Tom Hayes – Fintech TV Appearance – 9/27/2022

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – September 27, 2022

Watch in HD directly on Fintech TV

Be in the know. 15 key reads for Tuesday…

- Fed’s Evans says he’s getting a little nervous about going too far, too fast with rate hikes (cnbc)

- Everybody Is Feeling Bad These Days. Why That’s Actually Good for the Market. (barrons)

- Don’t Hide When Markets Tank. Instead, Seek Out Opportunity. (barrons)

- Rents Drop for First Time in Two Years After Climbing to Records (wsj)

- China’s Central Bank Moves Further to Bolster the Yuan (wsj)

- Casino Shares Gain on Hopes of Renewed Tourism in Macau (wsj)

- Gundlach Starts Buying After Worst US Treasury Rout in Decades (bloomberg)

- Deflation Risks Loom in China Amid Property Crisis, Survey Shows (bloomberg)

- Pound steadies after hitting record low as investors weigh the chances of the Bank of England stepping in (businessinsider)

- The conditions needed for a stock market bottom are forming as investors get overly bearish, JPMorgan says (businessinsider)

- Lumber Prices Fall Back to Pre-Covid Levels (wsj)

- JPMorgan’s Kolanovic: ‘Stocks are Looking Increasingly Cheap’ (streetinsider)

- Hong Kong confident of attracting lost talent with ‘0+3’ travel rule (scmp)

- US Business Equipment Orders Rise by Most Since Start of Year (bloomberg)

- German Nuclear Power Extension More Likely, Minister Says (bloomberg)

Thomas Hayes – Channel NewsAsia – CNA Singapore TV Appearance – 9/26/2022

Where the money flowing today?

Be in the know. 20 key reads for Monday…

- Macau to Reopen for Tours From Mainland China. Melco, Las Vegas Sands and Other Casino Stocks Climb. (barrons)

- Traders Who ‘Just Want to Survive’ Are Sitting on $5 Trillion Cash Pile (bloomberg)

- Wharton’s Siegel says Jerome Powell owes ‘the American people an apology’ (cnbc)

- Key Events This Week: PCE, Durables And A Barrage Of Fed Speakers (zerohedge)

- Atlanta Fed President Bostic expects job losses but says there’s a really good chance to get to 2% inflation without killing the economy (cnbc)

- China becomes ‘hothouse’ of intrigue ahead of crucial Communist party congress (theguardian)

- China’s Mistakes Can Be America’s Gain (theatlantic)

- Federal Reserve May Have Gone Too Far (investors)

- The Stock Market Is Reeling. Here’s What Could Stop the Pain. (barrons)

- Why the Midterm Elections Could Mark the Market’s Bottom (barrons)

- John Paulson on Frothy US Housing Market: This Time Is Different (bloomberg)

- UK Meltdown Raises Specter That Bond Market Vigilantes Are Returning (bloomberg)

- Central Banks May Stoke Risks by Raising Interest Rates Together (wsj)

- China Reins In Its Belt and Road Program, $1 Trillion Later (wsj)

- GOLDMAN SACHS: Buy these 26 stocks that are poised to outperform and generate rich cash flows in the near future despite the Fed’s rate hikes (businessinsider)

- The chief investment strategist at a $42 billion firm shares 9 stocks that can weather a recession while boosting income (businessinsider)

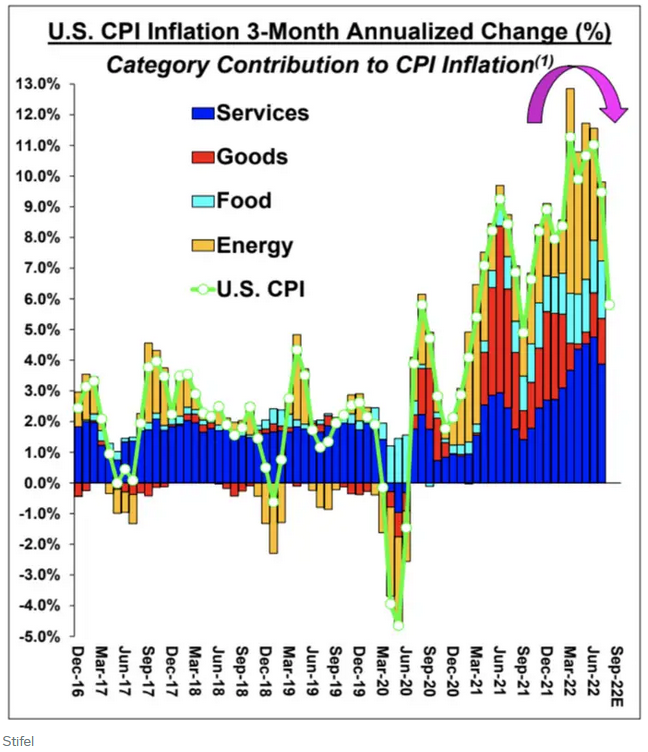

- Stifel’s stock chief shares 4 places to put your money now as an ‘immediate window’ for returns opens up while stocks hit a near-term bottom (businessinsider)

