- Investor case for Chinese assets rises despite regulatory and geopolitical risks (ft)

- Is Warren Buffett Selling? BYD Stock Is Down (barrons)

- PepsiCo Stock Rises as Earnings, Revenue Beat Forecasts (barrons)

- S. yield curve most inverted in 15 years (marketwatch)

- Money Is Pouring Into Bonds Again. What It Means. (barrons)

- Opinion: ‘A perfect business for an inflationary environment.’ Why this veteran value investor is bullish on a beaten-down telecom stock. (marketwatch)

- NFIB small-business optimism index falls to lowest level since the start of the pandemic (marketwatch)

- Cruises Are the Cheapest Way to Travel This Summer (wsj)

- Crispr for the Masses Gets a Little Closer to Reality (bloomberg)

- Charts suggest the market is poised for an August rebound, Jim Cramer says (cnbc)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/11/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 11, 2022

Watch in HD directly on Fox Business

Tom Hayes – Quoted in TheStreet article – 7/11/2022

Thanks to Ellen Chang for including me in her article on TheStreet.com today. You can find it here:

Click Here to View The Full Article on TheStreet.com

Where is the money flowing?

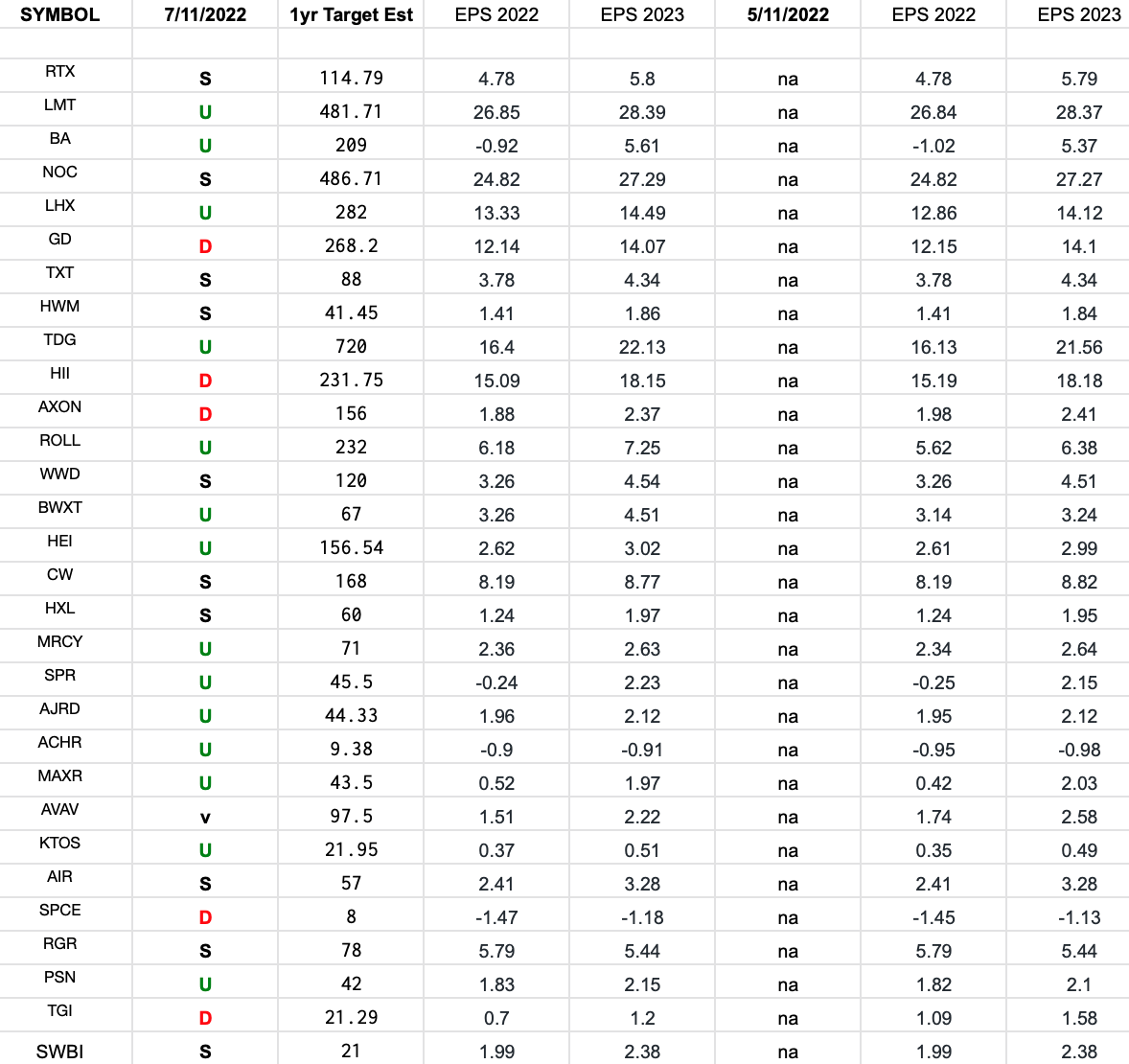

Defense & Aerospace Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Defense & Aerospace ETF (ITA). Continue reading “Defense & Aerospace Earnings Estimates/Revisions”

