- A Big Tech Trade Is Losing Its Luster (wsj)

- He’s Been a Walleye, a Steelhead, a Griffin, a Komet, a Comet and a Phantom. Now He’s an Olympian. (wsj)

- These 12 Countries Will Pay Their Olympians Six-Figure Bonuses For Winning Gold Medals (forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Rebecca Patterson on Global Macro Investing (bloomberg)

- The Towers and the Ticking Clock (nytimes)

- The Bentley Continental GT Speed Is Robb Report’s 2022 Car of the Year (robbreport)

- Aston Martin Unveils World’s Fastest and Most Powerful Luxury SUV (maxim)

- Former Google CEO Eric Schmidt on the Future of Artificial Intelligence (maxim)

- 6 Reasons Meta Is in Trouble (nytimes)

- Lunar New Year special | China’s tech majors are hoping to be leaner and meaner in the Year of the Tiger (technode)

- We ate all 12 Girl Scout cookie flavors in one sitting. And the best one is… (cnet)

- China Is Changing Its Coal Use, and It Affects the Whole World (bloomberg)

- Yellen Says ‘No Plans to Leave’ With Goals Far From Accomplished (bloomberg)

- China Predicts Low Inflation Based on Western Monetary Moves (bloomberg)

Unusual Options Activity – Energy Transfer LP (ET)

On Friday some institution/fund purchased 114,928 contracts of Jan 2023 $5 strike calls (or the right to buy 11,492,800 shares of Energy Transfer LP (ET) at $5). The open interest was 16,831 prior to this purchase. Continue reading “Unusual Options Activity – Energy Transfer LP (ET)”

Be in the know. 32 key reads for Saturday…

- S. to Waive Sanctions on Iran Civilian Nuclear Activities as Talks Heat Up (wsj)

- Here Are the Best Steakhouses in New York City Right Now (bloomberg)

- Adults Back in Charge of Stock Market as Fed Awakens Big Money (bloomberg)

- With Omicron Waning, Americans Are Ready for the Reopening (barrons)

- The next ‘pain trade’ could be on the horizon as investors crowd into bets pegged to Fed monetary policy (marketwatch)

- THE EMPLOYMENT SITUATION — JANUARY 2022 (bls)

- Future classic supercars (ft)

- GE Stock Could Light Up Your Portfolio. Here’s Why. (barrons)

- How Oaktree captured Evergrande’s castle (ft)

- ‘This is not 1980’: What investors are watching as next U.S. inflation reading looms (marketwatch)

- Peak everything — growth, inflation and COVID — may soon mean calmer markets ahead, economist says (marketwatch)

- AT&T Spent a Decade Buying Things. Now It’s Cleaning House. (barrons)

- Treehouse Foods, Delek US Holdings See Action From Activist Investors (barrons)

- Time to Lift All Covid Restrictions? As Omicron Eases, Here’s What Public Health Experts Are Saying. (barrons)

- With Omicron Waning, Here’s What the New Normal Could Look Like (barrons)

- Big Tech’s Week Featured Alphabet and Amazon Rallies, Meta Crash (bloomberg)

- Meta Stock Looks Cheap. That’s No Longer a Good Reason to Buy. (barrons)

- Boston Beer Fell Flat on a Hard Seltzer Glut. Its Stock Is Now a Buy. (barrons)

- Trian and Peltz Fixed Invesco. Janus Is Next. (barrons)

- 10-Year Treasury Yield Surges Above 1.9%, Highest Since 2019 (wsj)

- Can the Technology Behind Covid Vaccines Cure Other Diseases? (wsj)

- Team USA Doesn’t Have a Starting Goalie. That’s By Design. (wsj)

- Beijing Winter Olympics Medal Count (bloomberg)

- A Wall Street strategist who called January’s 10% stock market drawdown explains why it’s time to put new money to work after a high-volume ‘cathartic puke’ — and shares 25 beaten-down stocks to buy (businessinsider)

- Billionaire investor Leon Cooperman called inflation a friend of common stocks. Here’s why he might be right. (businessinsider)

- Almost every major industry saw job growth in January, led by robust gains in leisure and hospitality (businessinsider)

- What Omicron? Businesses spent $61 billion on Google ads in Q4 despite supply chain issues (usatoday)

- Michael Lewis Revisits ‘Liar’s Poker’ (nytimes)

- Royal Caribbean CEO says ‘we are past COVID,’ but cruise operator may not turn profitable this year as expected (marketwatch)

- Why every Costco product is called ‘Kirkland Signature’ (cnn)

- ESPN Co-Founder Bill Rasmussen — Fear{less} with Tim Ferriss (#569) (tim)

- The Small Steps of Giant Leaps (fs)

Tom Hayes – CGTN America Appearance – 2/4/2022

Tom Hayes – Quoted in Reuters article – 2/4/2022

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Tom Hayes – The Claman Countdown – Fox Business Appearance – 2/4/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – February 4, 2022

Watch in HD directly on Fox Business

Where is money flowing today?

