- Investors return to Chinese stocks after Covid and geopolitics triggered sharp sell-off (ft)

- What OPEC+’s Production Deal Means for Global Oil Markets (bloomberg)

- Stellantis: The Former Chrysler Is Now an Overlooked Star (barrons)

- Why a Not-So-Hot Economy Might Be Good News (nytimes)

- OPEC+ has ‘broken down,’ with tight spare capacity and Russia losing relevance (cnbc)

- Microsoft joins chorus of tech companies warning about the effects of a strong dollar (marketwatch)

- A Radical Plan To Halt The Oil Price Rally (zerohedge)

- Meta (FB) an ‘Aggressive Buy’ as it Enters New Phase – ‘The End of Adult Supervision’, Says Analyst (streetinsider)

- Musk says Tesla to pause hiring, wants to cut 10% of staff: report (foxbusiness)

- Mainland China Outperforms, Meituan Earnings Highlight Strong Growth Despite Lockdowns (chinalastnight)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 137

Hedge Fund Tips with Tom Hayes – Podcast – Episode 127

Hedge Fund Tips (PCN) – Position Completion Notification

Tom Hayes – Quoted in Reuters article – 6/2/2022

Thanks to Nivedita Balu for including me in her article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Tom Hayes – Quoted in Reuters article – 6/2/2022

Thanks to Anisha Sircar and Devik Jain for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is the money flowing?

Be in the know. 30 key reads for Thursday…

- Brian Moynihan dismisses Jamie Dimon’s warning on the economy: ‘You’ve got hurricanes that come every year.’ (marketwatch)

- JPMorgan’s Kolanovic Sees Sunny Stocks as Jamie Dimon Braces for Storm (bloomberg)

- Why a top Wall Street quant sees the S&P 500 stock index taking back all its losses by yearend (marketwatch)

- Tiger Global Losses for Year Reach 52% After Drop in May (bloomberg)

- OPEC+ Agrees on Bigger Oil-Production Hikes for Coming Months (bloomberg)

- Weibo Earnings Negate Investor Pessimism (chinalastnight)

- Jack Ma’s Ant Group Revamps Its Board (wsj)

- Chip Shortages Might Finally Ease. For Asia, That’s a Mixed Bag. (wsj)

- China Electric Car Sales Rose in May as Lockdowns Start to Ebb (bloomberg)

- Starbucks, eBay, and 29 Other Stocks for a Rally (barrons)

- Amazon Splits Its Stock Next Week. Who’s Next, and Why It Matters (barrons)

- Companies Are Borrowing Less. That’s Bad for S&P Global, but Not the Stock Market. (barrons)

- Ford Is Adding Jobs and Spending More Money in the Battle to Win the EV Wars (barrons)

- Change of Heart. The Energy Report 06/02/2022 (Phil Flynn)

- Wall Street has an expiration date for the dollar’s epic rally (marketwatch)

- Sheryl Sandberg Stepping Down as COO of Facebook Parent Meta Platforms (wsj)

- Documents Reveal Hundreds of Russian Troops Broke Ranks Over Ukraine Orders (wsj)

- Shanghai’s Covid Lockdown Ends; Time for Haircuts, Dog Walking and Jogging (wsj)

- Missed Payments, Rising Interest Rates Put ‘Buy Now, Pay Later’ to the Test (wsj)

- Investors Spot Bargains Among Small-Cap Stocks (wsj)

- Federal Reserve’s Portfolio Runoff Has Begun (wsj)

- US For-Sale Homes Rise in First Since 2019, Realtor.com Shows (bloomberg)

- Jamie Dimon Says JPMorgan Is Bracing Itself for Economic ‘Hurricane’ (bloomberg)

- Time is running out for Russia, German economy minister says (reuters)

- Saudi Arabia ready to pump more oil if Russian output sinks under ban (ft)

- Chinese developers to speed up sales after falling behind on annual sales targets (scmp)

- Small-cap growth stocks are the cheapest they’ve been in at least 24 years. Here’s how one manager is playing it. (marketwatch)

- ‘We’re clearly near the bottom’: The investing chief for a $120 billion wealth manager breaks down 3 catalysts that could help stocks to rally and break out of the bear market (businessinsider)

- Stocks just broke a 7-week losing streak – here are 3 reasons markets could be set for a long-term rally, according to LPL (businessinsider)

- The stock market will recover all of its 2022 losses by year-end as the economy avoids recession and Ukraine risks lessen, JPMorgan says (businessinsider)

