- Charlie Munger’s Daily Journal is still betting on stocks (ft)

- Li Qiang, Xi’s right-hand man (ft)

- Elon Musk, Paul Krugman, and Jeremy Siegel are warning the Fed risks hiking rates too high and tanking the US economy. Here’s where 7 experts see danger. (businessinsider)

- The Midterms Are Almost Here. What’s at Stake for the Economy. (barrons)

- Top Manager Of Top Fund: We’re In A Recession Right Now (investors)

- Where Are Markets Headed? Six Pros Take Their Best Guess (wsj)

- Earnings and Cash Flows: A Primer on Free Cash Flow (aswathdamodaran)

- S. Pensions Take a Fresh Look at China. Mr. Folwell of North Carolina said his fund isn’t planning any changes to its China allocation. “It’s the second-largest economy in the world,” he said. (wsj)

- Activist board battles to get more personal (ft)

- China to launch market-making on tech-focused STAR Market on Monday (reuters)

- PBOC to Maintain Normal Monetary Policy, Keep Yuan Stable (bloomberg)

- Poland Picks US, Westinghouse for First Nuclear Power Plant (bloomberg)

- UBS points out that Chinese shares are the cheapest in a decade, and that positive policy surprises could create a sharp rally, but that it’s waiting for more certainty. (barrons)

- Don’t Expect Home Prices to Crash (barrons)

- Why the Dow is having a killer month as it heads for best October ever (marketwatch)

- Small-Cap Stocks Are ‘Spring-Loaded’ for Recovery. 7 to Buy Now, According to a Pro. (barrons)

- Meta’s Problems Can Be Fixed. Don’t Get Your Hopes Up That They Will. (barrons)

- Record Buybacks Could Be Over. And Investors Might Be Relieved (bloomberg)

- Tech Is Getting Boring. That’s a Good Thing. (wsj)

- The Home-Improvement Boom Isn’t Over Yet (wsj)

- A dead cat bounce 250 years in the making (ft)

- Another jumbo Fed rate hike is expected next week — and then life gets difficult for Powell (marketwatch)

- The electric Pininfarina Battista costs a whopping $2 million. Here’s what that gets you (cnn)

- Warren Buffett Is Collecting 25% to 54% Yields on 3 Stocks: Here’s His Secret (theglobeandmail)

- Billionaire investor Bill Ackman joins Elon Musk calling for a Ukraine cease-fire that includes major concessions to Russia (fortune)

Where is the money flowing today?

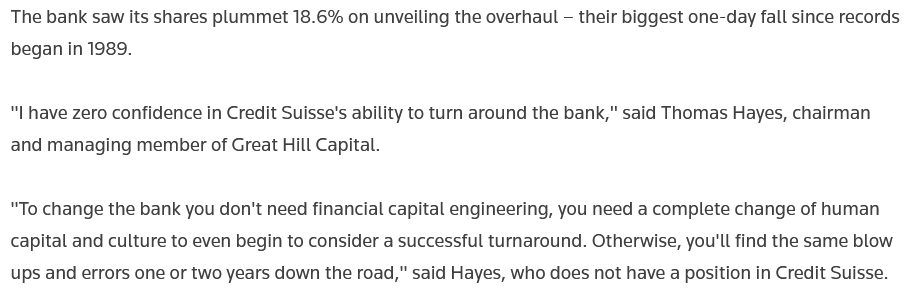

Tom Hayes – Quoted in Reuters article – 10/28/2022

Thanks to Pamela Barbaglia, Anshuman Daga, Andres Gonzalez and Megan Davies for including me in their article on Reuters. You can find it here:

Click Here to View The Full Article on Reuters

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 10 key reads for Friday…

- Markets have China’s new leadership all wrong (asiatimes)

- China’s Big Banks Post Profit Gains on Credit Expansion (bloomberg)

- The Semiconductor Shortage Just Quickly Became An Inventory Glut (zerohedge)

- Ten ways China has changed under Xi Jinping (reuters)

