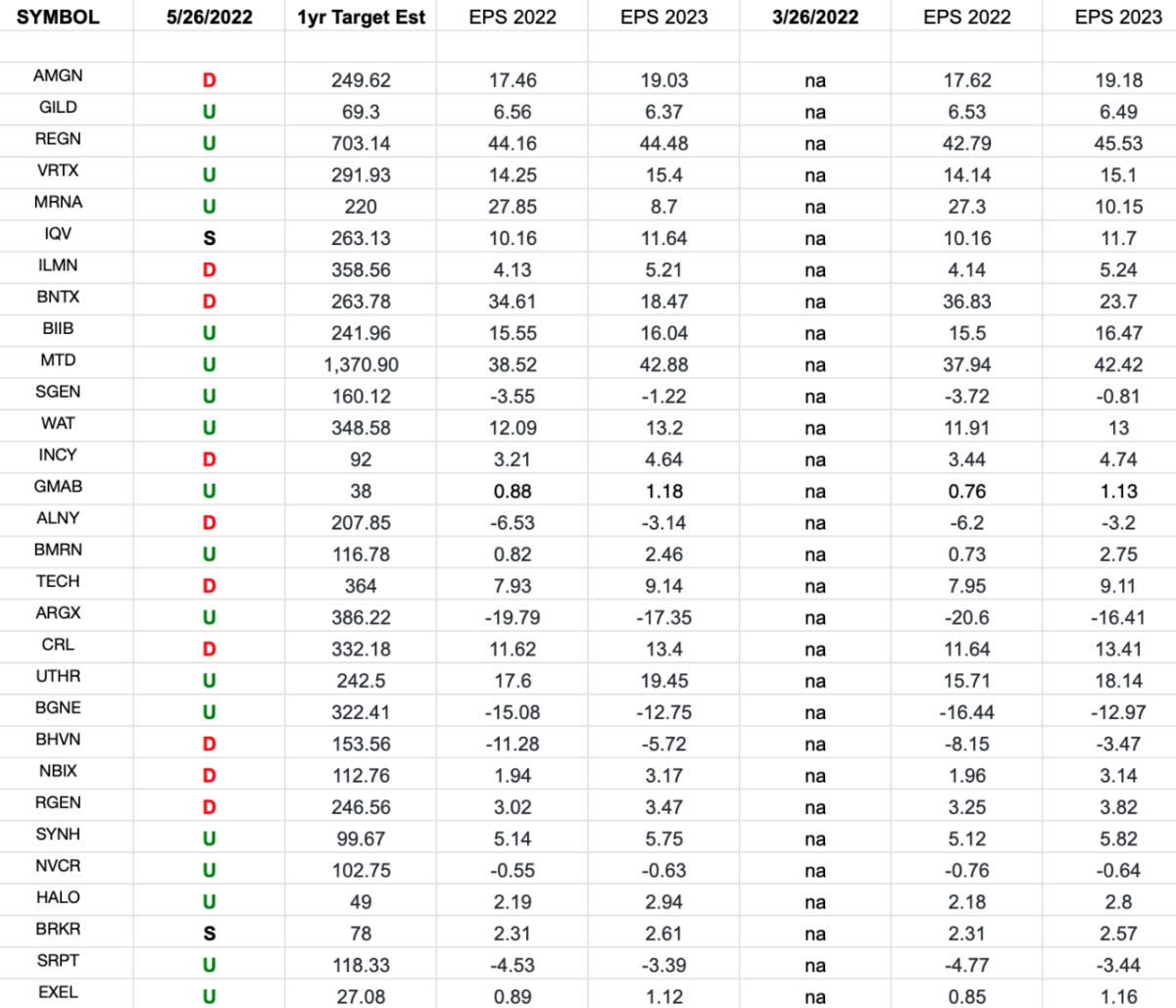

In the spreadsheet above I have tracked the earnings estimates for the Biotech ETF (IBB) top 30 holdings.

Hedge Fund Tips (PCN) – Position Completion Notification

Tom Hayes – Quoted in Reuters article – 5/26/2022

Thanks to Devik Jain and Anisha Sircar for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Tom Hayes – Public.com Appearance – 5/26/2022

Be in the know. 25 key reads for Thursday…

- Alibaba (BABA) Shares Jump as eCommerce and Cloud Demand Drives Solid Q4 Beat (streetinsider)

- Alibaba Sales Beat as Consumption Holds Up During Lockdowns (bloomberg)

- Shanghai Port Rebounds as Lockdown Loosens But Backlog Remains (bloomberg)

- CBO boosts U.S. GDP growth estimates, says inflation has topped and will cool to 2% by 2024 (cnbc)

- Wall Street thinks the only thing that will save the stock market is a ‘Fed pause’ — but 3 things would need to happen first for the central bank to stop tightening (businessinsider)

- Shanghai’s lockdown will end ‘as scripted’, city’s Commissar says, as fewer than 50 Covid-19 cases show symptoms for second day (scmp)

- Sir John Templeton’s growth fund averaged 15% annual returns over a 38-year period. These 4 principles helped guide his career success, according to his great-niece Lauren. (businessinsider)