“Chip Shot” Stock Market (and Sentiment Results)…

As I shared on recent podcast|videocast‘s, I started playing golf again after many years. My swing has come back – so now it’s just putting the time in. But to really score, I’m going to have to work on my short game aka chipping and putting to get my feel back. Continue reading ““Chip Shot” Stock Market (and Sentiment Results)…”

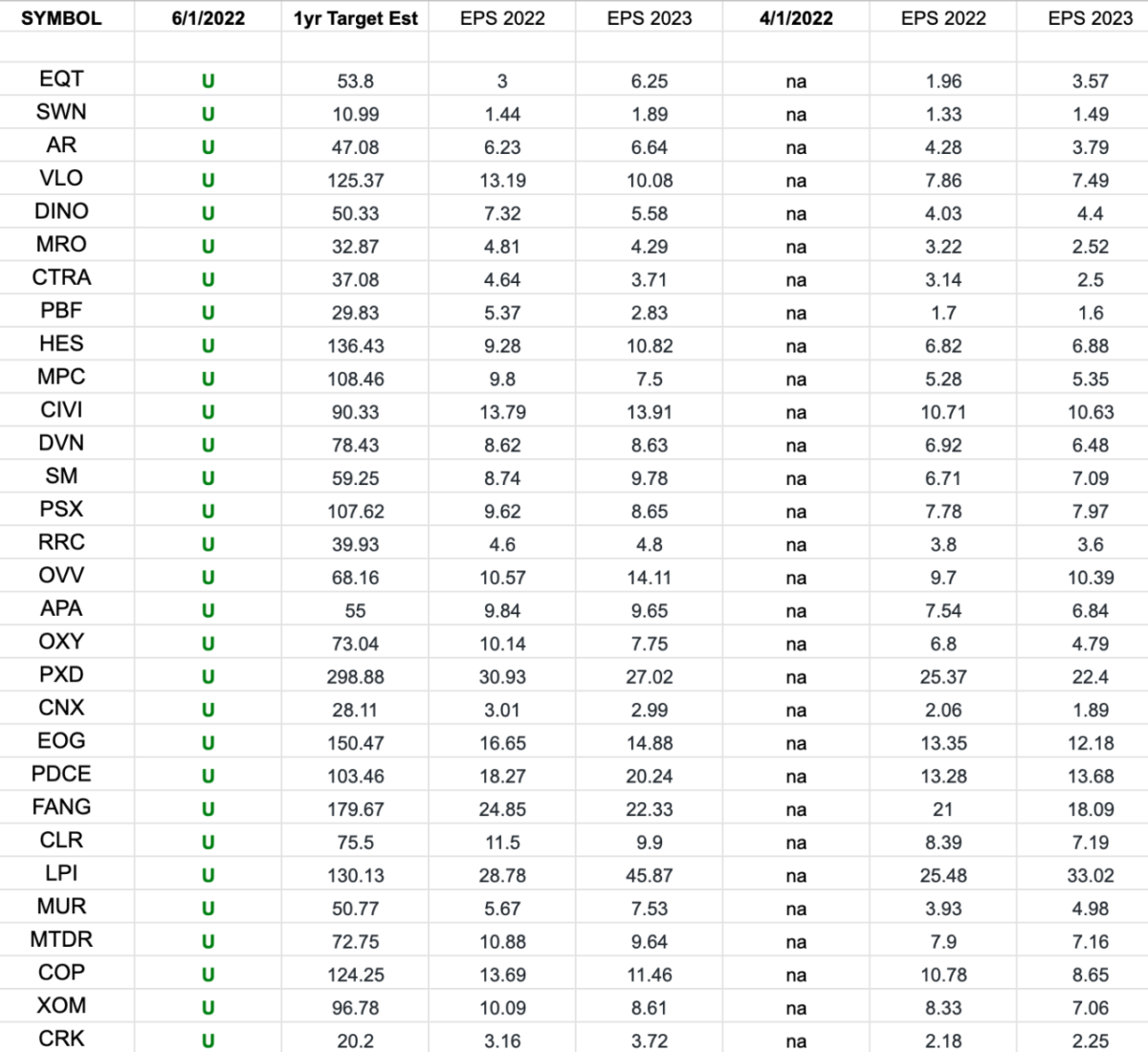

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2022 and 2023 estimates were on 4/1/2022 and today.

Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”