- S. consumer spending seeing a ‘mitigation’ in growth not a slowdown, says Bank of America CEO (cnbc)

- Intel stock set to snap 9-quarter streak of post-earnings declines (marketwatch)

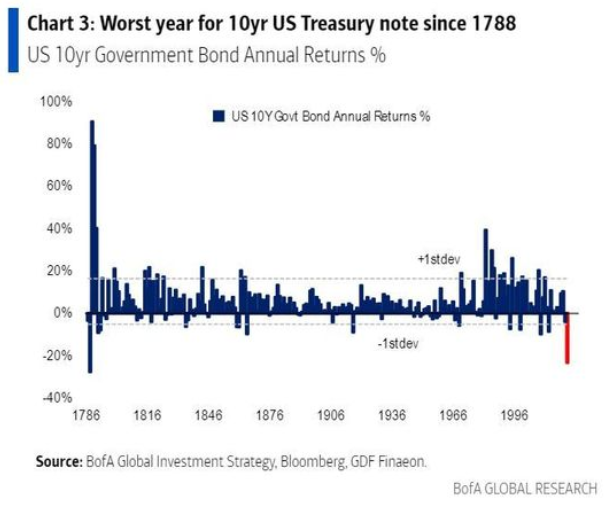

- 250 years of history is telling investors to bet on Treasury bonds in 2023, Bank of America says (marketwatch)

- Opinion: A seasonal stock-market trade that tends to be reliable begins Thursday (marketwatch)

- Intel stock set to snap 9-quarter streak of post-earnings declines (marketwatch)

- Hong Kong Airport Reopens Stores Ahead of Banking Summit and Rugby Sevens (bloomberg)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 158

Article referenced in Podcast above:

“It’s Five O’Clock Somewhere” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 148

Article referenced in Podcast above:

“It’s Five O’Clock Somewhere” Stock Market (and Sentiment Results)…

Where is the money flowing today?

Be in the know. 30 key reads for Thursday…

- A Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. (nytimes)

- Xi Says China Can Work With US Before Possible Biden Meeting (bloomberg)

- Post Party Congress Pivot to Economy Lifts Stocks (chinalastnight)

- Stocks could rally 25%, and GOP gains in midterm elections could spur lower inflation, Fundstrat says (businessinsider)

- Peter Schiff: Fed Folds With A Soft Pivot? (zerohedge)

- Traders bet on Fed downshift to half-point hike in December (streetinsider)

- Fed’s soothsayers see signs of an inflation downshift (reuters)

- Stocks Rise Despite Anxiety Over Big Tech (barrons)

- The U.S. Economy Grew, but It’s Not as Good as It Looks (barrons)

- Southwest Airlines Sees Strong Travel Demand Continuing. The Stock Is Up. (barrons)

- Mastercard’s Earnings Get a Lift From Travel, Consumer Spending (barrons)

- Visa Stock Has Been Unfairly Beaten Up. It’s Time to Buy. (barrons)

- Increased Spending at Meta Is Good News for These Stocks (barrons)

- European Central Bank Matches Fed With Rate Hike (barrons)

- Big Tech Suffers Advertising Hit as Recession Looms. The Fed Only Sees Inflation. (barrons)

- Apple Earnings Are on Deck as Consumer Demand Softens (barrons)

- Lockheed, Nvidia, and Other Have Pricing Power. Their Profit Margins Prove It. (barrons)

- Consumer spending cooled compared with previous quarter (wsj)

- Elon Musk barges into Twitter HQ as deal nears: ‘Let that sink in’ (nypost)

- The Latecomer’s Guide to TikTok (nytimes)

- Value Has a Price, But First It Needs to Be Seen (bloomberg)

- How Does Japan Intervene in Currency Markets? (bloomberg)

- Comcast tops expectations as it squeezes out small gain in broadband subscribers (cnbc)

- Macron Urges Pope To Get Biden & Putin To Dialogue On Ukraine (zerohedge)

- JPM Trading Desk: “Short Are Getting Nervous: The Inability Of GOOGL And MSFT To Break This Tape Is Truly Noteworthy” (zerohedge)

