Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

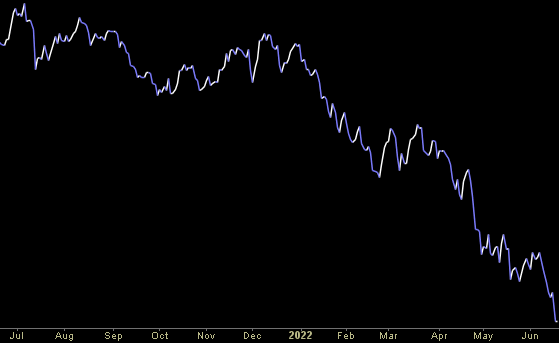

Where is the money flowing?

Be in the know. 20 key reads for Friday…

- Exclusive: China’s central bank accepts Ant’s application for financial holding company (reuters)

- Alibaba Soars 9% on Report China Approves Ant’s Application for Financial Holding Company (streetinsider)

- The Bank of Japan Declines to Follow the Fed. The Yen Is Getting Hammered. (barrons)

- The Days of Big Pharma Are Over. What the Era of Big Biotech Means for Investors. (barron’s)

- Layoffs Tick Up in the New Bear Market (barrons)

- The Fed Got More Hawkish. How Long Will It Last? (barrons)

- By Design, the Fed May Be Tightening Too Much (wsj)

- Chinese Slowdown Pushes Youth Unemployment to New Highs (wsj)

- Ferrari to Debut SUV-Like Model in September (wsj)

- After $2 Trillion Wipeout, US Stocks Are Poised for Some Relief (bloomberg)

- 65% of Warren Buffett’s Portfolio Is Invested in These 4 Stocks (fool)

- US rate rise: Chinese stocks emerge as safe haven from bear markets globally (scmp)

- Why beaten-down tech stocks could lead the next rally (yahoo)

- Brussels calls for Ukraine to become official candidate for EU membership (ft)

- Is the Swiss National Bank to Blame for yesterday’s Tech Stock Massacre? (streetinsider)

- Powell vows that the Fed is ‘acutely focused’ on bringing down inflation (cnbc)

- Real Estate Billionaire Stephen Ross Says Recession Would Drive People Back to Office (bloomberg)

- Warren Buffett’s Berkshire Hathaway likely spent $1.3 billion on stock buybacks over the past 6 weeks (businessinsider)

- Drug Pricing Debate in Washington Is a Headache for Pharma (wsj)

- Japan’s Kuroda Says He Won’t Raise Rates, Even With Weak Yen (wsj)

Where is the money flowing?

