Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 17, 2021

Where is money flowing today?

Hedge Fund Tips with Tom Hayes – Podcast – Episode 90

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 100

Article referenced in VideoCast above:

Credit Spreads and the Stock Market (plus Sentiment Results)…

Be in the know. 15 key reads for Friday…

- China, Wall Street Meeting Focused on Transparency, Stability (Bloomberg)

- America’s Spending Wave Is Yet to Hit (Wall Street Journal)

- Investors are in a historically rotten mood. Their three biggest fears are overblown, strategist says. (MarketWatch)

- Macau’s Review of Casino Operations Sparks a Selloff, and a Buying Opportunity (Barron’s)

- Traveling the High Seas in High Style (Barron’s)

- Investors are paying up for stocks where company profit resists squeeze from inflation, says strategist (MarketWatch)

- Hedge funders are chasing crypto despite warnings of a possible crash (New York Post)

- S. Economy Shows Resilience During Delta Surge (Wall Street Journal)

- Fed Seen Announcing Bond Taper in November, Rate Liftoff in 2023 (Bloomberg)

- China Formally Applies to Join Asian Trade Deal (Bloomberg)

- If Your CEO Talks Like Kant, Think Twice Before Investing (Bloomberg)

- ‘Cry Macho’ Review: Clint Eastwood Gets Back in the Saddle (Wall Street Journal)

- China’s Nightmare Evergrande Scenario Is an Uncontrolled Crash (Bloomberg)

- 5 Dividend Aristocrats to Buy Now for Safety and Dependable Income (24/7 Wall Street)

- Tech investor Chamath Palihapitiya: ‘I reserve the right to change my mind’ (Financial Times)

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Data Source: barchart

Today some institution/fund purchased 12,389 contracts of March ’22 $40 strike calls (or the right to buy 1,238,900 shares of Las Vegas Sands Corp. (LVS) at $39). The open interest was just 1,444 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Medicare Drug Pricing Reform Fails in Committee: Congress Update (Bloomberg)

- Macau’s Review of Casino Operations Sparks a Selloff, and a Buying Opportunity (Barron’s)

- Retail sales post surprise gain as consumers show strength despite delta fears (CNBC)

- No Chinese Stock Left Among Global Top 10 as Tencent Slides (Bloomberg)

- Southeast Asia has added 70 million online shoppers since Covid, report finds (CNBC)

- The stock market is undergoing a slow motion deterioration with pockets of shares down 20% or more (CNBC)

- FTC Turns Up Heat on Big Tech, Promising More Antitrust Scrutiny (Barron’s)

- Jerry Seinfeld Was Right: New York’s Not Dead (Bloomberg)

- Democratic Tax Proposal Takes Aim at ETFs (Wall Street Journal)

- Demand for Natural Gas Will Keep Prices High. What to Know. (Barron’s)

- Oil Just Broke $70. Why It Can Go to $100. (Barron’s)

- How the U.S. Nailed the Economic Response to Covid-19 (Wall Street Journal)

- China’s Economic Recovery Is Looking Gloomier (Wall Street Journal)

- China Has Fully Vaccinated More Than 1 Billion People (Bloomberg)

- Jim Cramer lists 12 ways for stocks to shake off their September struggles (CNBC)

- There was insider trading on NFT platform OpenSea, the $1.5 billion start-up admits (CNBC)

- Emotional AI and other ‘moonshot’ technologies could grow to $6 trillion market by 2030, says Bank of America (marketwatch)

- US builds bulwark against China with UK-Australia security pact (Financial Times)

- Lachlan Murdoch becomes serial dealmaker at helm of media empire (Financial Times)

- Stay bullish and remember September is markets’ weakest month of year: Belski (Fox Business)

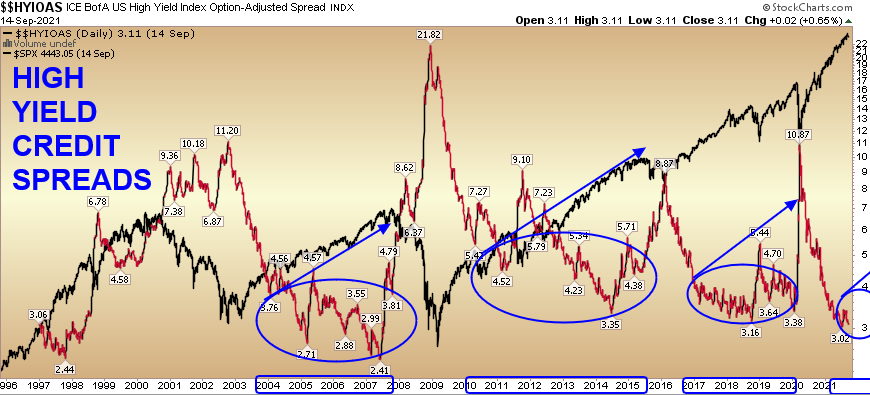

Credit Spreads and the Stock Market (plus Sentiment Results)…

Last week we said, “while everyone debates whether we are going to have a ‘September Swoon’ or not, take a step back and look for sectors/stocks that have already had a ‘Summer Swoon’ and buy the quality stocks that are on sale.” In that context we talked about BA, CI, and EOG. Continue reading “Credit Spreads and the Stock Market (plus Sentiment Results)…”