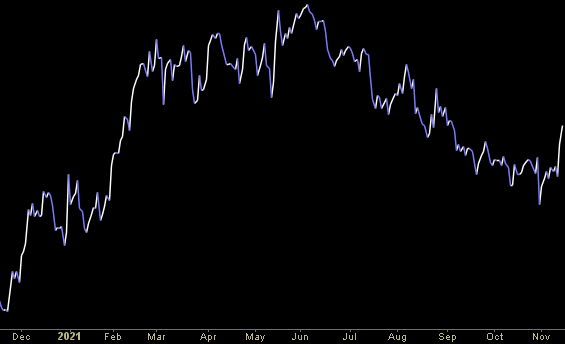

Data Source: Finviz

Be in the know. 17 key reads for Monday…

- Powell or Brainard as Fed Chief? Biden to Make a Pick Soon. (barrons)

- The Math Behind GE’s Breakup Makes Sense. Here’s How. (barrons)

- Boeing’s stock would add nearly 50 points to the Dow after announcement of converted freighter orders (marketwatch)

- S., China Seeking to Stabilize Ties With Biden-Xi Summit (bloomberg)

- China’s retail sales beat forecasts in October, despite property market slump (cnbc)

- Why the Internet Is Turning Into QVC (New York Times)

- What Does Inflation Mean for American Businesses? For Some, Bigger Profits (Wall Street Journal)

- COP26 Opens Path to International Carbon Trading (Wall Street Journal)

- Airbus Says It Can’t Meet Current Demand for Single-Aisle Jets (Wall Street Journal)

- What’s Driving Xi Jinping’s Economic Revamp? China’s Social Mobility Has Stalled (Wall Street Journal)

- For Whom Does This Bell Toll? Dallas Billionaire Harlan Crow (Wall Street Journal)

- The Energy Report 11/15/2021 (Phil Flynn)

- China’s Coal Addiction Runs Deeper Than Economics (Wall Street Journal)

- Boeing ‘Encouraged’ by Signs China May Soon Clear Max to Fly (bloomberg)

- India opens its doors to quarantine-free travel for tourists from 99 countries (cnbc)

- Market Bets on a Fed Interest-Rate Mistake (Wall Street Journal)

- The oldest asset class of all still dominates modern wealth (Financial Times)

Be in the know. 11 key reads for Sunday…

- China satisfied with Boeing 737 MAX changes, seeks industry feedback – document (Reuters)

- Week Before Thanksgiving, DJIA up 19 of 28, but weaker lately (Almanac Trader)

- ECRI Weekly Leading Index Update (advisorperspectives)

- So what is “the metaverse,” exactly? (arstechnica)

- Can Biden and Xi talk their way out of a slide into conflict? (LA Times)

- What Xi Jinping’s Elevated Status Signals for Chinese Foreign Policy (cfr)

- Alex Ovechkin Isn’t Too Old To Be (And Beat) A Great One (fivethirtyeight)

- Thomas S. Gayner on Things That Matter in Markets (Podcast) (bloomberg)

- Robert Cialdini: The Principles of Persuasion [The Knowledge Project Ep. #122] (farnam street)

- This Is the Perfect Storm That Caused Grain Prices to Soar (bloomberg)

- Stinson Dean on the Lumber Crash That Followed the Boom (bloomberg)

Be in the know. 30 key reads for Saturday…

- After $500 Billion Rout, Optimism Grows for China: Tech Watch (After $500 Billion Rout, Optimism Grows for China: Tech Watch (bloomberg)

- Boeing Signals Optimism on Resolving Dreamliner, Max Issues (bloomberg)

- Tiger Global’s $65 Billion Man Shrugs Off China Crackdown Threat (bloomberg)

- S.-China Surprise Cooperation on Climate Change Driven by Biden and Xi’s Need for Deal (Wall Street Journal)

- Hedge funds learn the hard way in bonds shock (Financial Times)

- Master Magician David Blaine — Fear{less} with Tim Ferriss (#546) (Tim Ferriss)

- Paramount’s ‘Yellowstone’ Premiere Draws 14.7 Million Viewers (bloomberg)

- Small-Company Stocks Are in Line to Be Big Winners in 2022 (Barron’s)

