Hedge Fund Trade Tip (PIN) – Position Idea Notification

January 2022 Bank of America Global Fund Manager Survey Results (Summary)

The January survey covered 329 managers with $1.1 trillion in assets under management. Continue reading “January 2022 Bank of America Global Fund Manager Survey Results (Summary)”

Hedge Fund Tips (PCN) – Position Completion Notification

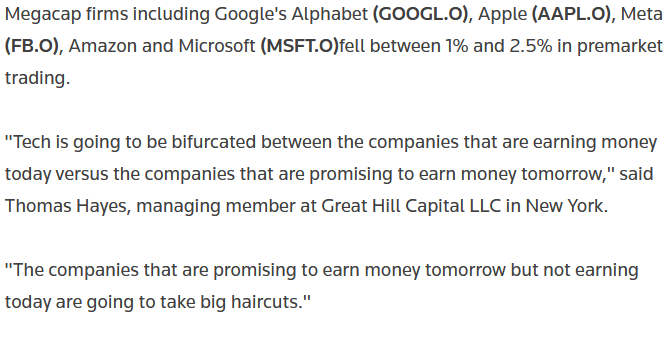

Tom Hayes – Quoted in Reuters article – 1/18/2022

Thanks to Bansari Kamdar for including me in her article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 28 key reads for Tuesday…

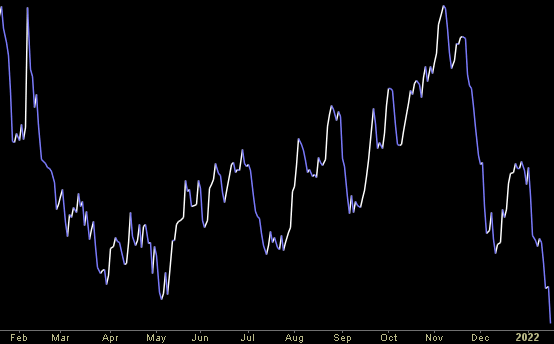

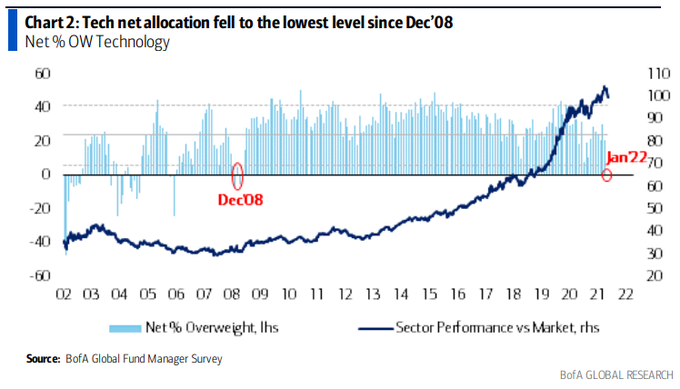

- Risk of central bank hikes prompts investors to shun tech – surveys (reuters)

- Surging Bond Yields Send Nasdaq Futures Tumbling (bloomberg)

- Investors Dismiss Inflation Fears to Place Record Bets on Stocks (bloomberg)

- Politics and Oil. The Energy Report 01/18/2022 (Phil Flynn)

- Tech tumble, lackluster GS earnings set to weigh on Wall Street (reuters)

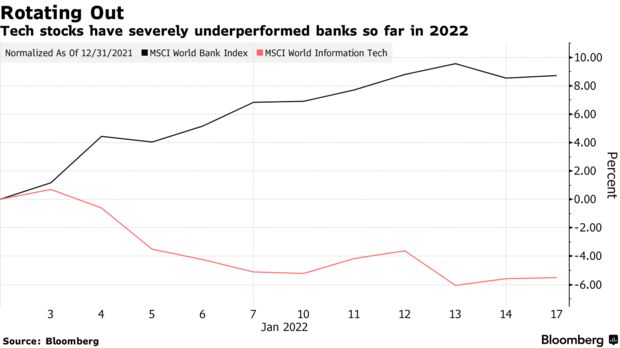

- Tech Stocks Unravel While Banks Are Hot in 2022 Rotation (bloomberg)

- Microsoft to Acquire Activision Blizzard for Nearly $70 Billion (barrons)

- Banks’ Earnings Show Lenders Aren’t All the Same (barrons)

- Investors Will Have Opportunity to Invest in Bausch Spinoffs (gurufocus)

- 23andMe Pivoting To Clinical Research: Could That Lead To A Turnaround For The Stock? (benzinga)

- Shopify, JD Strike Deal to Help U.S. Brands Sell in China (barrons)

- PC and Notebook Demand Is Rising. Why Intel Could Benefit. (barrons)

- Nikola Secures More EV Batteries in Deal With Proterra (barrons)

- Why Biogen Could Need to Sell ‘for Parts’ (barrons)

- Why AT&T May Be Leaning Toward a ‘Split-off’ of Its Discovery Stake (barrons)

- China’s XI Doesn’t Want the Fed to Raise Rates Either (barrons)

- Get ready for the climb. Here’s what history says about stock-market returns during Fed rate-hike cycles. (marketwatch)

- Buy the Dip? Consider These Value Stocks and ETFs Instead. (barrons)

- China Seeks to Cushion Blow of Economic Pain as Momentum Slows (wsj)

- That Dallas Cowboys Ending Was the Goofiest Stuff I’ve Seen in Ages (wsj)

