Where is money flowing today?

Quote of the Day…

Be in the know. 22 key reads for Tuesday…

- Multiplying Crackdowns Haven’t Stopped Cash Pouring Into China (Bloomberg)

- Millions of Americans Travel Over Holiday Weekend Despite Covid Outbreaks (Barron’s)

- Tired of Losing Yet? The Energy Report 09/07/2021 (Phil Flynn)

- China’s economy gets welcome boost from surprisingly strong Aug exports (Reuters)

- COLUMN-Hedge funds in historic double-down on higher U.S. yields: Jamie McGeever (Reuters)

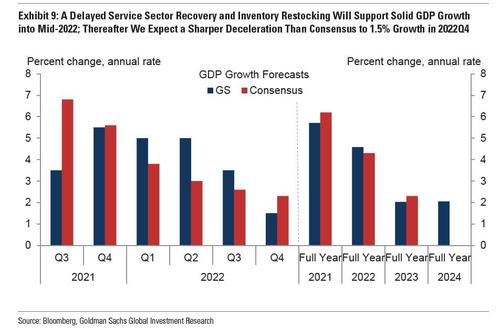

- Goldman Cuts Its US GDP Forecast For The Third Time In The Past Month (ZeroHedge)

- From Cradle to Grave, Democrats Move to Expand Social Safety Net (New York Times)

- China and Big Tech: Xi’s blueprint for a digital dictatorship (Financial Times)

- Famed Wharton professor says the next inflation reading is more important than the monthly jobs report. (Business Insider)

- Taper your pessimism — Fed’s actions won’t derail U.S. stocks, Barclays strategists say (MarketWatch)

- Boeing Now Has an Airbus Problem to Add to the List (Barron’s)

- Disney’s ‘Shang-Chi’ Flies to a Record Labor Day at the Box Office (Wall Street Journal)

- China’s Industrial Planning Evolves, Stirring U.S. Concerns (Wall Street Journal)

- Warning of Income Gap, Xi Tells China’s Tycoons to Share Wealth (New York Times)

- Consumers and Companies Are Buying In on Paying Later (New York Times)

- Xi Jinping May Be Leading China Into a Trap (Bloomberg)

- Chinese Technology Stocks Jump After Tencent Buys Back Shares (Bloomberg)

- Hong Kong Move to Reopen China Border Boosts Retail Stocks (Bloomberg)

- China’s ‘Mr. Income Distribution’ Explains Common Prosperity (Bloomberg)

- Xi’s Common Prosperity Drive Triggers a Rare Debate in China (Bloomberg)

- China Freezes Tutoring Firms’ Fees, Enrollment Pending Approvals (Bloomberg)

- Goldilocks Has Equity Investors In a Headlock (Bloomberg)

Be in the know. 8 key reads for Labor Day…

- Business Travel Rebound Stifled by Covid Resurgence (Wall Street Journal)

- China Says Government to Set Prices for After-School Classes (Bloomberg)

- Tech giants are rushing to develop their own chips – here’s why (CNBC)

- Some Chinese stocks briefly surge 30% as investors bet on a new Beijing exchange opening (CNBC)

- JD.com appoints new president as founder steps back from day-to-day operations (CNBC)

- Didi’s ride hailing rival Cao Cao raises $600 mln to expand (Reuters)

- China will improve opening up of capital market – securities regulator (Reuters)

- Dollar store chains are leading retail store openings in US: report (FoxBusiness)

Quote of the Day…

Be in the know. 10 key reads for Sunday…

- Gensler’s brewing battle with Robinhood could prove bloody (New York Post)

- 6 Retail Stocks on Sale (morningstar)

- Watch the Electrifying Final Trailer For ‘No Time To Die’ (Maxim)

- China Offers Tax Breaks to Boost Macau-Guangdong Integration (Bloomberg)

- 13 Undervalued Wide-Moat Companies With Exceptional Leadership (morningstar)

- Shale natural gas production in the Appalachian Basin sets records in first half of 2021 (EIA)

