In the spreadsheet above I have tracked the earnings estimates for the Oil Services Sector (OIH). I have columns for what the 2022 and 2023 estimates were on 8/17/2022 and today.

Continue reading “Oil Services (OIH) – Earnings Estimates/Revisions”

Continue reading “Oil Services (OIH) – Earnings Estimates/Revisions”

Thanks to Bansari Kamdar for including me in her article on Reuters today. You can find it here:

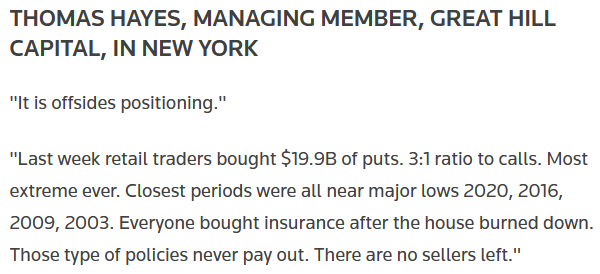

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – October 17, 2022