- Bull Markets Usually Don’t End With a Bang (Wall Street Journal)

- Higher Yields Should Help Stocks Like Industrials and Materials. Why They Haven’t. (Barron’s)

- 4 Things to Look for in Friday’s Jobs Report (Barron’s)

- A Vote on Biden’s $1 Trillion Infrastructure Bill Was Delayed. Watch These Stocks. (Barron’s)

- 4 Dividend Stocks for Some Inflation Protection (Barron’s)

- Record Chinese Aircraft Sorties Near Taiwan Prompt U.S. Warning (Wall Street Journal)

- China Evergrande to raise $5 billion from property unit sale – Global Times (Yahoo! Finance)

- White House announces new trade regulations on China (Fox Business)

- India’s $1 Trillion Opportunity (institutionalinvestor)

- At Uber and Lyft, Ride-Price Inflation Is Here to Stay (Wall Street Journal)

- Biden’s new China trade plan echoes Trump’s, but assumes Beijing won’t change (Reuters)

- The bull case for investing in China (Financial Times)

- OPEC World. The Energy Report 10/04/2021 (Phil Flynn)

- OPEC+ Agrees to Continue Gradual Monthly Supply Hikes; Oil Jumps (Bloomberg)

- Wall Street Mourns Chief Citi Stock Strategist Levkovich (Bloomberg)

Be in the know. 10 key reads for Sunday…

- ECRI Weekly Leading Index Update (advisorperspectives)

- China Tech Investor: Evergrande: How we got here, and what it means, with Ming Zhao (technode)

- Xi Jinping’s clampdowns herald a tense political year in China (economist)

- China sends 77 warplanes into Taiwan defense zone over two days, Taipei says (cnn)

- Best Luxury Dude Ranches to Explore North America’s Wide, Open Spaces (mensjournal)

- Big Tech’s Stock Market Leadership Is Threatened By Rising Rates (bloomberg)

- Iran Told U.S. to Unblock $10 Billion to Start Nuclear Talks (bloomberg)

- The End of China’s Rise (foreignaffairs)

- This Is What the Pandemic Did to the U.S. Rail System (Bloomberg)

- Amazon’s $30B+ ad business, explained (thehustle)

Be in the know. 25 key reads for Saturday…

- Democrats Try to Push Through Biggest Healthcare Overhaul Since Obamacare (Barron’s)

- For the Stock Market, Taxes Trump Stimulus (Barron’s)

- 10 Undervalued Wide-Moat Stocks (Morningstar)

- Airlines May Get a Business-Travel Boost. (Barrons)

- The Milken Way (neckar)

- Chemicals Firms See Large Stock Buys (Barron’s)

- Jack Ma: Overcoming Failures & Rejections (acquirersmultiple)

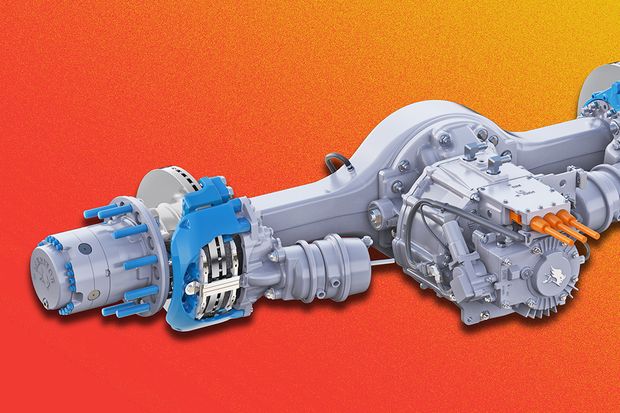

- Meritor’s Truck Parts Are Geared Toward an Electric Vehicle Future. Its Stock Could Double. (Barron’s)

- Online traders see 76% likelihood that Federal Reserve Chairman Jerome Powell will stay for a second term (MarketWatch)

- The Colorado River Is in Crisis. The Walton Family Is Pushing a Solution. (Wall Street Journal)