- Sir James Dyson — Founder of Dyson and Master Inventor on How to Turn the Mundane into Magic (#530) (Tim Ferriss)

- Weakness Day After Labor Day & Sell Rosh Hashanah (Almanac Trader)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Land Rover Defender V8 Bond Edition Channels ‘No Time to Die’ SUV (Maxim)

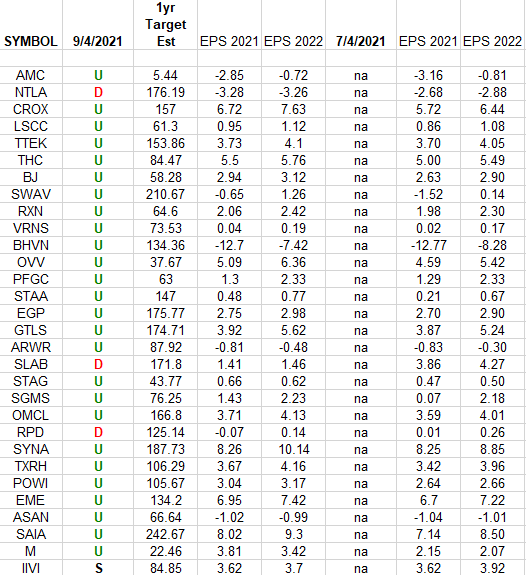

Russell 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2021 and 2022 estimates were on 7/4/2021 and today. Continue reading “Russell 2000 (top weights) Earnings Estimates”

Be in the now. 25 key reads for Saturday…

- Economic Headwinds Won’t Hinder Stocks, Because Bad News Is Good for Easy Money (Barron’s)

- Velvet Glove, Meet Iron Fist: The China Tech Crackdown (Aswath Damodaran)

- China’s Tech Crackdown: Its about Control, not Consumers or Competition! (aswathdamodaran)

- Researchers Infect Volunteers With Coronavirus, Hoping to Conquer Covid-19 (Wall Street Journal)

- Learning from John D Rockefeller (mastersinvest)

- Investors Are Ignoring the Tax Elephant in the Room (Barron’s)

- Multiplying Crackdowns Haven’t Stopped Cash Pouring Into China (Bloomberg)

- Taylor Morrison Home Stock Trails Its Peers. But in a Hot Market, It’s a Value Play. (Barron’s)

- Private equity is leveraged equity (Financial Times)

- Biotech Is Due for a Comeback. 5 Stocks That Could Lead a Revival. (Barron’s)

- Emerging-Market Stocks Are Battered. (Barron’s)

- Sell Rosh Hashanah, Buy Yom Kippur: What Does The Market Adage Look Like In 2021? (Benzinga)

- 5 Very Well-Known Hot Stocks to Buy Under $10 With Huge Upside Potential (24/7 Wall Street)

- Netflix Stock Gets a Boost on News That It Will Stream ‘Seinfeld’ (Barron’s)

- Is the Stock Market in a Bubble? Don’t Bet on It. (Barron’s)

- Price-Innovation Cycles & Speculators (investoramnesia)

- Why 2021 Is the Kind of Year to Banish the September Stock Blues (Barron’s)

- NFT marketplace OpenSea records $3.4 billion transaction volume in August, 10 times the month before (MarketWatch)

- The Stock Market Could Struggle This Fall, Strategists Say. Buy Quality. (Barron’s)

- SEC’s Gary Gensler Has a Big, New Vision for the Stock Market. There Are Too Many ‘Inherent Conflicts of Interest.’ (Barron’s)

- China’s Xi Had a Very Busy Week. Here’s What He Said and Did (Bloomberg)

- ‘People just aren’t applying’: Why the restaurant industry created no new jobs last month (MarketWatch)

- Jobs Won’t Look Great in September, Either (Wall Street Journal)

- Banks and investors gear up for US corporate debt binge (Financial Times)

- Investing in the Dividend Aristocrats from 2011 (dividendgrowthinvestor)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 98

Article referenced in VideoCast above:

The “Chasing After You” Stock Market (and Sentiment Results)…