Where is the money flowing today?

Tom Hayes – Quoted in Reuters article – 9/21/2022

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 23 key reads for Thursday…

- TRIP.com says China hotel bookings are surpassing pre-pandemic levels (cnbc)

- EXCLUSIVE China sends regulators to Hong Kong to assist U.S. audit inspection-sources (reuters)

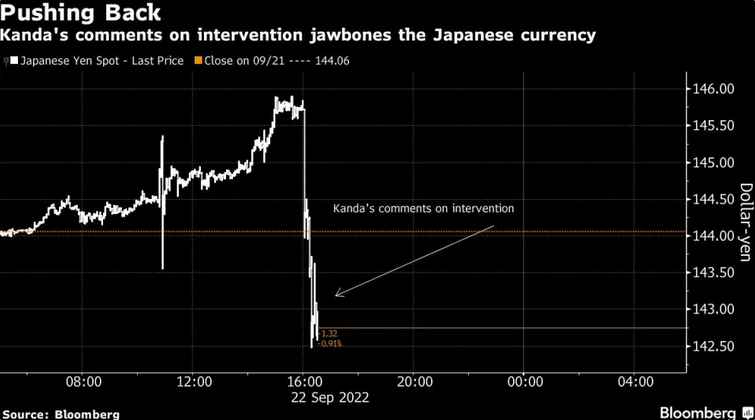

- Japan Intervenes to Support Yen for the First Time Since 1998 (yahoo)

- The Fed Raises Rates by 0.75 Point, Flags Higher Peak Than Expected (barrons)

- The Dollar Is Too Strong. Japan Is Fighting Back. (barrons)

- JPMorgan Chase CEO says stopping oil and gas production would be ‘road to hell’ for US (nypost)

- Mergers Might Get Easier. Watch These ‘Arb’ Stocks. (barrons)

- The Fed Went Big on Its Rate Hike. But the Bank of England Went for a Half-Point. (barrons)

- Goldman Lifts Fed Rate Hike Forecast on ‘Somewhat Hawkish’ Powell Comments (barrons)

- Nervous Investors Are Slamming Tech Deals. Just Look at Adobe. (barrons)

- The stock market tumbled because Jerome Powell’s Fed ‘isn’t going to blink’ (marketwatch)

- S&P 500 sees its third leg down of more than 10%. Here’s what history shows about past bear markets hitting new lows from there, according to Bespoke. (marketwatch)

- The Fed Signals More Pain. Volatility Is Sticking Around Too. (barrons)

- Royal Caribbean stock gains after disclosing bookings were ‘significantly outpacing’ pre-pandemic levels (marketwatch)

- Jamie Dimon: Bitcoin and Other Crypto Tokens Are ‘Decentralized Ponzi Schemes’ (barrons)

- Lennar and KB Home Beat Earnings Estimates. But Home Orders Slowed. (barrons)

- Estee Lauder Has Tumbled. Why That Could Change. (barrons)

- Facebook Parent Meta Wants to Cut Costs by at Least 10%: Report (barrons)

- Here’s why Nordstrom just adopted a ‘poison pill’ plan (nypost)

- Powell Signals Recession May Be Price to Pay for Crushing Inflation (bloomberg)

- Currencies Swing as Fed Hike Prompts Others to Move (wsj)

- Citrix Debt Deal Prices With Large Losses for Banks (wsj)

- ‘Bond King’ Jeff Gundlach says the Fed’s devotion to big rate hikes means there’s now a 75% chance of a US recession next year (businessinsider)

As Hawkish As It Gets. Walk-Back On The Way?

Following the Pandemic Crash and recovery, I gave Chairman Powell and Secretary Mnuchin a lot of credit for saving the world from a global depression by acting quickly and forcefully. As I take a look back, I think Mnuchin deserves all of the credit. Here’s why: Continue reading “As Hawkish As It Gets. Walk-Back On The Way?”

