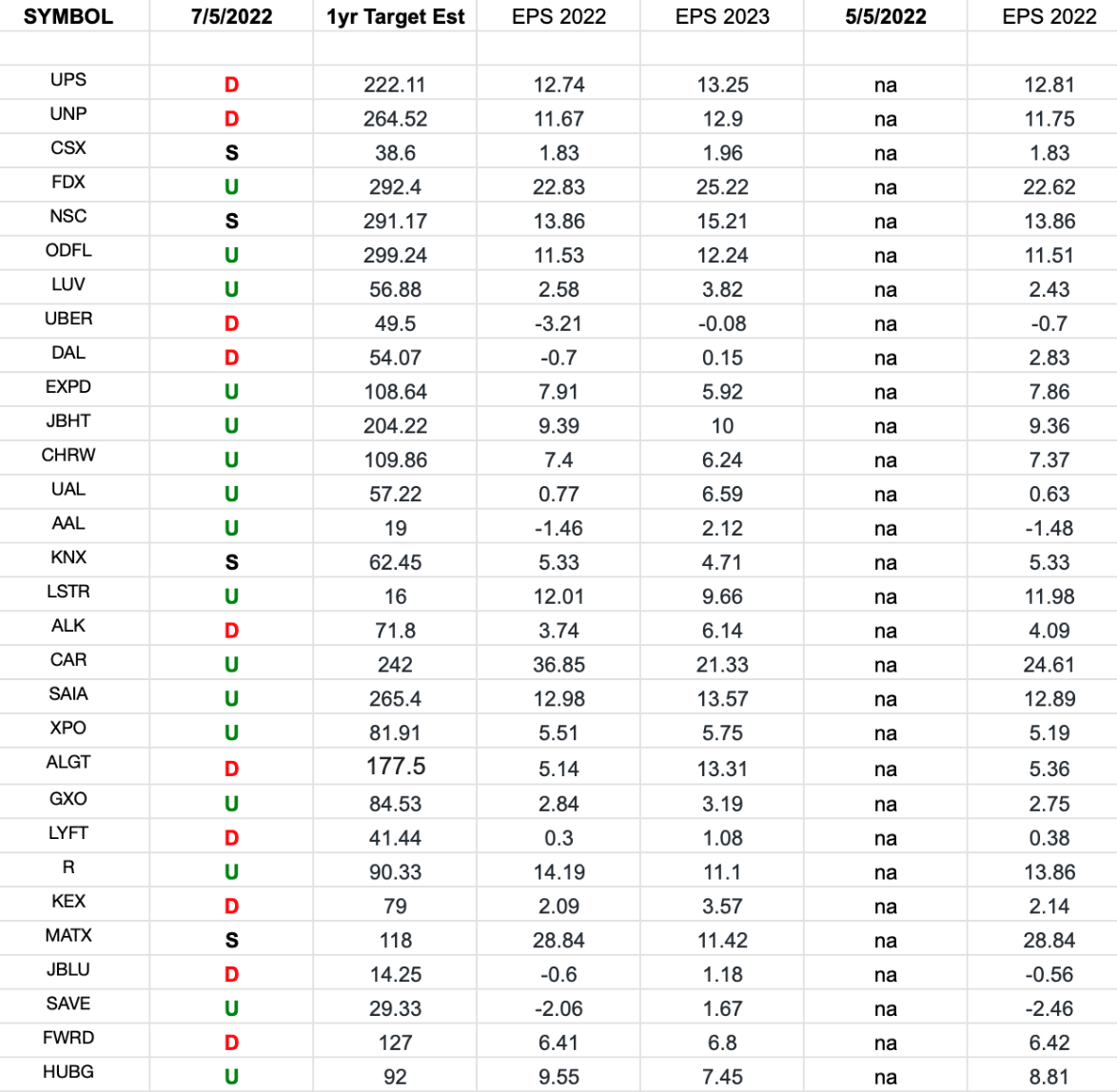

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) top 30 holdings. Continue reading “Transports Earnings Estimates/Revisions”

Be in the know. 27 key reads for Tuesday…

- Alibaba Stock Is Back in Its Groove. Why Chinese Tech Could Keep Outperforming. (barrons)

- Alibaba: Ant listing approval would help China stocks return to normality (ft)

- BofA’s Bull and Bear Indicator is at ‘Maximum Bearish’ For a Third Week In a Row (streetinsider)

- AstraZeneca to buy biotech firm TeneoTwo for up to $1.27 billion (foxbusiness)

- Biotech Stocks Finally Rose in June. What Does It Mean? (barrons)

- Why China’s Stock Market Looks Like It Can Keep Going Strong (barrons)

- Biden Dropping China Tariffs Could Be Good News for Tech Stocks (barrons)

