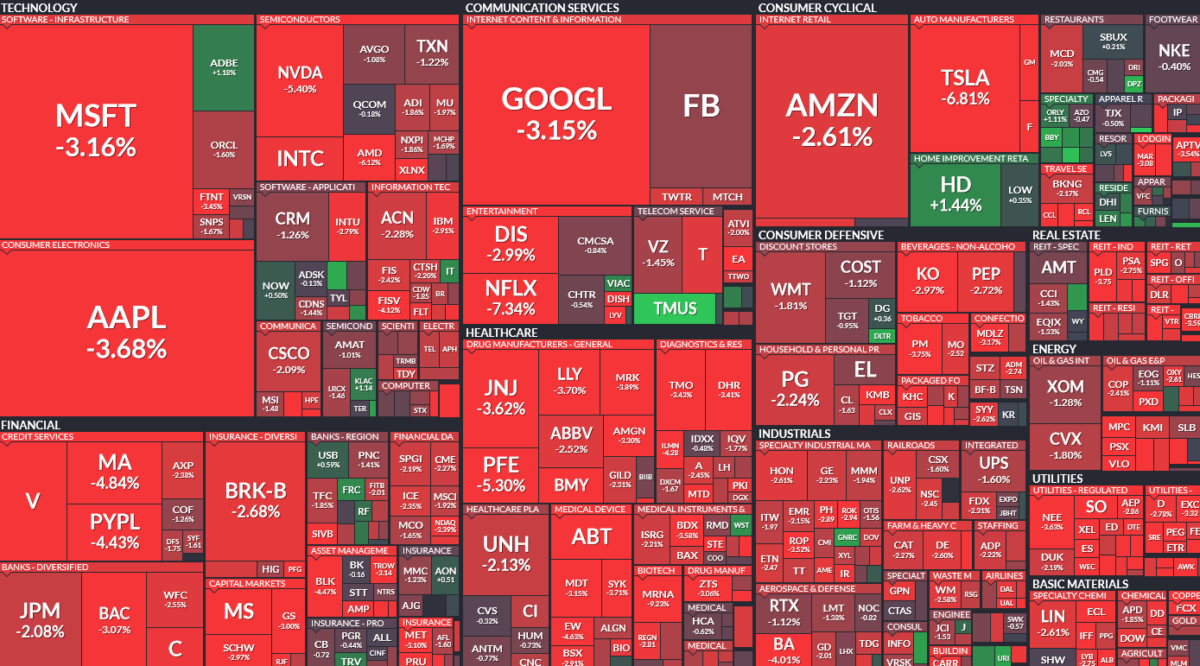

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

- Goldman Shrugs Off Rate Hikes to Bet on Emerging Stocks (bloomberg)

- 10 Cheap Stocks for Volatile Markets (barrons)

- New Study Finds CFA Charterholders Are Actually Worse At Investing (zerohedge)

- Berkshire Hathaway plans to hold its next annual meeting in person. (nytimes)

- High Alert. The Energy Report 01/25/2022 (Phil Flynn)

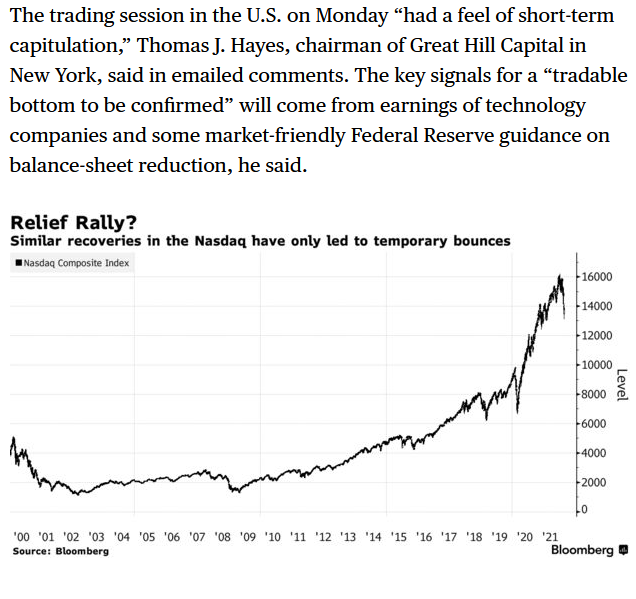

- Nasdaq Composite’s Wild Swing Precursor to Bounce, History Shows (bloomberg)

