- What does a pivot look like? Here’s how Australia’s central bank framed a dovish surprise. (marketwatch)

- S. Auto Sales Point to Continued Demand (nytimes)

- Fed Pivot Trade Sparks Again as Bonds Rally, Dollar Weakens (bloomberg)

- Sell low, buy high – max pain market remains king (zerohedge)

- Analysts Think 9 Cheapest Of The Cheap Stocks Are Worth A Shot (investors)

- Bond Yields Are Coming Back. What to Buy Now. (barrons)

- Gilead Has Growth Potential in HIV and Oncology Franchises, Analyst Says (barrons)

- Tech Stocks Are Rising, and J.P. Morgan Likes Amazon and Uber Best (barrons)

- Why an OPEC+ oil production cut could be less than meets the eye (marketwatch)

- Treasury Yields Fall on Hopes the Fed Won’t Hike Rates as High as Feared (barrons)

- Quite a pivot: Ray Dalio has just reversed his long-held stance on this key asset class. (marketwatch)

- K. Scraps Plan to Cut Income-Tax Rate for Top Earners (wsj)

- FedEx stock rises after setting $1.5 billion accelerated repurchase agreement (marketwatch)

- US to Announce New Limits on Chip Technology Exports to China (bloomberg)

- ‘We must change course’: UN warns that the world is on the brink of recession (cnbc)

- Hopes of a Fed pivot are rising. Here’s why the RBA’s lower-than-expected rate hike has buoyed investors. (businessinsider)

- The Fed will hike rates once more in November and then stop because the soaring dollar risks breaking markets, market veteran Ed Yardeni says (businessinsider)

- Alphabet (GOOGL) and Meta (META) Remain BofA’s Top Value Internet Stocks (streetinsider)

- Ford (F) EV Sales Tripled in September; F-150 Lightning Continues as Best-Selling EV Pickup (streetinsider)

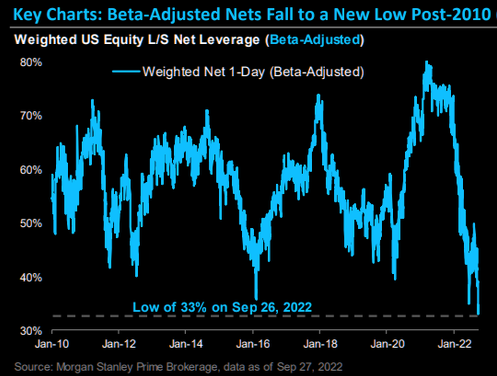

- $22 Billion in ‘Unrelenting’ New Short Positions Were Added Last Week – Citi (streetinsider)

- Apple supplier Foxconn ‘cautiously optimistic’ about fourth-quarter outlook (scmp)

- Real Estate Rebounds on Policy Support, China Begins Golden Week Holiday (chinalastnight)

Tom Hayes – Quoted in Reuters article – 10/4/2022

Thanks to Ankika Biswas and Medha Singh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

