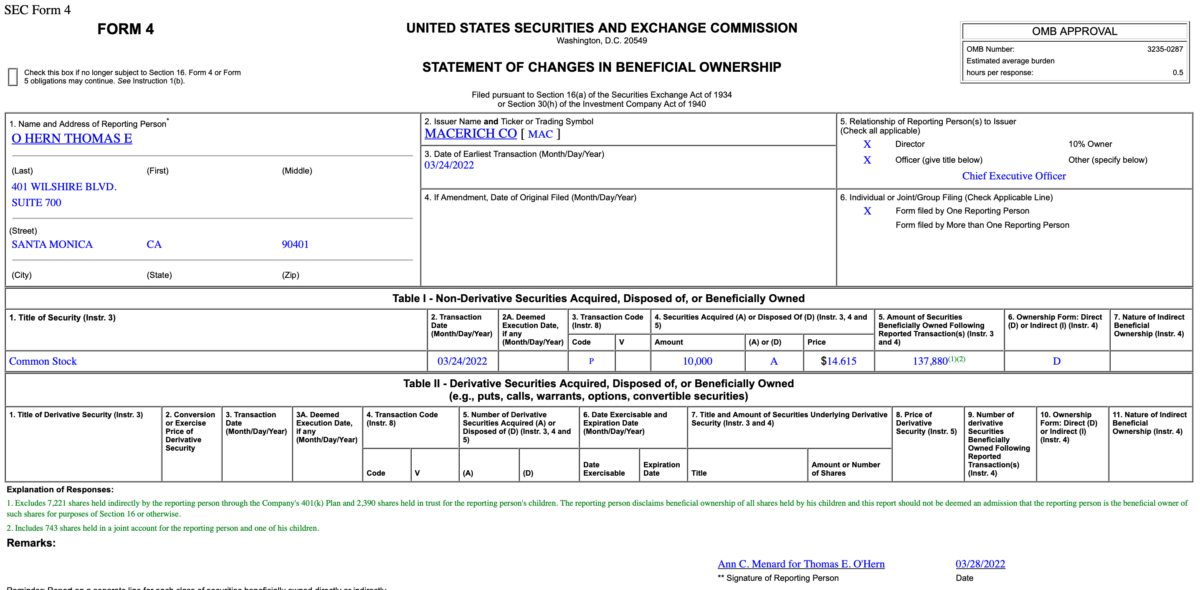

Insider Buying in The Macerich Company (MAC)

Where is the money flowing?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 22 key reads for Tuesday…

- Transport Stocks Are Flashing Bullish Signals for Broader Market (wsj)

- Biden’s Budget Calls for Increase in Defense Spending (wsj)

- Tesla, Alphabet, and Amazon Are Planning Stock Splits. Will That Help Them Join the Dow? (barrons)

- JPMorgan’s Kolanovic Sees Three Reasons for More Stocks Upside (bloomberg)

- Shanghai offers US$22 billion aid for businesses to survive lockdown (scmp)

- Billionaires like Jeff Bezos are big on owning farmland. Here are some ways average investors can play this sought-after commodity. (marketwatch)

- Biden Budget Targets Stock Buybacks. It Could Boost Dividends, if It Passes. (barrons)

- Elon Musk reveals 3 biggest existential threats to humanity’s survival (nypost)

- Blockchain bros are turning a South Pacific island into ‘crypto paradise’ (nypost)

- com, Bilibili trigger outcry after dismissals rebranded as ‘graduations’ amid wave of job cuts (scmp)

- Meituan Leads Hong Kong Internet Rebound (chinalastnight)

- Antitrust Bill Targeting Amazon, Google, Apple Gets Support From DOJ (wsj)

- Russia Says Military Will Reduce Operations Around Kiev & Chernihiv After Positive Ceasefire Talks (zerohedge)

- Bank of America’s Data Shows Hedge Funds Continue to Sell Equities (streetinsider)

- Investor Redemptions from China Funds Hit Pandemic High (institutionalinvestor)

- Oil prices resume slide after Russia-Ukraine talks (marketwatch)

- Consumer confidence rises for first time in 2022, but inflation and Ukraine still big worries (marketwatch)

- Xi Battles Distrust by Global Investors Burned in China Before (bloomberg)

- ‘Meme-Mania’ Is Back: Nomura Cautions Return Of “Foaming At The Mouth” Behavior In Options Markets (zerohedge)

- Warren Buffett disciple Joel Greenblatt doesn’t own bitcoin because he believes there’s no intelligent way to value it — and has no FOMO about that (businessinsider)

- Market bull Tony Dwyer says fears of a recession driven by bond yields are overdone (businessinsider)

- Elon Musk Says He’s ‘Giving Serious Thought’ to Creating a New Social-Media Platform (wsj)

Where is the money flowing?

Tom Hayes – Cheddar TV Appearance – 3/28/2022

Be in the know. 18 key reads for Monday…

- Legendary stock picker Peter Lynch made a remarkably prescient market observation in 1994 (tker)

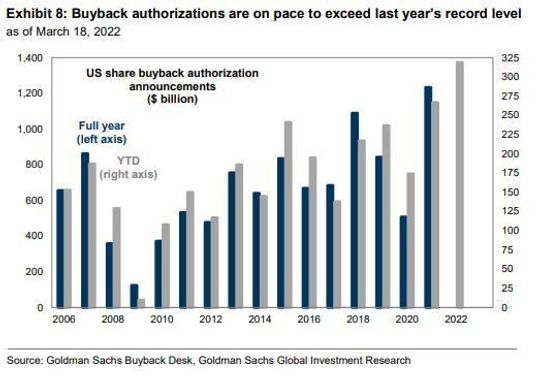

- Get ready for $900 billion of stock purchases this year, says Goldman Sachs. Here’s who’s buying. (marketwatch)

