- On Li Qiang’s appointment (after becoming the party’s second-highest ranking official), “Putting aside events in the past year, he’s basically had a good reputation in Shanghai among the business community. So he’s simultaneously a Xi protégé and someone who doesn’t look ‘anti-business’ to investors” (ft)

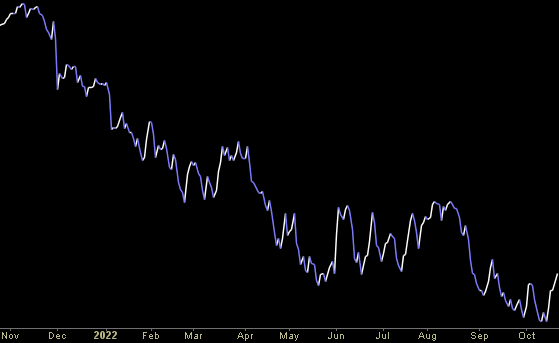

- Halloween Indicator, Sell in May, Call It What You Will, It Works (AlmanacTrader)

- Jonah Hill To Play Legendary Golfer John Daly In Biopic (maxim)

- The Squeeze That Has the US Treasury Thinking About Buying Back Bonds (bloomberg)

- A Fed shift from quantitative tightening to ‘tinkering’ will emerge as a new bull factor for the stock market in 2023, Bank of America says (businessinsider)

- Xi Says China Economy Is ‘Resilient,’ Will Deepen Global Links (bloomberg)

- Stock Manager Paranoia Is Only Thing the Market Has Going for It (bloomberg)

- Fed Officials Expect Debate on Rate Peak and When to Slow Hikes (bloomberg)

- Chinese Bonds Bounce Back in Favor as UK Fund Giants Look to Buy (bloomberg)

- Xi Will Need All His Men to Realize His China Dream. Xi vowed to grow China into a “medium-level developed country” by 2035, which, according to economists, requires an average 4.7% annual growth rate going forward. (bloomberg)

- Fed Officials Need to Stop Speaking Out of Turn (bloomberg)

- Xi Allies Fill China’s Top Jobs in Move Toward One-Man Rule (bloomberg)

- The Seven Men Who Will Lead China Into Xi’s Third Term (bloomberg)

- Key Takeaways as Xi Promotes Allies to China Leadership as Rivals, Women Lose Out (bloomberg)

- GOLDMAN SACHS: Buy these 22 profitable growth stocks that are set to turbocharge their sales and are trading at a bargain after a sharp sell-off (businessinsider)

- China shuffles leadership committee and retains many Xi allies (cnbc)

- “People who exit the stock market to avoid a decline are odds-on favorites to miss the next rally.” (oakmark)

- Fisher Investments’ Founder, Ken Fisher, Explains the Midterm Miracle (youtube)

