Where is the money flowing today?

Be in the know. 15 key reads for Tuesday…

- GM Posts $3.3 Billion Net Profit as Shipments to Dealers Rise (wsj)

- GM Stock Rises as Third-Quarter Earnings Shine (barrons)

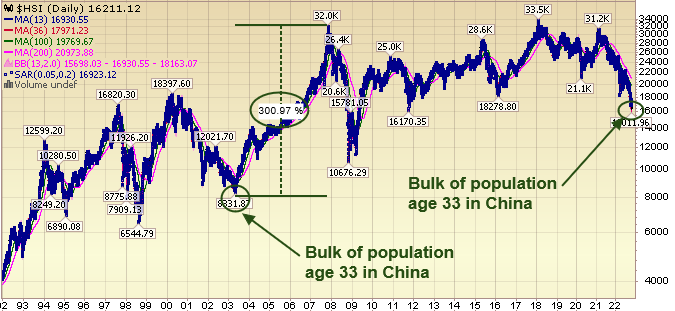

- Allianz China Fund Bets on Reopening as Xi Stands by Covid Zero (bloomberg)

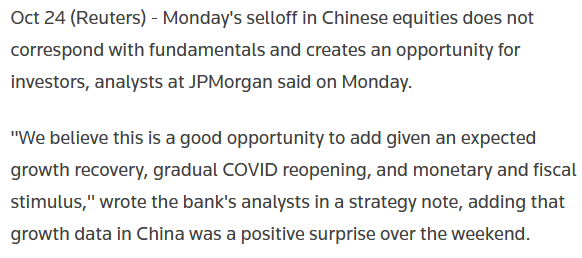

- JPMorgan’s Kolanovic Calls China Stocks Selloff a Buying Moment (bloomberg)

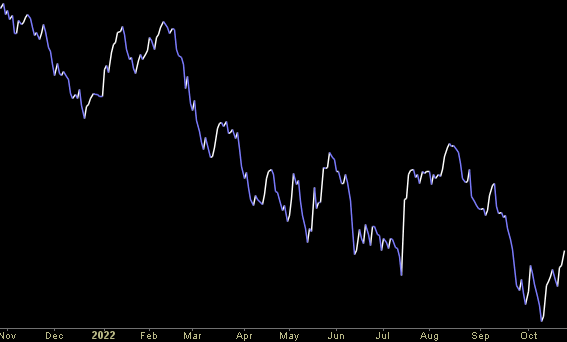

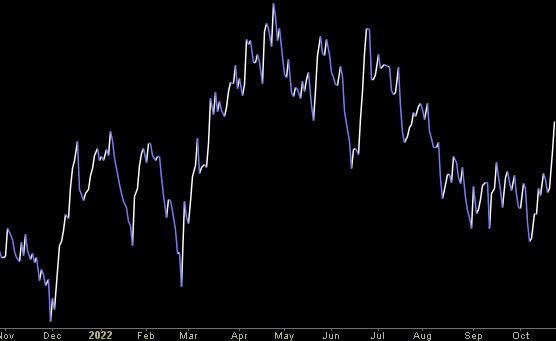

- Oversold China Stocks Poised for Rebound, Technical Charts Show (bloomberg)

- China Stock Rout Pauses as Investors Assess Xi’s Policy Outlook (bloomberg)

- Alphabet Faces Tough Questions About Ad Market (barrons)

- Microsoft: Focus on Azure (barrons)

- Why Right Now Could Be the Best Time to Buy Stocks (barrons)

- Airlines Are Cashing In on Pent Up Demand (barrons)

- 12 real-estate stocks you can buy on the cheap now that can weather the big housing downturn, says this fund manager (marketwatch)

- Biogen Lifts Profit Estimates. The Stock Rises. (barrons)

- UK’s new PM Rishi Sunak must spur expansion, cut spending (nypost)

- Fed Is Losing Billions, Wiping Out Profits That Funded Spending (bloomberg)

- US Home-Price Growth Slows Most on Record as Market Hits Brakes (bloomberg)

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Where is the money flowing today?

