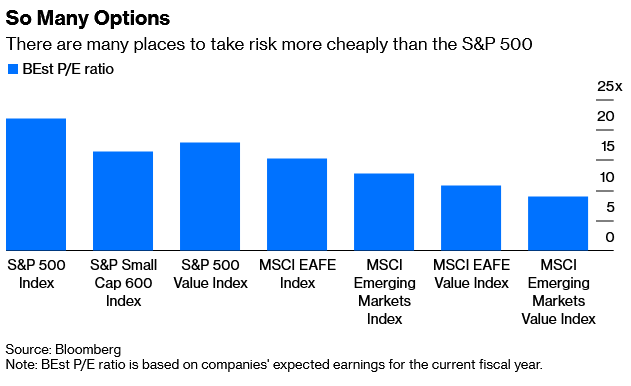

- Where to Find Cheaper Alternatives to Expensive Stocks (bloomberg)

- Americans aren’t scared of inflation. They already think it peaked. (businessinsider)

- Brace for more volatility and buy stocks in these 3 industries as the housing market stays red-hot in 2022, says the 30-year market veteran who runs JPMorgan Asset Management’s dividend-growth strategy (businessinsider)

- FDA Authorizes Pfizer Antiviral Pill to Fight Covid (barrons)

- Buckle Up and Hang On: A Bumpy Ride Is the Only Sure Thing About the New Year. (barrons)

- Ruler of the Metaverse: Blockchain or Big Tech? (barrons)

- Lesson of the Century: The U.S. Economy Is Nothing if Not Resilient (barrons)

- If the U.S. Rolls Back Iran Sanctions, Business Beware (barrons)

- Bank stocks may struggle to repeat gains of 2021 next year, but analysts see some grounds for optimism (marketwatch)

- TikTok was the world’s most visited internet site in 2021, surpassing last year’s leader, Alphabet’s Google, according to Cloudflare. (wsj)

- Confronting Inflation, Biden Administration Turns to Oil Industry It Once Shunned (wsj)

- Gilead’s Remdesivir Covid-19 Therapy Cuts Risk of Hospitalization in Study (wsj)

- Novartis to Buy Gene-Therapy Company Targeting Eye Condition (wsj)

- Morgan Stanley 2022 Global Strategy Outlook: Fundamentals Will Dominate (morganstanley)

- US financial conditions remain easy even as Fed pulls back on stimulus (ft)

The “Grinch is Dead” Stock Market (and Sentiment Results)…

After the Fed induced debacle in December 2018 – which caused the S&P 500 to cascade down over 16% in 3 weeks (making it the worst December since the Great Depression) – they took the Grinch out behind the barn and finished him off! There will be no Grinch this year, and Santa Claus is coming to town… Continue reading “The “Grinch is Dead” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 22 key reads for Wednesday…

- FDA Expected to Authorize Pfizer and Merck Covid Pills This Week (bloomberg)

- Why do Italians watch Trading Places on Christmas Eve? (wantedinrome)

- Rite Aid Stock Soars After Upbeat Forecast. The Chain Is Shrinking. (barrons)

- Holiday Travel Demand Remains Strong. It Looks Immune to Omicron. (barrons)

- The $100,000 Nine-Month Cruise: Royal Caribbean Is Betting on ‘Revenge Travel’ (barrons)

- Delta Air Lines Urges CDC to Cut Isolation Time for Breakthrough Covid Cases (barrons)

- Intel’s $9 Billion Sale of Memory Unit Approved by Chinese Regulator (barrons)

- South African medical experts say drop in new cases may mean omicron surge has passed (marketwatch)

- Biden Still Hopes to Strike ‘Build Back Better’ Deal With Manchin (wsj)

- Five Big Tech Stocks Are Driving Markets. That Worries Some Investors. (wsj)

- US may reduce CDC’s 10-day COVID isolation for the vaxxed, Fauci says (nypost)

- Omicron Has 80% Lower Risk of Hospitalization, New Study Shows (bloomberg)

- Jim Cramer: Micron practically carried ‘the whole market on its back’ Tuesday after its strong quarter (cnbc)

- Next for the metaverse: convincing you it’s not just for kids (cnbc)

- These stocks significantly off their highs look relatively cheap and ready to rally, traders say (cnbc)

- 3 reasons why the S&P 500 is set to rise at least 11% in 2022, according to Fundstrat’s Tom Lee (businessinsider)

- China’s Tech-Investment Paradox (wsj)

- Cruise Industry Keeps Calm and Sails On (wsj)

- The 5 Highest-Yielding ‘Strong Buy’ Dow Stocks Are Outstanding 2022 Ideas (247wallst)

- Hong Kong’s Year as the Worst Stock Market in Four Charts (yahoo)

- Apache Log4j bug: China’s industry ministry suspends support from Alibaba Cloud for six months for not reporting flaw to government first (scmp)

- Ships carrying natural gas head for Europe as prices surge to new high (ft)

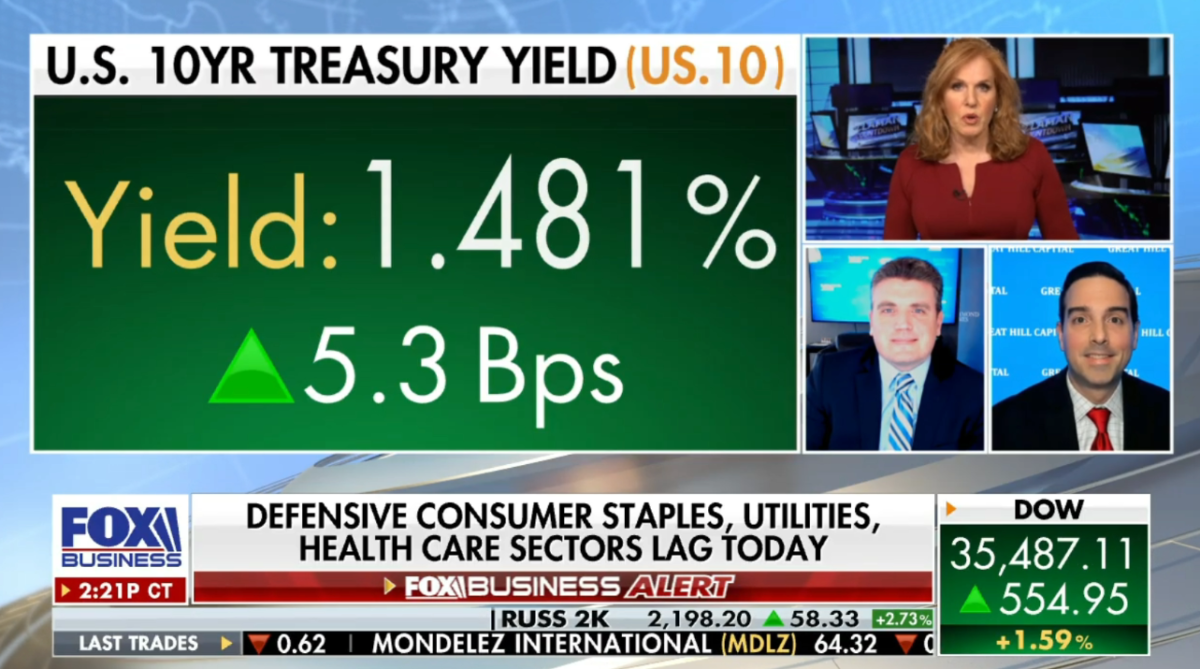

Tom Hayes – The Claman Countdown – Fox Business Appearance – 12/21/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 21, 2021