- 4 Things to Look for in Friday’s Jobs Report (Barron’s)

- Amazon Stock Has Had a Tough Year. Why J.P. Morgan Sees Big Gains Ahead. (Barron’s)

- How Tesla Avoided the Chip Problems That Hit GM and Other Car Makers (Barron’s)

- A Lyme Disease Vaccine From Pfizer and Valneva Will Have to Avoid the Pitfalls of the Past (Barron’s)

- Dow Has Big Plans for Zero-Carbon Growth. What Investors Need to Know. (Barron’s)

- Teens Are Buying More Clothes. Nike Remains the Top Brand (Barron’s)

- Palantir Stock Is Surging on a Big Army Contract Win (Barron’s)

- Energy commodities have been the best-performing asset against inflation, research finds. Here’s what else works. (MarketWatch)

- Facebook Is Not a Teen Favorite, Survey Says. These Social Media Sites Are. (Barron’s)

- Carl Icahn Holds Significant Stake in Southwest Gas, Opposes Planned Deal (Wall Street Journal)

- Isolated China Becomes Last Country Still Chasing Covid Zero (Bloomberg)

- Amazon CEO Says Video Games Could Become the Largest Entertainment Business (Bloomberg)

- Biden Says He and China’s Xi Will Stick to ‘Taiwan Agreement’ (Bloomberg)

- Uber can now track your flight so a ride home is ready when you land (CNBC)

- Companies hired at a brisk pace in September despite fears about Covid and the economy, ADP says (CNBC)

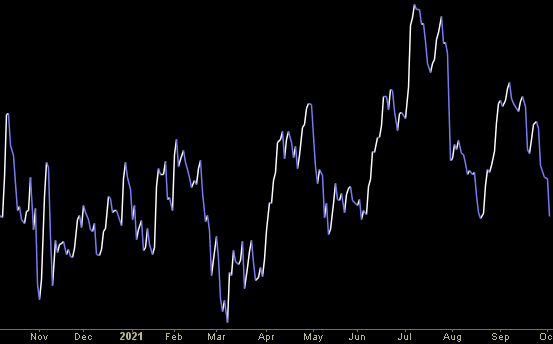

- Turbulent market is fueling a never-before-seen trend between energy and S&P 500, Bespoke’s Paul Hickey finds (CNBC)

- The 4 catalysts that could drive Amazon 29% higher in the next year, according to JPMorgan (Business Insider)

- Is This the Real Turning Point for Aviation Stocks? (Wall Street Journal)

- OPEC Says Gas Crisis Shows Energy Transition Is Being Botched (Bloomberg)

- Theaters Are Counting on James Bond’s Heroics (Wall Street Journal)

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 20 key reads for Tuesday…

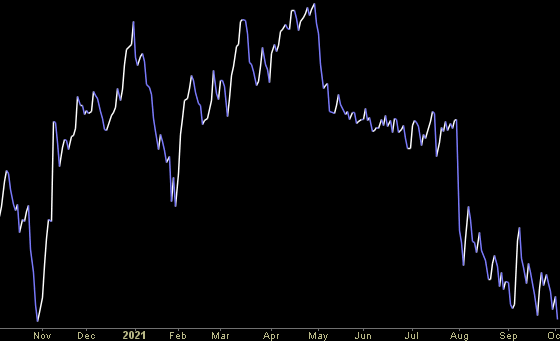

- 9 Stocks That Could Be Good Deals as Interest Rates Climb (Barron’s)

- BofA Securities Is Out With Its Top 10 Stock Picks for Q4 (247wallst)

- S. and Chinese Top Officials to Meet This Week, SCMP Says (Bloomberg)

- AstraZeneca Submits Covid Antibody Drug for U.S. Emergency Authorization (Barron’s)

- 10 Quality Stocks Ready to Bounce Back After September’s Selloff (Barron’s)

- Mark Cuban explains how ‘not all crypto is the same’ (foxbusiness)

- How green is your electric vehicle? (Financial Times)

- Seven Year High. The Energy Report 10/05/2021 (Phil Flynn)

- J&J amends FDA EUA submission for COVID-19 booster with data showing 94% protection against moderate to severe illness (marketwatch)

- Why a sudden spike in 10-year Treasury yields to around 1.5% shouldn’t spook investors, says BlackRock (marketwatch)

- Rate fears just another ‘white knuckle moment’ for tech stocks, says this analyst who’s forecasting rebound of at least 10% (marketwatch)

- OPEC+ Didn’t Need to Open the Spigots Yet (Wall Street Journal)

- Fed’s Evans: high inflation to fall as supply bottlenecks addressed (Reuters)

- These Assets Are Most Exposed to Commodity-Fueled Inflation (Bloomberg)

- Hedge fund billionaire Ken Griffin slams crypto as a ‘jihadist call’ against the dollar — and says regulation will oust those looking to make a quick buck (businessinsider)

- Warren Buffett warned Congress that failing to raise the debt ceiling would be an epic mistake – and called for the limit to be eliminated (businessinsider)

- S. faces a recession if Congress doesn’t address the debt limit within 2 weeks, Yellen says (CNBC)

- Unemployment recipients fell by more than half after Labor Day cliff (CNBC)

- Mastercard Stock Could Soon Perk Up (Barron’s)

- Nobel Prize in Medicine Awarded to Scientists Who Discovered How Our Bodies Feel Heat and Touch (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Quoted in Reuters article – 10/4/2021

Thanks to Shreyashi Sanyal and Devik Jain for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 15 key reads for Monday…

- Bull Markets Usually Don’t End With a Bang (Wall Street Journal)

- Higher Yields Should Help Stocks Like Industrials and Materials. Why They Haven’t. (Barron’s)

- 4 Things to Look for in Friday’s Jobs Report (Barron’s)

- A Vote on Biden’s $1 Trillion Infrastructure Bill Was Delayed. Watch These Stocks. (Barron’s)

- 4 Dividend Stocks for Some Inflation Protection (Barron’s)

- Record Chinese Aircraft Sorties Near Taiwan Prompt U.S. Warning (Wall Street Journal)

- China Evergrande to raise $5 billion from property unit sale – Global Times (Yahoo! Finance)

- White House announces new trade regulations on China (Fox Business)

- India’s $1 Trillion Opportunity (institutionalinvestor)

- At Uber and Lyft, Ride-Price Inflation Is Here to Stay (Wall Street Journal)

- Biden’s new China trade plan echoes Trump’s, but assumes Beijing won’t change (Reuters)

- The bull case for investing in China (Financial Times)

- OPEC World. The Energy Report 10/04/2021 (Phil Flynn)

- OPEC+ Agrees to Continue Gradual Monthly Supply Hikes; Oil Jumps (Bloomberg)

- Wall Street Mourns Chief Citi Stock Strategist Levkovich (Bloomberg)