Be in the know. 20 key reads for Monday…

- Great Reopening Trade Is Back as Hedge Funds Add Stock Longs (Bloomberg)

- Warren Buffett used the ‘Mona Lisa’ to explain why art is a terrible investment – but then compared Berkshire Hathaway to an art museum (Business Insider)

- Europe’s Energy Crisis Is Coming for the Rest of the World, Too (Bloomberg)

- What History Says a Shutdown Means (Barron’s)

- Oil Prices Surge. Here’s How High Goldman Sachs Says They Can Go. (Barron’s)

- How China Plans to Avert an Evergrande Financial Crisis (New York Times)

- New Limits Give Chinese Video Gamers Whiplash (New York Times)

- Rolls-Royce Surges on Report of $2 Billion ITP Unit Sale to Bain (Bloomberg)

- UPDATE 1-Rolls-Royce chosen by U.S. for new B-52 engines in contract worth up to $2.6 bln (Yahoo! Finance)

- The ‘Dividend Aristocrats’ With the Safest Payouts (Barron’s)

- Debt-Limit Standoff Could Force Fed to Revisit Emergency Playbook (Wall Street Journal)

- Individuals Embrace Options Trading, Turbocharging Stock Markets (Wall Street Journal)

- Cargo Piles Up as California Ports Jostle Over How to Resolve Delays (Wall Street Journal)

- S.-EU Trade Summit in Pittsburgh Aims to Deepen Economic Ties (Wall Street Journal)

- Orders for U.S. Business Equipment Rise for Sixth Straight Month (Bloomberg)

- China’s Tech Tycoons Pledge Allegiance to Xi’s Vision (Bloomberg)

- Anthony Scaramucci says people claiming big institutions are keen on crypto aren’t being totally honest (Business Insider)

- It’s hard to be bearish on the stock market as risk-happy millennials inherit $2 trillion per year, Fundstrat’s Tom Lee says (Business Insider)

- Fed’s Evans: U.S. economy “close” to meeting bond taper threshold (Street Insider)

- 5 European Dividend Aristocrats Offer Huge Income and Growth Potential (247wallst)

Be in the know. 10 key reads for Sunday…

- Ted Lasso’s leadership lessons (Financial Times)

- China’s war on fun (unherd)

- Hubert Joly on the Heart of Business (Podcast) (Bloomberg)

- September Seasonality Update (Almanac Trader)

- Home Builders Might Be a Home Run Once Supply Woes Ease (Wall Street Journal)

- COVID-19 vaccine boosters could mean billions for drugmakers (AP)

- Eddie Murphy Signs 3-Movie Deal with Amazon Studios (maxim)

- ‘Succession’ Season 3 Trailer: First Look at New Characters Played By Adrien Brody and Alexander Skarsgård (maxim)

- Why An Aging China Matters (NPR Planet Money)

- How To Understand the Inflation We’re Seeing Right Now (Bloomberg)

Quote of the day…

Be in the know. 30 key reads for Saturday…

- Delta CEO sees ‘place’ for 737 MAX in fleet, Airline Weekly reports (TheFly)

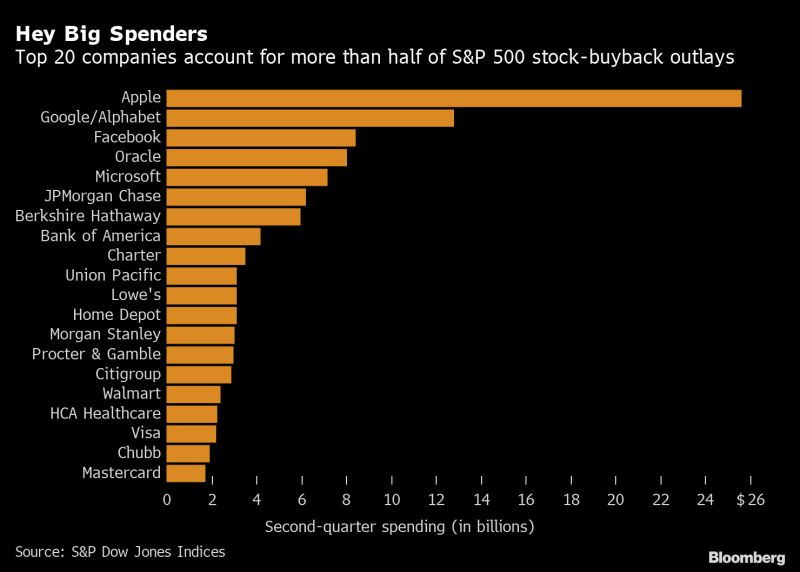

- A Faang Taper Quake Is What Active Manager Dreams Are Made Of (Bloomberg)