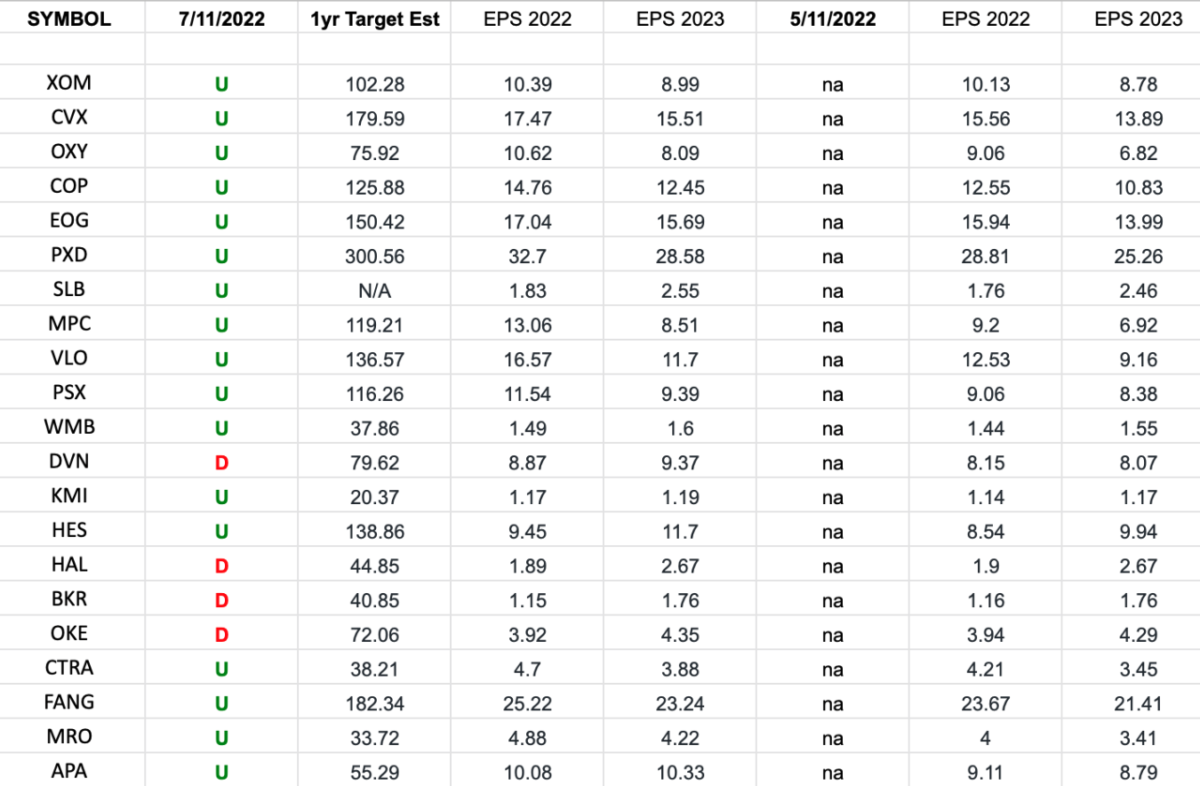

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Tom Hayes – Cheddar TV Appearance – 7/11/2022

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 21, 2022

Watch in HD directly on Cheddar

Be in the know. 27 key reads for Monday…

- A chief market strategist at a $1.8 billion firm explains why you should consider buying ‘beaten-up’ Chinese stocks and a risk-free, inflation-protected asset with a guaranteed 9.62% return as the market continues selling off (businessinsider)

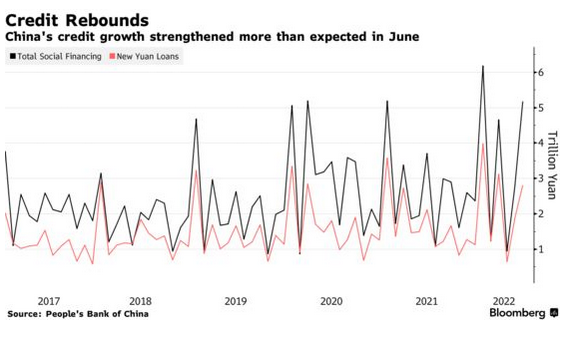

- China’s Credit Flow Jumps as Government Boosts Economic Stimulus (bloomberg)

- GOLDMAN SACHS: These 13 stocks have the most dramatic upside as equities slowly recover from their bear market plunge — including 8 that will more than double in value over the next year (businessinsider)