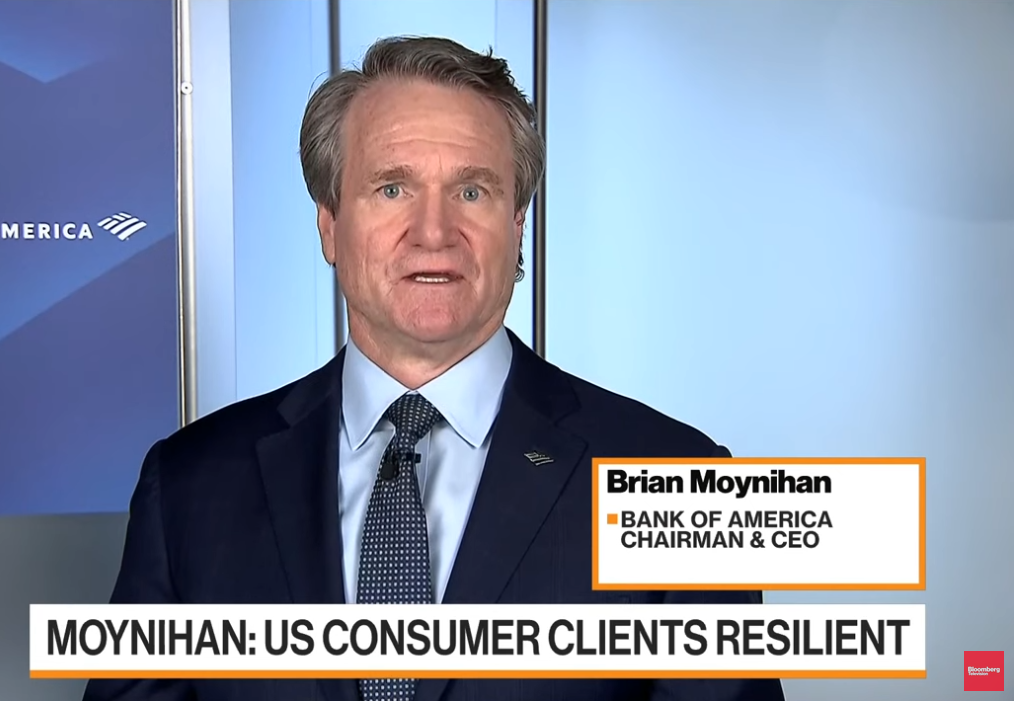

- BofA’s Moynihan: Consumer Spending Slowing, Still Strong (bloomberg)

- Why Value Investing is Making a Comeback (Columbia)

- Japan made intervention of at least $30bn to prop up yen (ft)

- The Definitive Ranking of The Wealthiest Americans In 2022 (forbes)

- Billionaire investor Barry Sternlicht says Jerome Powell and ‘his merry band of lunatics’ are destroying faith in capitalism and leading us toward ‘social unrest’ (fortune)

- The high cost of a strong dollar (npr)

- Toto Wolff, the Compulsive Perfectionist Behind Mercedes’s Formula 1 Team (newyorker)

Be in the know. 10 key reads for Saturday…

- 2-year Treasury yield has biggest weekly drop since July after Fed is seen as debating size of December rate hike (marketwatch

- Brace for Big Tech Earnings. 5 Key Things to Watch. (barrons)

- Time to Wade In—Just Don’t Expect Instant Gains (barrons)

- How Countries Should Respond to the Strong Dollar (imf)

- Dow Surged 749 Points on Hopes the Fed Will Shift Gears (barrons)

- Zoom Rode the Pandemic. Now the Stock Is Back to January 2020. (barrons)

- Stock-market investors brace for busiest week of earnings season. Here’s how it stacks up so far. (marketwatch)

- Salesforce Stock Boosted by Starboard Stake (barrons)

- 2 Chip Equipment Stocks to Buy on the Dip, According to an Analyst (barrons)

- Colgate Stock Pops as Activist Third Point Announces ‘Significant Position’ (barrons)

- Novartis CEO to Wall Street: Don’t Underplay What’s Ahead for This Company (barrons)

- Tesla Stock Could Rebound in 3 Months. Here’s What it Would Take. (barrons)

- The Stock Market Had a Great Week. It Still Hasn’t Gone Anywhere in a Month. (barrons)

- Enviva Stock Tumbled. Jeff Ubben and Insiders Bought Up Shares. (barrons)

- The Stock Market Is Rallying. What Needs to Happen for the Bear Market to End. (barrons)

- This Isn’t a Chip Winter. It’s a Chip War. (barrons)

- ‘Fragile’ Treasury market is at risk of ‘large scale forced selling’ or surprise that leads to breakdown, BofA says (marketwatch)

- Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes (wsj)

- Janet Yellen’s Learning Curve (wsj)

- China’s Xi Jinping Moves to Extend Rule as Top Communist Party Rivals Retire (wsj)