- China has 33 ways to get economy back on track, but critics say ‘adjusting zero-Covid strategy is key’ (scmp)

- Chances of a global recession are ‘touch and go’, economist Jim O’Neill says as he slams the Fed’s hawkishness and China’s COVID-zero policy (businessinsider)

- Amazon’s stock is about to get more affordable (foxbusiness)

- China’s economy in battle to keep growing, says premier (ft)

- Baidu beats revenue estimates helped by AI, cloud services (reuters)

- Fed Rate-Hike Pause in September May ‘Make Sense,’ Bostic Says (bloomberg)

- Under Armour Stock Got Pounded. The Comeback Will Be Slow. (barrons)

- Broadcom to Acquire VMware for $61 Billion in Mega Tech Deal (barrons)

- Southwest Airlines Raises Forecast for Revenue. Summer Bookings Are Speeding Up. (barrons)

- China pushes for regular mass testing in its ‘zero Covid’ pursuit. (nytimes)

- Splunk (SPLK) Stock Rises After Earnings Beat, Results Seen as ‘Solid’ (streetinsider)

- Opinion: Don’t believe the hype: The economy isn’t headed toward a recession, and the Fed isn’t ‘behind the curve’ on interest rates (marketwatch)

- Elon Musk’s Starlink Satellite Internet Hits 400,000 Users (zerohedge)

- Jack Ma’s Ant Ekes Out Profit Rise as Fintech Overhaul Advances (bloomberg)

- China holds an unprecedented massive videoconference on the economy (cnbc)

- Chinese Premier Li Keqiang warned of dire consequences if officials don’t move decisively to prevent the economy from sliding further (bloomberg)

- Xi Jinping’s First Trip Outside Mainland China in Over Two Years Is Set to Be Brief—or Scrapped (wsj)

- China’s Top Two Leaders Diverge in Messaging on Covid Impact (wsj)

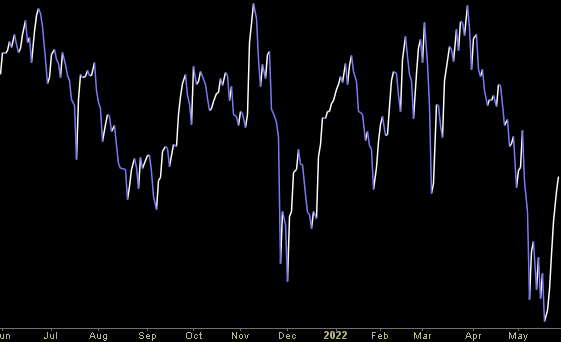

The Deflating “Inflation Narrative” Stock Market (and Sentiment Results)…

Image Source: RobinReport

There have been a few themes we’ve been pressing on in recent weeks’ article|podcast|videocast: Continue reading “The Deflating “Inflation Narrative” Stock Market (and Sentiment Results)…”

Tom Hayes – CGTN America Appearance – 5/25/2022

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – May 25, 2022

Watch in HD directly on CGTN America

Where is the money flowing?

Be in the know. 21 key reads for Wednesday…

- Guess who’s buying stocks? (marketwatch)

- These Are the 33 New Measures China Is Taking to Boost Growth (bloomberg)

- China Faces Growing Pressure to Iron Out Audit Deal With the U.S. (wsj)

- Xi Jinping May Not Get a Third Term? George Soros Thinks So. Here Are the Odds (bloomberg)

- China’s Central Bank, Regulator Urge Banks to Boost Lending (bloomberg)

- No Lying Flat for These Student Activists in Covid-Zero China (bloomberg)

- In the hotseat Putin cronies fed up with him, weighing replacements: report (nypost)

- Nordstrom Shares Soar After It Lifts Forecast. Shoppers Are Buying Dress Clothes Again. (barrons)

- Here’s the signal for investors from the deep pessimism of Bill Ackman and George Soros (marketwatch)

- Bernanke: Why the Fed Didn’t Act Faster (barrons)

- Fed Minutes Come Out Today. 4 Key Themes to Watch. (barrons)

- Nvidia Reports Earnings Today. Data Centers Could Be a Silver Lining. (barrons)

- Southern charms Exodus to Florida heating up despite NY reopening after COVID restrictions (nypost)

- High-profile NFT auctions from Beeple, Madonna flop amid crypto crash (nypost)

- Biden’s Iran Envoy Says Nuclear Talks Aren’t Dead But Almost (bloomberg)

- China Will Soon Aspire to American-Style Growth (bloomberg)

- China Truck Data Showing Lockdown’s Hit Disappears From Public (bloomberg)

- That’s Incredible. The Energy Report 05/25/2022 (Phil Flynn)

- China Growth Target in Tatters as Covid Zero Hammers Economy (bloomberg)

- Why Casinos Are Spying on Their Ultra-Rich Clients (bloomberg)

- Chances of a global recession are ‘touch and go’, economist Jim O’Neill says as he slams the Fed’s hawkishness and China’s COVID-zero policy (businessinsider)