- Array Stock Is Flying. Its CEO Says the Toughest Part Is Over. (Barron’s)

- Mall Stocks Are Back in Fashion as Shoppers Return. How to Play It. (Barron’s)

- CEO Robert Bakish and Chair Shari Redstone Bought Up ViacomCBS Stock (Barron’s)

- ViacomCBS Stock Will Get a Boost From Restructuring (Barron’s)

- China’s Xi Cements His Grip on Power. What That Means for China-U.S. Relations. (Barron’s)

- The Math Behind the GE Spinoffs Makes Sense. For Investors, It’s a Bet on CEO Larry Culp. (Barron’s)

- Why Dean Martin was the ‘King of Cool’ (New York Post)

- COP26 Negotiators Work Toward Climate Deal (Wall Street Journal)

- S. Moves to Ease Tariffs on Imported Steel, Aluminum From Japan (Wall Street Journal)

- Robert Califf, Former FDA Chief, Is Biden’s Pick to Run Agency (Wall Street Journal)

- The Covid drugs are finally here (Financial Times)

- US consumer sentiment hits 10-year low with inflation fears surging (Financial Times)

- Joe Biden and Xi Jinping to hold virtual summit on Monday (Financial Times)

- The road warriors will defeat the beancounters (Financial Times)

- China Developer Sunac Raises $953 Million in Share Sale Combo (bloomberg)

- Ex-PBOC Official Urges Caution on Effects of Property Curbs (bloomberg)

- Brainard’s Fed Contention Puts Focus on Inflation, Jobs Views (bloomberg)

- Americans feel worse about the economy today than they did when everything was shutting down and 22 million people were losing their jobs (businessinsider)

- Billionaire investor Ray Dalio says the US is ‘on the wrong path’ after inflation hits a 31-year high (businessinsider)

- Metaverse: Augmented reality inventor warns it could be far worse than social media (bigthink)

- Chinese Scientists Say They’ve Discovered Cheap New Way to Do Nuclear Fusion (futurism)

- Howard Marks: The Problem With Paying Up For A Popular Stock (acquirersmultiple)

Tom Hayes – Quoted in Reuters article – 11/12/2021

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Monday…

- Johnson & Johnson Stock Jumps. It Plans to Split in Two (Barron’s)

- XPeng Plans Launch of New SUV. The Stock Is Rising. (Barron’s)

- Wynn CEO’s sudden departure has analysts scratching their heads (New York Post)

- Dillard’s Smokes Profit and Sales Estimates. Are Department Stores Back? (Barron’s)

- Some Energy Stocks Could Double. Where to Invest Now. (Barron’s)

- A U.S. Fund Is Hit With a Closet Indexing Charge. How Close Is Too Close to a Benchmark? (Barron’s)

- Alibaba, JD smash Singles Day record with $139 billion of sales and focus on ‘social responsibility’ (CNBC)

- Gene Editor Verve Unveils Second Way to Lower Cholesterol (Barron’s)

- 3 Reasons to Buy GE Stock as the 129-Year-Old Company Reinvents Itself Again (Barron’s)

- China’s Xi Gains Power as Communist Party Designates Him a Historic Figure (Wall Street Journal)

- How Much Do Electric Vehicles Cost to ‘Fill Up’ Compared With Buying Gasoline? (Wall Street Journal)

- Biden and China’s Xi to Hold Virtual Summit on Monday (Wall Street Journal)

- Natural-Gas Supply Is Back in Balance, but Prices Are Still Swinging (Wall Street Journal)

- Pandemic Profits Show Why Stock Bulls Ignore Old-School Accounting (Bloomberg)

- Central Bankers Are Blowing Up Macro Hedge Funds (Bloomberg)

- Hong Kong Expects 2021 Growth Near Top of Forecasted Range (Bloomberg)

- China’s New ‘Starting Point’ Shows Xi Jinping Is Here to Stay (Bloomberg)

- Furious Investors Test China’s Resolve to Crack Down on Property (Bloomberg)

- China’s Dangerous Rush to Resolve the Property Crisis (Bloomberg)

- The Energy Weapon. The Energy Report 11/12/2021 (Phil Flynn)