- Merck Pill Intended to Treat Covid-19 Succeeds in Key Study (Wall Street Journal)

- Billionaire Charlie Munger’s Timely Apartment Bet Began With Hebrew Bible (Bloomberg)

- Warren Buffett dubbed his private jet ‘The Indefensible’ — then renamed it ‘The Indispensable’ after realizing it was worth the money (Business Insider)

- Energy rally has more room to run and these four stocks should benefit, Piper Sandler says (CNBC)

- Leon Cooperman: Conditions for a large market decline are not present (cnbc)

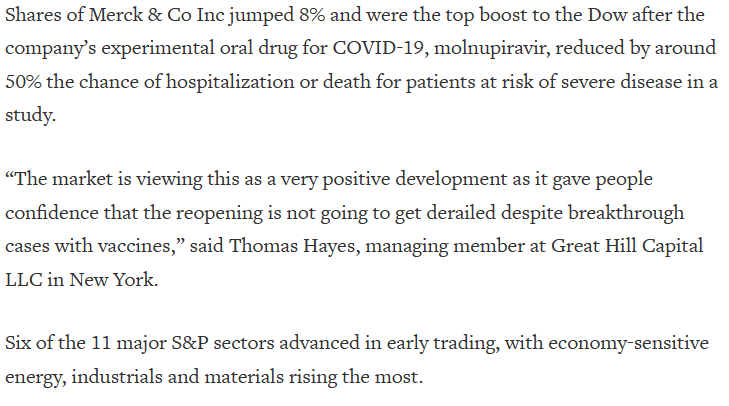

- Why a pill you take at home could change the direction of the pandemic (MarketWatch)

- Will the next web be built on ethereum? (Financial Times)

- How telehealth could become a $175 billion market in the next 5 years (MarketWatch)

- Merck COVID news could ‘ignite’ health care sector: Art Hogan (Fox Business)

- Low-wage workers are getting ‘eye-popping’ pay raises, Goldman Sachs says (CNN)

- Gene Therapy Restored Vision To Patient Who Hadn’t Seen Colors in Years (Futurism)

- Michael Dell, Founder of Dell — How to Play Nice But Win (#534) (Tim Ferriss)

- 5 Lessons Evergrande Taught Us About The Chinese Economy (npr)

- Think Different | Sam Zell (youtube)

- Berkshire shares are below Buffett’s late-spring repurchase prices (cnbc)

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 15,918 contracts of Jan 2022 $150 strike calls (or the right to buy 1,591,800 shares of Alibaba Group Holding Limited (BABA) at $150). The open interest was 5,046 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Tom Hayes – The Claman Countdown – Fox Business Appearance – 10/1/2021

Tom Hayes – Quoted in Reuters article – 10/1/2021

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- Merck Says Covid Drug Cut Hospitalization, Deaths by Half (Bloomberg)

- Evergrande bonds are being scooped up by bargain-hunting funds on bets China can ward off a messy collapse, reports say (Business Insider)

- Exxon Sees up to $1.5 Billion Third-Quarter Earnings Boost From Gas and Oil Rally (Barron’s)

- Merck to seek emergency US approval of oral COVID treatment (New York Post)

- Try These Dividend Stocks for Some Inflation Protection (Barron’s)

- Will the Supply-Chain Crisis Wreck the Holidays? What Investors—and Shoppers—Need to Know. (Barron’s)

- NIO, Li Auto Report Great Deliveries. What Chip Shortage? (Barron’s)

- Cigna, Humana, UnitedHealth to expand into new Medicare Advantage markets in 2022 (marketwatch)

- Coty to sell 9% stake in Wella to majority owner KKR (Reuters)

- 4 reasons why Dollar Tree is raising prices above $1 but below $3 and why the stock has 30% upside ahead, according to JPMorgan (Business Insider)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 102

Article referenced in VideoCast above:

The “Top Down, Bottom Up” Stock Market (and Sentiment Results)…