Be in the know. 20 key reads for Friday…

- Warren Buffett will discuss stocks, deals, and the pandemic at Berkshire Hathaway’s annual meeting on Saturday. Here are 18 questions he might answer. (Business Insider)

- EU says Apple’s App Store breaks competition rules after Spotify complaint (CNBC)

- Goldman Sachs Sees $80 Oil This Year: 4 Conviction List Energy Stocks to Buy Now (24/7 Wall Street)

- AstraZeneca Reveals Covid-19 Vaccine Sales. That Isn’t Why the Stock Is Rising. (Barron’s)

- It May Be Time to Check In to InterContinental Stock (Barron’s)

- Why It’s Great News That Cyclical Stocks Are Selling Off on Earnings (Barron’s)

- SPACs Switch Their Ticker Symbols—and Shares Climb. What’s Really Going On. (Barron’s)

- What Ails Gilead’s Sales (Barron’s)

- Apple’s Spectacular Earnings Aren’t Lifting the Stock. The Worry Is Growth. (Barron’s)

- Kraft-Heinz thrives as pandemic spurs home dining (New York Post)

- Cyclical Stocks Are Selling Off on Earnings. Why That’s Great News. (Barron’s)

- Apple v. Epic: What to expect from a trial that could change antitrust law and the mobile-app ecosystem (MarketWatch)

- Oil’s Rebound Greases the Way for Energy Giants’ Green Pitch (Wall Street Journal)

- U.S. fast-food chains cash in, seize market share during pandemic (Reuters)

- 5 Best Chinese Stocks To Buy And Watch Now (IBD)

- Amazon Continues To Outpace Google, Facebook On Ad-Revenue Growth: What You Need To Know (Benzinga)

- Cobalt price jump underscores reliance on metal for electric vehicle batteries (Financial Times)

- Exxon and Chevron surge back to profit (Financial Times)

- Colgate-Palmolive stock gains after profit, sales top expectations (Yahoo! Finance)

- Warren Buffett generates half of his dividend income from these stocks: Apple, Bank of America, Coca-Cola (USA Today)

Tom Hayes – Quoted in Reuters article – 4/29/2021

Thanks to Shivani Kumaresan and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 50,001 contracts of Jan ’22 $40 strike calls (or the right to buy 5,000,100 shares of Citigroup Inc. (C) at $40). The open interest was just 6,237 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”

Where is money flowing today?

Quote of the day…

Be in the know. 20 key reads for Thursday…

- Nokia Earnings Were Surprisingly Good. The Stock Is Soaring. (Barron’s)

- 25 Undervalued Stocks with Earnings Set to Beat Pre-Covid Levels (Barron’s)

- Amazon Is Likely to Post Blowout Profits. The Question Is What Follows. (Barron’s)

- Oil aims for 3-day win streak on demand optimism (MarketWatch)

- Texas Instruments Weighs In on the Chip Shortage—and Creates Confusion (Barron’s)

- Treasury yields come off highs as Fed’s Powell pushes back on taper speculation (MarketWatch)

- Apple Couldn’t Dodge Chip Pain Forever (Wall Street Journal)

- Google Springs Forward (Wall Street Journal)

- Northrop Grumman (NOC) Tops Q1 EPS by $1.09; Raises Guidance (streetinsider)

- Optimistic Breakout. The Energy Report 04/29/2021 (Phil Flynn)

- Shell (RDS) Gains on Raised Dividend and Q1 Beat, Analyst Says ‘Earnings Power Intact’ (streetinsider)

- Fed Chair Powell In Response To GameStop, Dogecoin Mania Says He Sees ‘Froth In Equity Markets’ (Benzinga)

- McDonald’s revenue tops pre-pandemic levels, fueled by the strong U.S. recovery (CNBC)

- Chip shortages for iPads and Macs may cool Apple’s hot streak (CNBC)

- These two stocks unloved by analysts may be worth a second look (CNBC)

- CDC to cruise industry: Sailing could restart in mid-July (USA Today)

- U.S. Recovery Gains Steam as Spending Fuels 6.4% GDP Growth (Bloomberg)

- Verizon Explores Sale of Media Assets, Including Parts of Yahoo and AOL (Wall Street Journal)

- Biden Proposal Would Close Longtime Real-Estate Tax Loophole (Wall Street Journal)

- Private Equity and Hedge Funds, Facing a New Tax Burden, Prepare Their Defense (Wall Street Journal)

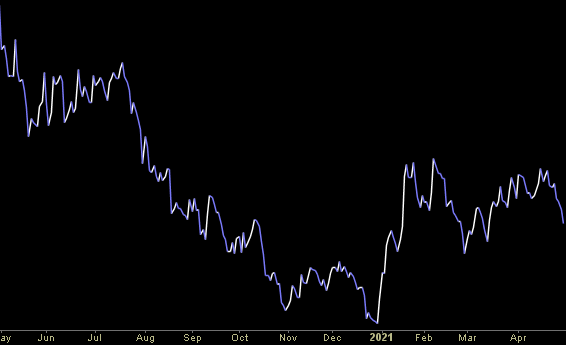

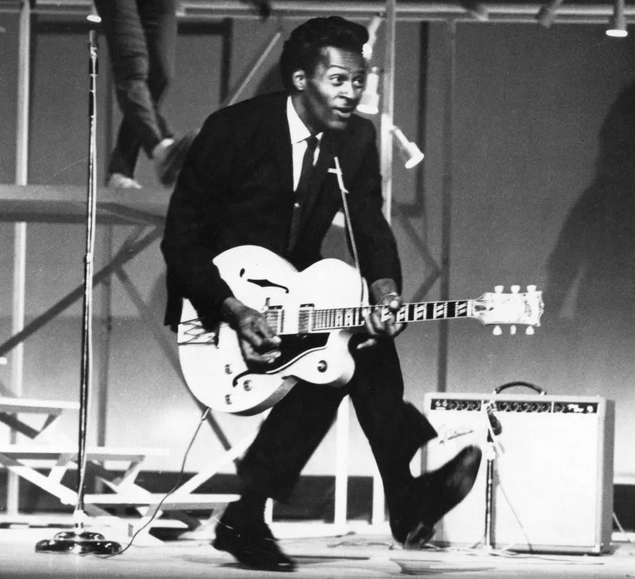

The Chuck Berry “Ridin’ Along” Stock Market (and Sentiment Results)…

This week I chose Chuck Berry’s classic song “No Particular Place to Go” to describe current market sentiment. As you can see below, watching the markets for the past ~2 weeks has been like watching paint dry: Continue reading “The Chuck Berry “Ridin’ Along” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Enterprise Products Partners L.P. (EPD)

Data Source: barchart

Today some institution/fund purchased 25,600 contracts of Jan ’23 $15 strike calls (or the right to buy 2,560,000 shares of Enterprise Products Partners L.P. (EPD) at $39). The open interest was just 3,749 prior to this purchase. Continue reading “Unusual Options Activity – Enterprise Products Partners L.P. (EPD)”

Tom Hayes – TD Ameritrade Network Appearance – 4/28/2021

TD Ameritrade Network Appearance – Thomas Hayes – Chairman of Great Hill Capital – April 28, 2021