- I’ll be speaking at the Money Show Accredited Investors Virtual Expo from 5:05-5:35pm today. Register free at this link (moneyshow)

- Alibaba Says Its Primary Listing in Hong Kong Has Been Approved (barrons)

- Applebee’s, IHOP parent Dine Brands tops profit, revenue expectations amid ‘sustained’ traffic and dine-in recovery (marketwatch)

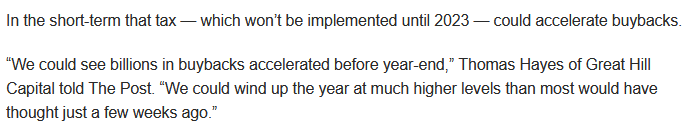

- Why Wall Street celebrating Inflation Reduction Act could be premature (New York Post)

- Baidu To Offer Robo Taxis In More Cities, Alibaba Prepares For Southbound Stock Connect Eligibility (chinalastnight)

- Boeing (BA) Expected to Resume 787 Dreamliner Deliveries in the Coming Days – FAA (streetinsider)

- China’s July Car Sales Rise 20% on Demand For Electric Vehicles (bloomberg)

- SoftBank Reports $23 Billion Loss as Tech Investments Plummet (nytimes)

- The Math Behind GE’s Breakup. It’s a Sum-of-the-Parts Party. (barrons)

- GM and 9 Other Stocks That Should Shine in a 2023 Recession: Citi (barrons)

- Here are 10 reasons why JPMorgan says the global stock market rally will continue (marketwatch)

- BANK OF AMERICA: Buy these 7 consumer discretionary stocks — including one with 56% upside — which will start to outperform as soon as 6 months before the Fed starts to cut interest rates (businessinsider)

- Alibaba Reduced Workforce by Nearly 10,000 in Three Months (bloomberg)

- Flight Bookings to Hong Kong Surge 249% After Quarantine Cut (bloomberg)

- BofA Sees Slower Card Spending as Rent Increases Dent Wallets (bloomberg)

- Saudi-Backed LIV Tour Makes PGA Winnings Look Like Chump Change (bloomberg)

- Walking Dead Network Still Has Life (wsj)

Tom Hayes – Quoted in New York Post article – 8/8/2022

Thanks to Lydia Moynihan and Josh Kosman for including me in their article in the New York Post today. You can find it here:

Click Here to View The Full Article at the New York Post

Tom Hayes – Benzinga Appearance – 8/8/2022

Benzinga – Thomas Hayes – Chairman of Great Hill Capital – August 8, 2022

Watch Directly On Benzinga HERE

Tom Hayes – Quoted in Reuters article – 8/8/2022

Thanks to Davide Barbuscia, Megan Davies, David Gaffen, Laura Sanicola, Saqib Ahmed Sinead Carew, Susan Mathew, Akash Sriram Aniruddha Ghosh & Megan Davies for including me in their article on Reuters today. You can find it here:

Tom Hayes – Quoted in Reuters article – 8/8/2022

Thanks to Bansari Mayur Kamdar and Aniruddha Ghosh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is the money flowing?

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 27 key reads for Monday…

- Pfizer agrees to buy Global Blood Therapeutics in deal valued at $5.4 billion: WSJ (MarketWatch)

- Share Buyback Tax’s Lag Could Spur Rush to Repurchase This Year (bloomberg)

- The Fed Is About to Ramp Up Balance-Sheet Shrinkage. It May Get Dicey. (barrons)

- SoftBank Posts a Record Loss, Says It’s Exploring a Sale of Fortress (barrons)

- Senate Passes Inflation Reduction Act. What’s Inside. (barrons)

- Tesla and 9 Other Companies That Would Take a Hit From a 15% Minimum Corporate Tax (barrons)

- GE Is Building the Electricity Grid of the Future. Here’s What We Found on a Tour. (barrons)

- The Math Behind GE’s Breakup. It’s a Sum-of-the-Parts Party. (barrons)

- Disney, Uber, and 11 Beaten Down Stocks That Look Like They Could Come Back (barrons)

- Clean Energy Stocks Rise on Senate Passage of Climate Bill (barrons)

- The Bull Market in Biotech Stocks Is Still Going Strong (barrons)

- Here’s how the Inflation Reduction Act’s rebates and tax credits for heat pumps and solar can lower your energy bill (marketwatch)

- A surging stock market is on the verge of signaling a ‘huge’ move — but there’s a catch (marketwatch)

- Wall Street Shuffles Bets on Consumer Loans as Economy Slows (wsj)

- How ‘Better Call Saul’ Refined the Art of Television (wsj)

- Two Chinese Cities Approve Baidu’s Unmanned Self-Driving Taxis (wsj)

- Home Sellers Cut Prices as Housing Market Cools (wsj)

- Shale Drillers Warn of Higher Costs as They Report Record Profits (wsj)

- Why Not to Worry, China Chip Stocks Rally, Week in Review (chinalastnight)

- Why Munster Thinks Tesla Is The Biggest Beneficiary Of The Climate Bill (benzinga)

- Investors swarm back to corporate bond ETFs (ft)

- ‘Bullet Train’ tops charts in opening weekend with $30.1M (foxbusiness)

- America’s Chinese Tech Ban Didn’t Stick (nytimes)

- Here’s What’s in the Senate’s Tax and Energy Bill (bloomberg)

- Winners and Losers in Democrats’ Signature Tax and Energy Bill (bloomberg)

- ‘The market bottom is in’: The chief investment strategist of a $1.4 billion firm explains why he’s rotating back into growth stocks — and lays out the 4 high-quality tech stocks that investors should bet on now (businessinsider)

- Lyft (LYFT) Surges on Record Earnings, Analysts Praise Improved Operating Efficiencies (streetinsider)

Be in the know. 20 key reads for Sunday…

- The Greatest Value Investor You’ve Never Heard Of (macroops)

- Can David Zaslav’s new Warner Bros. Discovery deals work? (nypost)

- Elon Musk challenges Twitter CEO Parag Agrawal to ‘public debate’ over bots (nypost)

- Share Buyback Tax’s Lag Could Spur Rush to Repurchase This Year (bloomberg)

- China’s Trade Surplus at Record as Exports Beat Expectations (bloomberg)

- Buffett’s Berkshire Pounces on Market Slump to Buy Equities (bloomberg)

- China IPO Market Trounces the World With Record $58 Billion Boom (bloomberg)

- China Eases Rules for International Covid Flight Suspensions (bloomberg)

- Senate Democrats Close In on Passing Climate, Tax Bill (wsj)

- “Deteriorating Situation” Shows Rent Growth “Collapsing” In Sunbelt Markets (zerohedge)

- Retail’s ‘Dark Side’: As Inventory Piles Up, Liquidation Warehouses Are Busy (nytimes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Limited Edition Maserati Grecale SUVs Are Coming To America (maxim)

- The Crypto Crash Is Driving Sales Of Rolex Watches On The Secondary Market (maxim)

- Chinese companies on the Fortune Global 500 list contribute more revenue than US companies for the first time (technode)

- The Secret to Being Lucky (wired)

- The Big Business of Burying Carbon (wired)

- Everything DARPA’s Been Doing for the Last 20 yrs (gizmodo)

- A new way to pay for college (Update) (npr)

- Musk says Twitter deal could go forward once user data confirmed (foxbusiness)