- 10 key debates on, and reasons to buy, China in 2022 (Goldman Sachs)

- Expect a Tough Year for Stocks but Lots of Opportunities for Bargain Hunters, Barron’s Experts Say (barrons)

- Retail Sales Fell in December. Why Some Economists Say the Decline Will Be Short-Lived. (barrons)

- In Proof That Irony Is Dead, People are Trying to Make Beanie Babies NFTs (futurism)

- Banks’ Earnings Show Lenders Aren’t All the Same. It’s Time to Pick and Choose. (barrons)

- The Misery Index Is Rising. What That Says About Rates. (barrons)

- Macau Reveals Casino Law Changes. Las Vegas Sands, Wynn Are Soaring. (barrons)

- Get ready for the climb. Here’s what history says about stock-market returns during Fed rate-hike cycles. (marketwatch)

- Las Vegas Sands Stock Could See Better Luck Ahead (barrons)

- After Scramble to Replace NHL Players, USA Hockey Reveals Men’s Olympic Team (wsj)

- How Game Theory Changed Poker (wsj)

- Wells Fargo profits soar thanks to increase in loans, cost-cutting steps (nypost)

- The Big Read. Zero-Covid policies threaten Hong Kong’s place in the world (ft)

- Opinion: Four reasons why value stocks are poised to outperform growth in 2022 — and 14 stocks to consider (marketwatch)

- JPMorgan plots ‘astonishing’ $12bn tech spend to beat fintechs (ft)

- opinion content. Person in the News. Ken Griffin, financial prodigy turned industry giant (ft)

- US accuses Russia of planning ‘false-flag operation’ in eastern Ukraine (ft)

- Elon Musk’s Tunnel System Works, but the Real Test Is Still to Come (bloomberg)

- The Virus Has Changed. Maybe We Should, Too. (bloomberg)

- Here Are the Most Eye-Popping Cars at the 2022 Tokyo Auto Salon (bloomberg)

- As bond yields spike to their highest levels of the recovery, a Wall Street firm shares exactly how investors can maximize their hunts for yield — and how to adjust portfolios now (businessinsider)

- GE suspends Covid vaccine, testing rules after high court nixes Biden mandate (cnbc)

- How Olympic gold medalist Tara Lipinski stays motivated: ‘I’m competitive’ (cnbc)

- Opinion: Nasdaq near a 10% correction isn’t the sell signal you probably think it is (marketwatch)

- Opinion: Why interest rates aren’t really the right tool to control inflation (marketwatch)

- Netflix is raising prices (cnn)

- Selling Out (oaktreecapital)

- Legendary investor Mario Gabelli breaks down auto, aerospace stocks to watch (youtube)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 117

Hedge Fund Tips with Tom Hayes – Podcast – Episode 107

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/14/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 14, 2022

Watch in HD directly in Fox Business

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 20 key reads for Friday…

- Macau Reveals Casino Law Changes. Las Vegas Sands, Wynn Are Soaring. (barrons)

- JP Morgan Says US Casinos in Macau Already Seen the Worst (gamblingnews)

- Macau keeps casino licences limited to six, halves duration (reuters)

- Macau Cuts Casino License Tenure, Caps Public Float in New Law (bloomberg)

- China reforms securities settlement system to attract foreign capital (reuters)

- Retail Sales Fell in December as Omicron and Inflation Stymied Spending (barrons)

- JPMorgan Earnings Beat Expectations. But the Stock Falls After Higher Expenses and Slower Trading. (barrons)

- Citi’s Trading Revenue Disappoints (barrons)

- Wells Fargo’s Quarterly Profit Soars 86% (wsj)

- 83 Squeeze. The Energy Report 01/14/2022 (Phil Flynn)

- S. industrial production edges lower in December as automobile production stumbles (marketwatch)

- With Biden Mandate Blocked, Many Companies Won’t Impose Covid-19 Vaccine Rules (wsj)

- Fed’s Brainard Says Reducing Inflation Is Top Priority (wsj)

- Omicron Appears to Have Peaked in U.K., Offering Hope the Wave Is Receding (wsj)

- Tom Brady Tackled These Guys. They Still Can’t Believe It. (wsj)

- Nike and Adidas Are Dipping Toes Into the NFT Market. The Sneakerheads Are Into It. (com)

- After Scramble to Replace NHL Players, USA Hockey Reveals Men’s Olympic Team (wsj)

- As Fintech Eats Into Profits, Big Banks Fight Back in Washington (bloomberg)

- China’s Trade Surplus Hit a Record $676 Billion in 2021 (bloomberg)

- Here’s the full list of the best-selling electric cars in China for 2021 (cnbc)

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Boeing Stock Leaps On Report 737 MAX To Return To Service In China Later This Month (thestreet)

- Delta Air Lines Earnings Beat Expectations. (barrons)

- Shell’s Buybacks and Low-Carbon Energy Shift Make This a Buying Opportunity (barrons)

- Wall Street Is Talking About the Fed’s Balance Sheet. What to Know About ‘QT.’ (barrons)

- Inflation Surge Is on Many Executives’ List of 2022 Worries (wsj)

- Fed’s Brainard to Tell Congress That Reducing Inflation Is Top Priority (wsj)

- U.S. Initial Jobless Claims Rose to Highest Since Mid-November (bloomberg)

- Smaller Gain in U.S. Producer Prices Is Hint of Cooler Inflation (bloomberg)

- Sell Dollar for Everything Else Is Echoing Across Trading Rooms (bloomberg)

- Discovery Shares Poised for Gains After Rough 2021 (bloomberg)

- Biogen Prepares to Fight Medicare Over Alzheimer’s Drug Limits (bloomberg)

- Wharton professor Jeremy Siegel sees the S&P 500 jumping 9% this year, saying stocks are the place to be when inflation is rising (businessinsider)

- These are the types of companies Warren Buffett says you should invest in during times of inflation (marketwatch)

- Saudi Sovereign Wealth Fund To Buy $10 Billion In Stocks This Year (zerohedge)

- Wells Fargo expects four U.S. rate hikes this year, cuts growth forecast (streetinsider)

- AT&T (T): UBS Expects WarnerMedia Sale Completed in 2Q, Seen as a Catalyst for Shares and Paving the Way for Buybacks in 2023 (streetinsider)

- Susquehanna Upgrades Delta (DAL) and United (UAL) to Positive, Downgrades Southwest (LUV) and Sprint (SAVE) to Neutral (streetinsider)

- Stabilisation signs emerge after inflation palpitations (reuters)

- J.P. Morgan: Hedge Funds Could Be the Go-To Investment for 2022 (institutional nvestor)

- Short sellers tuck into Beyond Meat (ft)

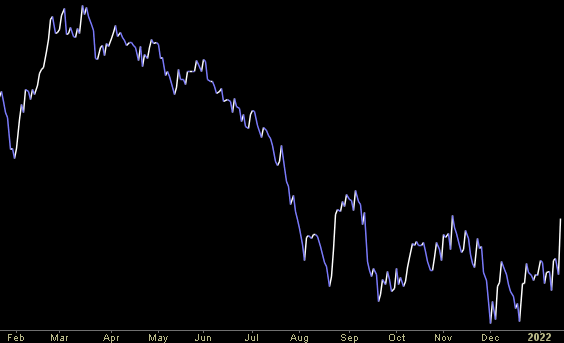

“The Last Shall Be First” Stock Market…

On Friday I was on Fox Business – The Claman Countdown – with Liz Claman discussing which sector (+company) and which asset class (+company) we are focused on for 2022. Thanks to Ellie Terrett and Liz for having me on: Continue reading ““The Last Shall Be First” Stock Market…”