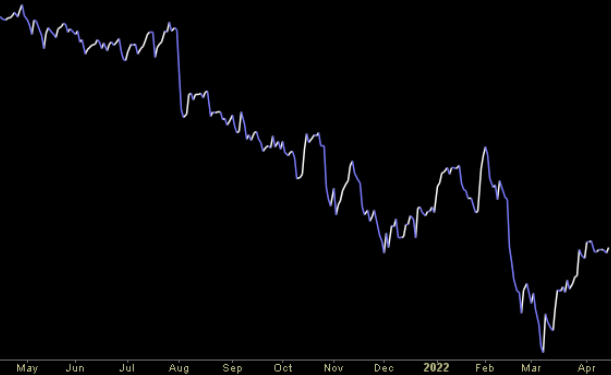

Datasource: Finviz

Be in the know. 33 key reads for Tuesday…

- exclusive | ‘Father of emerging markets’ says Chinese stocks have reached bottom (scmp)

- Asia-Pacific stocks rise; China announces financial support for Covid-hit sectors (cnbc)

- U.S. Housing Starts Unexpectedly Rise to Fastest Pace Since 2006 (bloomberg)

- Stocks Are Struggling After Reporting Earnings. These 5 Could Soar. (barrons)

- Market will break out of slump due to peaking inflation, Evercore ISI predicts (cnbc)

- Delta Leads Airline Stocks Higher After Judge Voids Mask Mandate (barrons)

- Uber Ditches Mask Mandate for Riders and Drivers (barrons)

- Apollo Is Interested in Financing a Twitter Deal (barrons)

- CMT Music Awards 2022: A list of winners and nominees (usatoday)

- Don’t Throw China Out With the Russian Bathwater (institutionalinvestor)

- Elon Musk Says Twitter’s Board Owns Almost No Stock. How It Compares to Tesla and Others. (barrons)

- Here are 30 stocks that Goldman Sachs likes when the economy stutters and markets gyrate (marketwatch)

- Shipping Giant J.B. Hunt Has Good News for Freight Stocks. (barrons)

- Want to Retire in Portugal? Here’s What to Know, as Americans Move There in Droves. (wsj)

- Utilities Want to Convert Coal Plants to Nuclear; Skeptics Abound (wsj)

- China Eastern Resumes Flights of Boeing 737 Model Involved in Crash (wsj)

- Investors Check Back Into Hotels as Travel Picks Up (wsj)

- Companies rushing to buy back stock are awful market timers (wsj)

- China’s Economic Trends Hint at Cost of Zero Covid Strategy (nytimes)

- Some early retirees are coming back. Can they solve the labor shortage? (USA Today)

- Russia Defies Most Dire Economic Forecasts Despite Looming Recession (bloomberg)

- S. Economy to See ‘Modest Recession’ Next Year, Fannie Mae Says (bloomberg)

- Beijing Crackdown Derails Alibaba’s Bid for Amazon-Size Profit (bloomberg)

- Tesla Gets 8,000 Workers Back at Shanghai Plant, Report Says (bloomberg)

- Didi’s Brief U.S. Foray Is Ending. What Happens Next? (bloomberg)

- In Defense of Elon Musk’s Managerial Excellence (bloomberg)

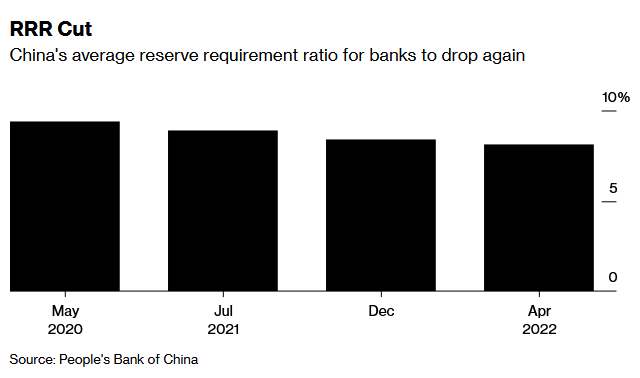

- PBOC Cuts RRR After Stronger Than Expected Economic Data Release (chinalastnight)