- Unilever Sets Out Ambition to Expand in Health Products (wsj)

- China’s Births Hit Historic Low, a Political Problem for Beijing (nytimes)

- Hedge Funds Are Dumping Tech, Buying Oil in Search for Returns (bloomberg)

- Big Tech Needs Big Profits With Multiples Under Fire: Tech Watch (bloomberg)

- Value-investing titan Seth Klarman opens up about rising inflation, Trump, and ballooning opportunities for his $31 billion Baupost (businessinsider)

- Netflix Gives Its Toughest Audience What It Wants (wsj)

- Oil hit 7-year highs as tight supply bites (reuters)

- China’s record trade gap a symptom of struggle to rebalance its economy (ft)

Tom Hayes – Cheddar TV Appearance – 1/18/2022

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 18, 2022

Watch in HD directly on Cheddar

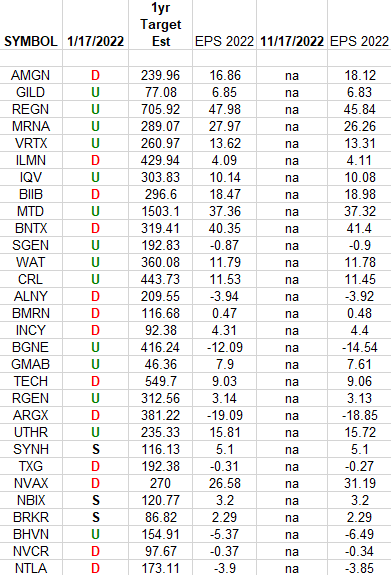

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

Be in the know. 20 key reads for Monday…

- China Cuts Policy Interest Rate for First Time Since April 2020 (bloomberg)

- China’s Xi says countries must abandon ‘Cold War mentality,’ warns against confrontation (cnbc)

- A quiet comeback is starting in emerging markets (ft)

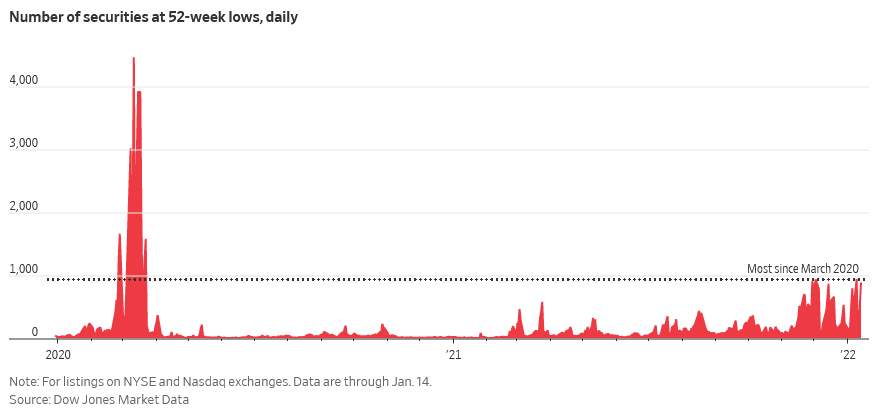

- Hundreds of U.S.-listed companies are off more than 20% from highs. (wsj)

- Tom Brady surprises 10-year-old cancer survivor with Super Bowl tickets (nypost)

- China’s Population Stalls With Births in 2021 the Lowest in Modern History (wsj)

- China’s Population Crisis Is Complicated. What It Means for the Country’s Economy. (barrons)

- Angi Could Be the Next Uber. Its Stock Looks Too Cheap. (barrons)

- Here Are 13 Stocks Whose Pandemic Dividend Suspensions Remain (barrons)

- China Seeks to Cushion Blow of Economic Pain as Momentum Slows (wsj)

- China GDP Grew 8.1% in 2021, but Momentum Slowed in Quarter (wsj)

- Big Tech Braces for a Wave of Regulation (wsj)

- These TikTok Stars Made More Money Than Many of America’s Top CEOs (wsj)

- Why China’s Central Bankers Are Still Worried (wsj)

- Amazon Scraps Plan to Stop Accepting Visa’s U.K. Credit Card (barrons)

- Day Traders as ‘Dumb Money’? The Pros Are Now Paying Attention (wsj)

- How to Use a Free Password Manager—and Make Your Logins Safer (wsj)

- Analysis: China’s ‘zero-COVID’ campaign under strain as Omicron surges (reuters)

- Boom Times for Classic Car Auctions Conducted Online (nytimes)

- Wells Fargo price target raised to $67 from $57 at Keefe Bruyette (thefly)

Be in the know. 10 key reads for Sunday…

- January Monthly Option Expiration Week Mixed Last 23 Years (almanactrader)

- The Campbell Soup Company Is A Lot Bigger Than You Ever Realized (digg)

- Bank Investors Must Wait for the Benefits of Rising Interest Rates (wsj)

- Welcome To “Billionaires’ Dirt Road”: This Pastoral Town Is Home To Larry Fink, Georgina Bloomberg, David Letterman, Richard Gere And More (forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Disney’s CEO reveals his strategy for 2022 and beyond—including creating a metaverse with your favorite characters (fortune)

- Understanding the Metaverse and Web 3.0 (goldmansachs)

- 5G’s next big launch could make its improved speed promises a reality (cnet)

- TikTok made me buy it (npr)

- Disappointing Decade for European Bank Stocks Gives Way to Rally (bloomberg)