- VIX Curve Inverts in Time-Honored Bull Signal Tied to Peak Panic (bloomberg)

- With Macau Overhang Fading, Wynn and Sands ‘Will Thrive’ (barrons)

- Crypto Is in Turmoil as Russia Eyes Putting Ban on Bitcoin (barrons)

- Pete Davidson and Colin Jost Buy a Staten Island Ferry (wsj)

- Coty Stock Is Up 33% in the Past Year. Shares Can Go Higher, This Analyst Says. (barrons)

- Investors Are Giving Up on Netflix. That Makes It a Good Time to Buy the Stock. (barrons)

- The Stock Market Just Suffered Its Worst Week Since 2020. Here’s What Comes Next. (barrons)

- Intuitive Surgical Stock Is Falling After Earnings. This Analyst Thinks It’s a Buy. (barrons)

- Where to Find Bargains Among Tech and Growth Stocks (barrons)

- Tech Stocks Need a Life Raft. Earnings Season Could Be It.(barrons)

- This Fed Meeting Is Crucial. Future Rate Hikes Are Just the Start. (barrons)

- These 3 Bank Stocks Won Earnings Season.(barrons)

- A Rough January Doesn’t Mean a Lost Year. Where the Deals Are in the Stock Market. (barrons)

- Microsoft’s Activision Merger Is No Sure Thing. Here’s How to Play the Stocks Now. (barrons)

- Biogen After the Alzheimer’s Drug Debacle: Time to Sell the Parts? (barrons)

- Amazon Could Rule 2022. Its Shares Might Be Undervalued, Too. (barrons)

- It’s Time to Bargain Hunt. 27 Picks to Beat the Stock Market From Barron’s Roundtable Experts. (barrons)

- The Big Read. Why gaming is the new Big Tech battleground (ft)

- US and Russia plan more Ukraine talks after Blinken-Lavrov meeting (ft)

- Why Alibaba’s Stock Is Attractive (morningstar)

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 20 key reads for Friday…

- China Seen Cutting Rates Once More Before July, Analysts Say (bloomberg)

- PBOC Gives Clear Easing Signal With Promise to Boost Growth (bloomberg)

- PBOC’s Pledge to Open Tool Box Puts Focus on Less-Known Options (bloomberg)

- China Urges Banks to Boost Lending After Slow Start to 2022 (bloomberg)

- China Urges Banks to Boost Property Lending on Default Fears (bloomberg)

- China’s personal luxury market grew 36% last year despite COVID-19 challenges (marketwatch)

- The Fed Weighed In on a Digital Dollar (barrons)

- These 12 Cheap Value Stocks Are Now Table-Pounding Buys, Analysts (IBD)

- Tech Stocks Need a Life Raft. Earnings Season Could Be It. (barrons)

- Verizon and AT&T Just Lit Up New Spectrum. 5G’s Promise Is Beginning to Arrive. (barrons)

- Amazon Could Rule 2022. Its Shares Might Be Undervalued, Too. (barrons)

- Intel to Invest $20 Billion in U.S. Chip-Making Site (barrons)

- Angi Could Be the Next Uber. Its Stock Looks Too Cheap. (barrons)

- Netflix Selloff Seems ‘Overcooked,’ Says This Long-Time Bearish Analyst (barrons)

- U.S. Existing-Home Sales Reached a 15-Year High of 6.1 Million Last Year (wsj)

- What the Metaverse Has to Do With Microsoft’s Deal for Activision Blizzard (wsj)

- Schlumberger shares rise premarket after company tops earnings estimates and offers upbeat outlook (marketwatch)

- Jack Ma’s Ant Group implicated in corruption scandal by Chinese state media (ft)

- Investors turn to Europe in search of stock market bargains (ft)

- Top stock pickers say to buy these 16 video gaming stocks, 7 of which could surge by over 50%, after Microsoft’s $69-billion offer for Activision Blizzard (businessinsider)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 118

Hedge Fund Tips with Tom Hayes – Podcast – Episode 108

Be in the know. 15 key reads for Thursday…

- Hong Kong’s Hang Seng jumps 3% as China cuts key lending rates; property, tech stocks soar (cnbc)

- China’s central bank cuts key lending rates, including one for the first time in nearly 2 years (cnbc)

- Alibaba and JD.com Are Outperforming Apple and Tesla. Here’s Why. (barrons)

- Oil nears $87 after Keystone Pipeline canceled one year ago (foxbusiness)

- American Airlines Beats Earnings Estimates (barrons)

- HSBC cuts its rating on U.S. stocks and says Chinese equities may be a ‘place to hide’ (marketwatch)

- How Nuclear Power Gets a Boost From Shift to Renewables (barrons)