- Top stocks hit by supply chain issues (FoxBusiness)

- Value Stocks Look Poised to Shine Again (Barron’s)

- Changing your mind (dividendgrowthinvestor)

- China Funds Counting On Beijing to Contain Evergrande Contagion (Bloomberg)

- Carnival Loss Widens a Bit, but Shares Climb on an Improving Cruise Outlook (Barron’s)

- New-Home Sales Climb Amid Shortage of Existing Homes (Barron’s)

- Medicine’s Golden Age Is Dawning. 10 Ways to Invest. (Barron’s)

- IS CHINA INVESTABLE? (goldmansachs)

- Views From the Bridge, America’s Most Over-the-Top Classic-Car Exhibition (Vanity Fair)

- China Faces a Reckoning With Evergrande Crisis. What Could Come Next. (Barron’s)

- China Adds $71 Billion in Cash in Past Week to Calm Nerves (Yahoo! Finance)

- Scotts Miracle-Gro Is a Cheap Cannabis Stock With Room to Grow (Barron’s)

- Markets Shrug Off China and Focus on Easy Money Instead (Barron’s)

- Why Disney Stock Should Be More Entertaining in Coming Years (Barron’s)

- Verizon and AT&T Made a Big Pitch for Their Stocks. Investors Still Need Convincing. (Barron’s)

- A Government Shutdown Is Looming. What History Says It Means for the Stock Market. (Barron’s)

- Ten-year Treasury yield breaches 1.45% to hit highest level since July amid parade of Fed speakers (MarketWatch)

- The Delta Variant Has Sapped Travel Stocks. What’s Next. (Barron’s)

- Why You Should Pay Attention to the Way Management Talks About Earnings (Barron’s)

- China Declares Crypto Dealings Illegal, Sending Bitcoin Lower (Wall Street Journal)

- Home Builders Might Be a Home Run Once Supply Woes Ease (Wall Street Journal)

- Elon Musk predicts global chip shortage will end next year (New York Post)

- An end to super-cheap money? Central banks begin tightening cycle (Financial Times)

- Oldest U.S. Bomber Will Get Rolls-Royce Engines Over GE, Pratt (Bloomberg)

- Ron Insana: China may be the first to ban bitcoin, but it won’t be the last (CNBC)

- EIA expects increasing consumption of natural gas by U.S. industry in 2021 and 2022 (EIA)

- 4 Stocks to Watch Amid Housing Demand Boom (morningstar)

- Warren Buffett: Putting 75% Of Your Net Worth Into A ‘Lead-Pipe Cinch’ (acquirersmultiple)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 9/24/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 24, 2021

Watch Directly on Fox Business

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

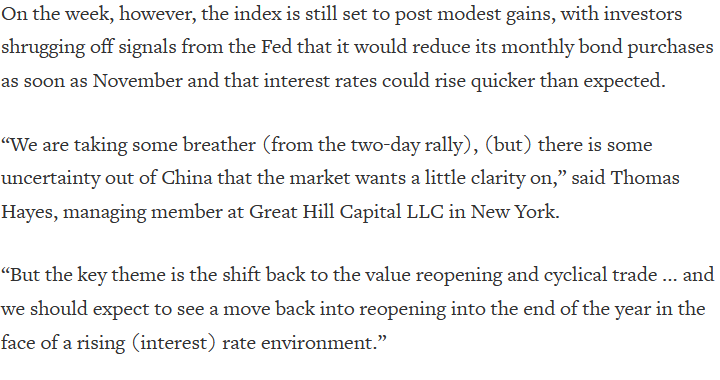

Tom Hayes – Quoted in Reuters article – 9/24/2021

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 12 key reads for Friday…

- Value Stocks Look Poised to Shine Again (Barron’s)

- Carnival Aims to Have Over 50% of Fleet Capacity Sailing Soon. Investors Cheer. (Barron’s)

- Bitcoin and Ethereum Sink as China Central Bank Says Crypto Transactions Illegal (Barron’s)

- Cathie Wood and Rob Arnott Debate Stock Valuations. Is There a Bubble? (Barron’s)

- Evergrande Looks to Have Missed Payment Deadline (Barron’s)

- GE Just Made a Deal. (Barron’s)

- Stocks Are Past the September Doldrums—for Now (Barron’s)

- Fed Officials See ‘Transitory’ Inflation Lasting Quite a While (Wall Street Journal)

- Investors Bet Environmental Fears Will Crunch Commodity Supply, Lifting Prices (Wall Street Journal)

- Market Offers a Second Bite at Value Stocks: John Authers (Bloomberg)

- ECB’s Lagarde warns energy price pressures could outlast Covid supply shocks (CNBC)

- Rob Arnott Sees Second Chance to Ride Quant Value Trade Revival (Bloomberg)