Where is money flowing today?

Be in the know. 20 key reads for Wednesday…

- Splunk upgraded to Buy from Neutral at UBS (TheFly)

- Boeing Max Takes to China’s Skies in Test to End Flight Ban (Bloomberg)

- This Turning Point for Markets Merits a Hard Look (Bloomberg)

- 9 Industrial Stocks With 30% Upside (Barron’s)

- George Foreman Grills, Kwikset Locks—Spectrum Brands’ Sales Are Growing. And the Stock Is Inexpensive. (Barron’s)

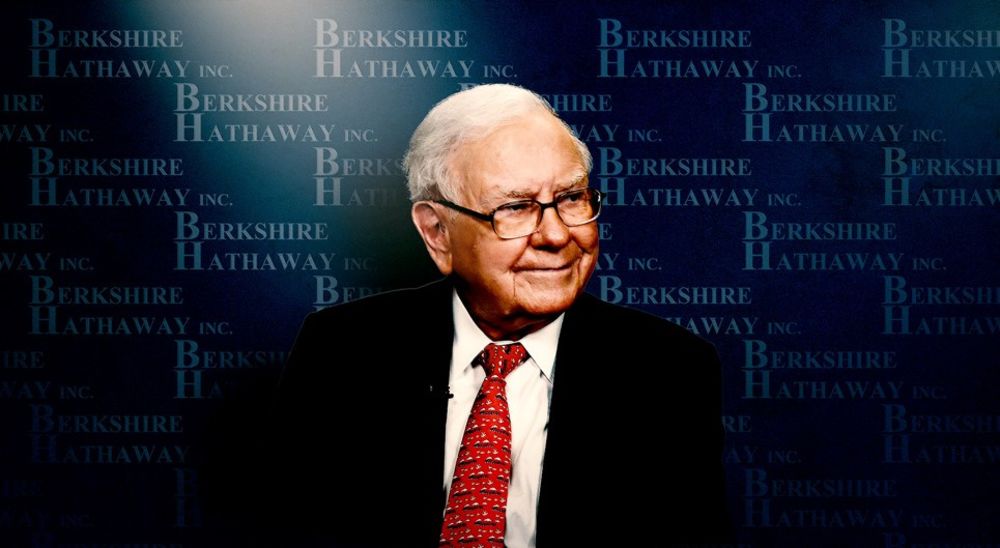

- These 7 Warren Buffett quotes can help you stay sane in today’s manic market (Yahoo! Finance)

- SoftBank CEO to Take Stake in Vision Fund 2 (Barron’s)

- Ridgefield, Conn.: Arts, Culture and Open Space (New York Times)

- China’s Credit Expands at Slowest Pace Since February 2020 (Bloomberg)

- SEC’s Gensler Seeks Warren Help in Crypto Exchange Crackdown (Bloomberg)

- Consumer Prices in U.S. Increase at a More Moderate Pace (Bloomberg)

- Chinese giant NetEase targets major overseas growth with new battle royale game (CNBC)

- Billionaire investor Dan Loeb trumpeted his bets on Buffett-backed RH, crypto, and private companies in his Q2 letter (Business Insider)

- Warren Buffett’s pandemic-hit businesses came roaring back last quarter. Here are his 7 big winners. (Business Insider)

- Democrats push through $3.5 trillion budget resoluton to assist families and fight climate change (MarketWatch)

- ‘From unreasonable to ridiculous’: Here’s why Moderna is set to fall 76%, according to Bank of America (Business Insider)

- S. mortgage applications rise as rates remain below 3% -MBA (Reuters)

- Manchin concerned about “grave consequences” of U.S. Senate’s $3.5 trln spending plan (Reuters)

- Cathie Wood Keeps ‘Open Mind’ on China Shares After Dumping Them (Yahoo! Finance)

- China’s Strict Covid-19 Strategy Risks Slowing Economic Recovery as Delta Variant Hits (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