Be in the know. 20 key reads for Friday…

- Hong Kong Stocks Cap Biggest Post-Lunar Holiday Gain Since 2009 (bloomberg)

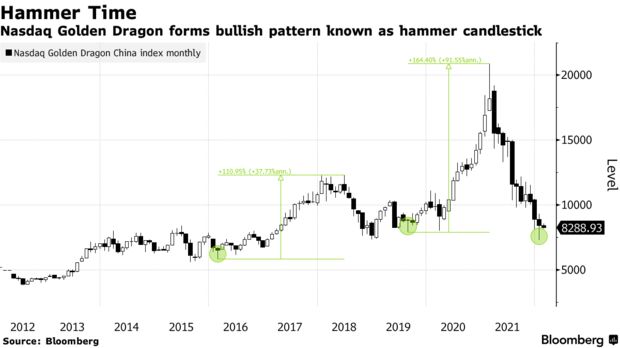

- Nasdaq Index of China Stocks Shows Signs of Life After Pummeling (bloomberg)

- Amazon Stock Soars on Good Enough Earnings. Plus, the Price of Prime Is Going Up. (barrons)

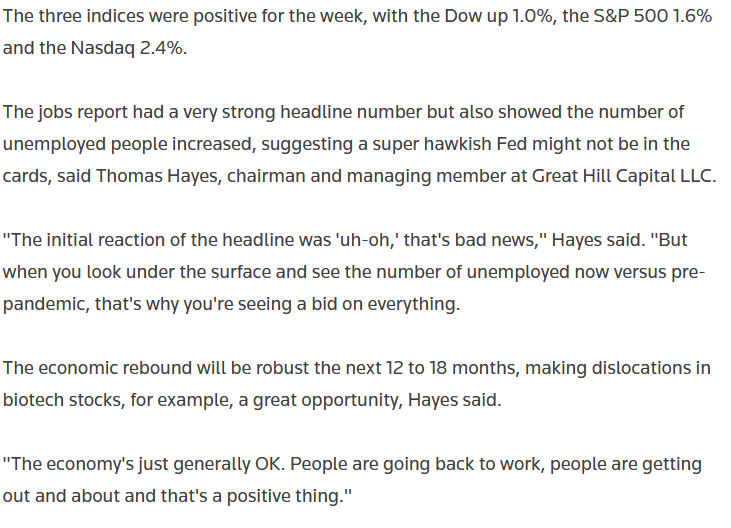

- S. Added 467,000 Jobs in January. Omicron’s Impact Was Less Than Feared. (barrons)

- Expect a Post-Omicron Boom as Americans Binge on Services. Workers Are the Wild Card. (barrons)

- Wall Street Is Trying to Make Sense of Meta’s Earnings. It Isn’t Easy. (barrons)

- Emerging Market Value Stocks Look Ready to Run (barrons)

- The Right Way to Read Unemployment Data (barrons)

- The Growth Scare Is Receding. The Fed Policy Scare Is Here. What That Means for Investors. (barrons)

- This way of picking value stocks has actually worked — and Berkshire Hathaway screens the best (marketwatch)

- Opinion: This market-timing model has made stock investors more money than the ‘Super Bowl Predictor’ (marketwatch)

- S. Sees Iran’s Nuclear Program as Too Advanced to Restore Key Goal of 2015 Pact (wsj)

- Why the World’s Biggest Ocean Shipping Lines Are Buying Cargo Planes (wsj)

- BofA Strategists See Surging Equity Flows While Bonds Get Dumped (bloomberg)

- A fund manager whose energy bets have placed him in the top 4% of fund managers this year shares 6 stocks to watch in 2022 — and why oil is destined to slip to $65 per barrel (businessinsider)

- Why US workers will return to the labour market (ft)

- Meta’s dramatic fall masks strong earnings week across Big Tech (ft)

- S. 30-Year Real Yield Turns Positive as Fed Hike Bets Increase (bloomberg)

- Flatter U.S. Yield Curve Dominates Emerging-Market Trader Minds (bloomberg)

- Rate-Hike Bets Wipe Out $1.5 Trillion of Sub-Zero Debt in a Day (bloomberg)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 120

Article referenced in VideoCast above:

https://www.hedgefundtips.com/whats-next-stock-market-and-sentiment-results/