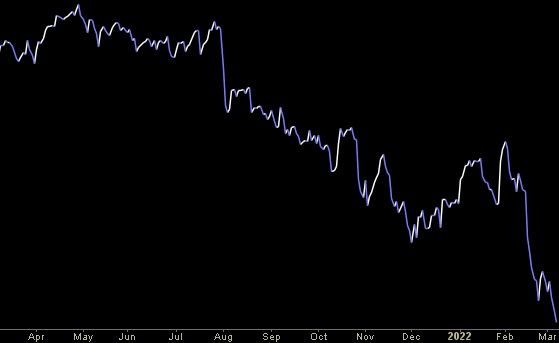

Datasource: Finfiz

Be in the know. 15 key reads for Tuesday…

- The U.S. Will Ban Imports of Russian Oil. What Exactly Does That Mean? (barrons)

- Petco Increased Its Guidance. The Stock Is Jumping. (barrons)

- Iran Chief Negotiator Unexpectedly Leaves Vienna as Nuclear Talks Hit Standstill (wsj)

- Biden to issue executive order on cryptocurrency (nypost)

- Bank of America Sees Consumers Spending More Money on In-Person Activities (bloomberg)

- Warren Buffett touted a past European crisis as a buying opportunity — and argued trouble on the continent is no reason to avoid stocks (businessinsider)

- Regeneron, BioNTech to test experimental combination therapy for lung cancer (marketwatch)

- Futures Rebound On “Massive” EU Bond Stimulus Plan (zerohedge)

- Canada Says Its Oil Could Replace US Imports Of Russian Crude, All It Would Take Is Approval Of The Keystone XL Pipeline (zerohedge)

- BofA: Hedge Funds are Selling at a Record Pace; Prepare for Months of High Uncertainty, Elevated Energy Prices, Strong Dollar and Underperformance of Risk Assets (streetinsider)

- China’s economic stability can support global growth amid Ukraine crisis- Citigroup (reuters)

- It’s Not Too Late for Keystone XL, Alberta’s Premier Says (yahoo)

- ‘Brutal’ selling in speculative tech stocks knocks Tiger Cub hedge funds (ft)

- Major Energy Crisis. The Energy Report 03/08/2022 (Phil Flynn)

- Do Russian oligarchs have the power to make Putin do something different? (foxbusiness)

Money Show Appearance – Tuesday, March 8, 2022 – 11:15 am to 11:45 am EST

I will be appearing on the Money Show – Tuesday, March 8, 2022 – 11:15 am to 11:45 am EST. Reserve your free pass here:

Money Show Free Pass

Hedge Fund Trade Tip (PIN) – Position Idea Notification

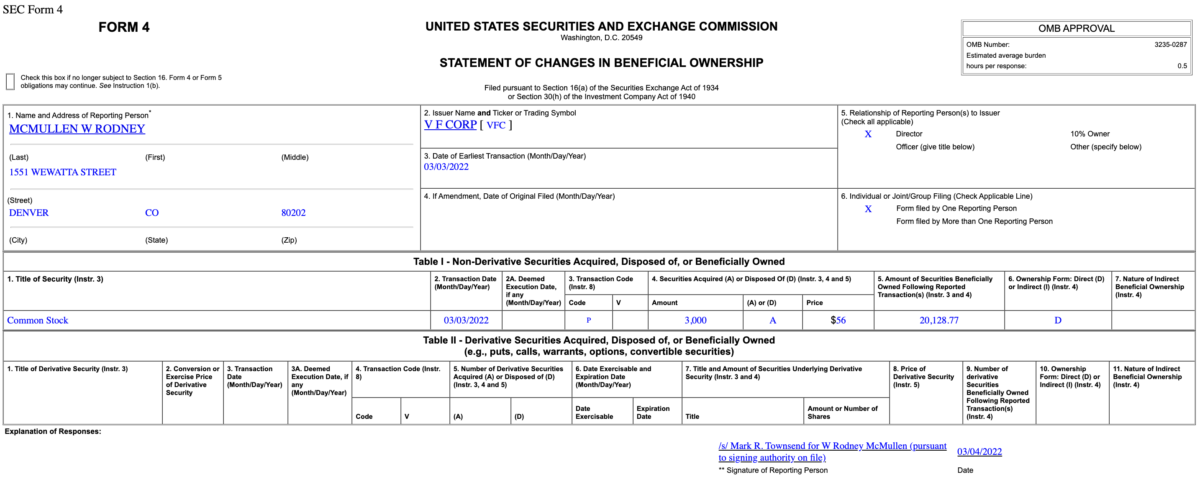

Insider Buying in V.F. Corporation (VFC)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is the money flowing?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Monday…

- Russia will stop ‘in a moment’ if Ukraine meets terms – Kremlin (reuters)

- China set a 5.5% goal for economic growth this year, paving the way, economists say, for more-aggressive stimulus measures in the coming months. (wsj)

- Intel’s Mobileye self-driving unit ‘confidentially’ files for IPO (marketwatch)

- Screaming For Oil. The Energy Report 03/07/2022 (Phil Flynn)

- Billionaire supermarket owner: Biden must return production to North America (foxbusiness)

- Opinion: ‘Drill, baby, drill’ is back amid the energy crisis, and that puts ESG efforts on the back burner (marketwatch)

- It’s Time to Take Profits in Energy Plays (barrons)

- Uber Increases Guidance. (barrons)

- Ackman’s New CP Rail Stake Worth $1.2 Billion (bloomberg)

- How the war in Ukraine and climate change are shaping the nuclear industry (cnbc)

- There’s only one person in the world now who can influence Putin, says economist Stephen Roach (cnbc)

- Carl Icahn Exits Occidental Petroleum After Nearly Three Years (wsj)

- Chewy Co-Founder Ryan Cohen Takes Large Stake in Bed Bath & Beyond, Pushes for Changes (wsj)

- Investors See Bullish Signals Under the Stock Market’s Surface (wsj)

- Europe’s Food Delivery Stocks Are Appetizingly Cheap (wsj)

- China’s Export Boom Eases, Raising Pressure for Stimulus (wsj)

- Warren Buffett Was Buying Occidental, Carl Icahn Was Selling. Who Will Be Right? (barrons)

- GOLDMAN SACHS: Buy these 50 high-dividend growth stocks trading at large discounts to the S&P 500 as they have historically outperformed the market in periods of hot inflation (businessinsider)

- Wells Fargo Outlines Long-Term Bull Case for Netflix (NFLX), Urges Investors to Stay Patient (streetinsider)

- 6 wild details from episode 1 of the new Uber show, ‘Super Pumped’ — and whether they really happened (businessinsider)