- Junk Loans Shine Amid Market Rout (wsj)

- An Anxious Market Awaits the Fed Meeting (barrons)

- American Express Boosts Forecasts as Credit Card Spending Sets Record (barrons)

- Throwing up the white flag? Retail investors dumped stocks at Monday’s open, JPMorgan analysis finds (marketwatch)

- IBM’s Earnings Signal Good News for Microsoft Stock—and Maybe the Whole Market (barrons)

- 3M Reports Better-Than-Expected Earnings. (barrons)

- Tech Crash or Bargain Season? It’s an Open Question. (barrons)

- Omicron Slows the Global Economy, Hitting the U.S. Particularly Hard (wsj)

- Fed Steps Up Deliberations on Shrinking Its $9 Trillion Asset Portfolio (wsj)

- Russia Cuts Key Oil Flows Just as Demand Looks Set to Jump (bloomberg)

- American Express CEO: We aren’t seeing any consumer cautiousness (yahoo)

- The Big Read. Citadel Securities: how the Wall Street outsider became ‘the Amazon of financial markets’ (ft)

- US antitrust head will look to block deals that ‘lessen competition’ (ft)

- Home prices surged in November, but at a slower rate than in October, S&P Case-Shiller says (cnbc)

Tom Hayes – Quoted in Bloomberg article – 1/25/2022

Thanks to Akshay Chinchalkar, CMT, CFTe, EPATian and Abhishek Vishnoi for including me in their article on Bloomberg. You can find it here:

Click Here to View The Full Article on Bloomberg

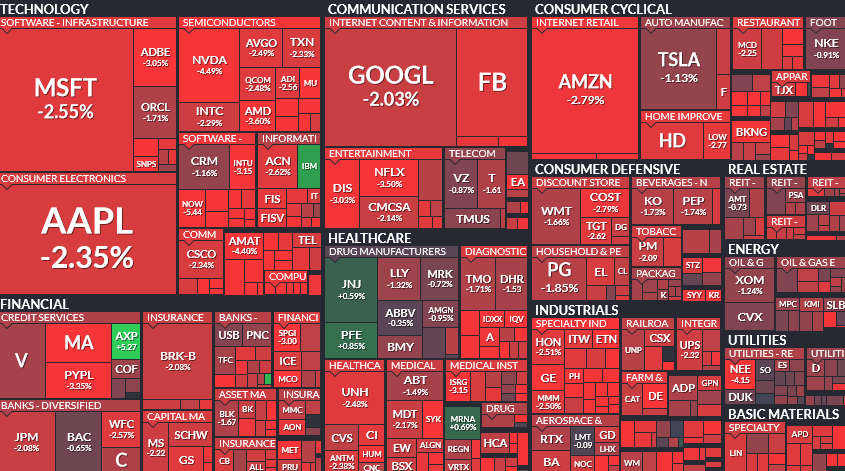

Where is money flowing today?

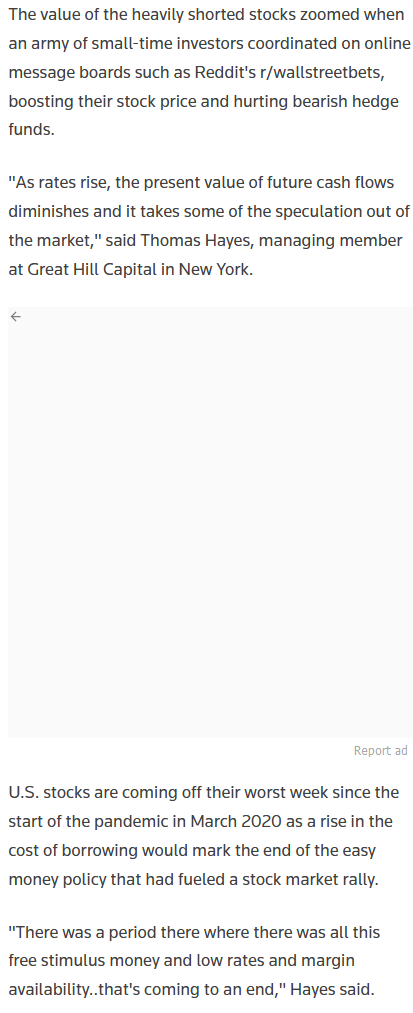

Tom Hayes – Quoted in Reuters article – 1/24/2022

Thanks to Anisha Sircar and Medha Singh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 25 key reads for Monday…

