Where is money flowing today?

Be in the know. 20 key reads for Monday…

- SoftBank unveils $8.8bn share buyback following investor pressure (Financial Times)

- S.-listed Chinese education companies jump on report of tutoring licensing (marketwatch)

- ChargePoint and Other EV-Charging Stocks Electrified by Infrastructure Bill (Barron’s)

- Coty Stock Surges on Earnings Beat and Outlook Boost (Barron’s)

- Airline Stocks Surge as U.S. Welcomes Travelers From Europe and Other Countries Again (Barron’s)

- Illumina’s Genetic Testing Business is Booming (Barron’s)

- Out Of Control. The Energy Report 11/08/2021 (Phil Flynn)

- Laggards for a Decade and Counting: Emerging-Market Stocks (Bloomberg)

- FANGs Are Getting Fatter on Falling Bond Yields (Bloomberg)

- Regeneron Antibody Prevents Covid Infections for 8 Months (Bloomberg)

- Xi Set to Unveil New Doctrine That Could Let Him Rule for Life (Bloomberg)

- S. Women Are Coming Back to the Job Market (Bloomberg)

- Here comes the travel boom (Yahoo! Finance)

- PwC to boost headcount in China by 20,000 with $1.25bn investment (Financial Times)

- Nuclear reactors are powering China’s energy transition (asiamarkets)

- Investors are sick of paying for private equity’s private jets (Financial Times)

- Chinese auto giant Geely launches electric truck, its rival to Tesla’s Semi (CNBC)

- What’s in the infrastructure bill? Electric vehicles, clean energy, and public transit are all included in $1 trillion policy (businessinsider)

- Are Investors Wrong To Worry About China? Morgan Stanley Responds… (zerohedge)

- Treehouse Foods (THS) Exploring Strategic Alternatives, Including Possible Sale to Maximize Value (streetinsider)

Quote of the Day…

Be in the know. 10 key reads for Sunday…

- Natural-Gas Exports Lift Prices for American Utilities (Wall Street Journal)

- Typical November Trading: Firm Beginning, Tepid Across Mid-Month, Rally to Close (Almanac Trader)

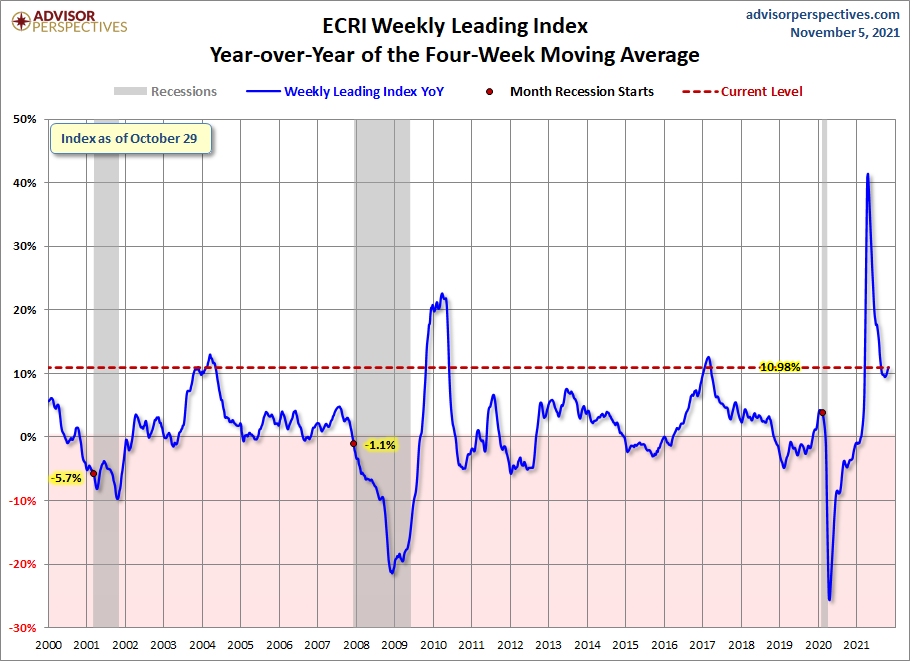

- ECRI Weekly Leading Index Update (advisorperspectives)

- AIRLINES LEAD INDUSTRIAL SPDR TO A NEW RECORD — DELTA AND UAL LEAD AIRLINES (stockcharts)