- US GDP Grows 2.6% In Q3 Driven Entirely By Trade; Price Index Comes Cooler Than Expected (zerohedge)

- As META Plunges To Double-Digits, Wall Street Gives Up On Facebook (zerohedge)

- Family Offices Get Opportunistic Amid Market Chaos (institutionalinvestor)

- Apple earnings: What do the iPhone production reports really mean? (marketwatch)

- Analysts slash their ratings on Meta as costs balloon: ‘The bad news is you suck, [and] the good news is you can only get better’ (marketwatch)

“It’s Five O’Clock Somewhere” Stock Market (and Sentiment Results)…

On Monday morning, we woke up to an abrupt market response to Xi Jinping’s new top leadership appointments. Global participants had hoped for some balance in the Standing Committee appointments and when it was not forthcoming, the Hang Seng index plummeted to the lowest levels since the Great Financial Crisis in 2008.

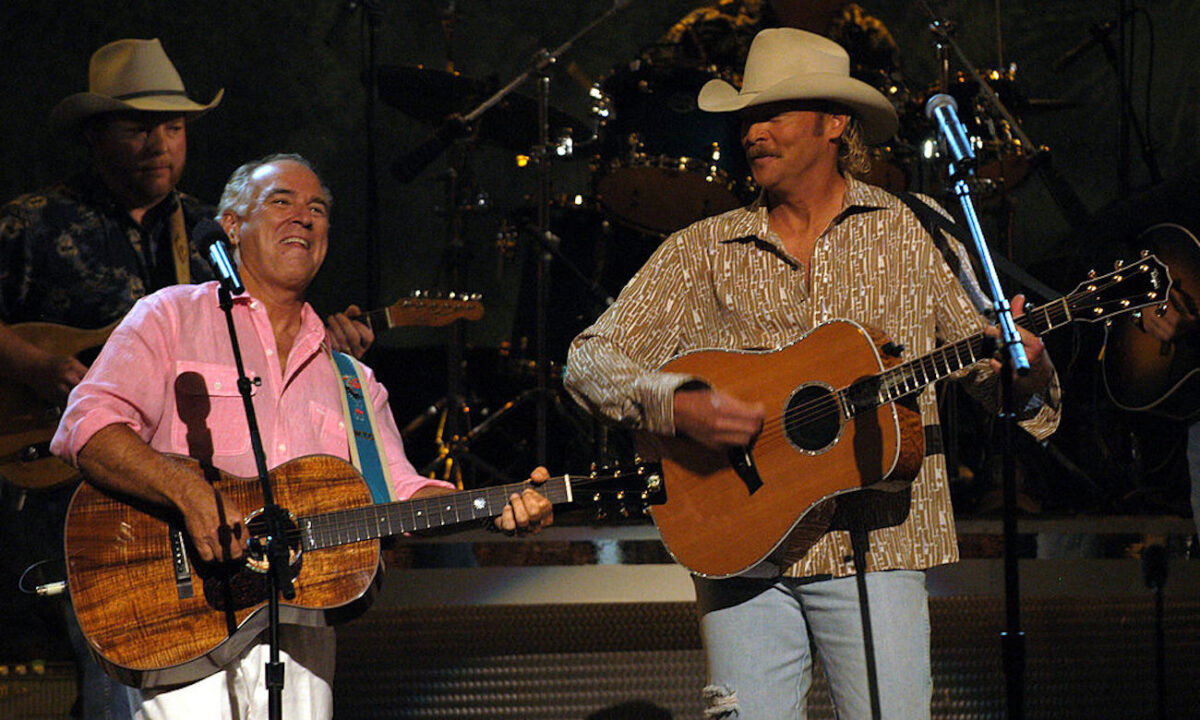

It was 5am in NYC, but 5pm in Beijing and I’m sure there were many traders (Chinese and otherwise) following Country Legend Alan Jackson’s mantra “It’s Five O’ Clock Somewhere”: Continue reading ““It’s Five O’Clock Somewhere” Stock Market (and Sentiment Results)…”