- Perfect contrarian indicator? Jim Cramer declares the bear market is over (marketwatch)

- Shanghai to Lock Down 25 Million People, Half of the City at a Time (wsj)

- Capital Spending Boom Helps Raise Productivity, Contain Costs (wsj)

- Yandex, Russia’s Internet Giant, Struggles to Dodge Geopolitics (wsj)

- Will Smith Wins Best Actor After Striking Chris Rock, ‘CODA’ Takes Best Picture for Apple (wsj)

- Chinese Tech Stocks Are Back. Their Glory Days Aren’t. (wsj)

- The Dying Art of Driving a Stick Shift (wsj)

- Avoiding World War III Zelensky says Ukraine’s open to this compromise to end war (nypost)

- Goldman, JPMorgan Strategists Say Equities Can Weather Bond Rout (bloomberg)

- Zelenskiy Says Ukraine Seeking Peace ‘Without Delay’ in Talks With Russia (bloomberg)

- Chinese tech stocks mostly up as Meituan jumps more than 11% in mixed Asia trade (cnbc)

- The US will emerge as the world’s largest natural-gas exporter this year, a top energy market historian says (businessinsider)

- Russia just narrowly avoided a huge default, but investors still think there’s a 50/50 chance of it happening in the next 12 months (businessinsider)

- 5 Goldman Sachs Conviction List Stocks to Buy With 65% to 100% Upside Potential (247wallst)

- Brazil Central Bank Says 12.75% Rate Enough to Tame Inflation (bloomberg)

- China factories set up ‘bubbles’ to ride out Covid lockdowns (ft)

Be in the know. 15 key reads for Sunday…

- Who’s Buying Russian Stocks? (nytimes)

- Netflix’s ‘Drive To Survive’ Has Made F1 Racing More Popular Than Ever In U.S. (maxim)

- Exclusive: China’s Sinopec pauses Russia projects, Beijing wary of sanctions (reuters)

- Portfolio manager with 50 years of experience shares 1970s bear-market lesson, and three stocks to buy now (marketwatch)

- China’s Sinopec plans its biggest capital expenditure in history (reuters)

- What Is Holding U.S. Nuclear Energy Back? (oilprice)

- A Blue Chip Name is About to Offer a 6% Yield (thestreet)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Elon Musk says he’s probably not the richest man in the world: ‘Putin is significantly richer than me’ (fortune)

- The Clubs Tiger Woods Used to Win 4 Straight Majors Have Hit the Auction Block (robbreport)

- Gene Editing: The Future of Genomic Medicine & Biotech Investing (goldmansachs)

- Alibaba and Tencent readying big job cuts-sources (reuters)

- Uber granted 30-month license to continue operating in London (theverge)

- Russian stocks and sanctioned gold (npr)

- Michio Kaku makes 3 predictions about the future (bigthink)

Be in the know. 30 key reads for Saturday…

- Russia Says Donbas Is Ukraine Focus in Possible Shift in Aim (bloomberg)

- If the Fed Pulls This Off, It’s Party Time (barrons)

- Why Housing May Not Get as Hammered as Usual in This Rate-Hike Cycle (barrons)

- The 8 Stocks in the S&P 500 That Are Still Negative Since the Pandemic (barrons)

- SoftBank’s Alibaba Stake in Spotlight Amid Stock-Market Turbulence (wsj)

- US economy hitting on all cylinders, not heading for a recession: Expert (foxbusiness)

- Natural-Gas Industry Gets Boost as Biden Shifts Stance (wsj)

- How Anne Scheiber Made $22 Million Investing in Dividend Growth Stocks (dividendgrowthinvestor)

- Biden warns China its economic future is the West, not Russia (foxbusiness)

- Semiconductor Stock Analyst Sweet On MANGO Portfolio Of Top Chipmakers (investors)

- Netflix and Other Streamers Could Win Big at the Oscars. Why Wall Street Isn’t Applauding Yet. (barrons)

- Southeast Asia Is Surging Postpandemic. Where to Invest. (barrons)

- Mark Zuckerberg — Founder and CEO of Meta (#582) (tim ferriss)

- The Great Resignation Is Beginning to Reverse Course (barrons)

- Bill Miller’s Market Perspective: March 2022 (millervalue)

- These Stocks Should Benefit From the U.S.’s Deal to Send Natural Gas to Europe (barrons)

- Why the Postwar 1940s May Tell Us More About Our Inflation Than the ’70s (barrons)

- Why This Is a ‘Golden Age’ for U.S. Refiners (barrons)

- The Stock Market Has Been Ripping. Three Reasons It Can Keep Gaining. (barrons)

- Tiger Woods Isn’t a Masters Lock But You Can Still Bet on Him (bloomberg)

- Jim Cramer says to buy FAANG stocks next time analysts say they’re not investable (cnbc)

- Stem cells may finally offer a cure for Type 1 diabetes (cnbc)

- Smart money has been buying the dip. (sentimentrader)

- Petroleum and natural gas are the most-used fuels in the United States through 2050 (eia)

- Stocks Cap Largest Two-Week Gain Since Late 2020 (wsj)

- SoftBank finalising loans of up to $10bn from banks before Arm IPO (ft)

- Our Ultimate Stock-Pickers’ Top 10 Dividend-Yielding Stocks (morningstar)

- The Pendulum in International Affairs (oaktreecapital)

- Carl Icahn describes how his style is different from that of fellow investing icon Warren Buffett (cnbc)

- Citadel’s Ken Griffin: Be a Problem Solver (bloomberg)