Be in the know. 20 key reads for Thursday…

- “In the Midst of Chaos, There is Also Opportunity.” -Sun Tzu (chinalastnight)

- Profits Soar as U.S. Corporations Have Best Year Since 1950 (bloomberg)

- 3 reasons why stocks could move higher in the face of an inverted yield curve, according to Fundstrat’s Tom Lee (businessinsider)

- Opinion: Stop panicking over the inverted yield curve — the odds of a recession are still low (marketwatch)

- This Is How Boeing’s 737 MAX Will Again Be Flying in China (barrons)

- Consumer Spending Grows Less Than Expected (barrons)

- The Yield Curve Briefly Sent a Recession Warning. Here’s What That Tells Us. (barrons)

- Big Stock Sales Are Supposed to Be Secret. The Numbers Indicate They Aren’t. (wsj)

- Biden Is Expected to Tap Oil Reserves to Control Rising Gasoline Prices (wsj)

- It Isn’t Just Tom Brady—More People Are Coming Out of Retirement (wsj)

- OPEC+ Refuses to Deviate From Gradual Oil Output Hikes (bloomberg)

- China Says it Opposes U.S. Putting Its Firms on Security List (bloomberg)

- Xi Keeps China Investors Guessing With Mystery Politburo Meeting (bloomberg)

- Chinese stocks fall after SEC warns Baidu of potential delisting for failing to comply with US financial audit (businessinsider)

- S. inflation jumps again and hits 6.4% rate, the Fed’s favorite price gauge shows (marketwatch)

- Waymo starts testing fully driverless robotaxi rides in San Francisco (marketwatch)

- Goldman Confirms Biden’s SPR Release Plan Does Nothing To Resolve Structural Supply Deficit, OPEC+ Sticks To Output Plan (zerohedge)

- Vertex shares promising clinical data for its experimental non-opioid pain treatment (marketwatch)

- Russia Evades Default Again as JPMorgan Processes Bond Payment (bloomberg)

- CDC lifts travel warning for the cruise industry two years into pandemic (foxbusines)

To Invert or Not To Invert? That is the key Stock Market question…

On Tuesday, the 2/10 yield curve inverted by -3bps (for a few minutes) and closed with a positive spread +2bps on the day. There are a number of factors that led to this incident, but one stands out from the crowd. Continue reading “To Invert or Not To Invert? That is the key Stock Market question…”

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 128

Article referenced in VideoCast above:

To Invert or Not To Invert? That is the key Stock Market question…

Where is the money flowing?

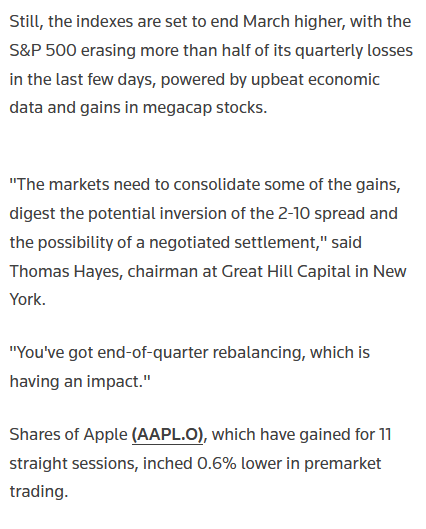

Tom Hayes – Quoted in Reuters article – 3/30/2022

Thanks to Bansari Kamdar and Amruta Khandekar for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 37 key reads for Wednesday…

- China’s PBOC Vows to Boost Confidence, Support Economy (bloomberg)

- Stock-market investors brush off yield curve’s recession warning — for now. Here’s why. (marketwatch

- If the Yield Curve Inverts, Will Recession Follow? (commonwealth)

- Business Travel Lives Again, as Many Are Hitting the Road (wsj)

- The ‘Yield Curve Inversion’ Is Signaling Something Important. No One Can Agree on What It Is. (barrons)

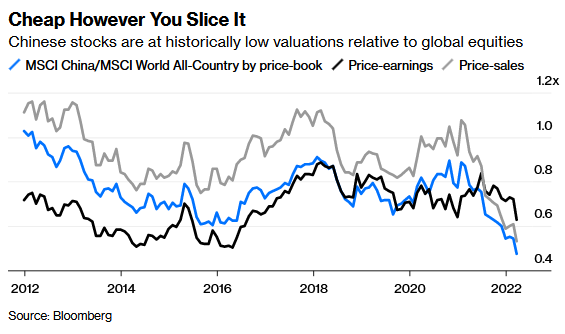

- China’s Stocks Are Still Pricing In a Lot of Pain (bloomberg)

- Economic Forecasts with the Yield Curve (frbsf)

- Lotus Electric SUV Is a Lean, Mean, China-Made Driving Machine (bloomberg)

- Goldman Sachs Starts PayPal (PYPL), Block (SQ) at Buy (streetinsider)

- Explainer: U.S. yield curve inversion: What is it telling us? (reuters)

- One Avocado a Week Cuts Risk of Heart Disease by 20% (bloomberg)

- The Fed Has Made a U.S. Recession Inevitable (bloomberg)

- Analysis-U.S. Treasuries yield curve flashes red to investors (reuters)

- JPMorgan’s quant guru says an inverted yield curve and a hawkish Fed warrant caution from investors, but a recession is still unlikely (businessinsider)

- Bank of America Bullish on Walt Disney’s (DIS) Theme Park Recovery, Sees Strong Attendance in Next 2 Years (streetinsider)

- Biogen Files the Final Design for Aduhelm’s Post-Approval Study (barrons)

- BioNTech’s Earnings Top Estimates. It Plans a Buyback and Special Dividend. (barrons)

- Alibaba Makes Metaverse Push With Bet on Augmented Reality Glasses Maker (barrons)

- Treasury yield curve steepens after brief inversion (marketwatch)

- Brand Loyalty Takes a Hit From Inflation, Shortages (wsj)

- Shanghai Lockdown Adds to China’s Economic Woes (wsj)

- Ukraine Proposes Neutral Status With Guarantees, and Zelensky Seeks More Western Help (wsj)

- Shanghai’s Lockdown Tests Covid-Zero Policy, and People’s Limits (nytimes)

- The War Is Reshaping How Europe Spends (nytimes)

- S. Companies Added 455,000 Jobs in March, ADP Report Shows (bloomberg)

- China Pledges to Stabilize Economy and Plan for Uncertainty (bloomberg)

- Everyone’s Talking About The RH CEO’s Ominous Macro Comments On The Company’s Earnings Call (bloomberg)

- The Vultures Are Coming for Russian Debt (bloomberg)

- EU to pressure China over its stance on Russia-Ukraine war: Sources (cnbc)

- China’s rich are moving their money to Singapore (cnbc)

- The ruble surges close to pre-invasion levels as Russia-Ukraine talks raise hopes for end to fighting (businessinsider)

- Why Weiss’s Jordi Visser Thinks the S&P 500 Will Hit All-Time Highs This Year (institutionalinvestor)

- The LNG Export Boom Is Draining U.S. Natural-Gas Supplies and Lifting Prices (wsj)

- China’s regulator cracks down on using feng shui to predict stock market trend (reuters)

- One Bank Spots Powerful Selloff Trigger Hidden Within Historic Market Divergence (zerohedge)

- S&P 500 exits correction: Here’s what history says happens next to U.S. stock-market benchmark (marketwatch)

- TikTok Rival Kuaishou Beats Expectations as Hong Kong Internet Gains (chinalastnight)