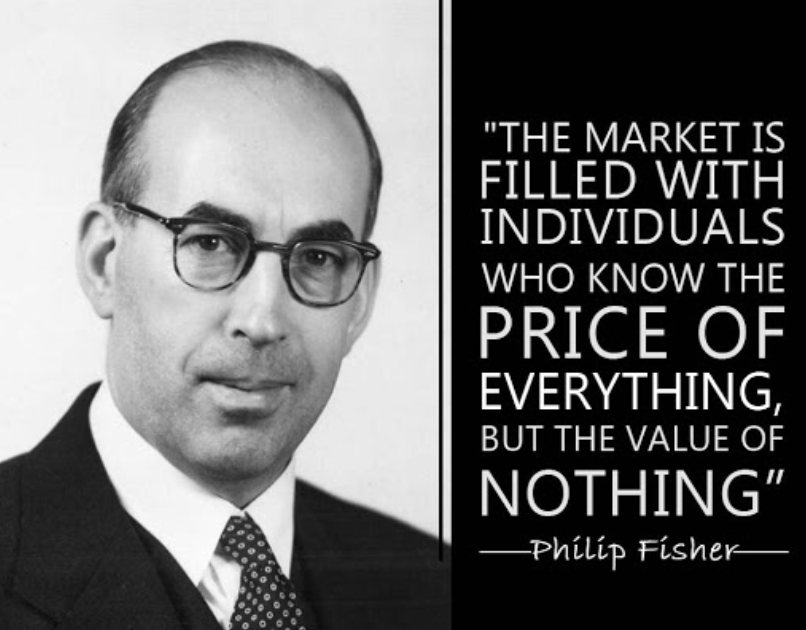

Quote of the Day…

Be in the know. 10 key reads for Monday…

- China equity selloff not on fundamentals, creates opportunity – JPM (reuters)

- China’s Improved Economic Growth Is Overshadowed by Xi’s Power Grab (barrons)

- Rishi Sunak to Be Next U.K. Prime Minister (barrons)

- Home Builder Stocks Are Way Down. A Calmer Bond Market Could Help. (barrons)

- AT&T Stock Gets an Upgrade From This Analyst After 3 Years. Here’s Why. (barrons)

- Morgan Stanley’s Wilson Sticks to Bullish Call Amid Client Doubt (bloomberg)

- This Is What the US Just Did to China on Semiconductors (bloomberg)

- Investor gives Zuckerberg list of demands in scathing open letter (foxbusiness)

- Tencent steps up buybacks as share price sinks (ft)

- Ocean Shipping Costs Decline 84%, Truckers On Verge Of Losing Money (zerohedge)

18 Point Thread on Alibaba Developments.

The last few points are the most important so make sure you see all 18 points in the thread.

Long thread on $BABA: A friend asked this morning what I was doing with our portfolio position in $BABA (https://t.co/3pJtkBEDuA) given the news over the weekend. My reply was, “Only play is to wait it out. Not buying, not selling. Just waiting.” (1) 👇

— Thomas J. Hayes (@HedgeFundTips) October 24, 2022

If you can’t find any of the 18 points, they are all posted individually under my profile here:

Be in the know. 25 key reads for Sunday…

- On Li Qiang’s appointment (after becoming the party’s second-highest ranking official), “Putting aside events in the past year, he’s basically had a good reputation in Shanghai among the business community. So he’s simultaneously a Xi protégé and someone who doesn’t look ‘anti-business’ to investors” (ft)

- Halloween Indicator, Sell in May, Call It What You Will, It Works (AlmanacTrader)

- Jonah Hill To Play Legendary Golfer John Daly In Biopic (maxim)

- The Squeeze That Has the US Treasury Thinking About Buying Back Bonds (bloomberg)

- A Fed shift from quantitative tightening to ‘tinkering’ will emerge as a new bull factor for the stock market in 2023, Bank of America says (businessinsider)

- Xi Says China Economy Is ‘Resilient,’ Will Deepen Global Links (bloomberg)

- Stock Manager Paranoia Is Only Thing the Market Has Going for It (bloomberg)

- Fed Officials Expect Debate on Rate Peak and When to Slow Hikes (bloomberg)