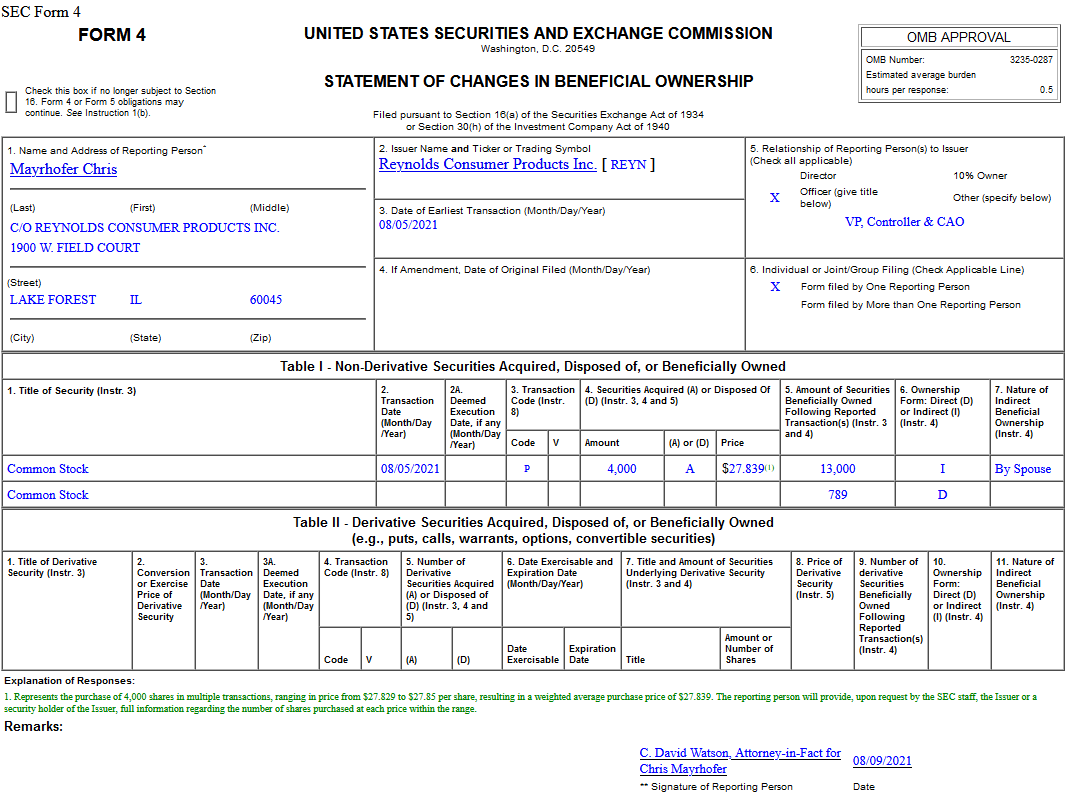

Insider Buying in Reynolds Consumer Products Inc. (REYN)

Be in the know. 10 key reads for Tuesday…

- China Tech Stocks Rise as Analysts Turn Positive After Selloff (Bloomberg)

- Delta Done. The Energy Report 08/10/2021 (Phil Flynn)

- 11 Undervalued Stocks That Analysts Love (Barron’s)

- Earnings Slump at Softbank but It Shrugs Off the Chinese Crackdown–for Now (Barron’s)

- Infrastructure Is Almost a Done Deal. Now the Focus Turns to the $3.5 Trillion Budget. (Barron’s)

- Tyson Foods Says Labor, Grain Costs Boosting Meat Prices (Wall Street Journal)

- Citigroup Reaches First Deal of Jane Fraser’s Refresh, Selling Australian Consumer Bank (Wall Street Journal)

- The Sage of Omaha’s Berkshire Hathaway bet on China’s BYD looks like it’s paying off. It’s all about the technology. (Bloomberg)

- Odds Are Sports Betting Will Bring Trouble (Bloomberg)

- Fed’s Bostic: U.S. needs to be “beyond the crisis” before rate hike (Street Insider)

Tom Hayes – CGTN Global Business Appearance – 8/9/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – August 9, 2021

Watch Directly on CGTN America

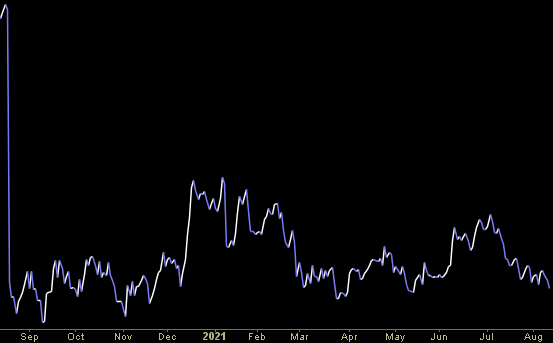

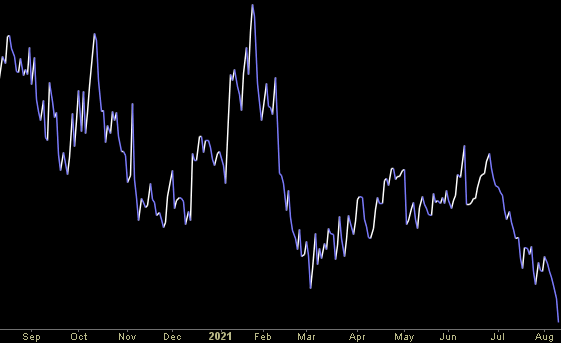

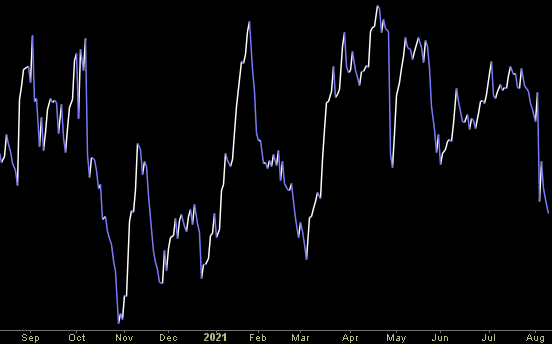

Unusual Options Activity – Intel Corporation (INTC)

Data Source: barchart

Today some institution/fund purchased 6,001 contracts of June 2022 $75 strike calls (or the right to buy 600,100 shares of Intel Corporation (INTC) at $375). The open interest was 4,588 prior to this purchase. Continue reading “Unusual Options Activity – Intel Corporation (INTC)”