Yesterday, I read an article in the Wall Street Journal that chronicled Journey’s 1981 hit “Don’t Stop Believin’.” The genesis of the Billboard hit (and ending ballad to the Soprano’s series), was a streak of bad luck for Journey keyboardist-guitarist Jonathan Cain. Continue reading “The “Don’t Stop Believin’” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Intel Corporation (INTC)

Data Source: barchart

Today some institution/fund purchased 2,756 contracts of Mar $45 strike calls (or the right to buy 275,600 shares of Intel Corporation (INTC) at $45). The open interest was just 367 prior to this purchase. Continue reading “Unusual Options Activity – Intel Corporation (INTC)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

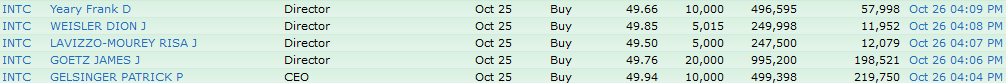

Insider Buying in Intel Corporation (INTC)

Where is money flowing today?

Be in the know. 25 key reads for Wednesday…

- Intel Insiders Bought Up $2.5 Million Worth of Stock (Barron’s)

- Some Strategists Are Turning Positive on China’s Stocks (Barron’s)

- Inflation Could Mean Value Stocks’ Time to Shine (Wall Street Journal)

- 5 Stocks That Could Be Bargains After Tax-Loss Selling (Barron’s)

- ‘Don’t Stop Believin’ ’: Journey’s Smash Hit Started as a Pep Talk (Wall Street Journal)

- Star China Fund Manager Targets Comeback With Tencent Bet (Bloomberg)

- Kraft Heinz sees stronger earnings for the year thanks to higher prices (CNBC)

- Jack Ma Visits Dutch Agricultural Research Institute (zerohedge)

- Mobsters, brawlers and notoriety: Danbury Trashers left a mark on hockey (New York Post)

- ViacomCBS nears sale of CBS Studios lot in LA as it pares real estate holdings (New York Post)

- Boeing Earnings Were Terrible. The Stock Is Rising Anyway. (Barron’s)

- Google Nearly Doubles Profit Behind Red-Hot Ad Market (Wall Street Journal)

- 3-D Printed Houses Are Sprouting Near Austin as Demand for Homes Grows (Wall Street Journal)

- S. Consumer Confidence Rose as Delta Covid-19 Wave Eased (Wall Street Journal)

- Microsoft Earnings Jump as Cloud Services Thrive (Wall Street Journal)

- Oil retreats on industry data showing rise in U.S. crude inventories (marketwatch)

- 2023 Corvette Z06 extends legend with radical new engine, 2.6-second 0-60 dash (usatoday)

- These Economists Aren’t Worried About Inflation. Here’s Why. (Barron’s)

- Xi Jinping’s China Roadmap Is Awash in Contradictions (Bloomberg)

- China Warns U.S. Support for Taiwan Poses ‘Huge Risks’ to Ties (Bloomberg)

- Who’s Building Facebook’s Metaverse? Meet CTO Andrew Bosworth (Bloomberg)

- Investors pour money into Chinese start-ups despite regulatory crackdown (CNBC)

- 5 Top Dividend Stocks to Buy Now Should Still Perform Well If Stagflation Bubbles Up (24/7 Wall Street)

- Here’s what it will take to resolve the supply-chain disruptions roiling the U.S. economy (marketwatch)

- Opinion: These 8 money-losing stocks could bring you big gains come January (marketwatch)

Where is money flowing today?

Be in the know. 17 key reads for Tuesday…

- GE Earnings Made the Most of a Difficult Environment (Barron’s)

- Home Prices for August Expected to Set Another Record (Barron’s)

- Existing-Home Sales Soared. (Barron’s)

- MGM Resorts Sells 11 Picasso Masterworks for $109 Million (Barron’s)

- These 3 Stocks Have High Dividends With Ultrasafe Payouts (Barron’s)

- 8 Small-Cap Stocks That Look Undervalued (Barron’s)

- Jeff Bezos’ Blue Origin Wants to Build a Commercial Space Station With Boeing (Barron’s)

- Four Small-Cap Energy Stocks Ready to Pump Out Cash (Barron’s)

- Terrible idea — taxing profits that don’t exist (New York Post)

- Shutting Down Big Oil. The Energy Report 10/26/2021 (Phil Flynn)

- 5 Dividend Aristocrats Stocks Have Raised Their Dividends for Almost 60 Years (247wallst)

- Houston Rockets owner: ‘Our great Capitalism will come to an end’ if Dems pass unrealized gains tax (foxnews)

- The 50th All-America Research Team (institutionalinvestor)

- China Evergrande Says Work on Some Residential Projects Has Resumed (Wall Street Journal)

- Fed Prepares to Taper Stimulus Amid More Doubts on Inflation (Wall Street Journal)

- Market Agrees That Inflation Isn’t a Blip: Authers’ Indicators (Bloomberg)

- Verizon partnering with Amazon to use tech giant’s satellite internet (CNBC)

Tom Hayes – Quoted in Reuters article – 10/25/2021

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here:

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 1,014 contracts of Sept. 2022 $160 strike calls (or the right to buy 101,400 shares of Alibaba Group Holding Limited (BABA) at $160). The open interest was just 651 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”