- Beijing Crackdown Derails Alibaba’s Bid for Amazon-Size Profit (bloomberg)

- IMF cuts global growth forecast to 3.6% as Ukraine war hits neighbours hard (ft)

- Fed tightening sends US ‘real yields’ to brink of positive territory (ft)

- The Big Read. Can the EU wean itself off Russian gas? (ft)

- Baby bust: Pandemic accelerates fall in China’s birth rate (ft)

- Missing The Target. The Energy Report 04/19/2022 (Phil Flynn)

Tom Hayes – CNBC Squawk Box (Asia) Appearance – 4/18/2022

CNBC Squawk Box (Asia) Appearance – Thomas Hayes – Chairman of Great Hill Capital – April 18, 2022

On Elon Musk and Twitter (Click here to watch in HD directly on CNBC):

On China and Alibaba:

On Rates and Biotech:

Full 13 minute segment (Banks, Biotech, China Tech, Elon Musk, Twitter):

Where is the money flowing?

Be in the know. 25 key reads for Monday…

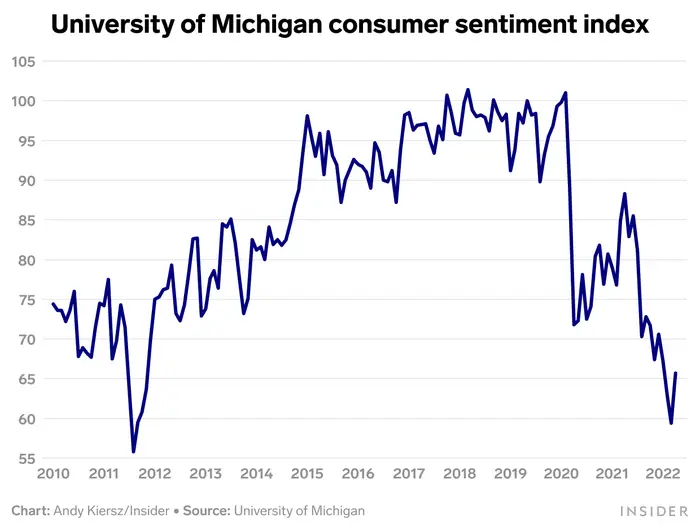

- Americans suddenly feel much better about the economic rebound (businessinsider)

- China Eastern Resumes Boeing 737-800 Flights After Crash (barrons)

- China’s Central Bank Pledges Support for Businesses Amid Covid (bloomberg)

- Here’s what could trigger another ‘risk-on, risk-on’ bout for stocks and bonds (marketwatch)

- Bank of America’s Earnings Beat Forecasts as Lending Picked Up (barrons)

- China’s first-quarter GDP beats expectations to grow 4.8% year-on-year (cnbc)

- Shanghai factories sputter towards reopening as city aims to ease lockdown (reuters)

- China Joblessness Climbs, Spending Drops on Covid Lockdowns (bloomberg)

- Fed’s Brainard Surprised by Moderation in This Inflation Gauge (barrons)

- Consumer Preference for Brand Labels Is Good News for Kellogg and General Mills (barrons)

- Europe Is in Recession, and the U.S. May Be Able to Avoid One, This Economist Says (barrons)

- Hong Kong Reports 613 New Covid Cases as Infections Decline (bloomberg)

- Elon Musk Says Twitter Board’s Interests Aren’t Aligned With Shareholders (barrons)

- Netflix’s Earnings Report Is Coming. Wall Street Is Watching Subscriber Growth. (barrons)

- AT&T’s Spinoff Was a Long Time Coming. For Investors, It Was Worth the Wait. (barrons)

- Let Elon Musk Buy Twitter (barrons)

- Why the Pandemic’s Toll on China’s Economy Is Hard to Measure (barrons)