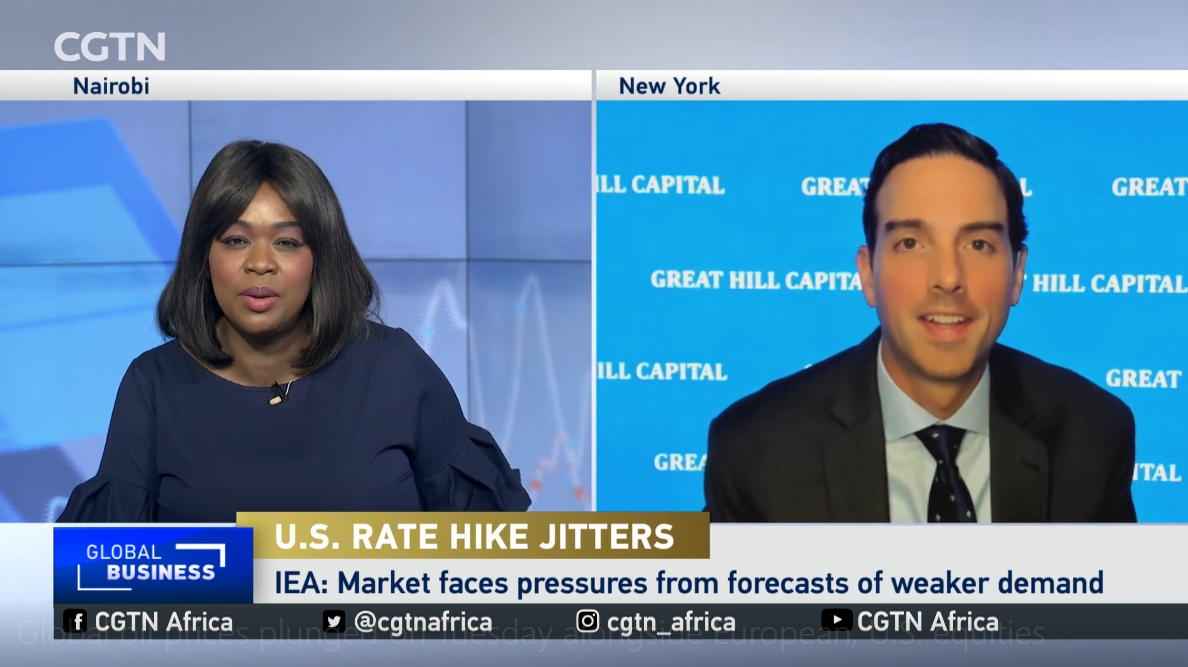

Tom Hayes – CGTN Africa Appearance – 9/21/2022

CGTN Africa – Thomas Hayes – Chairman of Great Hill Capital – September 21, 2022

Watch in HD directly on CGTN Africa

Where is the money flowing today?

Tom Hayes – Quoted in TheStreet article – 9/21/2022

Thanks to Ellen Chang for including me in her article on TheStreet.com. You can find it here:

Click Here to View The Full Article on TheStreet.com

Be in the know. 22 key reads for Wednesday…

- Top influencer Li Jiaqi’s return gives Alibaba renewed live-streaming edge (scmp)

- End of Hong Kong quarantines a catalyst for stock rebound: analysts say (scmp)

- Hong Kong Reopening Announced Along with Pro-Consumption Policies (chinalastnight)

- S&P 500 History Points to a Sharp Bounce After Fed Meeting (yahoo)

- Fed committee fears another jumbo rate hike could add trillions to debt (foxbusiness)

- China Meets With Boeing, Raising Hopes for 737 MAX Flight Resumption (wsj)

- ‘Disinflationary wave is building’ even as investors anticipate aggressive Fed rate increase, says this economist (marketwatch)

- Jeffrey Gundlach says bonds are ‘wickedly cheap’ compared with stocks — and offers one way to get a 9% return without much risk (marketwatch)

- Fed Day Is Here. A Rate Hike Is Just Part of the Equation. (barrons)

- On Fed Day Putin Reminds Wall Street It’s Not All About Higher Rates (barrons)

- 5 Auto-Parts Stocks That Will Gain From Ford’s Inflation Problem (barrons)

- What Home Builders’ Earnings Can Tell Us About the Slumping Housing Market (barrons)

- Tencent Considers More Stake Sales to Fund Share Buybacks, Future Growth (wsj)

- High Natural-Gas Prices Push European Manufacturers to Shift to the U.S. (wsj)

- Mortgage demand rises for the first time in six weeks, despite sharply higher interest rates (cnbc)

- Here’s everything the Federal Reserve is expected to do today (cnbc)

- China Reacts To Putin Speech, Urges Immediate Ceasefire & Dialogue (zerohedge)

- The stock market has rallied on day of every Fed rate-hike decision in 2022. Could it happen again today? (marketwatch)

- Tech IPOs Not Returning to the Market Anytime Soon (thestreet)

- The Market Red Flags That Could Prompt the Fed to Slow Down on Rate Hikes (yahoo)

- News in-depth. Why Putin is raising the stakes in Ukraine war (ft)

- French billionaire Xavier Niel builds 2.5% Vodafone stake (ft)