- Cooper Standard Reports Second Quarter Results, Reaffirms Full-year Guidance for Adjusted EBITDA (cooperstandard)

- Cooper Standard (CPS) rose 69.58% on Friday. Our Original Cooper Standard Thesis from Fox Business Appearance – June 7, 2022 (Fox Business)

- Our Original Cooper Standard Presentation from our June 9, 2022 VideoCast (HedgeFundTips)

- Cooper Standard Q2 Presentation Deck (cooperstandard)

- Cooper Standard Q2 Earnings WebCast (cooperstandard)

- Pfizer in Advanced Talks to Buy Global Blood Therapeutics (wsj)

- GE Stock Is a Buy as Breakup Looms (barrons)

- Gas prices are falling. So is interest in electric cars (cnn)

- Advertising Is Still Going Strong. Apple Wants In. (barrons)

- Rocket CEO Jay Farner Bought Shares Before Earnings Miss (barrons)

- Alibaba earnings highlight ‘attractive turnaround story,’ though stock gives back gains. Latest results brought a ‘needed surprise’ and other positives, say analysts (marketwatch)

- QT will represent the equivalent of at least a half-point rate hike, and probably closer to a full-point increase. (barrons)

- Buy PayPal Stock. The Battered Payments Company Is Starting to Perk Up. (barrons)

- Wireless Is Undergoing a Growth Surge That Will Fuel the Big Telecoms (barrons)

- Rocket CEO Jay Farner Bought Shares Before Earnings Miss (barrons)

- The economy took 2½ years to recoup the 22 million jobs lost (wsj)

- Elon Musk predicts Tesla’s robotaxi will be like Uber, Airbnb combined (nypost)

- US Consumer Borrowing Jumps by More Than $40 Billion, Second-Most Ever (bloomberg)

- Tiger Cubs Stung by Rout Dumped Stocks, Then Missed Rally (bloomberg)

- Schumer says Sinema left ‘no choice’ but to cut carried interest from key bill (cnbc)

- What Is It About Friendships That Is So Powerful? (nytimes)

- Opinion: Step aside, FAANMGs. This new crop of tech companies are the ones to watch for the next decade. (marketwatch)

- Study Suggests That Pill Can Cut Hereditary Cancer Risk by 60 Percent (futurism)

- Changing World Order with Ray Dalio and Tony Robbins (Tony Robbins)

- Investing The Warren Buffett Way: EPS Screening (forbes)

- Why Is Taiwan Semiconductor’s Stock So Cheap? (morningstar)

- 10 Stocks for a Recession (morningstar)

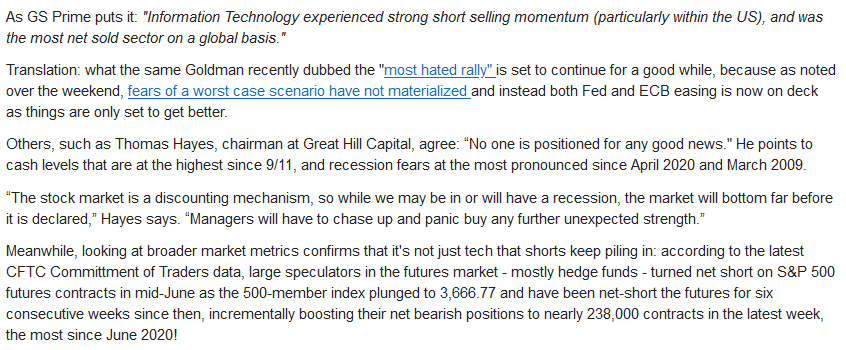

Where is the money flowing?

