Over Powell’s Inflation-Busting Fed (barrons)

- Shopify CEO Buys $10 Million of Stock in the Open Market (barrons)

- GSK Raises Guidance as Earnings Help Shore Up Position of CEO (barrons)

- Traders Expect Higher Interest Rates to Stay for Foreseeable Future (wsj)

- Fed Meeting to Focus on Interest Rates’ Coming Path (wsj)

- US Holds Quarterly Debt Sales Steady, Keeps Pondering Buybacks (bloomberg)

- Reopening Rumor Sends Stocks Flying (chinalastnight)

- Tencent and China Unicom get Beijing’s nod for public-private JV (scmp)

- John Lee urges global banks to ‘get in front’ as Hong Kong roars back (scmp)

- US ETFs draw almost $500bn of inflows despite grim year for Wall St (ft)

- Fed set for another big rate hike, may tamp down future tightening (reuters)

- Goldman Sachs’ Solomon Sees Deal Recovery Possible Next Year (bloomberg)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is the money flowing today?

Be in the know. 12 key reads for Tuesday…

- Healthy Singles’ Day presales for Alibaba, JD.com despite slow economy (scmp)

- Alibaba, JD.com, and Other Chinese Stocks Are Flying Amid Covid Rule Rumors (barrons)

- Jack Ma’s talent scheme lands in Hong Kong as Ant Group joins hands with government to train fintech professionals (scmp)

- What Fed Chair Powell can say to keep the stock-market rally alive — or kill it (marketwatch)

- Meta shareholders rage at ‘tone-deaf’ Mark Zuckerberg’s metaverse push (nypost)

- JPMorgan Says Dovish Fed Could Spark 10% S&P Surge (bloomberg)

- Hyun Song Shin Explains Why This Dollar Shock Is So Unique (bloomberg)

- Jerome Powell’s favorite bond-market gauge is on the verge of inverting, a sign of impending recession. That could mean a Fed pivot within months. (businessinsider)

- Higher Interest Rates Fuel Losses at the Federal Reserve (wsj)

- Fed Meeting to Focus on Rates’ Coming Path (wsj)

- Dollar drops as optimism spreads before Fed and BoE decisions (reuters)

- Tightening Has Peaked, Yields are in ‘Process of Peaking Out’ – JPM’s Kolanovic (streetinsider)

Where is the money flowing today?

Be in the know. 15 key reads for Monday…

- Ant CEO says AlipayHK now has almost half the city’s population signed up as users (scmp)

- Chinese tech giants’ push into U.S., Europe’s markets sets up potential clash with Amazon (cnbc)

- exclusive | JPMorgan’s wealth chief Erdoes backs China markets after stock rout as best opportunity to emerge when doubters flee (scmp)

- HKEX chairwoman: China economy sure to rebound as reforms continue and markets ‘digest’ leadership reshuffle (scmp)

- Dovish FOMC Would See Traders Scrambling to Catch Up, Survey Shows (bloomberg)

- Jerome Powell Is Popular. His War on Inflation Could Change That. (nytimes)

- The Midterms Are Almost Here. What’s at Stake for the Economy. (barrons)

- 3 Potential Outcomes for the Midterms—and What Each Scenario Would Mean (barrons)

- The Dow Is Having a Great Month, the Nasdaq Is Having a Good One. What History Says Happens Next. (barrons)

- Higher Interest Rates Fuel Losses at the Federal Reserve (wsj)

- Morgan Stanley’s Wilson Says End of Fed Tightening Nearing (bloomberg)

- China Covid Cases Top 2,500, Rising the Most in Over 80 Days (bloomberg)

- China’s factory activity drops, bogged down by more Covid controls (cnbc)

- Japan Spent Record $42 Billion in October to Prop Up Yen (bloomberg)

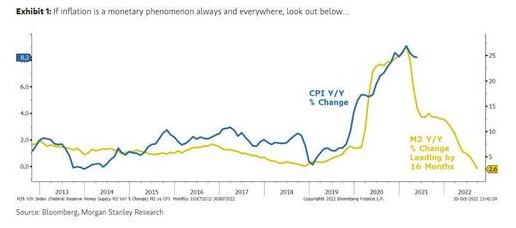

- Morgan Stanley: Why Inflation Is Likely To Fall Faster Than Most Expect Based On M2 Growth (zerohedge)

Be in the know. 10 key reads for Sunday…

- China’s State Council vows revived policy support for nation’s digital economy (scmp)

- According to Handelsblatt, the Founder of German mRNA Covid Vaccine maker BioNTech will be part of Olaf Scholz’s delegation to Beijing on November 4th. (twitter)

- China c.bank reaffirms it will step up support for real economy (reuters)

- Unhealthy talk about mini-purge by Xi Jinping could not be further from the truth (scmp)

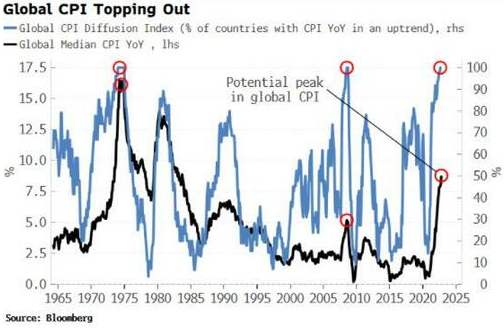

- Have Global Central Bank Hawkishness & Inflation Both Peaked? (zerohedge)

- Siegel and Schwartz on Stocks for the Long Run (bloomberg)

- Cash-Rich Consumers Could Mean Higher Rates for Longer (wsj)

- November is Top NASDAQ Month in Midterm Years (Almanac Trader)

- Junk Bonds Reversal Would Be Bullish For Stocks! (kimblechartingsolutions)

- Flying Cars Are Finally Coming: Here Are 3 That Will Hit the Skies Soon (robbreport)