- NYSE Sees More Chinese Companies Listing in the U.S. and Hurdles for Stocks Like Alibaba Cleared in Months (barrons)

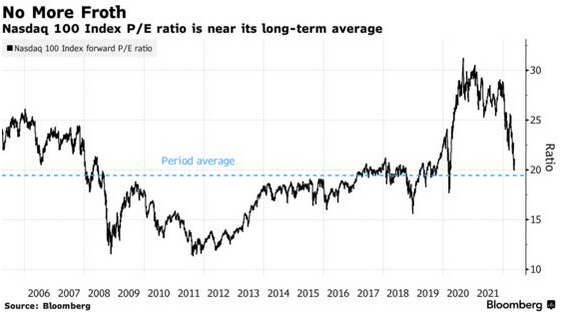

- After Meltdown, Tech-Bottom Signals Have Yet to Scream ‘Buy Now’ (bloomberg)

- Futures Jump After Biden Says Trump’s China Tariffs Under Consideration (zerohedge)

- Exclusive | Beijing mulls relaxing quarantine policy amid investor anger, sources say (scmp)

- China’s Markets Are Tested by Foreign Outflows and a Falling Currency (wsj)

- China’s Big Tech sees new wave of job cuts as Covid lockdowns hurt economy (scmp)

- Broadcom in Advanced Talks to Buy VMware (wsj)

- The stock market is ‘vulnerable to good news’ and a 10% to 12% rally, says this strategist (marketwatch)

- JPMorgan Stock Rises as Bank Lifts Net Interest Income Forecast (barrons)

- XPeng Reports Narrower-Than-Expected Loss (barrons)

Be in the know. 15 key reads for Sunday…

- Investors Dare to Dip Back Into Bonds (wsj)

- Biotech Dominates Goldman Sachs 5 Buy-Rated Stocks Under $10 With 400% to 800% Upside Potential (24/7 Wall St.)

- Unique Commodities Indicator Pointing To Treasury Bonds Rally (kimble)

- Gerard O’Reilly on Academic Research and Stocks (bloomberg)

- ECRI Weekly Leading Index Update (advisorperspectives)

- How Lima, Peru Became One Of The World’s Greatest Food Towns (maxim)

- Why Italy’s Amalfi Coast Should Be On Your Travel Bucket List (maxim)

- Bentley’s 1,400-HP EV Will Hit 60 MPH In 1.5 Seconds, Says CEO (maxim)

- Elon Musk praises WeChat model as he discusses plans for Twitter (technode)

- Apple Looks to Boost Production Outside China (wsj)

- The Birth of Spy Tech: From the ‘Detectifone’ to a Bugged Martini (wired)

- Factory boom, credit card debt defaults and housing (npr)

- The Incredible Shrinking Car Dealership (wired)

- Hedge Fund Up 138% This Year Is Turning Bullish on China Stocks (bloomberg)

- Crypto Might Have an Insider Trading Problem (wsj)

Be in the know. 37 key reads for Saturday…

- ‘The capitulation model for biotech is a Category 5 storm, the same as energy in 2020’ — why contrarians say the sector is a buy (marketwatch)

- After Big Pullback, It’s Time to Shop for Walmart Stock (barrons)

- Cheer Up. Even a Bear Market Has a Silver Lining. Or 2. Or 3. (barrons)

- Meta and 2 Other Internet Stocks to Buy After the Big Market Drop (barrons)

- Margin Calls Don’t Seem to Be a Major Market Problem–Yet, Say Market Pros (barrons)

- Hedge fund insiders are calling the Melvin Capital unwind a ‘black swan’ not a larger trend: ‘The massive carnage is done’ (fortune)

- Germany and Italy approved Russian gas payments after nod from Brussels – sources (reuters)

- Boeing Gets Boost With Long-Awaited 737 MAX Deal From British Airways Owner (wsj)

- Amazon Head of Devices: Company Focused on Real-World Tech, Not Metaverse (wsj)

- Chinese Developers Get State Help to Tap Bond Market (wsj)