- This 650-HP Chevy Beast Concept Truck Is Being Compared to ‘Halo’ Warthog (maxim)

- Citi’s Matt King on Why Inflation Isn’t Transitory and the Fed May Induce a Recession (Bloomberg)

- China’s exports remain strong despite power shortages, COVID outbreaks (foxbusiness)

- Using CRISPR Technology, Scientists Plan to Grow a More Durable Strawberry (smithsonianmag)

- Watch Over 150 Bison Weave Through Traffic in Yellowstone as Winter Migration Begins (smithsonianmag)

- NHL Rank: Predicting the top 100 players for the 2021-22 season (espn)

Be in the know. 30 key reads for Saturday…

- Buy This Insurance Conglomerate Stock. It’s a Miniature Berkshire Hathaway. (Barron’s)

- Central bank induced bond tumult stings big name hedge funds (Financial Times)

- How Intel plans to catch Samsung and TSMC and regain its dominance in the chip market (CNBC)

- 40 Defensive Stocks on Sale (morningstar)

- Here’s to Yellowstone, the Most-Watched Show Everyone Isn’t Talking About (vanityfair)

- Travel stocks rally, stay-at-home companies plunge as pandemic wanes and tourism rebounds (CNBC)

- House Approves $1 Trillion Infrastructure Bill, Sending to Biden (Barron’s)

- Berkshire Earnings Are Out. What to Know. (Barron’s)

- The Latest Jobs Report Was Good, but Labor Issues Persist (Barron’s)

- Theories on Where the Workers Went (Barron’s)

- It’s the Weirdest Time in History for Finance. What to Know About Bubbles in Crytpos, Meme Stocks, and NFTs. (Barron’s)

- Vodafone Is Getting a Boost From Fintech in Africa. The Stock Is Due for a Rebound. (Barron’s)

- Workers Feel Emboldened. It’s the Start of a New Labor Movement. (Barron’s)

- Only the Wealthy Have Prospered in America? That Isn’t True. (Barron’s)

- Blade Stock Is Ready to Take Off. Just Don’t Call It the Uber of the Sky. (Barron’s)

- Gene Therapy Is a Huge Opportunity. It Pays to be Patient. (Barron’s)

- A bargain you can’t ignore: Small-cap stocks are trading at their second-biggest discount in 20 years (marketwatch)

- The Stay-at-Home Trade Is Over—With 1 Key Exception (Barron’s)

- Timberwolves Co-Owner Marc Lore Buys More Archer Aviation Stock (Barron’s)

- R. Donnelley & Sons and PAE Stock See Action From Activist Investors (Barron’s)

- Shake Shack Stock Gets an Upgrade. An Analyst Sees ‘Upside.’ (Barron’s)

- China turns inward: Xi Jinping, COP26 and the pandemic (Financial Times)

- Joe Biden meets Jay Powell as clock ticks on Fed chair decision (Financial Times)

- Buffett’s Cash Pile Tops Record With $149.2 Billion On Hand (Bloomberg)

- 2021 McLaren 765LT: An Extreme Supercar, Now Faster and Lighter (Wall Street Journal)

- What is the Metaverse? The Future Vision for the Internet (Wall Street Journal)

- Legendary Investor John Doerr on Picking Winners — From Google in 1999 to Solving the Climate Crisis Now (#543) (Tim Ferriss)

- Is Bitcoin Too Big to Fail? (institutionalinvestor)

- Joel Greenblatt Keynote Presentation: Ben Graham VIII Annual Conference (cfany)

- Is Value Investing Making A Comeback, Or Has It Been Here All Along? (finance-monthly)

Unusual Options Activity – The Boeing Company (BA)

Data Source: barchart

Today some institution/fund purchased 20,434 contracts of Dec $255 strike calls (or the right to buy 2,043,400 shares of The Boeing Company (BA) at $255). The open interest was just 1,914 prior to this purchase.

Monitoring unusual options activity can be a useful tool. Large amounts of options being traded on a particular stock may provide some valuable insight into what the “smart money” is doing.

Checking unusual options activity on a regular basis can draw attention to stocks that would have otherwise been missed and can prompt traders to analyze why options volume has spiked for a certain equity. For example, a large option order could be done for a number of different reasons, sometimes they can even look deceptive. For the most part, options can be used to hedge an existing position or for speculation. Our job is to look at the underlying security and figure out why – before taking any action.