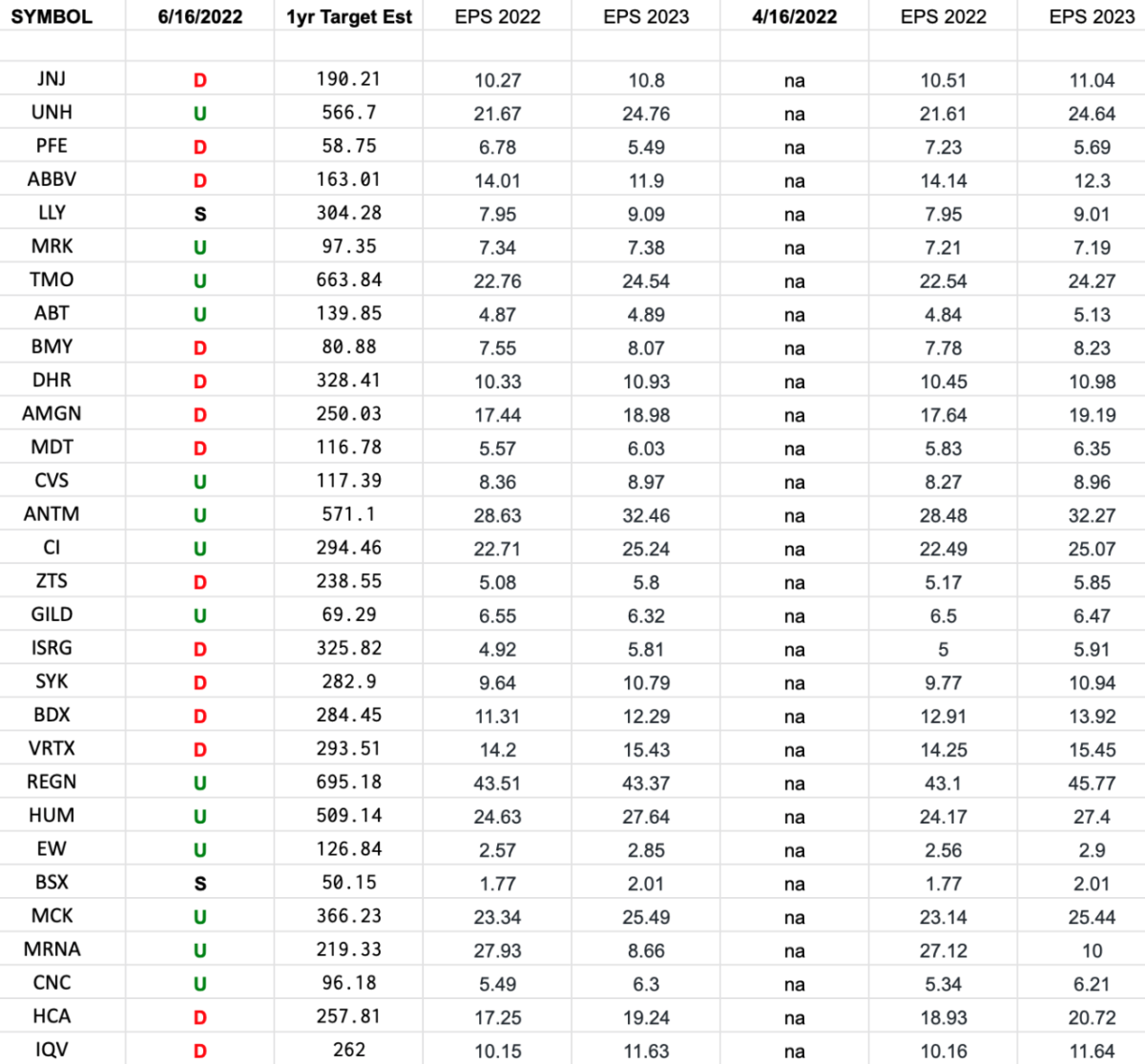

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2022 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 20 key reads for Thursday…

- Bargain Hunters Are Buying Up Alibaba Stock (barrons)

- Chinese stocks are looking cheap. Fund manager explains why he’s betting on Alibaba (cnbc)

- China Triples Investment Project Approvals to Stimulate Economy (bloomberg)

- ‘Big Oil’ Responds To Biden’s Threats: Here’s 10 Things You Can Do To Ease Gas Prices (zerohedge)

- ‘Let it rot’: China’s tech workers struggle to find jobs (ft)

- Charlie Munger reads like a machine, swears constantly, and clashed with Warren Buffett over Costco and BYD, a close friend reveals in a new interview. Here are the 9 best quotes. (businessinsider)

- Truckers Will Benefit as Companies ‘Onshore’ Supply Chains: Survey (barrons)

- Fed Fights Inflation With Largest Rate Hike Since 1994 (barrons)

- The Yen’s Weakness Is Another Sign That Something Isn’t Right in the Global Economy (barrons)

- The Housing Market Is Slowing Down. There’s Some Hope for Buyers. (barrons)

- S. Home Equity Hits Highest Level on Record—$27.8 Trillion (wsj)

- Macron Says Ukraine and Russia Must Eventually Talk (wsj)

- China’s Economy Shows Signs of Recovery, but Covid Lockdown Threat Remains (wsj)

- The PGA Tour Banned LIV Golfers. They’re Playing in the U.S. Open Anyway. (wsj)

- Powell Sets Path to Restrain Economy and Stop Runaway Inflation (bloomberg)

- Why China’s 2022 Party Congress Will Be a Landmark (bloomberg)

- Cigna to buy back $3.5 billion of its stock through accelerated repurchases (marketwatch)

- JPMorgan Estimates Amazon Prime Worth $1100 to Subs, Stock Remains Best Idea (streetinsider)

- Fed’s full-tilt inflation fight makes a ‘softish’ landing harder to achieve (ft)

- Buy This Warren Buffett Stock for 58 Cents on the Dollar (fool)