- Biden Might Soon Ease Chinese Tariffs, in a Decision Fraught With Policy Tensions (wsj)

- Cutting Tariffs Would Ease Inflation. What Are We Waiting For? (barrons)

- Consumers’ Inflation Psychology Worries Fed (wsj)

- Short Sellers Pull Back on Their Bets Against the Stock Market (wsj)

- Secrets of Sovereign (institutionalinvestor)

- Earnings Season Will Be All About Vibes From Management (barrons)

- Tesla Is No Longer the World’s Largest EV Seller. Here’s Who Is. (barrons)

- Ray Dalio attacks U.S. populists and warns Russia may be ‘lesser loser’ in Ukraine war (marketwatch)

- Here’s how far house prices are set to fall as rates go up, according to this forecasting firm (marketwatch)

- Euro to reach parity against the U.S. dollar unless natural-gas crisis ends, Citi strategists warn (marketwatch)

- If the U.S. Is in a Recession, It’s a Very Strange One (wsj)

- Nuclear Power Gets New Push in U.S., Winning Converts (nytimes)

- Liquefied Natural Gas Comes to Europe’s Rescue. But for How Long? (nytimes)

- NHL mock draft: Projected first-round picks for Thursday in Montreal (usatoday)

- China’s Liu He and U.S. Treasury Secretary Janet Yellen hold virtual talks (cnbc)

- Citi Says Oil May Collapse to $65 by the Year-End on Recession (bloomberg)

- American Factories Are Making Stuff Again as CEOs Take Production Out of China (bloomberg)

- Consumer Debt Isn’t Stressing Banks — Yet (bloomberg)

- Ford U.S. sales jump in June (marketwatch)

- China to Set Up a $75 Billion Infrastructure Fund to Reaccelerate Economy Growth (streetinsider)

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Be in the know. 25 key reads for Independence Day!

- Futures Rebound On Report Biden To Roll Back Chinese Tariffs Soon (zerohedge)

- Commodity Price Slide Raises Hopes Inflation May Ease (wsj)

- Why China’s Stock Market Looks Like It Can Keep Going Strong (barrons)

- Alibaba to test self-driving trucks on public roads without human safety drivers (technode)

- Las Vegas Sands Stock Could Win Big in a Reopened China (barrons)

- Rolls-Royce: Six sites shortlisted for nuclear reactor factory (bbc)

- The Chandler Brothers: The Greatest Investors You’ve Never Heard of (macro-ops)

- The big banks are much better businesses than they were decades ago, says Oakmark’s Bill Nygren (cnbc)

- John C. Malone – Chairman – Liberty Media LLC (youtube via acquirersmultiple.com)

- Meta Plunge Lures Value Buyers as Growth Funds Flee (yahoo)

- Elon Musk once laughed at Warren Buffett–backed BYD. (fortune)

- The DeLorean Comes Back From The Past (forbes)

- Bezos slams Biden’s call for gasoline stations to cut prices (reuters)

- New Oriental is planning an education livestream platform (technode)

- SpaceX’s Starlink is coming to planes, trains, and automobiles (thenextweb)

- Google Password Manager just got an update (mashable)

- China More Dependent on US and Our Technology Than You Think (dailysignal)

- All roads lead to Russian indicators (npr)

- A chat with Ray Dalio (thehustle)

- Iran Slashes the Cost of Its Oil to Compete With Russia in China (bloomberg)

- 3-D Printing Grows Beyond Its Novelty Roots (nytimes)

- Home sellers are realizing that the market has turned (yahoo)

- Boeing and 7 More Industrial Stocks for the Second Half of 2022 (barrons)

- Glut of Goods at Target, Walmart Is a Boon for Liquidators (wsj)

- Warren Buffett Has Advice for the Barbarians at Japan’s Gate (bloomberg)

Be in the know. 20 key reads for Sunday…

- Investing icon Peter Lynch warned against speculating, panicking, and trying to predict the market in a rare interview. Here are the 9 best quotes. (businessinsider)

- Hong Kong’s Dry Spell for IPOs Set to End With Big China Deals (bloomberg)

- Zuckerberg says Meta is ‘turning up the heat’ so employees will quit: ‘That self-selection is OK with me’ (nypost)

- Ritzy new developments are turning Hudson Valley into the Hamptons (nypost)

- Biden Seeks to Block New Offshore Drilling in Atlantic, Pacific (wsj)

- Supreme Court Climate Ruling Adds Obstacles to SEC Policies (wsj)

- How America’s Summer Vacation Came Back Stronger Than Ever (wsj)

- Cooling Demand for Goods Threatens to Turn Pandemic Boom Into Bust (wsj)

- 2023 Aston Martin DBX707: An SUV That Drives Like a Super Coupe (wsj)