- The Electric-Vehicle Unicorn Crash (wsj)

- Tiger Woods makes cut at PGA Championship after gutsy performance Friday (USA Today)

- Melvin Investors Irate Over Hedge Fund’s Shutdown (bloomberg)

- Fed’s Bullard Says Front-Loading Could Lead to Rate Cuts by 2023 (bloomberg)

- Bull Market Near-Death Experiences Are Weirdly Common in History (bloomberg)

- Veteran technical analyst Larry Williams sees a market bottom in the making, Jim Cramer says (cnbc)

- Russian oil production is rebounding. (businessinsider)

- As Global Markets Shudder, Investor Sentiment About China Ranges from Exuberant to Highly Cautious (institutionalinvestor)

- China cuts mortgage lending rate by record as lockdowns hit economy (ft)

- Mercedes-Benz crashes record for most expensive car sold at $142M (nypost)

- The Stock Market Has Avoided a Bear. (barrons)

- Sanofi Receives Another Approval for Blockbuster Drug Dupixent (barrons)

- The technician who called the 2020 market bottom says a ‘shocking rally’ is in store (marketwatch)

- ‘Revenge travel’ started in 2021, but it’s really coming back with a vengeance in Summer 2022. Here’s where Americans want to go (marketwatch)

- Eli Lilly Gets Positive Opinion for Olumiant in Europe. The Stock Rises. (barrons)

- Supreme’s Parent Company Is Upbeat on Margins. The Stock Gains Despite Earnings Miss. (barrons)

- If Globalization Is Dead, No One Told U.S. Businesses (barrons)

- 3 Off-Price Retailers That Look Like Bargains in the Stock Market’s Wreckage (barrons)

- Who Won the U.S.-China Trade War? (wsj)

- Welcome to the ‘Network Generation’ (wsj)

- Rising U.S. Star Will Zalatoris Takes the Lead at the PGA Championship (wsj)

- Lagarde Says Crypto Is ‘Worth Nothing’ and Should Be Regulated (bloomberg)

- How Does the Davos Elite Deal with War in Ukraine? (bloomberg)

- A portfolio manager at billionaire investor Mario Gabelli’s $41 billion firm says to buy these 27 stocks that have the pricing power to deliver returns as inflation soars (businessinsider)

- Who’s finding value in Apple at these levels? Maybe Warren Buffett (cnbc)

- Jim Cramer says he likes these three smaller plays in battered retail sector (cnbc)

- Big Tech Is Getting Clobbered on Wall Street. It’s a Good Time for Them. (nytimes)

Tom Hayes – Quoted in Fortune article – 5/20/2022

Thanks to Anne Sraders for including me in her article on Fortune today. You can find it here:

Click for PDF of Full Article

Click Here to View The Full Article on Fortune

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is the money flowing?

Be in the know. 10 key reads for Friday…

- China Banks Cut Key Rate by Record to Boost Ailing Economy (bloomberg)

- China’s Stimulus Tops $5 Trillion as Covid Zero Hits Economy (bloomberg)

- WHO clears COVID vaccine by China’s CanSino Biologics for emergency use (reuters)

- Stocks Rise as Chinese Stimulus Boosts Global Sentiment (barrons)

- Why the Retail Wreck Is Good News for Amazon Stock (barrons)

- Foot Locker Tops Profit Estimates. Sees Year Earnings at ‘Upper End’ of Guidance. (barrons)

- Deckers Outdoor Stock Jumps. Thank Strong UGG Sales for That. (barrons)

- China Promised to Shore Up Its Battered Tech Companies. It Helped Boost Stocks for Now. (barrons)

- Boeing’s Starliner Reaches Orbit, Adding to Recent Better News for the Stock (barrons)

- The technician who called the 2020 market bottom says a ‘shocking rally’ is in store (MarketWatch)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 135

Article referenced in VideoCast above:

The “Mystery Liquidator Revealed” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 125

Article referenced in podcast above:

The “Mystery Liquidator Revealed” Stock Market (and Sentiment Results)…