- Boeing and Spirit Airlines upgraded to outperform at Bernstein on expectations for recovery in air travel (MarketWatch)

- Tech stocks were just stomped. Here’s what to watch next, according to Goldman Sachs. (MarketWatch)

- Only 47 stocks in the S&P 500 have fallen over the past year — Wall Street predicts they will climb up to 54% in 12 months (MarketWatch)

- Dollar Tree adds $1.05 billion to share buyback program, bringing total to $2.5 billion (MarketWatch)

- Dollar Tree to Sell More Items Above $1 as Costs Rise (Wall Street Journal)

- Merck Says Its Covid-19 Antiviral Pill Looks Good Against Variants (Barron’s)

- Meet Ramzi Musallam, Wall Street’s Top-Secret Billionaire Investor (Forbes)

- What Is in the $3.5 Trillion Reconciliation Bill? (Wall Street Journal)

- Catch the Early Bird Special on Restaurant Stocks (Wall Street Journal)

- Bond-Yield Surge Challenges Investor Confidence in Big Tech Companies (Wall Street Journal)

- China Evergrande Has Made Restructuring Progress. What to Know. (Barron’s)

- How Bad Are Things in China? Goldman Sachs Just Slashed Its Growth Forecast to Zero. (Barron’s)

- Elon Musk Weighs In on Space Travel, Crypto, Death, and Taxes (Barron’s)

- China Evergrande Group said it plans to raise about $1.5 billion by selling a minority stake in a Chinese bank to a state-owned enterprise. (Wall Street Journal)

- ‘No Time to Die’ is Bond shaken, not stirred — and a fitting last outing for Daniel Craig (New York Post)

- Crisis Pause. The Energy Report 09/29/2021 (Phil Flynn)

- Cargill Sees Bullish Signs for Agricultural Commodities, Despite China Weakness (Bloomberg)

- China Hidden Local Government Debt Is Half of GDP, Goldman Says (Bloomberg)

- Brian Sullivan: Five key takeaways from OPEC’s 2045 oil outlook (CNBC)

- More than a quarter of Nasdaq-100 stocks are in bear markets — Wall Street sees a buying opportunity (MarketWatch)

- Valuing stocks: why investors should look harder at expectations (Financial Times)

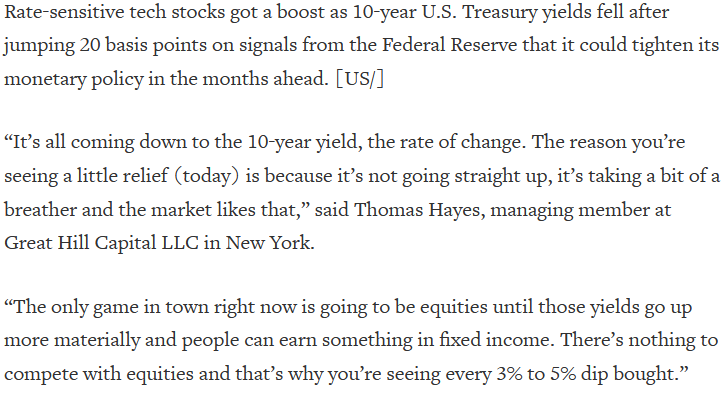

Tom Hayes – Quoted in Reuters article – 9/29/2021

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

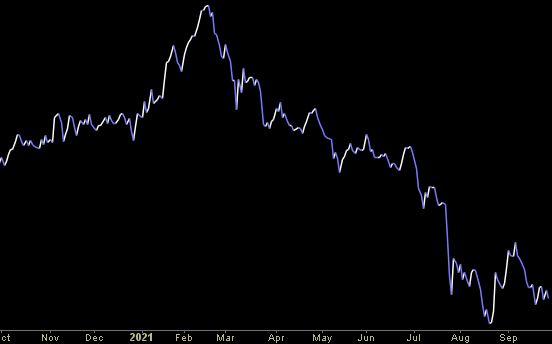

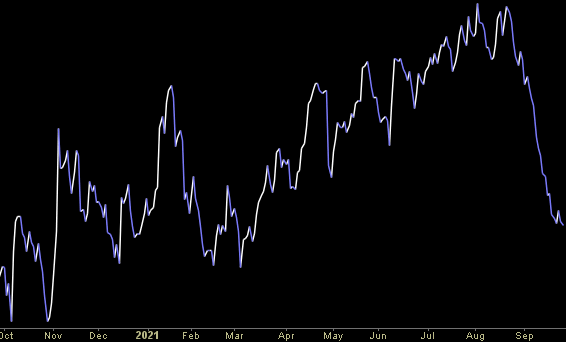

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 25 key reads for Tuesday…

- Bond Yields Are Rising. These Stocks Could Be Good Bets. (Barron’s)

- It’s time to increase investment in Chinese stocks as risks of government intervention are priced in, BlackRock says (businessinsider)

- China asking state-backed firms to pick up Evergrande assets – sources (Reuters)

- Boeing Stock Is Rising After Getting Good News From an Unusual Source (Barron’s)

- Iran says nuclear talks to resume ‘very soon,’ gives no date (Reuters)

- AMD CEO Sees Chip Shortage Easing in 2022 (Barron’s)

- Ford Just Went All-In on EVs. It Will Have a Megacampus to Compete With Tesla’s Gigafactories. (Barron’s)

- Merck Reportedly Close to Buying Acceleron Pharma (Barron’s)

- Xi Jinping Grasps for Power, Even If It Means Hurting Business (Barron’s)

- Here Are the 10 Cheapest Mid-Cap Stocks (Barron’s)

- Which Stocks Corporate Insiders Are Buying Now (Barron’s)

- In China, Even Jump-Rope is Competitive—So Parents Pay for Lessons (Wall Street Journal)

- China Releases Two U.S. Citizens Blocked From Leaving Since 2018 (Wall Street Journal)

- Tom Brady Speaks His Mind (Wall Street Journal)

- Bank Mergers Are On Track to Hit Highest Level Since the Financial Crisis (Wall Street Journal)

- OPEC Predicts a Winner in Global Energy Transition: OPEC (Wall Street Journal)

- Fed Chief Jerome Powell Says Inflation Is Elevated but Likely to Moderate (Wall Street Journal)

- China’s Xi Calls For More R&D Spending and High-Tech Talent (Bloomberg)

- Goldman Sachs cuts its China GDP forecast for 2021, warning the economy’s energy crunch is yet another growth shock (businessinsider)

- Is energy sector now so cheap that investors will put their green preferences on a back burner? (MarketWatch)

- Exclusive-Fed’s Bullard: More aggressive Fed stance best to ensure longer expansion (Reuters)

- General Electric (GE) Price Target Raised at Cowen Ahead of Q3 Print (streetinsider)

- 5 Dow Stocks With the Biggest Dividends Are Great Q4 Buys Now (247wallst)

- China’s Electricity Crunch Is World’s Latest Supply-Chain Threat (Yahoo! Finance)

- Oil prices rise above $80 a barrel for first time in three years (Financial Times)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – AT&T Inc. (T)

Data Source: barchart

Today some institution/fund purchased 3,769 contracts of March $25 strike calls (or the right to buy 376,900 shares of AT&T Inc. (T) at $25). The open interest was 2,787 prior to this purchase. Continue reading “Unusual Options Activity – AT&T Inc. (T)”