- Chinese Stocks Glimpse Light at the End of the Tunnel (wsj)

- After Three Weeks Of Absence, Stock Buybacks Are Back… As Is VWAP Dip-Buying (zerohedge)

- BofA Reiterates Buy on Alibaba (BABA) as Consumption Recovery in 2H22 is Likely to Fuel Recovery (streetinsider)

- Hawkish Fed Doesn’t Mean Doom for Resilient Emerging Markets (bloomberg)

- Bitcoin Slumps Again. It Isn’t Just the Fed Putting Crypto Prices at Risk. (barrons)

- El Salvador’s president adopts McDonald’s uniform for Twitter profile after bitcoin plunge (marketwatch)

- A Digital Dollar Would Have Winners and Losers. Here’s What’s at Stake. (barrons)

- This Fed Meeting Is Crucial. Future Rate Hikes Are Just the Start. (barrons)

- Commentary: Vladimir Putin Senses Weakness (barrons)

- Tech Stocks Got Hit Hard. Where to Find Bargains Now. (barrons)

- GE Earnings Are Tuesday. Don’t Forget, There Is No More GE Capital. (barrons)

- Activist Investor Peltz Builds Up Stake in Unilever. The Stock is Up. (barrons)

- Foreign Executives in Isolated Hong Kong Head for Exit, Sick of Zero-Covid Curbs (wsj)

- Patrick Mahomes and Josh Allen Produced One of the Greatest NFL Games Ever (wsj)

- Tech Rout Fueled by Bond-Market Turn (wsj)

- Wall Street’s Art Cashin says Monday’s plunge could be the ‘washout selling’ the stock market needs (cnbc)

- Dan Niles says market could see a near-term bounce and he might buy stocks (cnbc)

- S. economy slows sharply during omicron wave, Markit surveys show (marketwatch)

- CFA Study Casts Doubt on Whether Passing Test Is Key to Fund Manager Success (bloomberg)

- Russia plans to target Ukrainian capital in ‘lightning war’, UK warns (ft)

- Boeing pumps extra $450m into self-flying air taxi start-up (ft)

- China’s aviation authority says its 5G network plan for airports is safe (scmp)

- State-backed firms come to the rescue of embattled Chinese developers (scmp)

- Alibaba’s home province to offer preferential tax policies and promote ‘hard tech’ such as chips and digital security (scmp)

- Goldman Warns Earnings Guidance Is “Disappointing” With 5 of 6 Companies Lowering Expectations (zerohedge)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Sunday…

- Opinion: A bullish sign? Nasdaq investor sentiment is worse now than it was in March 2020 (marketwatch)

- 2022 Performance Car of the Year (roadnadtrack)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Here Comes The Pivot: JPM Sees Sharp Slowdown In US Economy, “No Further Hawkish Developments From The Fed” (ZeroHedge)

- Another Peloton Heart Attack on TV? ‘Billions’ Says It’s a Coincidence. (nytimes)

- What Happened (and Didn’t) When Davos Disappeared (nytimes)

- A/D Line Nearing Selling Climax Indices Test Support (almanactrader)

- This German Tuner Has Already Given the New Ferrari 296GTB a Bonkers 900 HP (robbreport)

- How Robinhood Investors Robbed Themselves (wsj)

- Microsoft can rescue a historic trove of lost games from Activision’s vault (mashable)

- Goldman Sachs juniors now earn up to $500,000 as Wall Street hikes bonuses (fn)

- What we know about Intel’s $20 billion bet on Ohio — and US manufacturing (theverge)

- Microsoft’s splurge on Activision Blizzard could mainstream the metaverse (thenextweb)

- Paul Mcnamara on the Problem With Turkey, and the Attempt to Save the Lira (bloomberg)

- The True History Behind HBO’s ‘The Gilded Age’ (smithsonianmag)