- A Value Investor in Canada’s Oil Heartland Targets U.S. Housing (bloomberg)

- China’s Surprisingly Strong Growth Invites Analysts’ Skepticism (bloomberg)

- ‘Voting with their feet’: China’s wealthy look to leave after Shanghai lockdown (ft)

- Chinese ride-hailing giant Didi keeps losing ground under Beijing’s wrath (scmp)

- Baby bust: economic stimulus helps births rebound from pandemic (ft)

- Elon Musk tweet hints at possible tender offer to Twitter shareholders (cnbc)

- Home-builder confidence declines in the face of rising interest rates (marketwatch)

- A 40-year bull run in the bond market is under pressure as Treasury yields touch the ‘most important trend line of all time’ (businessinsider)

Be in the know. 20 key reads for Easter Sunday…

- In a wide-ranging conversation, Warren Buffett, the chairman and CEO of Berkshire Hathaway, talks to Charlie Rose about the company he created, his friends, his values, and life at 91. (charlierose)

- How China’s Zero Covid policy is failing Shanghai (vox)

- Corporate profit is at a level well beyond what we have ever seen, and it’s expected to keep growing (marketwatch)

- Netflix Needs to Handle Its Freeloaders Delicately (wsj)

- Twitter’s Poison Pill, Elon Musk’s ‘Plan B’: 6 Possible Scenarios Of What Happens Next (forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- ‘The NFT thingy is starting to burst,’ warns guru whose ‘Black Swan’ theory foresaw 2007 financial crisis (fortune)

- What China gets wrong (economist)

- An Extraordinary Collection of 128 Patek Philippe Timepieces Will Be Auctioned This Spring (robbreport)

- ‘An undebatable political decision’: Why China refuses to end its harsh lockdowns (science)

- Maserati Muscles Back Into the Limelight With MC20 (mensjournal)

- ‘Jack Dorsey’s First Tweet’ NFT Offered For $48 Million, Flops With $12,700 Top Bid (maxim)

- aston martin DBX 707 first drive: we got pulled over while driving the fastest SUV out there (designboom)

- China’s tech layoffs: How many people have been affected? (technode)

- Zuckerberg scrambles to monetize the metaverse amid fears over Meta’s future (thenextweb)

- She Was Missing a Chunk of Her Brain. It Didn’t Matter (wired)

- Elon Musk talks Twitter, Tesla and how his brain works — live at TED2022 (TED)

- Yield curve jitters (npr)

- In 1903, New York Times predicted that airplanes would take 10 million years to develop (bigthink)

- Why Mark Zuckerberg is fixated on creating AR’s ‘iPhone moment’ (fastcompany)

Be in the know. 35 key reads for Saturday…

- UBS breaks down why inflation may have peaked at 8.5% – and shares 6 stock market sectors that now look cheap to navigate the uncertainty (businessinsider)

- Sustainable Investing Failed Its First Big Test. A Reckoning Is Coming. (barrons)

- China’s Central Bank Takes Small Steps to Support Economy (wsj)

- China’s Commitment to Covid-Zero Undermines Support for Market (bloomberg)

- Joe Biden resumes oil and gas leases on federal land (ft)

- China cuts banks’ reserve rules in effort to combat economic impact of Covid (ft)

- Hong Kong Reports Fewer Than 1,000 Covid Cases for Second Day (bloomberg)

- Big Banks’ Earnings Show a Clampdown on IPOs, M&A (barrons)

- For FedEx Founder Fred Smith, the Sky Is Still the Limit (wsj)

- China frees up $83 billion in cash for its banks as the economy faces its slowest growth in 3 decades (businessinsider)

- How FedEx Stock Can Finally Deliver (barrons)

- Opinion: Stocks tanked in Q1, but this new research shows there should be a reversal by the end of June (marketwatch)

- Who Burned Down the Sculpture of Xi Jinping at a California Park? (wsj)