- China’s Central Bank Moves Further to Bolster the Yuan (wsj)

- Macau Gaming Stocks Surge, Relaxation of Travel Rules Seen as a ‘Positive Surprise’ (streetinsider)

- Travel Plays Fly on Hong Kong & Macau Reopening, PBOC Pumps Brakes on CNY Depreciation (chinalastnight)

Be in the know. 14 key reads for Sunday…

- Where You Can Find Stock-Market Bargains (wsj)

- XPeng Founder Lifts Stake With $30 Million Purchase After Plunge (bloomberg)

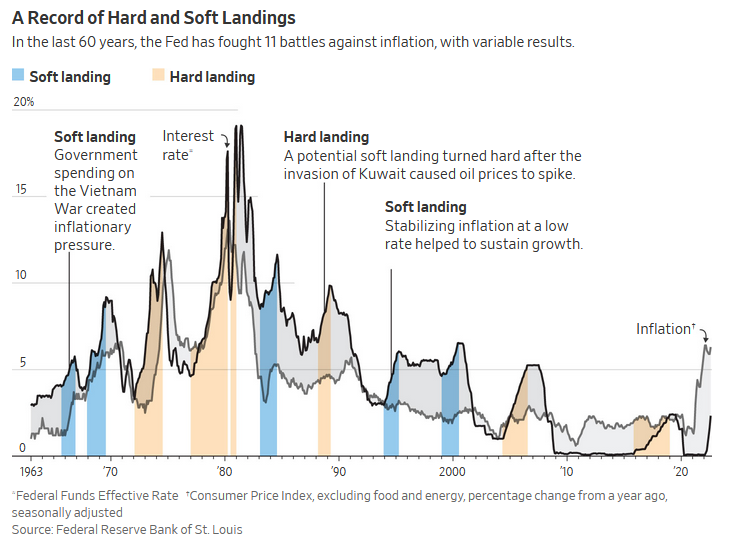

- The Fed’s Surprising Record With ‘Soft Landings’ From Inflation (wsj)

- Insights Live: Howard Marks on Top Misconceptions About Private Credit (OakTree)

- NYU Stern School of Business Professor of Finance Aswath Damodaran (ReCode)

- Our Ultimate Stock-Pickers’ Top 10 Dividend-Yielding Stocks (morningstar)

- “I’m Afraid…” Wharton Prof Rips Powell Apart Over Fed’s “Biggest Policy Mistake” Ever (zerohedge)

- Beto O’Rourke Says US Guest-Worker Program Would Help Slow Inflation (bloomberg)

- The Great Bond Bubble Is ‘Poof, Gone’ in Worst Year Since 1949 (bloomberg)

- US Is Inflating Its Debt Away After Unprecedented Spending Binge (bloomberg)

- Fed Hikes Rates By 75 Basis Points—Here’s Why It’s Not All Doom And Gloom For Investors (forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- The World’s Wildest Hypercars Are On Display At L.A.’s Petersen Automotive Museum (maxim)

- Housing, yen, supply chains vs. the Fed (npr)

Be in the know. 10 key reads for Sunday…

Be in the know. 20 key reads for Saturday…

- “I think we’re giving Powell too much praise. … The last two years are one of the biggest policy mistakes in the 110-year history of the Fed by staying so easy when everything was booming.” Wharton Professor Jeremy Siegel (marketwatch)

- Fundstrat’s Tom Lee is sticking with his bullish year-end stock market forecast even as yields soar and equities plunge amid sticky inflation (businessinsider)

- Amazon and Other Growth Stocks Have Been Hammered. Get Ready to Buy. (barrons)

- Healthcare Learned a Lot From Covid. 12 Ways to Invest Now. (barrons)

- Spooked Traders Just Piled Into Stock Protection at Record Rate (bloomberg)

- Junk-Bond Yields Top 8%. It Could Be a Good Time to Buy. (barrons)

- Brazil Stocks to Buy as Its Economy Booms (barrons)

- Why the ‘sell Rosh Hashanah, buy Yom Kippur’ trade is a tough call as stock-market selloff deepens (marketwatch)

- Home values in August saw their largest monthly decline since 2011. Some cities see house prices drop by 3%. (marketwatch)

- Jamie Dimon says stopping oil and gas funding would be ‘road to hell for America’ (marketwatch)

- Oil Retreats Below $80 (barrons)

- Uber Stock Can Rise on These 2 Trends (barrons)

- Stocks plummet over fears hawkish inflation policy will trigger recession (nypost)

- Bill Ackman: US should fight inflation with ‘increased immigration’ (nypost)

- Zuckerberg takes up MMA training: ‘This nerd is a silent killer’ (nypost)

- Investors demand overhaul of ‘outdated’ US accounting rules (ft)

- The Wrath of Kanye Threatens Sneaker Maker Adidas (bloomberg)

- Commodities Gauge Slumps to Lowest Since July Amid Broad Selloff (bloomberg)

- Wall Street Risks a Breaking Point After Week of Monetary Mania (bloomberg)

- China Vanke’s Property Management Arm Plans Up to $783.6 Million IPO (wsj)