- Chinese Bonds Bounce Back in Favor as UK Fund Giants Look to Buy (bloomberg)

- Xi Will Need All His Men to Realize His China Dream. Xi vowed to grow China into a “medium-level developed country” by 2035, which, according to economists, requires an average 4.7% annual growth rate going forward. (bloomberg)

- Fed Officials Need to Stop Speaking Out of Turn (bloomberg)

- Xi Allies Fill China’s Top Jobs in Move Toward One-Man Rule (bloomberg)

- The Seven Men Who Will Lead China Into Xi’s Third Term (bloomberg)

- Key Takeaways as Xi Promotes Allies to China Leadership as Rivals, Women Lose Out (bloomberg)

- GOLDMAN SACHS: Buy these 22 profitable growth stocks that are set to turbocharge their sales and are trading at a bargain after a sharp sell-off (businessinsider)

- China shuffles leadership committee and retains many Xi allies (cnbc)

- “People who exit the stock market to avoid a decline are odds-on favorites to miss the next rally.” (oakmark)

- Fisher Investments’ Founder, Ken Fisher, Explains the Midterm Miracle (youtube)

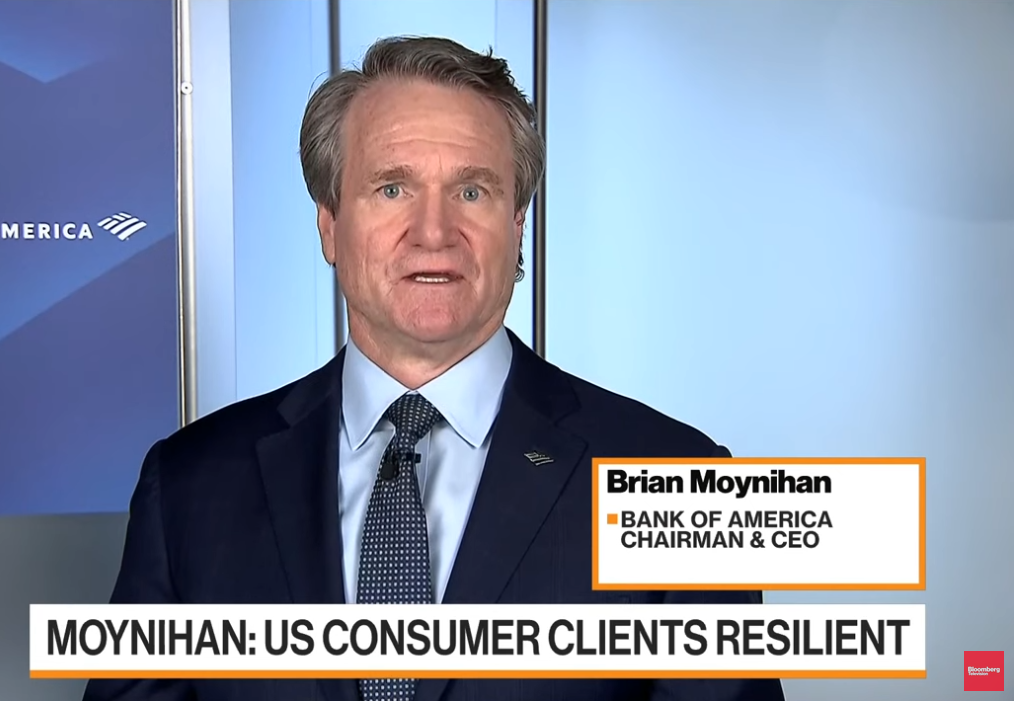

- BofA’s Moynihan: Consumer Spending Slowing, Still Strong (bloomberg)

- Why Value Investing is Making a Comeback (Columbia)

- Japan made intervention of at least $30bn to prop up yen (ft)

- The Definitive Ranking of The Wealthiest Americans In 2022 (forbes)

- Billionaire investor Barry Sternlicht says Jerome Powell and ‘his merry band of lunatics’ are destroying faith in capitalism and leading us toward ‘social unrest’ (fortune)

- The high cost of a strong dollar (npr)

- Toto Wolff, the Compulsive Perfectionist Behind Mercedes’s Formula 1 Team (newyorker)