- It’s a Bright New Day for AT&T—and Its Investors (barrons)

- New Jersey Will Start Selling Recreational Marijuana. What It Means for Pot Stocks. (barrons)

- A Big Weapon in the Pandemic Fight: Antivirals (barrons)

- How Tech-Trend Guru Mary Meeker Sees the World Now (barrons)

- China, unlike other countries, seeks more lending to help its economy. (nytimes)

- ‘Too smelly to sleep’: Thirteen days in a Shanghai isolation facility. (nytimes)

- Why Corporate Insiders Sat Out the First Quarter (barrons)

- The New York Auto Show is Back (barrons)

- Is U.S. Booming or Busting? Hard to Tell as Numbers Speak From Both Sides of Their Mouth. (barrons)

- Cheap Thrills: Munis Are Down So Much That They’re Buys Again (barrons)

- Musk Math: A Look at the Numbers Behind the Bid for Twitter (barrons)

- Why Twitter Shareholders Should Sell Out to Elon Musk (barrons)

- Tesla Could Reopen Its Shanghai Factory Next Week: Report (barrons)

- Here’s What Elon Musk Can Do if Twitter Rejects His $43 Billion Bid (barrons)

- Russia on verge of default after making payments in rubles, Moody’s warns (nypost

- Elon Musk considering bringing in partners on Twitter bid: sources (nypost)

- Dogecoin can become internet’s currency with key change: Robinhood CEO (nypost)

- How I Got Here: Michael Phelps (bloomberg)

- Several Million Seen Staying Out of Labor Force Indefinitely (wsj)

- The Chips That Rebooted the Mac (wsj)

- News in-depth. ‘You have to do things perfectly . . . but it’s so secret’ — how to build an oligarch’s yacht (ft)

- Death of Shanghai health worker sparks online zero-Covid anguish (scmp)

Be in the know. 22 key reads for Good Friday…

- The Travel Boom: Which Companies Will Take the Lead (barrons)

- China’s Central Bank Gives Lenders Cash Boost to Spur Growth (bloomberg)

- China Urges Banks to Cut Deposit Rates in Bid to Support Economy (bloomberg)

- China’s Central Bank Cuts Reserve Ratio for Banks to Spur Growth (bloomberg)

- China, unlike other countries, seeks more lending to help its economy. (nytimes)

- Jim Cramer says falling used car prices suggests inflation could be easing (cnbc)

- Commodities Are Hot Right Now. But the Party May Be Over. (barrons)

- Living With the Pandemic: Antivirals Will Make a Big Difference (barrons)

- Warren Buffett Says He Is in Great Health With No Plans to Step Down as Berkshire CEO (barrons)

- What Musk Can Do if Twitter Rejects His $43 Billion Bid (barrons)

- Ford Starts Electric F-150 Lightning Deliveries This Month. This Is Big. (barrons)

- Kohl’s, Guess and other consumer companies are facing off with activist investors. One expert says it’s a signal of optimism (marketwatch)

- Corporate profit is at a level well beyond what we have ever seen, and it’s expected to keep growing (marketwatch)

- Markets Are Reading the Yield Curve Inversion All Wrong. What It Really Means.(barrons)

- Shanghai Residents Face Food Shortages Amid Strict Covid Lockdowns (wsj)

- China’s economy pays a price as lockdowns restrict nearly a third of its population. (nytimes)

- Xi Moves to Stop Shanghai Covid Rage From Sweeping Across China (bloomberg)

- PBOC Urges Loans to Logistics Firms to Ease Supply Chain Pain (bloomberg)

- China Infrastructure Approvals Already 70% of Last Year’s Total (bloomberg)

- China’s Key Economic Data to Show Price Paid for Covid Zero (bloomberg)

- China Home Prices Fall at Slower Pace Amid Easing Measures (bloomberg)

- China Cuts Reserve Ratio To Cushion Slowing Economy As PBOC Runs Out Of Easing Space (zerohedge)