Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 25, 2022

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 127

Hedge Fund Tips with Tom Hayes – Podcast – Episode 117

Where is the money flowing?

Be in the know. 23 key reads for Friday…

- Russia will likely default with April 4 payment due of $2.2B: experts (nypost)

- Apple, Alphabet, and the Rest of Big Tech Faces a Tough New EU Competition Regime (barrons)

- Tilray, Sundial, and Other Cannabis Stocks Buzz. The House Will Consider Decriminalization. (barrons)

- Boeing, “Transportation Safety Committee said there wasn’t enough evidence to say what caused the crash, but the NTSB dissented, saying that the captain most likely did it intentionally in a murder-suicide.” (bloomberg)

- Government bonds on track for worst year since the Marshall Plan was enacted (marketwatch)

- Yellen says it’s not appropriate ‘at this point’ to sanction China for Russia ties (marketwatch)

- A ‘Marshall Plan’ for energy? Here’s what that would look like, as a new cold war dawns. (marketwatch)

- Southwest Airlines to Launch New Ticket Type to Boost Revenue (wsj)

- Uber Looks a Lot Less Exclusive (wsj)

- US ENERGY SAVES THE WORLD. The Energy Report 03/25/2022 (Phil Flynn)

- Global equity funds gain big inflows after three weeks of outflows (reuters)

- Amazon Stock Is Marching Higher. 4 Reasons the Shares Can Keep Rising. (barrons)

- S. to Boost Gas Deliveries to Europe Amid Scramble for New Supplies (wsj)

- It’s China’s ‘Nobel Prize Moment’ to Stop War, UN Official Says (bloomberg)

- Who Are Russia’s Oligarchs and Can They Sway Putin? (bloomberg)

- Buy Teva Pharmaceuticals amid confluence of positive news, Bernstein says (cnbc)

- Legendary investor Bill Miller highlights 7 attractive bets for investors as markets grapple with uncertainty (businessinsider)

- Erdogan Calls On Putin To “Make An Honorable Exit” From Ukraine (zerohedge)

- Surge In Bond Yields Says It’s Time To Buy Bonds (zerohedge)

- China factories set up ‘bubbles’ to ride out Covid lockdowns (ft)

- The Weekend Essay. Russia, Ukraine and Europe’s 200-year quest for peace (ft)

- China’s financial stability guarantee fund to safeguard against systemic risks to be ready by September (scmp)

- com Beats Expectations Following Tencent’s Tumble (chinalastnight)

Unusual Option Activity – Intel Corporation (INTC)

Data Source: Barchart

On Thursday some institution/fund purchased 2,608 contracts of OCT 2022 $55 strike calls (or the right to buy 260,800 shares of Intel Corporation (INTC) at $55). The open interest was just 620 prior to this purchase.

Continue reading “Unusual Option Activity – Intel Corporation (INTC)”

Where is the money flowing?

Be in the know. 22 key reads for Thursday…

- U.S. reinstates 352 product exclusions from China tariffs (reuters)

- USTR Issues Determination of Reinstatement of Certain Exclusions from China Section 301 Tariffs (ustr)

- The CSRC is considering a new approach that grants the US accounting oversight board access to Chinese audit papers after vetting by China’s finance ministry (scmp)

- Fosun sees profit rise, set to make generic Pfizer, Merck Covid-19 pills (scmp)

- Wall Street bonuses hit all-time high as banker shortage rages (nypost)

- Former Boeing Pilot Found Not Guilty in 737 MAX Case (wsj)

- Uber stock gains after company strikes partnership with NYC taxis: WSJ (marketwatch)

- New jobless claims fall to 187,000, setting more than 5-decade low (yahoo)

- Wynn Resorts’ New CEO Likes His Odds, Despite Macau Troubles (bloomberg)

- Alaska Air’s stock gains after 2022 outlook detailed ahead of investor day (marketwatch)

- China’s Stock Market Weathers Heavy Foreign Outflows (wsj)

- Russian Tycoons Get $8.3 Billion Richer as Trading Resumes (bloomberg)

- AT&T Is Too Cheap to Ignore While Others ‘Wait and See’ (yahoo)

- The Boeing 737 NG models are the third-safest planes in the world with a crash rate of just .07 crashes per million flights through 2017 (foxbusiness)

- The Big Read. Oligarchs, power and profits: the history of BP in Russia (ft)

- Hedge funds search for bargains in Russian and Ukrainian bonds (ft)

- Tencent Reports Q4 Financial Results With an Eye to the Future (chinalastnight)

- Tencent calls talks of break-up ‘highly speculative’ (scmp)

- JPMorgan CEO Jamie Dimon reportedly told President Biden the US must increase domestic energy production called for Europe to end reliance on Russian oil (businessinsider)