- GM expects to complete the sales later in the year (wsj)

- Banks Get Burned by Risky Debt, Imperiling Buyout Activity (wsj)

- Russia claims full control of Luhansk region after seizing last city (ft)

- China’s self-styled Warren Buffett haunted by Fosun’s $40bn debt (ft)

- Shipping boss says Japan has no choice but to buy Russian gas (ft)

- Here are 4 growth stocks that can succeed in any market setting, according to a portfolio manager who’s beaten 99% of peers over the past 15 years (businessinsider)

- Forget the Eiffel Tower. Here’s where the French travel in France (cnbc)

- Master Investor Ed Thorp on How to Think for Yourself, Mental Models for the Second Half of Life, How to Be Inner-Directed, How Basic Numeracy Is a Superpower, and The Dangers of Investing Fads (#604) (blog)

- Howard Marks, Co-chairman of Oaktree Capital Management (Goldman Sachs)

- Time is ripe to snap up bargains, says debt investor Howard Marks (ft)

- We are in a mild recession: Wharton’s Jeremy Siegel (cnbc)

Be in the know. 17 key reads for Saturday…

- BlackRock’s China ETF Lures Record Cash Amid World-Beating Rally (bloomberg)

- Secrets of Sovereign – Chandler Brothers (institutionalinvestor)

- Las Vegas Sands Stock Could Win Big as China Eases Zero-Covid Rules (barrons)

- 10-year Treasury yield tumbles further below 3%, sees biggest weekly drop since March (marketwatch)

- Berkshire Hathaway buys 9.9 mln more Occidental shares, has 17.4% stake (reuters)

- Wedbush’s Dan Ives reveals the whisper number for Tesla deliveries (foxbusiness)

- Netflix Crashes After ‘Stranger Things 4’ Finale Release (bloomberg)

- Home Sellers Are Slashing Prices in Sudden Halt to Pandemic Boom (bloomberg)

- Wheat Sinks to Pre-War Levels as Recession Fears Grow (bloomberg)

- Song By Song, Country Star Luke Combs Grows Into Stadiums (bloomberg)

- Home Prices Could Level Out Next Year. Here’s How. (barrons)

- Commodities Prices Are Falling. What It Means. (barrons)

- Forget the 1970s — this market is drawing comparisons to the 1870s (marketwatch)

- Big-name investors are back putting more ‘junk’ in their funds, despite the carnage in bonds (marketwatch)

- Boeing Just Can’t Get the Upper Hand Against Airbus. Why That’s No Problem. (barrons)

- S. Banks Are ‘Dramatically Undervalued.’ 8 Stocks to Buy. (barrons)

- Driving the 2022 Porsche 911 Targa 4 GTS, a Car with History (barrons)

Where is the money flowing?

Tom Hayes – Public.com Appearance – 7/1/2022

Be in the know. 20 key reads for Friday.

- Xi Tells Hong Kong to Focus on Business After Turmoil (bloomberg)

- Supply chain issues ‘eased significantly’ — and inflation could be next (yahoo)

- Iran Nuclear Talks Likely to Resume After Biden’s Mideast Trip (bloomberg)

- S&P 500’s Brutal First Half Has Little Bearing on the Future (bloomberg)

- Goldman Strategists Warn Risk of Stock Selloff Is Still High (bloomberg)

- China’s Economy Returns to Growth Mode as Covid-19 Lockdowns Lift (wsj)

- The Wheels Have Come Off Electric Vehicles (bloomberg)

- The Top Luxury Convertibles, From European Supercars to US Classics (bloomberg)

- Li Auto stock rallies after June EV deliveries rise nearly 70% (marketwatch)

- NIO stock jumps after June EV deliveries rise sharply from a last month and from last year (marketwatch)

- The Fed Is Quietly Handing Out $250 Million To A Handful Of Happy Recipients Every Single Day (zerohedge)

- XPeng stock rallies after June deliveries more than double from a year ago (marketwatch)

- Here’s what one investor says he’s learned from Warren Buffett and Charlie Munger — and the mistakes he’s made (marketwatch)

- The Dow suffered its worst first half since 1962. What history says about the path ahead. (marketwatch)

- The chip boom likely over, as Micron says it’s in a ‘downturn’ (marketwatch)

- The Super, Super Rich: 20 People Worth More than $50 Billion (barrons)

- Supreme Court Puts Brakes on EPA in Far-Reaching Decision (wsj)

- Supply-chain issues restrict inventory on dealer lots; ‘We could sell all of the vehicles that we could possibly get’ (wsj)

- Attention Biotech Investors: Mark Your Calendar For These July PDUFA Dates (benzinga)

- Chinese stocks still cheap for Credit Suisse as others fret about zero-Covid (scmp)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 141

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)