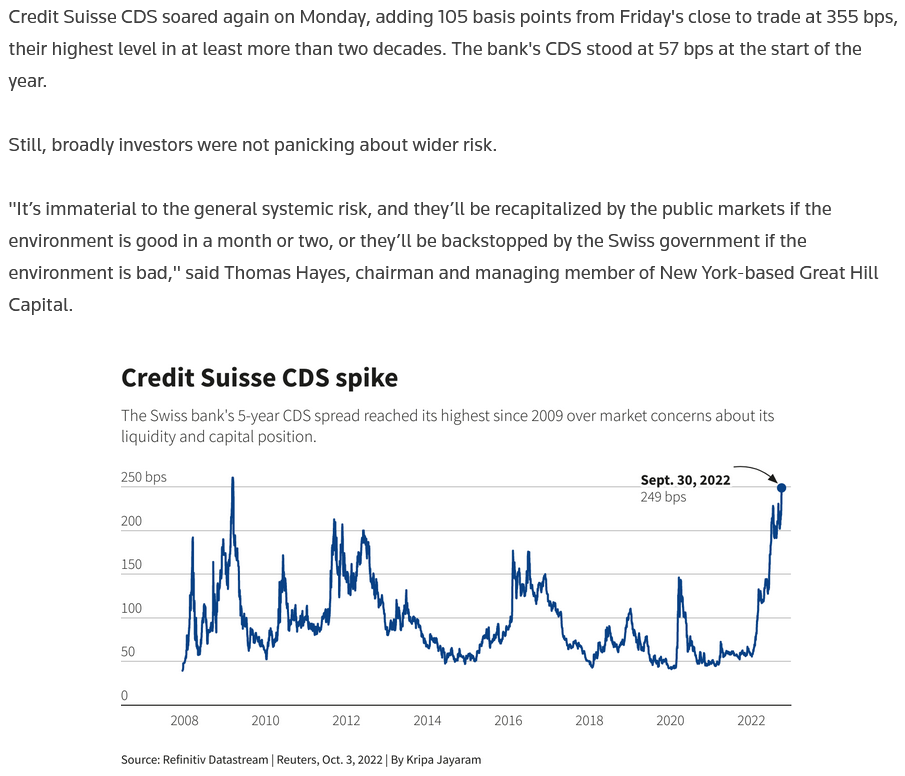

Tom Hayes – Quoted in Reuters article – 10/3/2022

Thanks to Davide Barbuscia for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is the money flowing?

Be in the know. 20 key reads for Monday…

- Pound Climbs as U.K. Scraps Tax Cut for Highest Earners (barrons)

- This big tech stock looks way oversold. Here’s your best strategy for buying it now in this volatile market. (marketwatch)

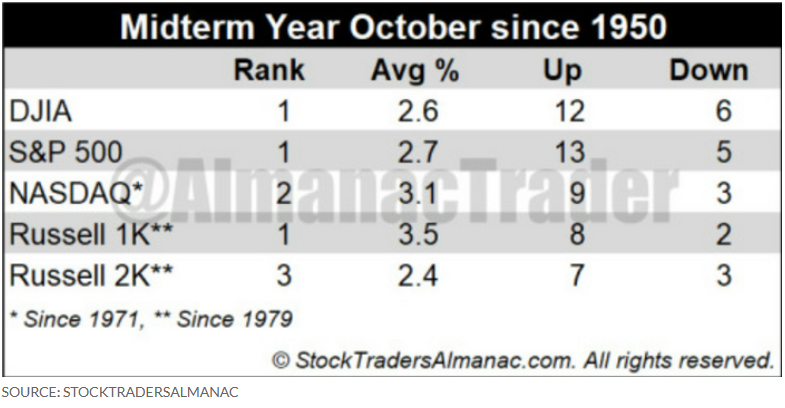

- What investors need to know about October’s complicated stock-market history (marketwatch)

- The bear market may not be over, but corporate insiders are acting like it is (marketwatch)

- An Alzheimer’s Drug’s Big Surprise: What It Means (barrons)

- It’s Time to Buy Tech Again. Here Are 20 Stocks to Start With. (barrons)

- Russia’s War on Ukraine Is Escalating. It’s Time to Buy Defense Stocks. (barrons)

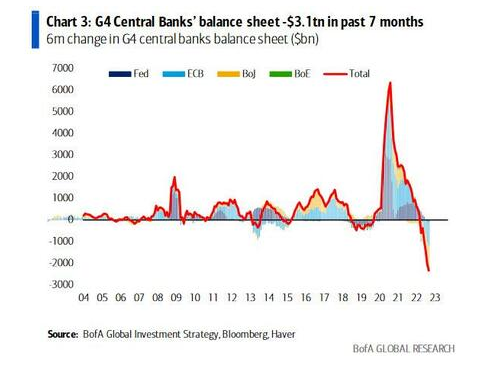

- Central Banks’ Higher Rates, Bond Sales Clash With Government Needs (wsj)

- Builders Offer Homes at Discount to Investors (wsj)

- US Home Prices Now Posting Biggest Monthly Drops Since 2009 (bloomberg)

- JPMorgan Is Worried About Who’s Going to Buy All the Bonds (bloomberg)

- ‘The Fed is breaking things’ – Here’s what has Wall Street on edge as risks rise around the world (cnbc)

- David Rubenstein sees Warren Buffett as the ultimate investor. The private equity billionaire lays out the 12 traits and habits that are key to Buffett’s success. (businessinsider)

- Macau’s Recovery Is Far Off—But Now Possible to Imagine (wsj)

- China Is Rerouting U.S. Liquefied Natural Gas to Europe at a Big Profit (wsj)

- China’s new tax cuts for private pensions likely to lure participants (scmp)

- News in-depth. China’s demographic crisis looms over Xi’s third term (ft)