- Apple, Tesla, and 98 Other Growth Stocks That Are Getting Their Groove Back (barrons)

- First Alibaba, Now Toyota. Why Companies Are Suddenly Buying Back Their Stock. (barrons)

- Stocks Hit Bottom 2 Years Ago. Why a New Bear Market Seems Unlikely. (barrons)

Avoid the Noid – Stock Market (and Sentiment Results)…

Wikipedia, “The Noid was an advertising character for Domino’s Pizza created in the 1980s. Clad in a red, skin-tight, rabbit-eared body suit with a black N inscribed in a white circle on his chest, the Noid was a physical manifestation of all the challenges inherent in getting a pizza delivered in 30 minutes or less. Though persistent, his efforts were repeatedly thwarted.”

Continue reading “Avoid the Noid – Stock Market (and Sentiment Results)…”

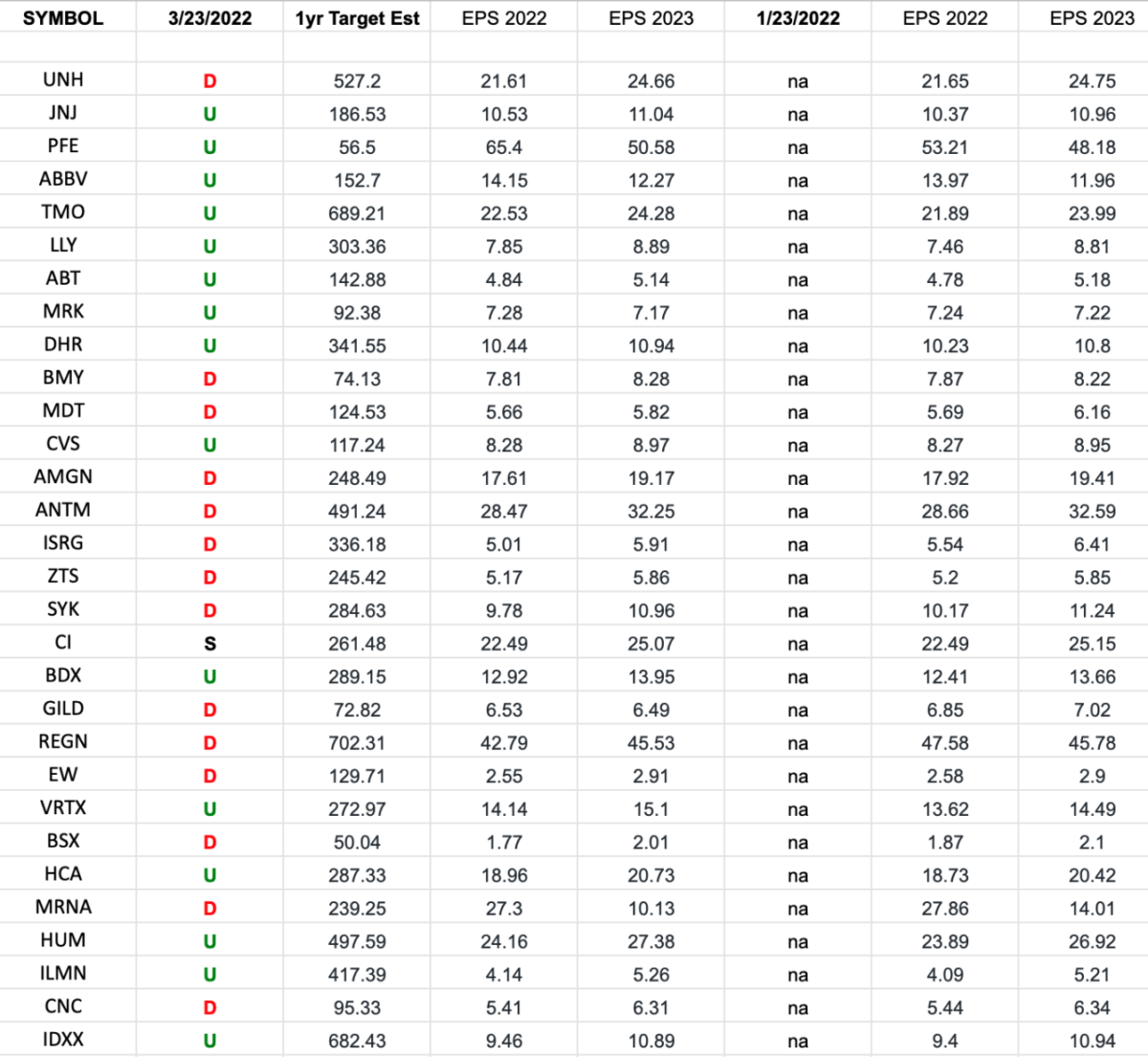

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2022 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”