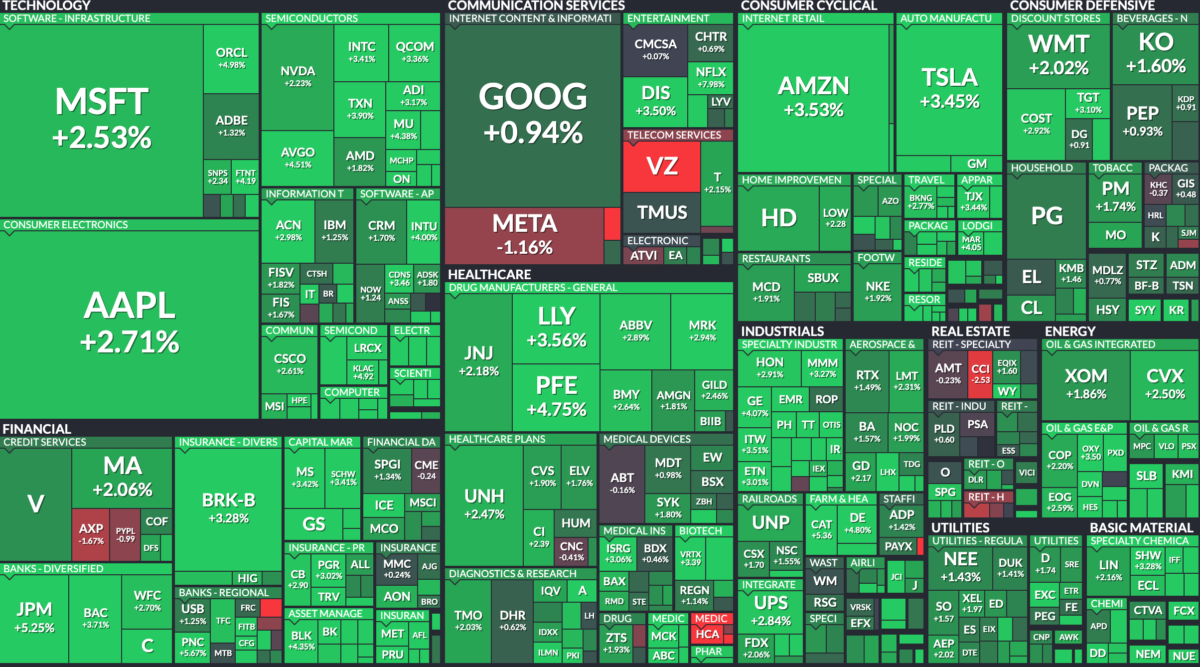

Where is the money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notifications

Quote of the Day…

Be in the know. 17 key reads for Friday…

- Why We Believe China Matters For Markets (nb)

- What’s needed for stocks to rally is capitulation, but that could come from unexpected sources, strategist says (marketwatch)

- Chinese Stock Traders Told Not to Disrupt Market Around Communist Party Meeting (wsj)

- 5 Things to Watch in Big Tech’s Results Next Week. (barrons)

- Good Company: Glice’s Eco-Friendly Skating Rinks (barrons)

- Pfizer Targets Covid Vaccine Price of at Least $110 a Dose (wsj)

- Buying on the Bad Chip News (wsj)

- Xi Must Finally Show Hand on What Third Term Will Look Like (bloomberg)

- How China Became a Threat to the US’s Tech Leadership (bloomberg)

- Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes (wsj)

- Ex-Treasury chief Larry Summers sees interest rates peaking above 5% – and says markets have priced in most of this hiking cycle (businessinsider)

- Fundstrat’s Tom Lee says the Fed could pause its rate hikes next year – and suggests stocks may rebound in the months ahead (businessinsider)

- Elon Musk has a new arch-enemy: the Fed (businessinsider)

- The housing market is in free fall with ‘no floor in sight,’ and prices could crash 20% in the next year, analyst says (businessinsider)

- Currency/China ADR Weakness as Hong Kong Sees Massive Buying from Mainland Investors (chinalastnight)

- Amazon (AMZN) Reiterated as Top Pick at Morgan Stanley, Credit Suisse (streetinsider)

- Nike (NKE): UBS Reiterates Buy on Strong Survey Results, HSBC More Cautious (streetinsider)