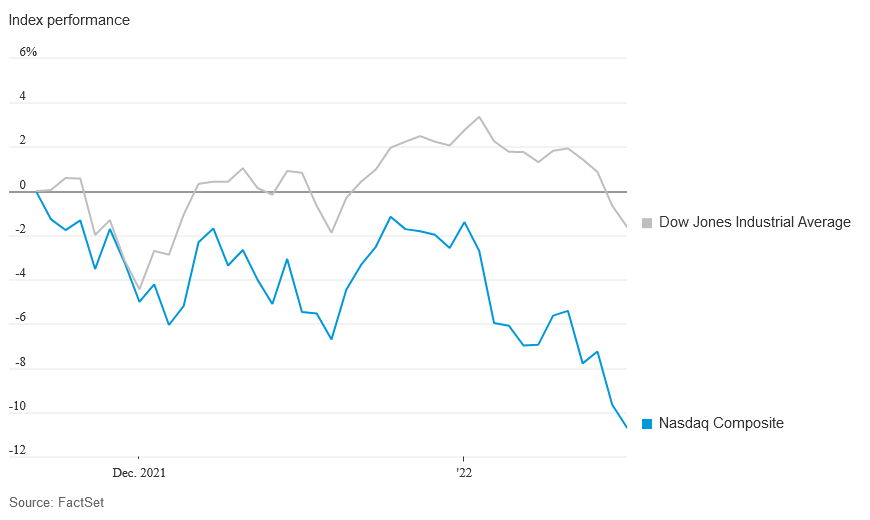

- The Nasdaq Composite just logged its 66th correction since 1971. Here’s what history says happens next to the stock market. (marketwatch)

- Real Interest Rates Are Rising. Here Are 4 Stocks That Can Still Thrive. (barrons)

- China still ‘three or four generations’ away from latest semiconductors, IDC says (cnbc)

- U.S. Flight Disruptions Ease as New 5G Service Goes Live (wsj)

- United Airlines (UAL) Reported Q4 Beat, Provides Q1/2022 Outlook (streetinsider)

- Biden predicts Russia will ‘move in’ on Ukraine (ft)

- China’s internet watchdog denies it has issued policy to vet Big Tech deals (scmp)

- Hang Seng surges by most in 18 months as China cuts rates, boosts spending (scmp)

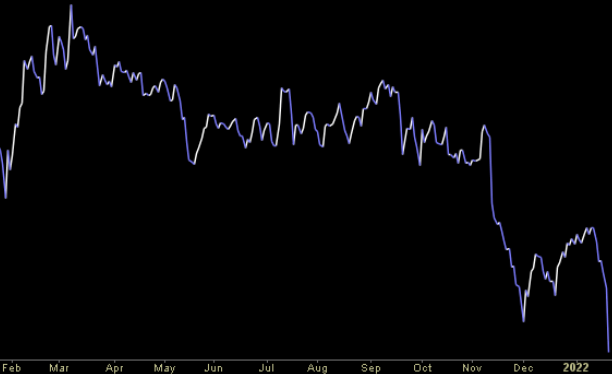

Time to Cry or Time to Fly Stock Market?

(source: WSJ)

(source: WSJ)

The Nasdaq Composite has officially fallen into correction territory – down 10.7% from its November high on Wednesday’s close. Continue reading “Time to Cry or Time to Fly Stock Market?”

Where is money flowing today?

Be in the know. 30 key reads for Wednesday…

- Rocket Is a ‘Clear Industry Leader.’ The Stock Receives a Double Upgrade. (barrons)

- Homebuyers are rushing to get mortgages before higher rates price them out (cnbc)

- ‘Buy Now’: Boeing (BA) Stock Gains as Bernstein Names it Top Choice for 2022, Sees Several Near-Term Catalysts (streetinsider)

- SoFi Gets Regulatory Clearance for Bank Charter. The Stock Is Surging. (barrons)

- 5 Biotech Stocks That Are Bucking the Selloff (barrons)

- China Considers Major Step to Ease Developer Cash Crunch (bloomberg)

- Bitcoin mining startup GRIID inks major deal with Intel (foxbusiness)

- Housing Starts Beat Expectations to End Year on a Strong Note (barrons)

- $87 in a Flash. The Energy Report 01/19/2022 (Phil Flynn)

- Procter & Gamble Tops Earnings Estimates and Lifts Organic Sales Outlook (barrons)

- Bank of America Earnings Rise 28% and Top Forecasts. (barrons)

- Texas, Arizona Have Recovered All the Jobs Lost When Covid-19 Hit (wsj)

- Pfizer’s New Covid-19 Pill Works Against Omicron in Lab (wsj)

- With Rate Increases Looming, Investors Dump Shares of Money-Losing Companies (wsj)

- Pfizer’s new Covid-19 pill, Paxlovid, was effective against the Omicron variant in laboratory tests, the company said. (wsj)

- UnitedHealth Logged Steady Revenue Growth to Close 2021 (wsj)

- Oil Demand to Exceed Pre-Covid Levels in 2022, IEA Says (wsj)

- Can Anyone Satisfy Amazon’s Craving for Electric Vans? (nytimes)

- One Year Into His Term, Biden Finds Himself Boxed In on China (bloomberg)

- Developers Soar on China’s Easing Proposals: Evergrande Update (bloomberg)

- 10 trends that will shape the travel landscape in 2022 (usatoday)

- Airlines Step Up Hygiene to Keep Covid Out of the Air (bloomberg)

- One Year Into His Term, Biden Finds Himself Boxed In on China (bloomberg)

- After years of 5G hype and investment, Wednesday’s network launch makes it real (cnbc)

- UBS upgrades Las Vegas Sands, says new Macao rules should boost stock (cnbc)

- Oil prices have surged, but here’s why one fund manager warns they’ve gone too far (marketwatch)

- Why do so many investors sell out too early? (ft)

- Elon Musk Reiterates Warning About ‘Population Collapse:’ There Aren’t Enough People For Earth, Let Alone Mars (benzinga)

- Shanghai offers big subsidies to attract chip talent and investment (scmp)

- These are the 4 hottest IPO prospects for 2022, including 2 that could reach a valuation of $50 billion, according to a retail investment expert (businessinsider)