- Conventional Wisdom Says M&A Slows as Rates Rise. History Shows a Different Story. (institutionalinvestor)

- Tencent, Alibaba and Didi fined for old unreported merger deals (scmp)

- UBS says the dollar’s surge is ‘unlikely to endure’ as the Fed will be forced back into rate-cutting mode. Strategists reveal when this could happen and name 3 global currencies that are now a better bet. (businessinsider)

- Elon Musk Is Walking Away from the Twitter Deal. Here’s How It Could Still Happen. (barrons)

- Worried About a Recession? Watch the Big Banks’ Earnings. (barrons)

- Recession May Be on Our Doorstep. Why That Could Be Good News for Investors. (barrons)

- Why Starbucks Stock Could Be Ready to Run (barrons)

- This Analyst Cut His Price Target for Nvidia. Its Challenges Go Beyond Russia and China. (barrons)

- MGM and Wynn Stocks Fall as Macau Shuts Down Casinos Again (barrons)

- Bed Bath & Beyond Insiders Scooped Up the Stock After an Awful Quarter (barrons)

- The Stock Market Faces Next Test as Inflation Looms Over Earnings Season (wsj)

- Show of force How ‘Yellowstone’ turned Taylor Sheridan into a TV kingmaker (nypost)

- The top 20 NHL free agents and where they may land (nypost)

- Macau Shuts Casinos as City Enters Weeklong Lockdown (wsj)

- Citi, Morgan Stanley Disagree on Earnings Impact for US Stocks (bloomberg)

- Home-Sale Cancellations Jumped in June as Buyers Backed Away (bloomberg)

- Costco CEO’s one-word answer to whether he would raise the price of hot dogs: “No” (cnbc)

- Millennial and Gen Z’s days of remote working could be numbered, says author (cnbc)

- Charlie Munger personally backed an investor seeking to build the Berkshire Hathaway of Australia — even though he rarely trusts anyone except Warren Buffett to manage his money (businessinsider)

- Electric car survey finds this as the biggest reason preventing people from buying them (foxbusiness)

- Goldman Sachs Cuts Buffett’s Favorite Occidental to Neutral After Outperformance (streetinsider)

- The Big Read. FT interview: Brazil’s Lula on the prospects of an extraordinary comeback (ft)

- Russia turns off gas pipeline to Germany for repairs (ft)

- Joe Biden seeks reset on Saudi Arabia as oil tensions flare (ft)

Tom Hayes – Quoted in Bloomberg article – 7/10/2022

Thanks to Sagarika Jaisinghani, Jess Menton, and Kat Van Hoof for including me in their article on Bloomberg. You can find it here:

Click Here to View The Full Article on Bloomberg

Be in the know. 23 key reads for Sunday…

- Is a Recession Coming? Investors Turn to Earnings for Clues (bloomberg)

- Charlie Munger – Daily Journal Corp. Latest Holdings (dataroma)

- Rethinking the value of collateral for money markets (ft)

- 5 Best Chinese Stocks: All Are Near Buy Points (investors)

- This David Brown Speedback GT Is A Glorious Tribute To James Bond’s Favorite Ride (maxim)

- ‘This is all because of the politicians’: rising prices anger Indians (ft)

- Why This Baseball Billionaire Is Betting On Amazon, AT&T And J.P. Morgan (forbes)

- ‘If it’s a recession… buy!’ This little-known market indicator is telling you to scoop up stocks on the cheap (marketwatch)

- Buy Unilever and Las Vegas Sands, Causeway’s Ellen Lee Says (bloomberg)

- Hong Kong’s Paul Chan Says China’s Economy Will Rebound Quickly (bloomberg)

- China Car Sales Jump as Covid Curbs Relaxed (wsj)

- Small-Cap Stocks Are Starting to Stage Their Comeback (wsj)

- McLaren Speedtail: A $3 Million Zoom With a View (wsj)

- Goldman Sachs: Buy these 50 stocks with strong dividend growth (businessinsider)

- Biden-Xi Call Likely to Take Place in Coming Weeks, Blinken Says (bloomberg)

- Elon Musk Terminates Twitter (TWTR) Acquisition Citing ‘Material Breach’ (streetinsider)

- Short Sellers May Be Signaling a Market Bottom (institutionalinvestor)

- The mystery of how quantitative tightening will affect markets (ft)

- Shanghai to ramp up support for metaverse development, low-carbon projects, smart gadgets to help China’s economic recovery (scmp)

- Why Is Meta Stock So Cheap? (morningstar)

- Peter Lynch Articles For Worth Magazine (dividendgrowthinvestor)

- This Ultra-Rare 1957 Ferrari Race Car Could Fetch up to $10 Million Auction Next Month (robbreport)

- Chris Chandler’s Legatum – CIO & Partner – Philip Vassiliou talks investing w/Tom Hayes. HFT VC #142 (youtube)