- Bill Gates rejects climate ‘moral crusade,’ says telling people not to eat meat won’t help solve ‘crisis’ (foxbusiness)

- Ukraine Recaptures Key Eastern Town Of Lyman A Day After Putin’s Annexation Speech (zerohedge)

- Stocks Climb After Selloff as Yields Get Respite: Markets Wrap (bloomberg)

Be in the know. 15 key reads for Sunday…

- Fed Begins to Split on the Need for Speed to Peak Rates (bloomberg)

- Fed “Begins To Split” On Rate Hikes As “Chaotic Market Breakdown” Looms (zerohedge)

- Billionaire investor Bill Ackman has the cure to tame high inflation: a massive wave of Russian immigration (yahoo)

- ‘If you’re going to build something from scratch, this might be as good a time as in a decade’ (mckinsey)

- When Bad Things Happen to Good Stocks (wsj)

- Calling it poor monetary policy is an understatement, Says Prof. Jeremy Siegel on Fed hikes (CNBC)

- David McRaney on the Science Behind Persuasion (bloomberg)

- Billionaires Who’ve Stood The Test Of Time: This Small Group Made The Forbes 400 In 1982–And Are Still On This Year (forbes)

- Gas prices in Connecticut drop to lowest level in 18 months (theridgefieldpress)

- Elon Musk Boldly Claims the Tesla Cybertruck Will Be Able to ‘Serve Briefly as a Boat’ (robbreport)

- This Custom Land Rover Defender Is Inspired By The Iconic Chinook Helicopter (maxim)

- Bilibili announces dual-primary listing in Hong Kong on October 3 (technode)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Portugal Beats Paris for US Travelers Seizing on a Strong Dollar (blooomberg)

- The mighty US dollar (Encore) (npr)

Be in the know. 10 key reads for Saturday…

- Steep Slide: Bonds Are Down 30% This Year (barrons)

- It’s Time to Wade Back Into Tech—Just Don’t Expect Instant Gains (barrons)

- Here’s why investors should start betting on Apple and the stock market now (marketwatch)

- An Alzheimer’s Drug’s Big Surprise: What It Means (barrons)

- The Fed Is Starting to Break Things. The Stock Market Is Paying the Price. (barrons)

- Adobe Stock Crumbled. Chief Financial Officer Dan Durn Bought the Dip. (barrons)

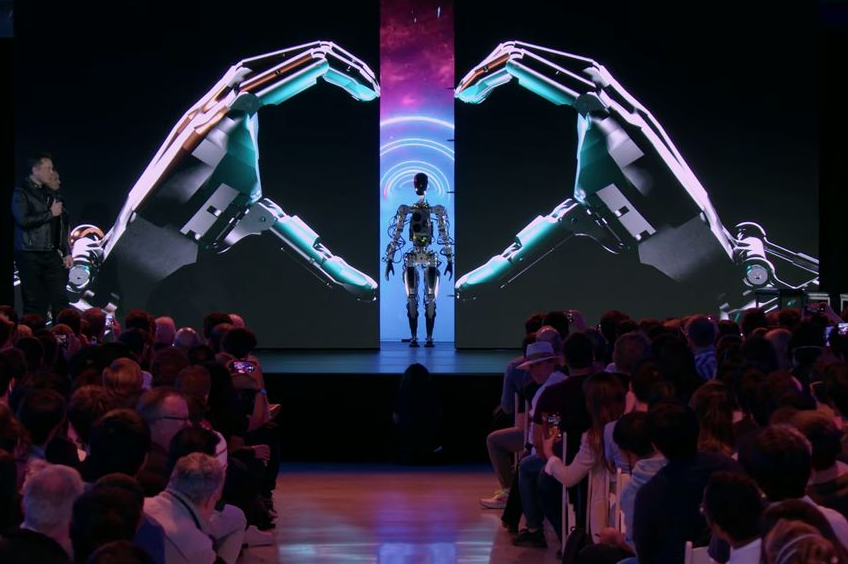

- Elon Musk Unveils Prototype of Tesla’s Humanoid Robot Optimus, Says It Will Cost Less Than a Car (wsj)

- Nike to offer big discounts amid a glut of inventory (nypost)

- ‘The Fed is breaking things’ – Here’s what has Wall Street on edge as risks rise around the world (cnbc)

- 10 Undervalued Wide-Moat Stocks (morningstar)