Tom Hayes – Quoted in Zero Hedge article – 8/1/2022

Thanks to Tyler Durden for including me in his article on ZeroHedge today. You can find it here:

Click Here to View The Full Article on ZeroHedge

Be in the know. 15 key reads for Friday…

- Musk Sees Inflation Easing, Citing Tesla’s Costs Coming Down (bloomberg)

- The Bull Market in Biotech (barrons)

- Kyrsten Sinema Wins Tax Changes to Democrats’ Climate Bill (wsj)

- GE’s Looming Breakup Means It’s Time to Buy the Stock (barrons)

- Meta’s first-ever corporate bond deal sees $30 billion in demand despite Zuckerberg’s gloomy warning (marketwatch)

- Expedia Stock Jumps on Solid Earnings. People Are Traveling. (barrons)

- New Buyback Tax Will Force Companies to Think Twice on How to Use Cash (barrons)

- Almost Half of Mortgaged Homes in US Now Considered Equity-Rich (bloomberg)

- Million-Dollar Ferraris, Lambos to Defy Bear Market at Pebble Beach (bloomberg)

- New Weight-Loss Drugs Can Fatten Drugmakers’ Profits (wsj)

- Alibaba-backed AI Speech moves forward with Star Market listing plan, aiming to raise US$1.5 billion in Shanghai IPO (scmp)

- Alibaba-backed AI Speech moves forward with Star Market listing plan, aiming to raise US$1.5 billion in Shanghai IPO (scmp)

- Jobs shocker: U.S. adds 528,000 jobs in July and unemployment falls to pre-pandemic levels (marketwatch)

- Speculators Exit Agricultural Markets, Intensifying Crop Selloff (wsj)

- ‘Bullet Train’ Review: Brad Pitt’s Rowdy Ride (wsj)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 146

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)

Article referenced in VideoCast above:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 136

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)

Where is the money flowing?

Be in the know. 21 key reads for Thursday…

- Alibaba stock shoots higher after company beats on earnings, says business improved in June (marketwatch)

- 80% of new IRS revenue will come from small businesses earning under $200K: tax experts (nypost)

- SoftBank raises $22bn in moves to sell down Alibaba stake (ft)

- Tiger Global blames inflation after 50% drop in flagship hedge fund (ft)

- Big Tech Is the West’s Surprise Weapon in Competition With Russia, China (wsj)

- Russia Claims Capture of Donbas Position Long Held by Ukrainian Forces (wsj)

- Iran Nuclear Negotiators to Meet in Last-Ditch Effort to Revive Deal (wsj)

- Phone Hacks to Get You Out of Customer-Service Hold (wsj)

- Michael Saylor Bet Billions on Bitcoin and Lost (wsj)

- Alnylam Shares Soar as Drug Trial for Heart Disease Delivers Positive Results (wsj)

- MMA fighter springs into action to take down NYC assault suspect (nypost)

- Sinema Stalls Revamped Reconciliation Bill, Demands Several Changes (zerohedge)

- Goldman, Bernstein Strategists Say Stock Rally Set to Fade (bloomberg)

- Lamborghini CEO on Going All Electric: ‘We Don’t Need to Decide Now’ (bloomberg)

- Facebook parent Meta is looking to potentially tap the bond market for the first time ever (businessinsider)

- The Federal Reserve is playing with fire as recession risk rises, says the top strategist at JPMorgan Asset Management. Here are 4 ways investors can protect their money. (businessinsider)

- Alibaba Sales Better Than Feared in Defiance of Economic Turmoil (yahoo)

- Alibaba appoints two independent directors as it seeks Hong Kong primary listing (scmp)

- Why the U.S. stock rally looks more like a new bull market than a bear bounce to these analysts (marketwatch)

- WTI Oil Falls Below $90 for First Time Since Ukraine Invasion (bloomberg)

- Jack Ma’s Ant Sees Profit Fall 17% After Regulatory Setback (bloomberg)

The “Jawboning” Stock Market (and Sentiment Results)…

The Hawks were out this week, trying to walk-back the “data dependent” pivot from Chairman Powell last week. With a technical recession now booked in the rear view mirror (2 quarters of negative GDP growth in 1H), DON’T BUY IT! Continue reading “The “Jawboning” Stock Market (and Sentiment Results)…”