Where is money flowing today?

Be in the know. 25 key reads for Wednesday…

- Earnings Estimates Are Rising Again. That’s Good for Stocks. (Barron’s)

- VMware’s Solo Act Should Sing (Wall Street Journal)

- No Responsibility. The Energy Report 11/03/2021 (Phil Flynn)

- The RBA’s Defeat Down Under Should Worry Central Bankers (Wall Street Journal)

- The Fed’s Two-Day Meeting Is About to End. What to Expect. (Barron’s)

- Powell Will Have a Tough Time Reeling in the Market’s Rate-Hike Expectations (Barron’s)

- Bed Bath & Beyond Stock Soars 59% on Likely Short Squeeze (Barron’s)

- CVS Boosts Forecast and Earnings Beat Expectations. The Stock Edges Higher. (Barron’s)

- Five Stocks With Safe and Growing Dividends (Barron’s)

- Buy DuPont Stock, Analysts Say. Its Strategic Shift Is ‘Transformative.’ (Barron’s)

- Activision Blizzard Stock Is Falling. Key Game Delays Trump an Earnings Beat. (Barron’s)

- Lyft Stock Gets a Lift from Better-Than-Expected Earnings (Barron’s)

- Jerome Powell’s Dashboard Casts Doubt on Inflation Easing Quickly (Wall Street Journal)

- BP, Buoyed by Resurgent Oil Price, to Boost Investor Returns (Wall Street Journal)

- China Binges on U.S. Gas to Manage Energy Shortage, Carbon Footprint (Wall Street Journal)

- Opioid Makers Win Major Victory in California Trial (New York Times)

- Hong Kong in Talks With China to Open Border, Report Says (Bloomberg)

- Short Sellers Crushed as Bed Bath & Beyond Adds to Avis Blow (Bloomberg)

- China’s PBOC Says Digital Yuan Users Have Surged to 140 Million (Bloomberg)

- Fed to Taper Bonds, Show Patience on Rates: Decision-Day Guide (Bloomberg)

- Companies add 571,000 jobs in October thanks to a big boost in hospitality hires, ADP says (CNBC)

- China Junk Bond Yields Hit All Time High As Property Default Contagion Spreads, Home Sales Plunge 32% (zerohedge)

- Goldman Sachs Upgrades Phillips 66 (PSX) to Conviction Buy (streetinsider)

- Fed prepares to start tapering as US inflation concerns persist (Financial Times)

- ‘It’s really a toy’: Zillow closes home-flipping business. What does that say about the reliability of its Zestimate home-valuation tool? (marketwatch)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 24 key reads for Tuesday…

- The Fed Is Boxed In. What It Means for Investors. (Barron’s)

- Soaring Oil and Gas Prices Boost BP Profit in the Shadow of COP26 (Barron’s)

- Intel Chairman Omar Ishrak and Other Insiders Bought $2 Million in Stock (Barron’s)

- 100 million Barrels and Counting. The Energy Report 11/02/2021 (Phil Flynn)

- Mortgage Bond Sales Surged in October (Wall Street Journal)

- The U.S. and EU Shake Up Global Trade (Wall Street Journal)

- Amazon to Launch First Two Internet Satellites in 2022 (New York Times)

- S&P 500 performance in 2022 will be bullish if history is a guide (asiamarkets)

- Wall Street Warns Bond Market Rout Will Catch Up With Stocks (Bloomberg)

- J&J, Teva Beat $50 Billion Opioid Case in First Industry Win (Bloomberg)

- One Trader Calls All the Shots in the Treasury Bond Market (Bloomberg)

- Bond Whiplash Raises Risk of a Financial Market Accident (Bloomberg)

- Small caps kick off November with a rally — why that’s good news for the S&P 500 (CNBC)

- Beijing’s flights are cancelled as China’s capital city tightens Covid restrictions (CNBC)

- China’s coal shortage eases after Beijing steps in, report says (CNBC)

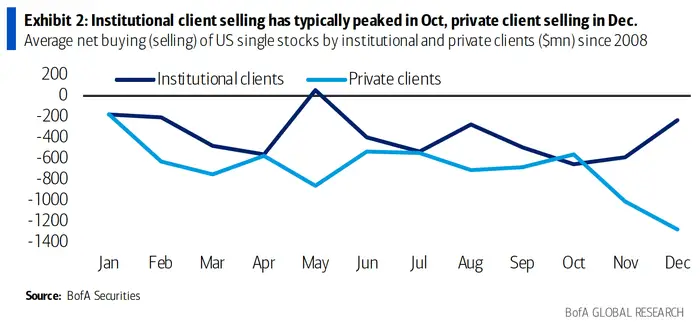

- Bank of America names 13 stocks that are primed to rebound by January after underperforming this year due to tax-loss harvesting (businessinsider)

- Stocks are in ‘melt-up’ mode and have further to run before hitting a top as strong participation drives latest rally, Leuthold CIO says (businessinsider)

- Value investing legend John Rogers told us 4 stocks he’s been buying for the market’s next phase — and why the meme stock and bitcoin rallies remind him of a mistake he made in his earliest days (businessinsider)

- Signs of a new capex cycle’ emerge as S&P 500 companies report earnings, says BofA (marketwatch)

- Opinion: Higher interest rates probably won’t cause this bull market in stocks to end, according to research dating to 1871 (marketwatch)

- Clorox (CLX) Stock Gains 5% Following Q1 EPS Beat, Reaffirmed 2022 Outlook (streetinsider)

- Evercore ISI Reiterates Uber (UBER) as No.1 Mega Cap Pick Ahead of Earnings (streetinsider)

- Pfizer raises 2021 sales forecast for Covid vaccine to $36bn (Financial Times)

- US bond tumult risks triggering stock market volatility, analysts warns (Financial Times)

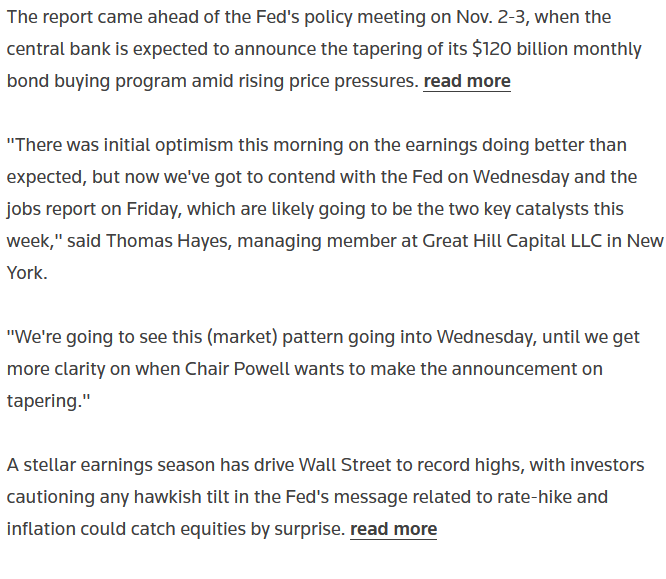

Tom Hayes – Quoted in Reuters article – 11/1/2021

Thanks to Devik Jain and Bansari Mayur Kamdar for including me in their article on Thomson Reuters today. You can find it here: